PCE price index June

31/7/2025 (Thu)

Previous: 2.7% Forecast: 2.7%

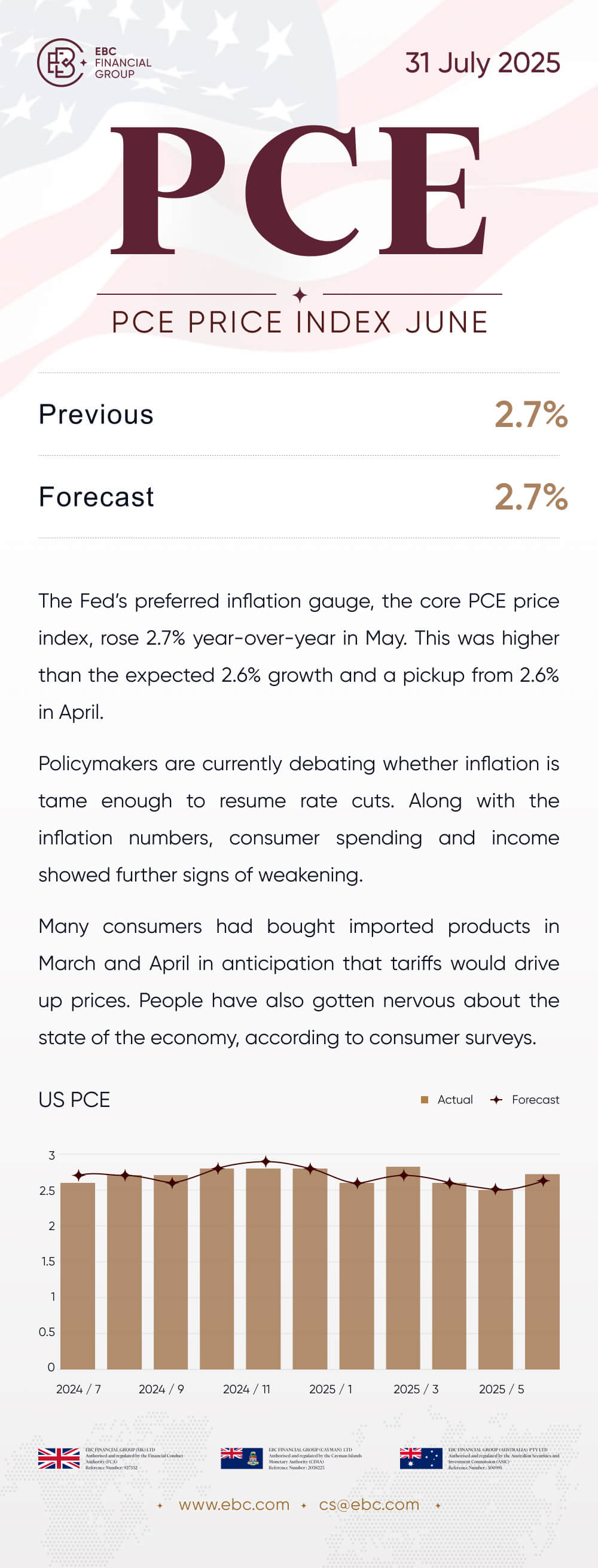

The Fed's preferred inflation gauge, the core PCE price index, rose 2.7%

year-over-year in May. This was higher than the expected 2.6% growth and a

pickup from 2.6% in April.

Policymakers are currently debating whether inflation is tame enough to

resume rate cuts. Along with the inflation numbers, consumer spending and income

showed further signs of weakening.

Many consumers had bought imported products in March and April in

anticipation that tariffs would drive up prices. People have also gotten nervous

about the state of the economy, according to consumer surveys.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.