The yen was poised for its strongest weekly performance in over a month as

expectations grow that the BOJ will raise rates next week, putting the dollar on

the back foot ahead of Donald Trump's return to the White House.

Deputy Governor Ryozo Himino said on Tuesday wage growth will likely remain

strong this year. A day later, Ueda echoed the optimism in line with the

conviction that Japan was progressing towards durably hitting its inflation

target.

The central bank will raise interest rates again at one of the two meetings

this quarter to 0.50%, an overwhelming majority of economists surveyed by

Reuters said, with most leaning toward a January move.

With increased prospects of sustained wage gains, the only remaining hurdle

for monetary tightening next week would be the risk of Trump roiling financial

markets with some protectionist speeches.

Japan's 40-year government bond yield reached its highest since inception

amid a global debt selloff and expectations of gradual rate hikes. But the yield

spread between Japan and the US remains substantial.

Data showed US retail sales increased in December, pointing to strong

consumer demand and lending strength to the view that the Fed should be cautious

in its approach to cutting rates this year.

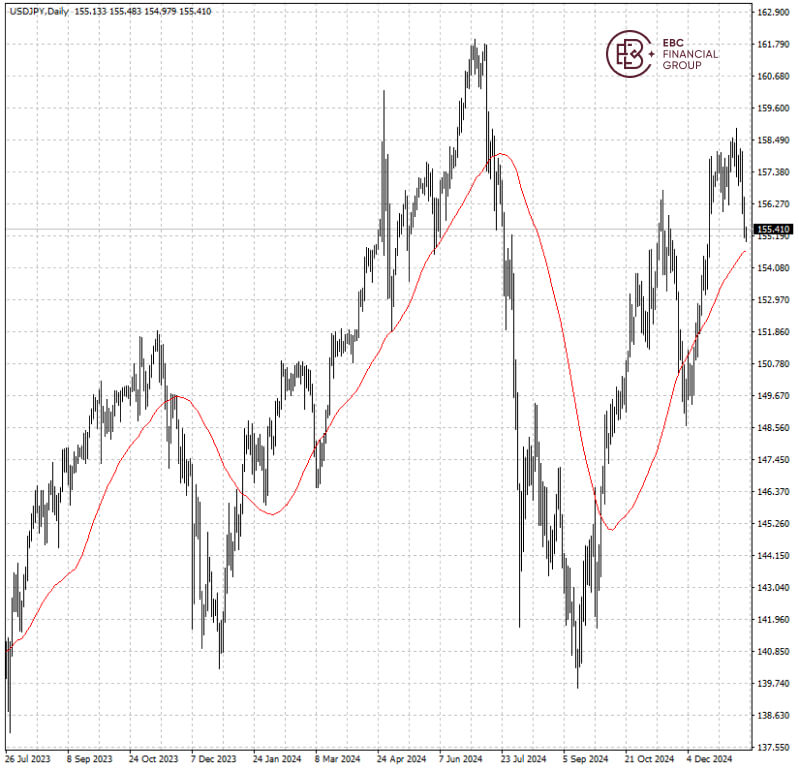

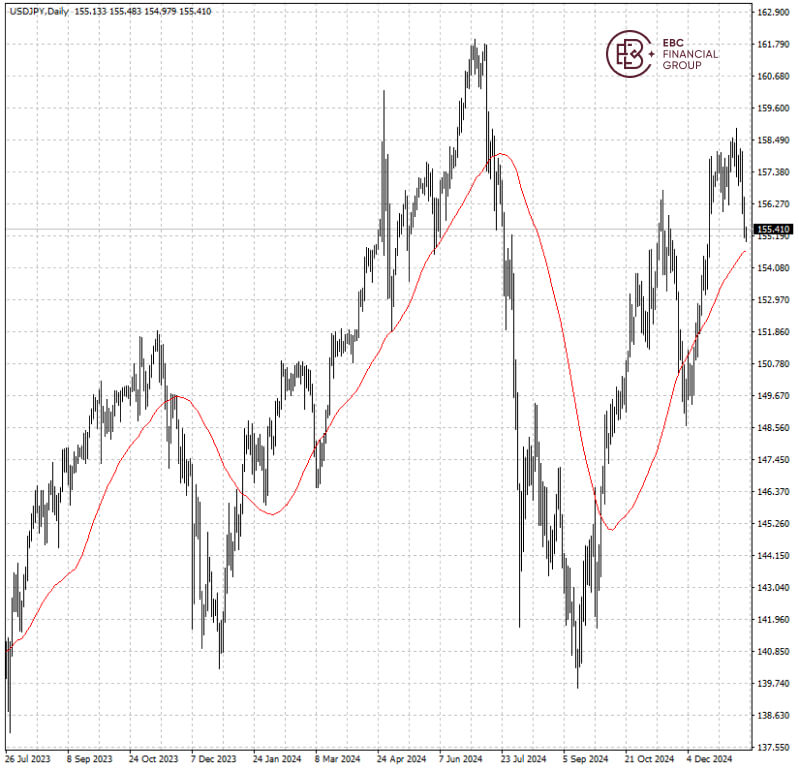

The yen strengthened towards the resistance at 50 SMA. If the level is

smashed through, further gains are likely to bring the currency to 150 per

dollar.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.