US stocks have underperformed the rest of the world this year by the widest

margin in more than three decades as Trump's erratic policymaking sparks massive

outflow from local assets.

That underlines expectation that the president will take a heavier toll on

the economy, by hurting growth and driving up inflation. The tumbling greenback

has helped widen the gap in performance.

Even so, US equities could remain overvalued. Goldman Sachs estimates that

each 5 percentage point rise in the US tariff rate leads S&P 500 EPS to fall

roughly between 1% and 2%.

The number of earnings downgrades by analysts so far this year has reached

recessionary levels, though the actual magnitudes of the downgrades appear to be

relatively less significant.

There are more reasons to stay cautious. The AI model unveiled by DeepSeek

were presumably trained at a fraction of the cost and computing power of US

rivals, putting billions of capex in doubt.

Therefore, Magnificent Seven, which account for one-third of the S&P

500's market cap, may suffer more pains ahead as the group's forward P/E

multiples are still above pre-pandemic levels.

For years the US has attracted capital by virtue of its deep liquidity,

stability and the safe-haven status of its assets. But political uncertainty is

making it a less reliable place to park capital.

Capital flows back

Now, as the dollar falters on fear the US is heading for a slowdown,

investors say the outlook for developing-world assets hinges on just how much

economic suffering Trump's trade spat will cause.

The hope is growing that developing nations can pull back at least some of

the $211 billion that investors have yanked out of the asset class since 2022,

including about $30 billion this year.

EM has the potential to continue to outperform and draw more funds, said Jeff

Shultz, an economist at BNPP. "But it really depends on what happens over the

next couple of months."

For some, if the US skirts a drastic slowdown while a weaker greenback

persists, EM central banks can cut interest rates to spur growth. China's

commitment to stability also lends some support.

Senior Chinese officials on Monday outlined plans to support jobs and help

exporters, while hinting at the possibility of more stimulus. That came after a

Politburo meeting calling for targeted measures to help businesses.

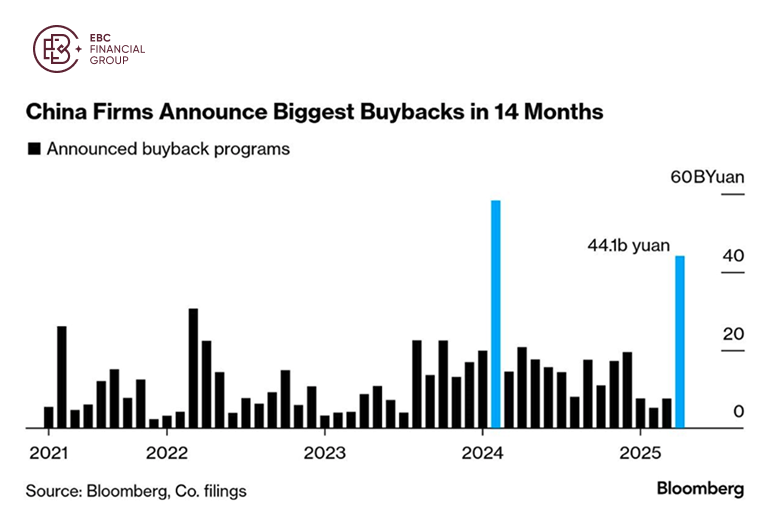

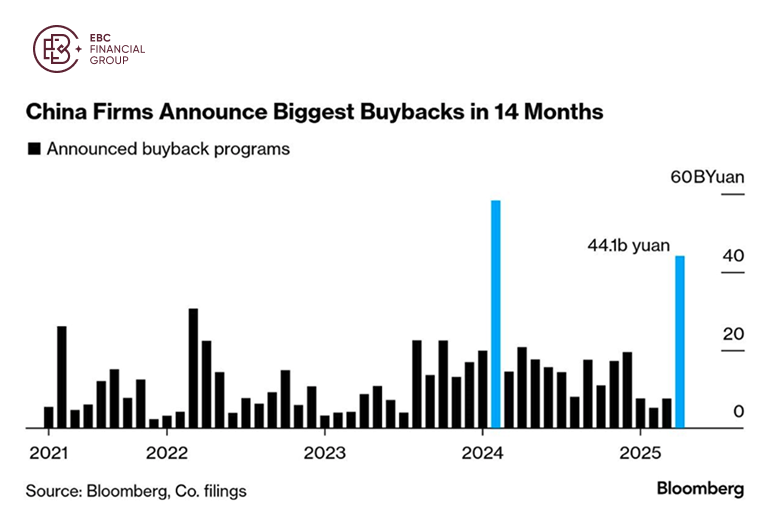

Share repurchases pledged by 139 companies in Shanghai and Shenzhen amounted

to 44.1 billion yuan as of Thursday, the most since February 2024, according to

exchange data compiled by Bloomberg.

China's exports to big developing economies have already more than doubled

since Trump's first presidential term – the reason why it is less threatened by

the US tariff agenda, according to Jefferies.

Asia takes the lead

Asian economies geared for exports and facing some of the highest US

"reciprocal" tariffs are leading the way over their western counterparts in

trade negotiations with the Trump administration.

Tokyo's current top trade negotiator, Ryosei Akazawa, says the two sides are

yet to agree on a full scope of negotiations ahead of his second trip to

Washington for tariff talks, expected in the next few days.

With the US and China at an impasse and other major Asian economies charting

a faster track, US trading partners in North America and Europe are still trying

to understand the basic parameters.

Last week Bessent said the US and South Korea could reach an "agreement of

understanding" on trade as soon as this week. Korean officials say they see

early July as the initial deadline for any concrete deal.

Asian governments are looking to buy more US energy as they scramble to lower

their trade surplus with Washington in hopes of easing their tariff burden.

India has agreed to boost the imports as early as February.

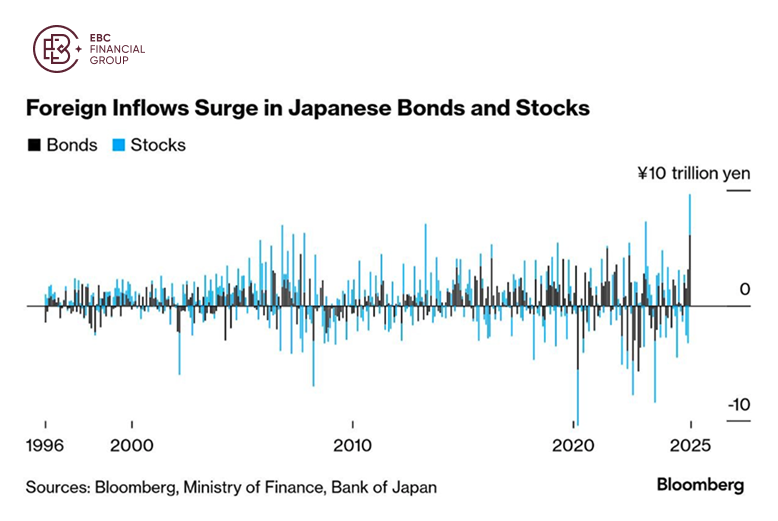

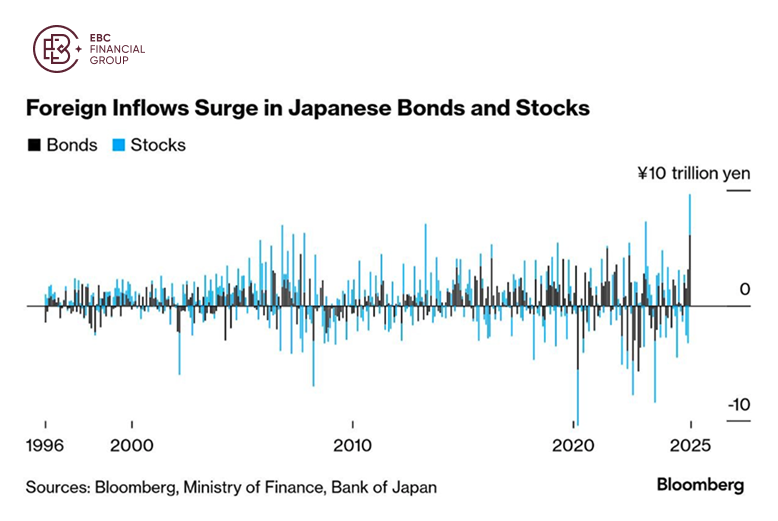

Japanese bonds and stocks are set to draw the biggest combined monthly

foreign inflows on record. Overseas investors' stock purchases hit a two-year

high, adding to signs global funds are seeking alternatives to US assets.

The IMF project growth in APAC will slow to 3.9%t this year but the rate

outpaces the forecast for other emerging markets. The Asian Century will hardly

be ended by headwinds from heightened trade tensions.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.