British disease

The U.K. has become the only country among the G7 wealthy nations where

inflation is still rising, according to data from the OECD.

U.K. consumer prices across all items rose to 7.9% in May when compared to

the previous year, the OECD said, up slightly from 7.8% in April.

Meanwhile, G7’s Inflation rate fell to 4.6% in May, down from 5.4% in April,

reaching its lowest level since Sept 2021.

According to the OECD, the U.K. will post annual headline inflation of nearly

7% this year, the highest among all advanced economies.

That, before a critical election in 2024, poses a dire threat to Rishi Sunak

who vowed to halve inflation by the end of the year.

Furthermore, the country’s growth has all but stalled and public debt has

surpassed 100% of GDP for the first time since March 1961.

The U.K. hit double-digit inflation in the 1990s and was the only developed

country with inflation significantly above target in the aftermath of the global

financial crisis.

Last month, the BOE hiked interest rates by 50 bps, a larger increase than

many expected. Its 13th consecutive rate hike has taken the rate to the highest

level since 2008.

stagflation risk

The kingdom is suffering from a textbook case of stagflation, and the

symptoms are clear from the latest labour market trends.

The legacy of the pandemic has affected the supply of labour. Although the

number of vacancies has fallen since last summer, it is still well above

pre-pandemic levels.

In a recent CNBC-moderated panel at a monetary policy forum in Portugal,

BOE’s governor Bailey noted that the U.K. labour force is unique in remaining

below its pre-Covid levels.

‘I see this when I go around the country talking to firms. What they say to

me very frequently is that their plan is to retain labour as much as they can,

even in the event of a downturn, because they’ve been concerned and it’s been

difficult to recruit labour.’’

Labour shortages makes it easier for workers to secure higher pay deals. Even

so, private sector pay is not keeping pace with price rises, and the resulting

squeeze on real incomes is a big factor behind the sluggish state of the

economy.

However, Bailey denied that Brexit was the key component in the labour market

tightness and sticky inflationary pressures, instead citing the country’s

response to the Covid pandemic.

There is a silver lining: food inflation finally begins to cool. Prices rose

14.6 percent in June 2023, down from 15.4 percent in May, according to the

British Retail Consortium.

‘If the current situation continues, food inflation should drop to single

digits later this year.’ BRC Chief Executive Helen Dickinson told Reuters on 27

June.

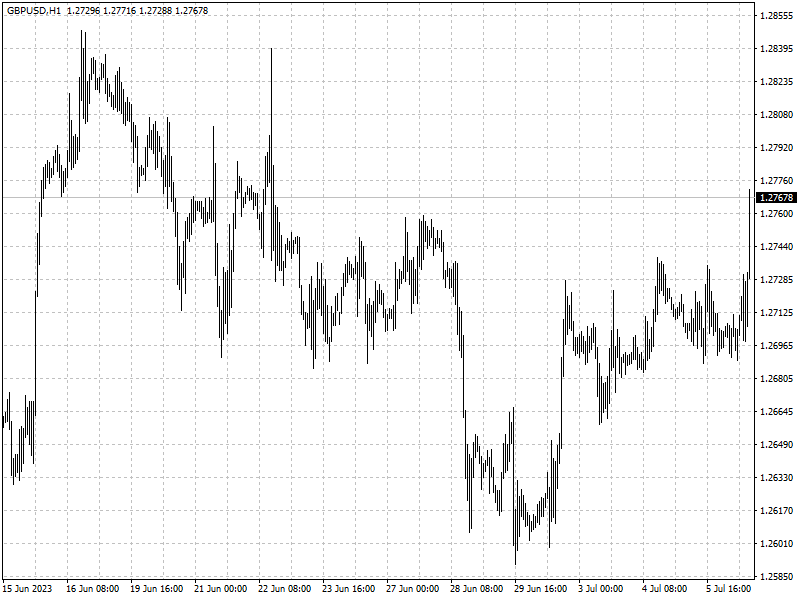

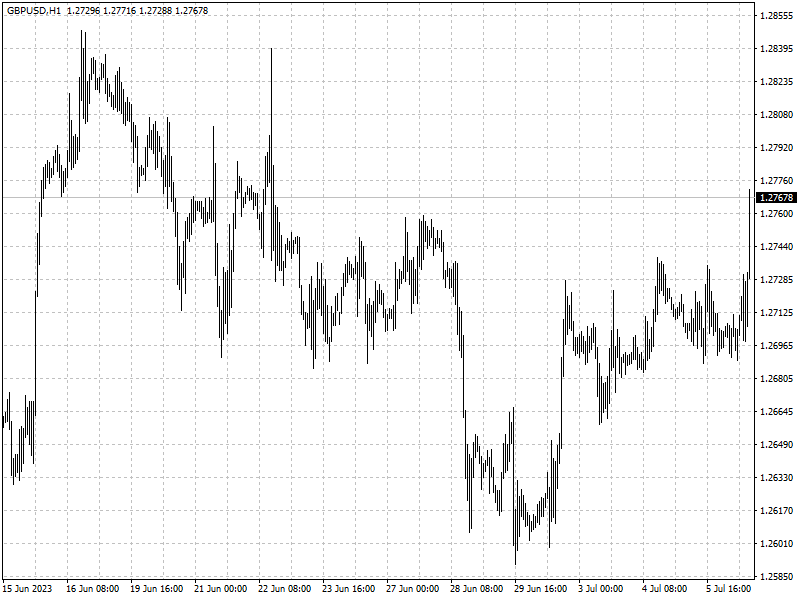

Contrarian indicator

speculators have boosted bullish wagers on the pound to the highest level for

nine years despite recent signs that sterling’s strong rally this year is

flagging.

Net long speculative positions on sterling to almost 52,000 contracts for the

week ended Tuesday June 27, the highest level since July 2014, according to data

from the CFTC.

The currency has fallen by nearly 1 percent since the BoE raised interest

rates more than expected on June, upending the typical correlation between

higher rates and stronger currencies.

The fact that the BoE is tightening because inflation has been persistently

high is a negative for the pound given lacklustre growth, said Paul Robson, a

currency strategist at NatWest.

Surging bullish sentiment points to greater risk for traders to be caught in

a long squeeze if stagflation does materialise around the corner.

‘In theory we should see a bigger drop because there are more positions that

could be scaled back,’ said Francesco Pesole, a currency strategist at ING. ‘We

think sterling is quite vulnerable.’

Goldman Sachs is at odds with that view, saying that the pound should

strengthen as real rates move higher.

With energy prices declining and the labour market still strong, real incomes

are improving, and the BOE is no longer reluctant to raise rates, said the

bank.