Dow Jones futures are a cornerstone of global financial markets, offering traders a way to speculate on or hedge against movements in the dow jones industrial average (DJIA).

For active traders, understanding how these futures work, what drives their price, and how to manage risk is essential for success. Here's a comprehensive guide to Dow Jones futures, tailored for those looking to stay ahead in fast-moving markets.

What Are Dow Jones Futures?

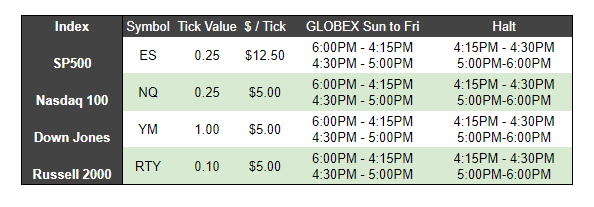

Dow Jones futures are standardised contracts that allow traders to buy or sell the value of the DJIA at a future date. Traded on the Chicago Mercantile Exchange (CME), these contracts reflect expectations for the DJIA's performance and are used for both speculation and hedging.

Why Trade Dow Jones Futures?

1. 24-Hour Market Access

Dow Jones futures trade nearly 24 hours a day, five days a week, allowing traders to react to global news and events even when the underlying stock market is closed.

2. Leverage

Futures contracts require only a margin deposit, enabling traders to control a large notional value with a relatively small amount of capital. This magnifies both potential gains and losses.

3. Liquidity

Dow Jones futures are among the most liquid contracts globally, ensuring tight spreads and efficient execution for active traders.

4. Hedging and Speculation

Active traders can use futures to hedge equity portfolios or to speculate on short-term market moves, taking both long and short positions with ease.

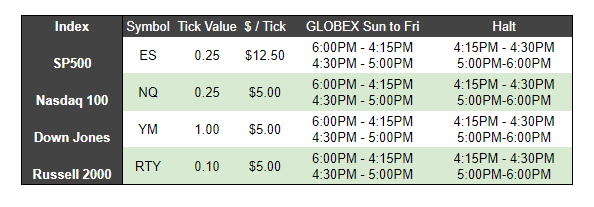

Key Trading Hours

Regular trading: 5:00 PM – 4:00 PM (Central Time), Sunday to Friday, with a 1-hour break each day.

Highest liquidity: During US stock market hours (9:30 AM – 4:00 PM ET).

After-hours trading: Allows for reaction to global events and economic releases outside of US market hours.

Factors Driving Dow Jones Futures

1. Economic Data

Key US economic indicators-such as non-farm payrolls, inflation data, and GDP releases-can cause significant moves in Dow Jones futures.

2. Corporate Earnings

Earnings reports from major DJIA components (e.g., Apple, Microsoft, JPMorgan) often drive futures volatility, especially during quarterly reporting seasons.

3. Federal Reserve Policy

Interest rate decisions and commentary from the Federal Reserve can shift sentiment quickly, impacting futures prices.

4. Geopolitical Events

Global news, including trade policy, conflicts, and elections, can trigger sharp moves in Dow Jones futures as traders adjust risk exposure.

Popular Trading Strategies

1. Trend Following

Traders use technical indicators (like moving averages and MACD) to identify and ride sustained moves in the futures market.

2. Breakout trading

This strategy seeks to capture sharp moves when Dow Jones futures break through established support or resistance levels, often around major economic releases.

3. Scalping

Active traders execute multiple trades throughout the day, aiming to profit from small price fluctuations. High liquidity in Dow Jones futures makes this approach viable.

4. Hedging

Portfolio managers use Dow Jones futures to offset risk in their equity holdings, especially during periods of heightened volatility.

Risk Management Tips

Use stop-loss orders: Protect your capital by setting predefined exit points for losing trades.

Monitor leverage: Futures trading magnifies both gains and losses; use leverage cautiously.

Stay updated: Follow economic calendars, earnings schedules, and central bank announcements.

Diversify: Avoid concentrating all risk in a single position or market.

Review performance: Regularly analyse your trades to identify strengths and areas for improvement.

Common Mistakes to Avoid

Overtrading: High leverage and liquidity can tempt traders to take excessive positions.

Ignoring news: Major events can cause rapid price swings; always stay informed.

Neglecting risk controls: Trading without a clear risk management plan can lead to significant losses.

Final Thoughts

Dow Jones futures offer active traders a powerful vehicle for participating in the US equity market, with nearly round-the-clock access, high liquidity, and the flexibility to go long or short.

By understanding how these contracts work, staying on top of market-moving news, and applying disciplined risk management, traders can navigate volatility and capitalise on opportunities in this dynamic market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.