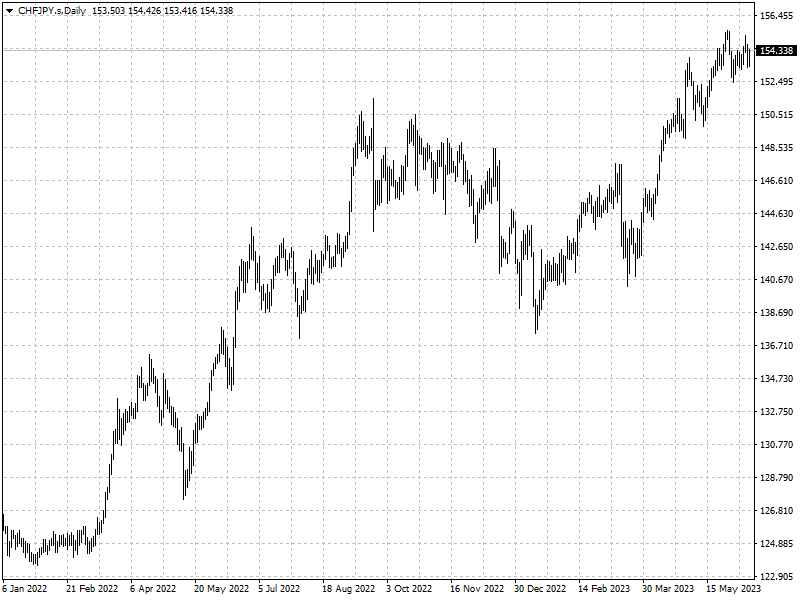

CHF/JPY divergence

The yen has sunk to historic lows against the Swiss franc last month as

Japan’s chronic trade deficits diminish its currency’s safe-haven status.

The ten weakened to 153.80 against the Swiss franc on May 20, nearly a third

of its record high of about 58 yen which it hit in 2000.

There are few signs of reversal with CHF/JPY traded above 154 as of now. The

divergence on full display contradicts the traditional FX theory.

‘It's hard to put the yen and the Swiss franc in the same category of

currencies now,’ said Daisuke Karakama, chief market economist at Mizuho

Bank.

Traders have turned bullish on the franc in the past few weeks, something

that hasn’t happened since September 2021.

That smaller currency outperforms easily in the current risk-off environment

as Japan is now the only major economy to continue monetary easing.

Dove among hawks

Kazuo Ueda decided to keep ultra-low interest rates but announced a plan to

review its past monetary policy moves in his debut policy meeting

The new chief said the broad-based review won't be tied to near-term policy

shifts and stressed the need to wait for more evidence to conclude inflation

would sustainably achieve the 2% target.

The yen tumbled then on expectations that it would take him longer to

withdraw the stimulus of his dovish predecessor.

Other big global central banks all underestimated the scale and persistence

of inflation, causing them to raise interest rates far faster than usual.

After raising borrowing costs by 225 basis points since June 2022, the SNB is

widely predicted to hike interest rates again on June 22.

‘The fight against inflation is not over yet — we need to make sure we bring

it back below 2% in the long term,’ Thomas Jordan said in a recent interview.

‘At this point in time, we can’t exclude a further tightening of monetary

policy.’

The yen may not gain strength easily even global rates are close to peak. The

impact of potential global stimulus on the franc could be immediate as capital

pipelines are unclogged and profits start flowing toward tax-advantaged

destinations.

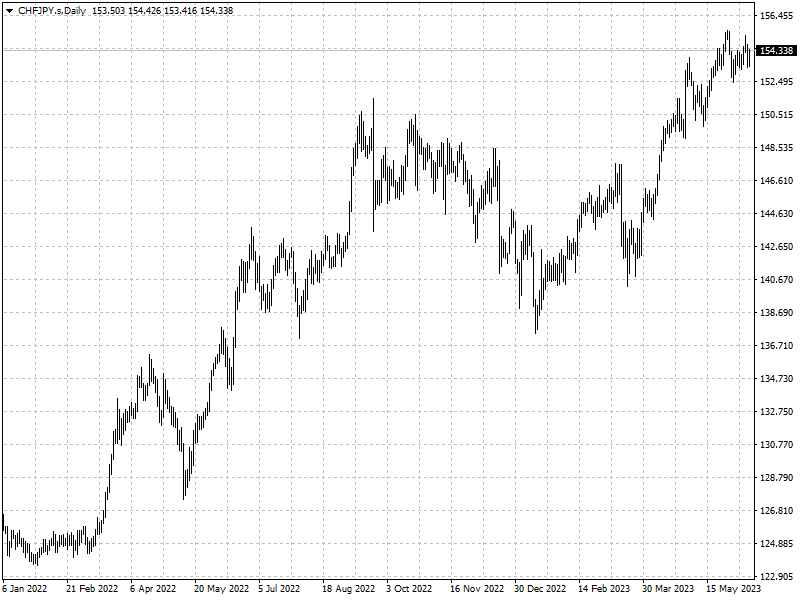

Upside potential intact

Trade proves to be another drag for the yen, itself a traditional currency

haven, with Japan posting a deficit for a 21st straight month in April.

Conversely, Switzerland logged its third-largest surplus of 42.8 billion

Swiss francs in 2022. The country's heavy reliance on nuclear power and

hydropower make it less vulnerable to fluctuations in energy prices.

The country does not have continuously high levels of fiscal spending and its

largest public companies are less capital-intensive and not subject to the high

levels of overseas competition.

While the trade-weighted exchange rate appears high, the franc’s long-term

valuations appear fair after accounting for inflation differentials in other

countries, according to JPMorgan.

The franc remains a good hedge against late-cycle risks and benefits from a

more activist central bank as well as better yields compared with the Japanese

yen, they said.

However, traders should stay on alert given that Japan’s Finance Ministry

intervened last year after the yen dipped below 150 against the U.S. dollar and

stretched yen-bearish positions.

The BOJ is expected to play for time again this month, so we prefer looking

for a dip to buy CHF/JPY for which the path of the least resistance is still

skewed to the upside.