EBC Forex Snapshot, 29 Aug 2024

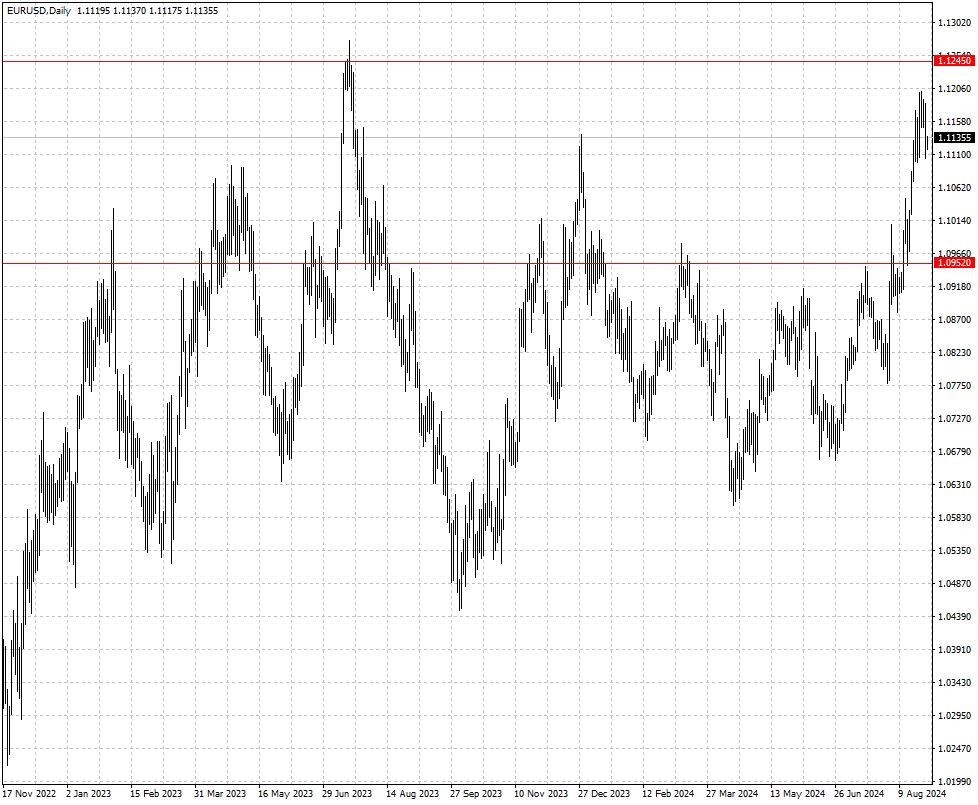

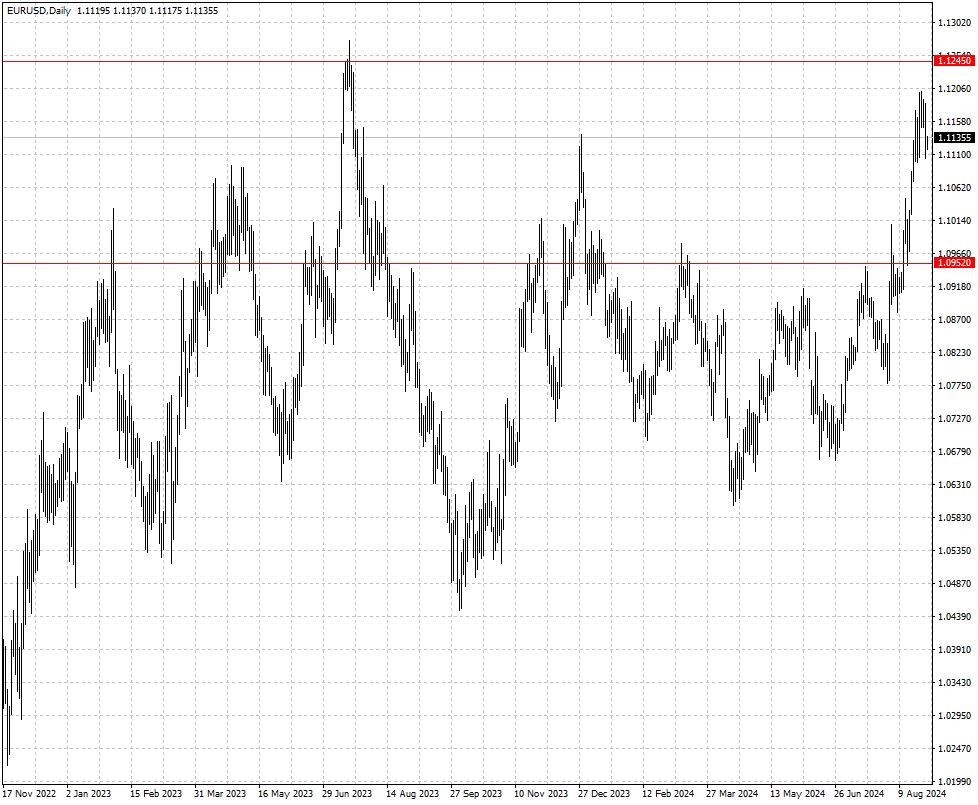

The dollar steadied on Thursday as it nursed some of its earlier losses.

Markets have fully priced in a 25-bp rate cut from the Fed next month, with a

34.5% chance of a 50-bp reduction, according to the CME FedWatch tool.

The euro was off its 13-month high as the GfK consumer climate index hit its

lowest level since May. The German consumer remains deeply pessimistic about

economic conditions.

Europe is suffering from an innovation deficit and weak productivity, putting

the region's economy on a path to stagnation, according to Nobel laureate

Michael Spence.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 19 Aug) |

HSBC (as of 29 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.1068 |

1.0952 |

1.1245 |

| GBP/USD |

1.2673 |

1.2946 |

1.2853 |

1.3396 |

| USD/CHF |

0.8333 |

0.8827 |

0.8303 |

0.8644 |

| AUD/USD |

0.6363 |

0.6799 |

0.6628 |

0.6877 |

| USD/CAD |

1.3597 |

1.3946 |

1.3362 |

1.3674 |

| USD/JPY |

145.89 |

150.00 |

142.20 |

148.16 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.