Oil prices fell more than $2 a barrel in early Asian trade on Monday as OPEC+

is set to further speed up oil output hikes despite little evidence to support

the assertion of healthy market fundamentals.

Both contracts touched their lowest since 9 April. The group could fully

unwind its voluntary cuts by the end of October if members do not improve

compliance with their production quotas, OPEC+ source said.

For the first four months of 2025 Asia's seaborne imports are still down

280,000 bpd from the same period in 2024 and there is an increasing likelihood

that the trade war launched by Trump will start curbing oil demand.

The decision may be aimed to please Trump calling for cheaper energy, and to

limit oil output in other major producers, such as the us and Brazil, given

their higher cost of production.

Barclays lowered its Brent forecast by $4 to $66 a barrel for 2025 and by $2

to $60 a barrel for 2026. Goldman Sachs sees prices fall into the $40s in 2026,

and below $40 in an unlikely extreme scenario.

Meanwhile, tensions flared in the Middle East after Israeli PM Benjamin

Netanyahu vowed to retaliate against Iran for the Tehran-backed Houthi group

firing a missile that landed near Israel's main airport.

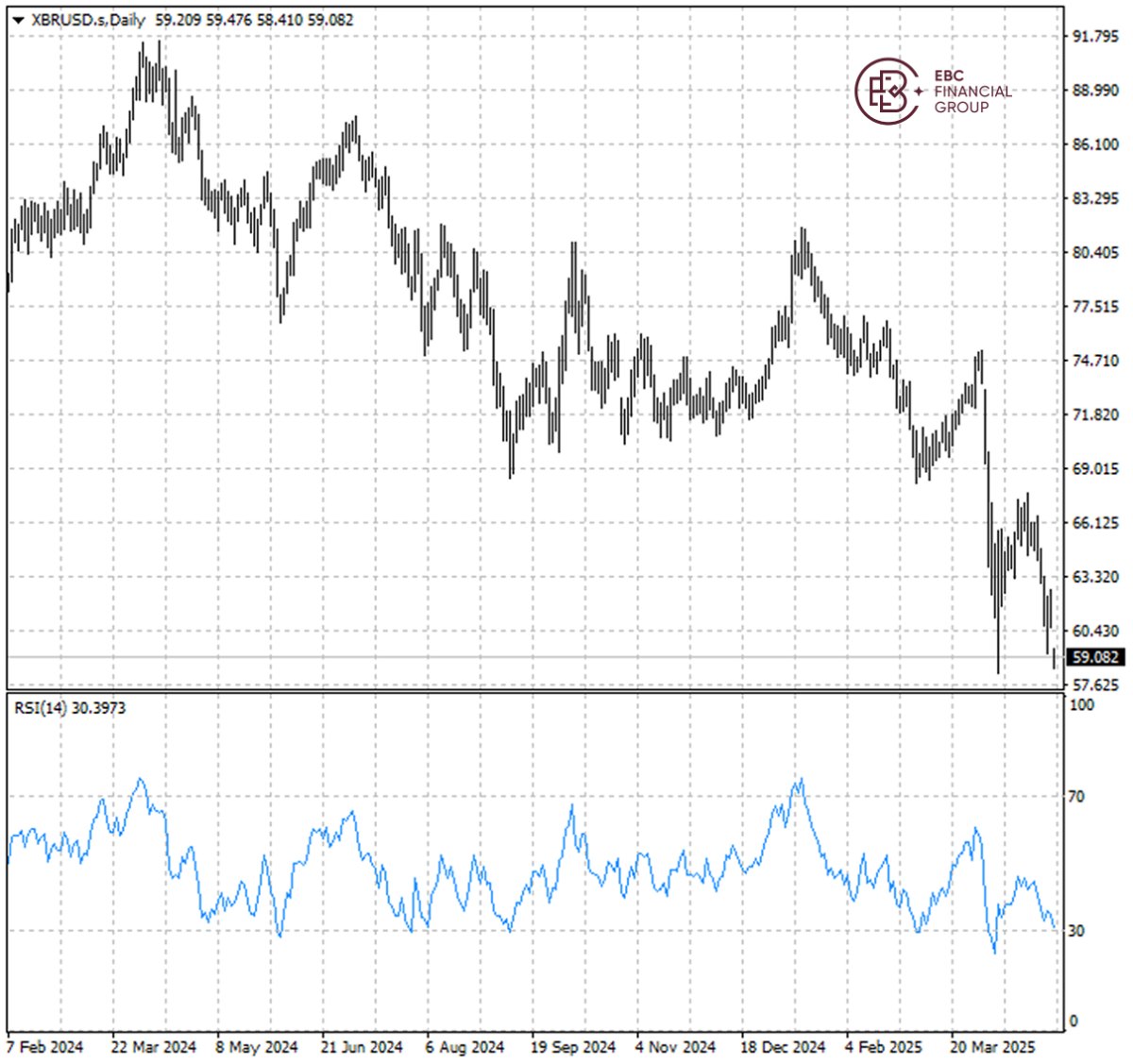

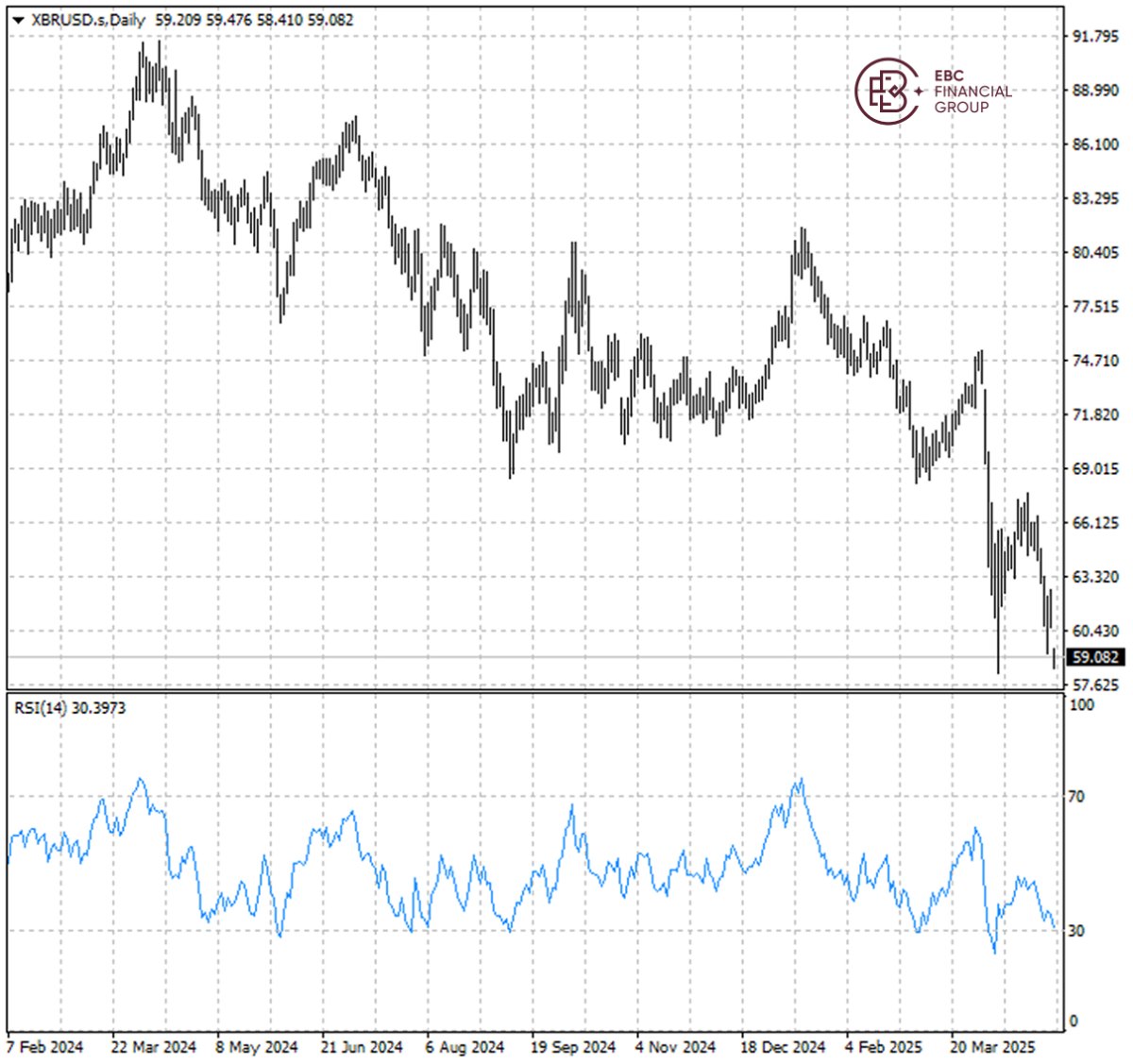

Brent Crude is on track to retest the bottom it hit last month at $58.20. AS

RSI approaches 30, an imminent rally is on the cards around that level though it

still looks weak on a longer horizon.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.