Understanding Moving Average Indicators

The moving average, abbreviated as MA, is an indicator that

reflects changes in the trend of indices and Stock Prices. The moving average

analysis method was founded by American investment expert Granville and evolved

from the "three trends theory" of Dow's stock price analysis theory. It moves

the closing price of the last N days to obtain the N-day moving average, which

serves as a tool for evaluating stock price trends.

MA Indicator

In general, moving averages can be divided into the following types: simple

moving averages, exponential moving averages, unobstructed moving averages, and

linear weighted moving averages. In fact, investors can perform a moving average

on any column of data, including opening and closing prices, highest and lowest

prices, trading volume, etc.

In fact, if classified according to the standard of time length, the moving

average can be divided into short-term, medium-term, and long-term moving

averages: the 5-day and 10-day moving averages are often defined as short-term

moving averages; the 20-day and 30-day moving averages are defined as

medium-term moving averages; the 60-day moving averages are defined as medium-

and long-term moving averages; and the 120-day and 250-day moving averages are

defined as long-term moving averages. Generally speaking. Due to the close

proximity of the 5-day moving average to the actual price level, it is difficult

to reveal the trend of changes in variables. Therefore, it is necessary to use

it in conjunction with the 10-day moving average as an effective discriminant

signal for short-term behavior. The 20-day moving average can be used as the

basis for making mid-term investment decisions. The 30-day moving average is

mainly used for combining analysis with short-term lines to determine whether

the trend is rebounding or reversing. The 60-day moving average is more reliable

in understanding medium- to long-term acquisition costs, revealing regular

fluctuations in the medium- to long-term, correcting short-term randomness and

deception (commonly known as deception lines), and making up for the lack of

slow reflection of long-term lines. The 120-day and 250-day moving averages are

highly reliable for predicting economic trends within a year and are one of the

investment decision-making tools for institutions. Among them, the 250-day

long-term moving average is the boundary between a bull market and a bear

market.

Characteristics of Moving Average (MA)

1. Trend Judgment

The moving average indicator can help investors judge market trends. By

calculating the average price over a certain period of time, the trend of price

changes can be observed. When the price is above the moving average, it

indicates that the market is in an upward trend. When the price is below the

moving average, it indicates that the market is in a downward trend.

2. Support and Resistance

The moving average indicator can provide a

reference for support and resistance. When prices fall near the moving average,

the moving average may become a support, suppressing the continued decline of

prices. When prices rise near the moving average, the moving average may become

resistance, suppressing further price increases.

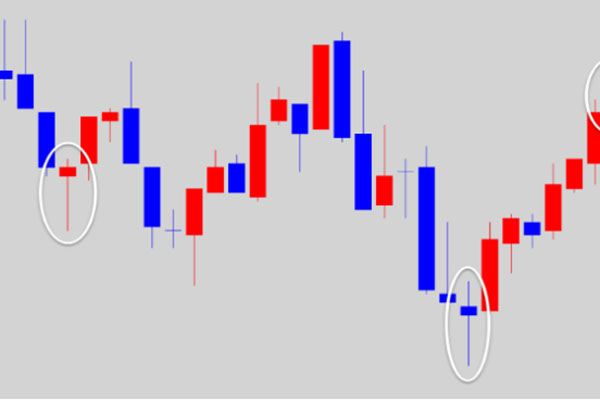

3. Cross Signal

The cross signal of the moving average indicator can be used

to determine the buying and selling timing. When the moving average of a shorter

period of time crosses the moving average of a longer period of time from the

bottom, it is called a "golden cross", which may indicate an upward trend in

prices and can be considered for buying; When the moving average of a shorter

period of time crosses the moving average of a longer period of time from top to

bottom, it is called a "dead cross" and may indicate a downward trend in prices.

Therefore, selling can be considered.

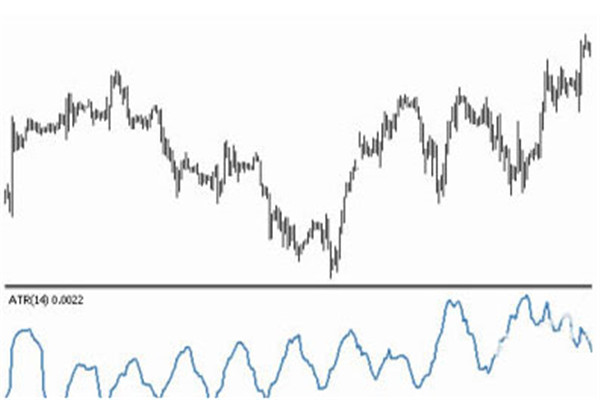

4. Smoothing Price Fluctuations

The moving average indicator can smooth out

price fluctuations, making the trend more clear. By calculating the average

price, short-term fluctuations in prices can be weakened, making it easier for

investors to observe changes in long-term trends.

5. Relative Lag

The moving average indicator is a lagging indicator that is

calculated based on past price data. Therefore, the moving average indicator may

lag behind the actual price changes, leading to a delay in buying and selling

opportunities. Investors need to conduct comprehensive analysis based on other

indicators and market conditions to reduce the adverse effects of lag.

Different moving average indicators have different characteristics, such as

simple moving average (SMA), exponential moving average (EMA), and weighted

moving average (WMA). Investors should choose suitable moving average indicators

based on their trading strategies and market conditions and conduct

comprehensive analysis in conjunction with other technical indicators.