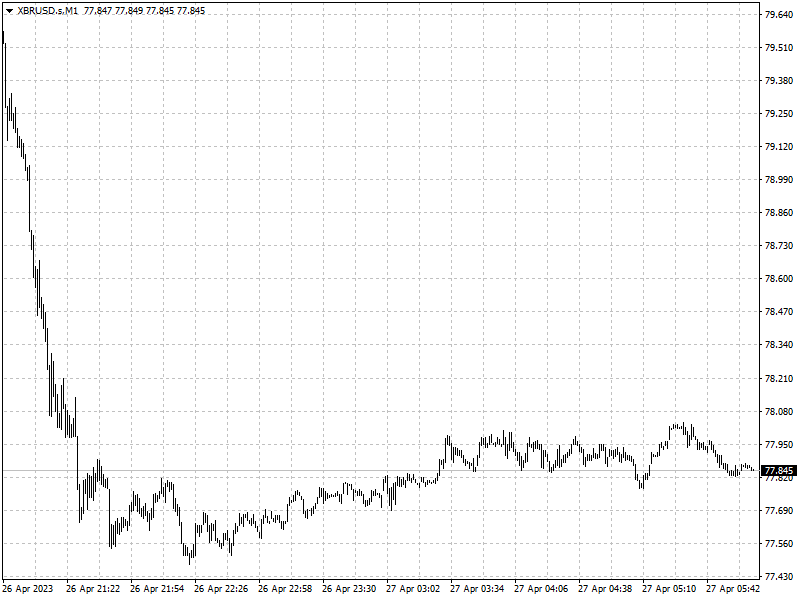

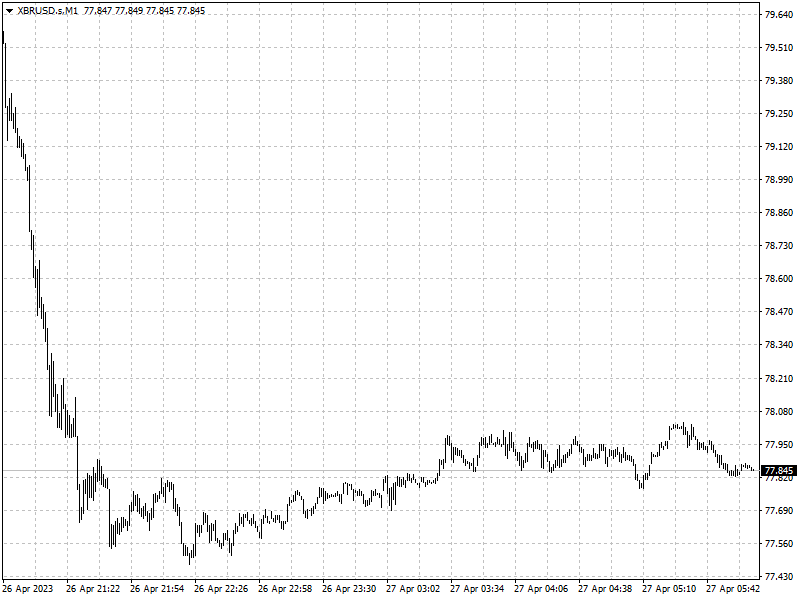

Oil prices dropped by almost 4% on Wednesday as markets weighed more weak

economic data indicative of dire growth outlook.

U.S. stocks closed mixed following strong quarterly results from Microsoft

and Alphabet that both beat analyst expectations.

New orders for key U.S. manufactured capital goods fell more than expected in

March and shipments also declined.

Commodities

Oil prices have erased all their gains since OPEC+ announced in early April

an additional output reduction until the end of the year. Future prices are

signaling a market weaker than normal, while spreads are signaling the

opposite.

Brent’s 6-month Calendar Spread has slipped to a backwardation of $2.4 per

barrel, down from $3.99 on April 12. Consumption is slack but expected to bounce

back later.

EIA data shows U.S. crude inventories fell last week by 5.1 million barrels

to 460.9 million barrels, far exceeding forecasts of a 1.5 million drop.

Refinery run help boost the demand side but that is offset by the expectation

of lower crude exports, as the tightening of spreads weighs on buying appetite,

noted lead oil analyst Matt Smith.

Forex

The canadian dollar hit a 4-week low, dragged lower by oil price woes. The

BoC paused earlier this month, waiting for more evidence of the effects of rate

hikes on growth and inflation.

Canadian core inflation is expected to remain above 3% until the 4th quarter

of this year, which could dash hope of an early BoC shift to easing.

The German government has raised its economic growth forecast for this year

to 0.4% from a previously predicted 0.2%, in marked contrast to the downward

revision to growth for 2023 by the Fed.

Driving the dollar versus major currencies are early signs of a U.S. slowdown

and decelerating inflation that will be greater than other economies, said

Thierry Wizman, global FX & interest rates strategist at Macquarie in New

York.