Alphabet Inc., the parent company of Google, has once again delivered a standout quarterly performance, reigniting investor confidence and prompting several Wall Street banks to raise their price targets. The Google stock price (GOOG) climbed sharply in after-hours trading following the release of its second-quarter results for 2025. reflecting strong momentum across both core and emerging business segments.

Robust Q2 Results Beat Expectations

On 23 July 2025. Alphabet announced its second-quarter earnings after the U.S. market closed. The results easily outpaced analysts' forecasts, sending a strong signal about the company's resilience amid growing competition in the artificial intelligence (AI) and cloud computing sectors.

Alphabet reported total revenue of $96.4 billion, marking a 14% year-on-year increase, while earnings per share (EPS) rose 22% to $2.31. Both metrics comfortably exceeded market expectations.

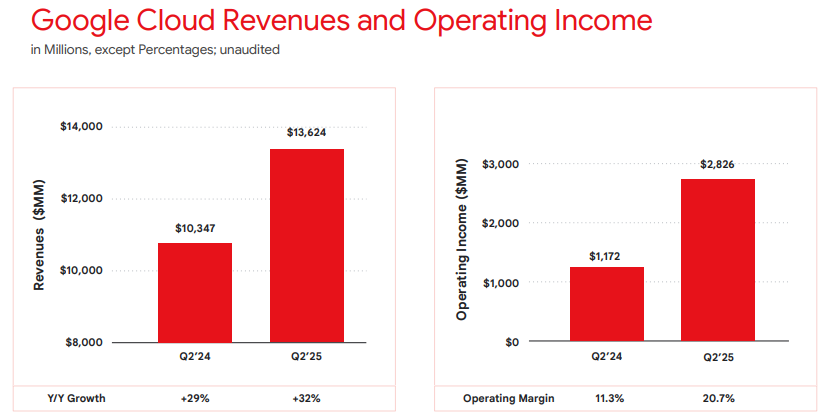

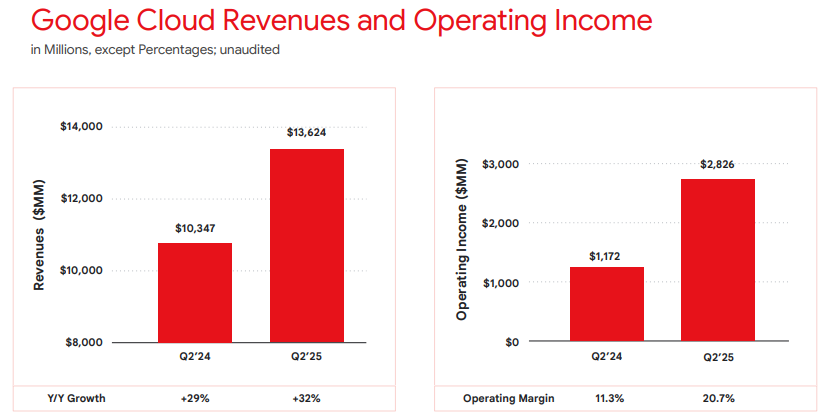

The biggest highlight of the report was Google's cloud business, which saw revenue jump to $13.6 billion, representing a 32% year-on-year increase. This stellar performance underscored Google Cloud's growing relevance in the enterprise technology space, driven by AI integration, digital transformation trends, and expanding demand from large-scale clients.

Meanwhile, Google's core search business brought in $54.2 billion in revenue, growing 12% year-on-year and marginally beating forecasts—an encouraging sign, considering mounting competitive pressure from AI-based search alternatives like ChatGPT and Perplexity.

Strategic Capital Spending on the Rise

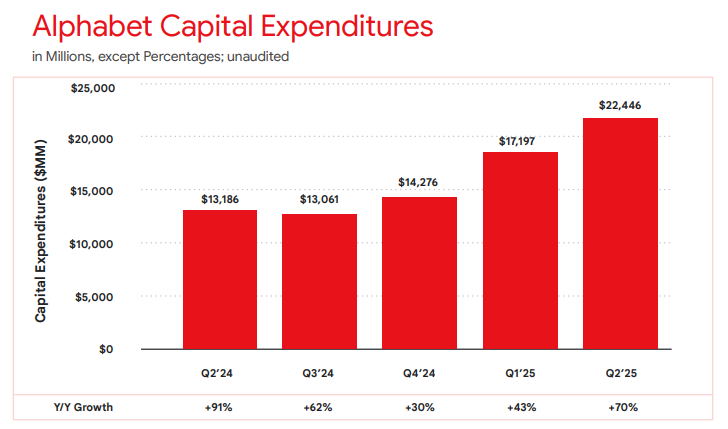

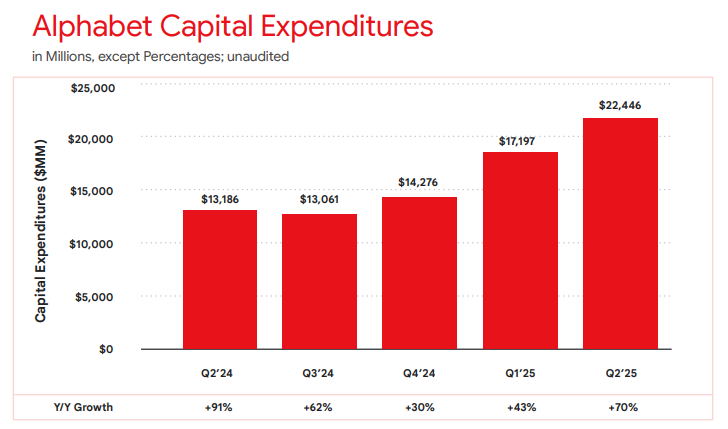

Another point of note in the earnings release was Alphabet's ambitious increase in capital expenditure. The company has raised its full-year capital spending target by 13% to $85 billion, up significantly from $52.5 billion in 2024. According to CFO Anat Ashkenazi, capital investment is expected to climb further in 2026. suggesting continued expansion in data infrastructure, AI capability, and product development.

This aggressive reinvestment signals Alphabet's intent to remain at the forefront of AI and cloud services, both of which require substantial infrastructure and R&D outlays to maintain a competitive edge.

Positive Market Reaction and Analyst Upgrades

Following the earnings announcement, the Google stock price surged 3%, trading at $196.5 at the time of writing. The bullish market reaction has been accompanied by several upward revisions to Alphabet's target price by major investment banks.

These upgrades imply a potential upside of over 20% from current levels, further solidifying market confidence in the company's trajectory.

Can Google Maintain Its Edge Amid AI Competition?

Despite the promising results, Alphabet is not without challenges. The emergence of AI-native search and productivity tools—particularly OpenAI's ChatGPT and its evolving ecosystem—poses a long-term threat to Google's dominance in search and information retrieval.

Nevertheless, the current quarter proves that Google's traditional business model retains its strength, even as the digital landscape evolves. With strategic investments flowing into AI and cloud technologies, Alphabet appears well-positioned to adapt and lead in the next wave of technological innovation.

Conclusion

The second-quarter earnings reaffirm Alphabet's status as a technology powerhouse. The Google stock price is gaining momentum thanks to strong cloud revenue, steady search growth, and assertive capital allocation.

While AI competition presents real risks, Alphabet's willingness to invest heavily in infrastructure and innovation may be the key to sustaining its competitive advantage. With multiple analysts projecting further upside and robust financial metrics to support that optimism, the outlook for Google stock remains decidedly bullish in the near to medium term.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.