Future and options trading can seem complex to newcomers, but it plays a crucial role in global financial markets. These instruments are widely used by investors, traders, and corporations to manage risk, speculate on price movements, and increase potential returns. Understanding how they work is an important first step for anyone looking to expand their investment strategy or deepen their market knowledge.

At its core, future and options trading involves contracts known as derivatives. These contracts derive their value from an underlying asset, such as a stock, commodity, currency, or index. Futures and options are the two most common types of derivative contracts, and they offer distinct ways to engage with market movements without directly owning the underlying asset.

How Future and Options Work

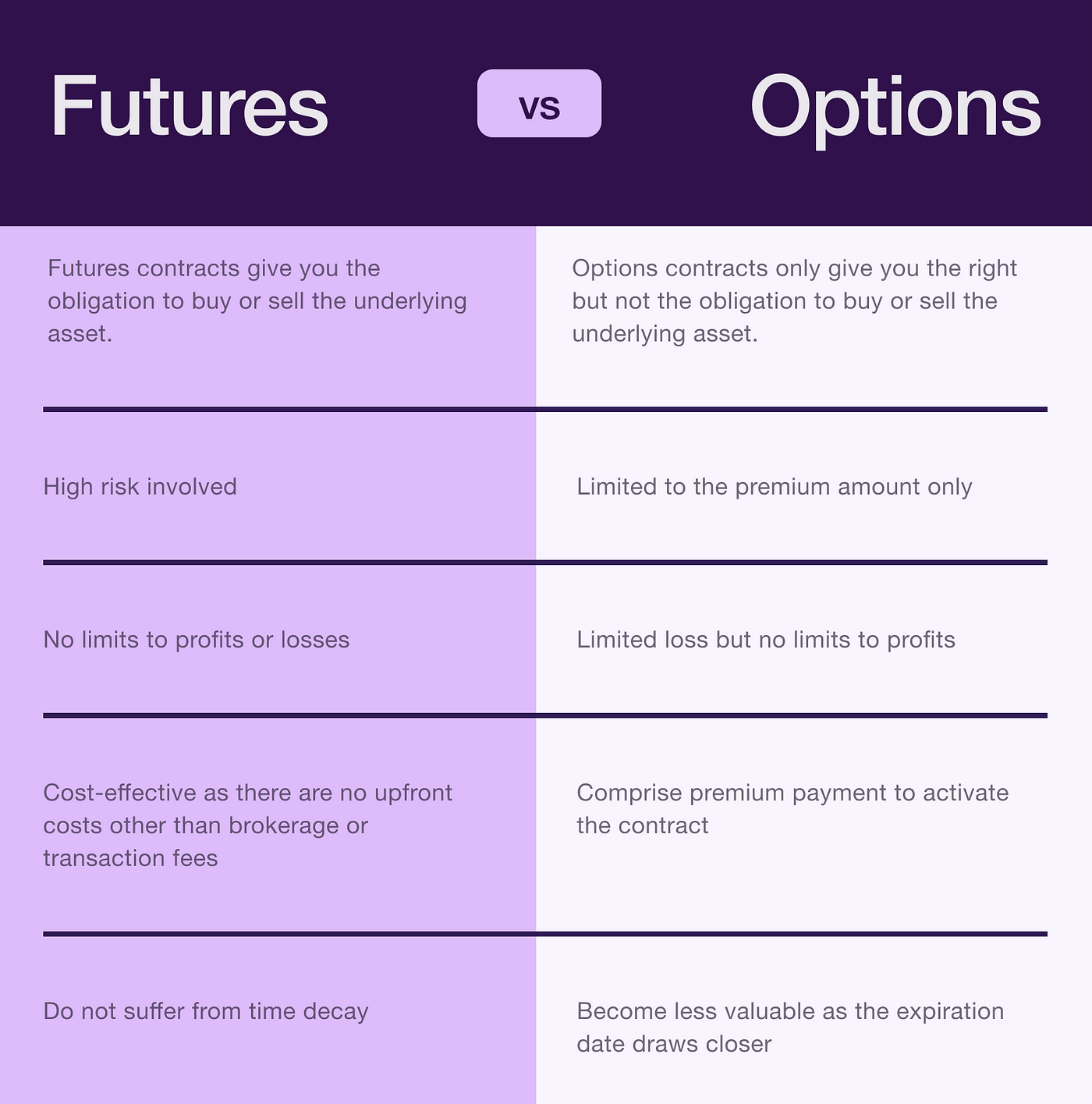

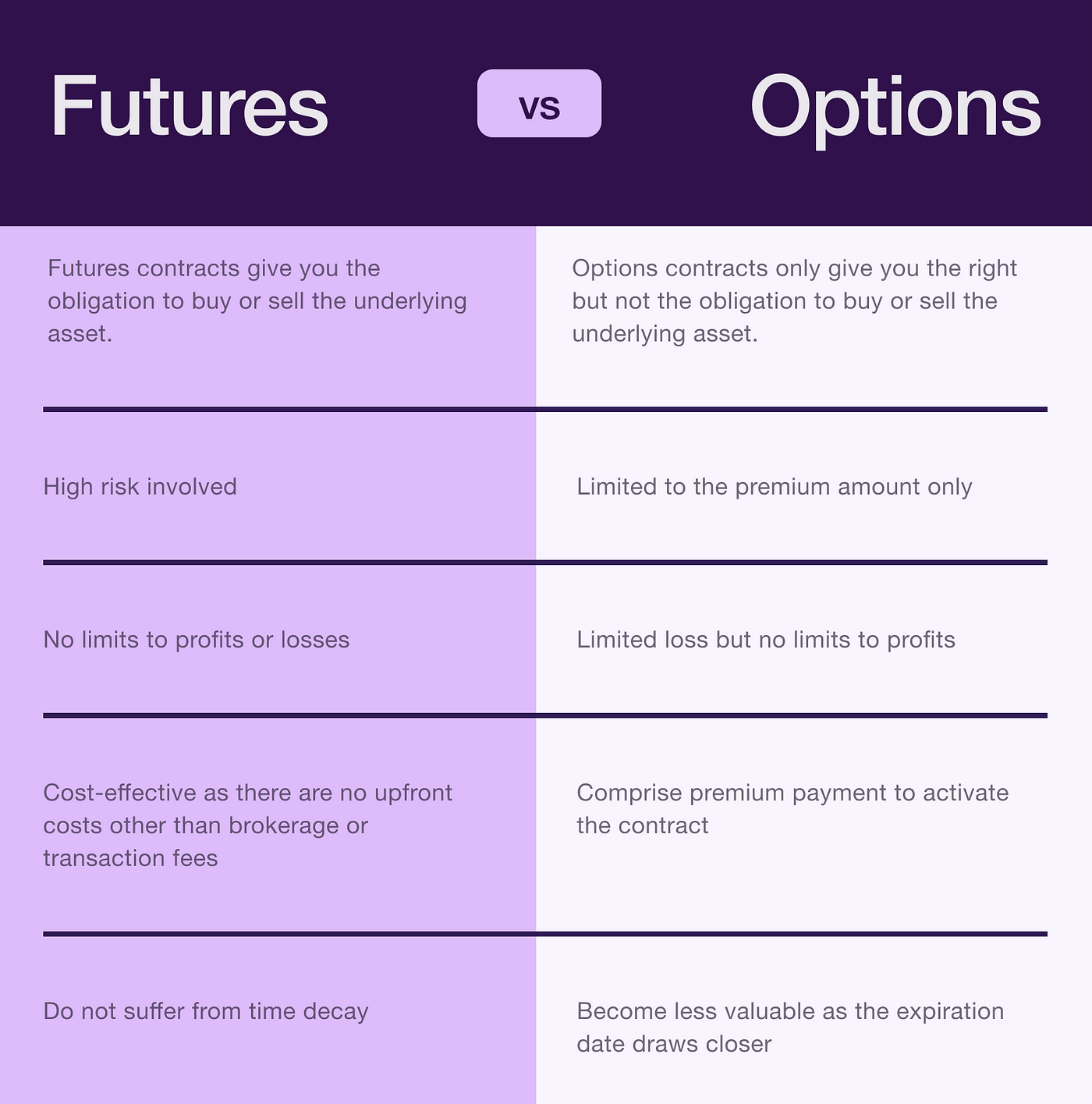

Futures contracts are agreements between two parties to buy or sell an asset at a set price on a predetermined future date. These contracts are legally binding, and both the buyer and seller are obligated to honour the terms at expiry. Because of this commitment, futures are often used by institutional traders or producers who want to lock in prices and reduce uncertainty. For instance, an airline might use oil futures to fix fuel costs, shielding itself from rising prices.

Options contracts function differently. They give the buyer the right, but not the obligation, to buy or sell the underlying asset at a specific price within a certain time frame. There are two main types of options: call options, which allow the purchase of an asset, and put options, which allow its sale.

This flexibility makes options a popular choice for retail traders, especially those looking to hedge existing positions or limit potential losses. Since the buyer is not required to exercise the contract, the maximum loss is limited to the premium paid upfront.

Why People Use Future and Options Trading

One of the primary appeals of future and options trading is its versatility. Investors use these instruments for several purposes. Some employ them as a hedge, using derivatives to protect their portfolios from adverse market movements. A farmer, for example, might sell futures on their crops to secure a favourable price months before the actual harvest. This approach reduces exposure to sudden price drops due to weather or global supply issues.

Others use future and options trading for speculative purposes. Traders aim to profit from price movements by predicting whether an asset's value will rise or fall. Because these instruments often involve leverage, even small changes in price can lead to significant gains—or losses. This potential for higher returns attracts many participants, but it also requires a disciplined and well-informed approach.

There are also those who engage in arbitrage, seeking to exploit temporary price differences between markets. By buying and selling similar instruments simultaneously, they can potentially lock in profits with minimal risk. However, this strategy typically demands advanced knowledge, sophisticated tools, and rapid execution.

Key Concepts and Terms to Understand

To engage in future and options trading successfully, it is essential to understand the basic terms and mechanics. Every contract comes with key specifications, such as the strike price (the price at which the asset can be bought or sold), the expiry date, and the underlying asset it tracks.

Options involve an upfront cost known as a premium, while futures require a margin deposit to open and maintain positions. Contracts are also standardised in terms of lot size and settlement type—some settle in cash, while others require physical delivery of the asset.

Risks of Future and Options Trading

Risk is an inherent part of future and options trading. Leverage, which allows traders to control large positions with relatively small amounts of capital, magnifies both gains and losses. Volatility in the market can lead to unexpected outcomes, especially for traders who are overexposed or lack a solid risk management strategy. Time sensitivity adds another layer of complexity. Options, in particular, are affected by time decay, meaning their value decreases as the expiry date approaches if the underlying asset does not move in the desired direction.

Despite the risks, beginners can get started with future and options trading, provided they invest time in education and practice. Many brokers offer demo accounts where users can test strategies without risking real money.

Understanding contract details, market behaviour, and basic pricing models can significantly increase the chances of success. It is also helpful to keep up with economic news, central bank policy changes, and industry reports that may influence asset prices.

Can Beginners Trade Futures and Options?

Yes, they can—but education and discipline are key. Before trading with real money, beginners should gain confidence through learning resources, simulated trading, and market observation. They should also be aware of regulatory considerations and always choose platforms that are licensed and transparent.

The growth of online brokerages has made future and options trading more accessible than ever, but accessibility does not guarantee success. Clear goals, a sound strategy, and emotional control remain essential to navigating these markets effectively.

Final Thoughts

Future and options trading is a powerful financial tool that opens up a wide range of strategic possibilities. From protecting against price drops to speculating on market trends, these instruments offer value to both cautious investors and aggressive traders.

However, success does not come from guesswork. Like all financial products, futures and options carry risk, and the key to managing it lies in knowledge, preparation, and consistent discipline. With the right foundation, beginners can make informed decisions and gradually develop confidence in one of the most dynamic areas of modern investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.