The USD to RMB (CNY) exchange rate has always been a focal point in global currency markets due to the immense economic influence of both the United States and China.

As of May 23, 2025, the USD/CNY exchange rate stands at approximately 7.2886, reflecting a relatively stable position over the past week, with minor fluctuations between 7.197 and 7.225.

To fully understand the dynamics of this currency pair in 2025 and forecast for the USD to RMB, it's helpful to examine its historical trajectory and then evaluate the current relationship between the two economies and their respective currencies.

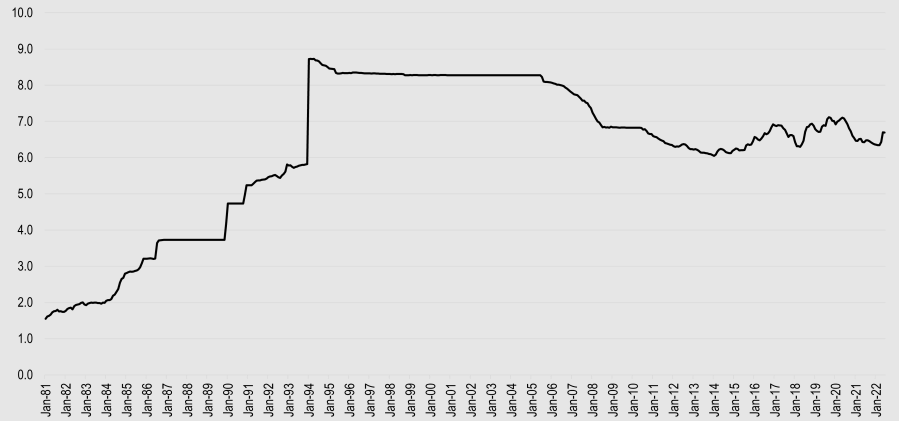

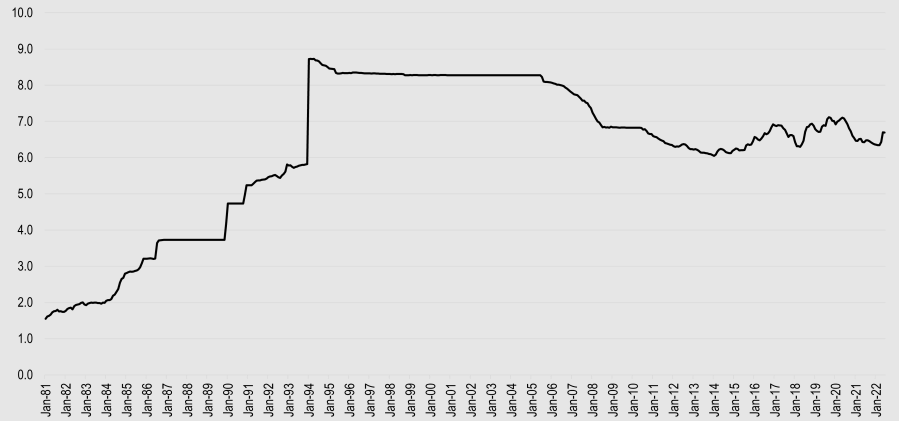

Historical Exchange Rate Overview

The evolution of the USD/CNY rate reflects shifting economic fundamentals, policy decisions, and geopolitical tensions between the U.S. and China. Here's a quick snapshot of the key milestones:

Pre-2005 Peg Era: Before July 2005, China maintained a fixed exchange rate, pegging the yuan at around 8.28 per U.S. dollar. This was part of its strategy to support export-led growth.

2005–2008 Gradual Appreciation: China adopted a managed float system that allowed the yuan to appreciate gradually. By 2008, the exchange rate had fallen to around 6.8, reflecting strong growth in China and significant foreign capital inflows.

2008–2010 Stability Amid Crisis: During the Global Financial Crisis, China re-pegged the yuan to the dollar to stabilise its economy, keeping the rate mostly flat.

2010–2015 Strengthening of the Yuan: Economic recovery and international pressure led to renewed yuan appreciation. By early 2014, the USD/CNY rate reached 6.05, marking one of its strongest points.

2015 Devaluation Shock: In August 2015, the People's Bank of China (PBoC) surprised markets with a one-time devaluation of the yuan, sparking volatility. The rate spiked to around 6.4–6.6 and 7.0 in subsequent years due to trade tensions and slowing Chinese growth.

2020–2022 COVID and Policy Divergence: The pandemic and the divergent U.S.--–China policies created a new wave of fluctuations. The dollar strengthened in 2022 as the Fed raised rates aggressively while China implemented stimulus and lockdowns, pushing the USD/CNY rate back above 7.0.

2023–2024 Volatility and Rebalancing: The rate fluctuated between 6.7 and 7.3, driven by reopening effects in China, shifting U.S. monetary policy, and capital outflows from emerging markets.

USD to RMB Exchange Rate in 2025

In 2025, the U.S. dollar and Chinese yuan exchange remain complex and highly sensitive to macroeconomic and geopolitical developments.

Current Rate (May 23, 2025): ~7.29 USD/CNY

Year-to-Date Range: 7.00 – 7.50

Recent Trend: Moderate dollar strength amid global uncertainties

The USD/CNY pair has experienced fluctuations within a relatively narrow band, influenced by divergent monetary policies and trade dynamics between the U.S. and China.

Key Factors Influencing the Exchange Rate

1) Monetary Policy Divergence

One of the biggest drivers of the USD/CNY exchange rate is the divergence in monetary policy. The U.S. Federal Reserve has shifted toward a neutral-to-dovish stance after an aggressive hiking cycle lasting through 2023–2024. While inflation in the U.S. has cooled, the Fed is cautious about cutting rates too quickly.

On the other hand, China has maintained accommodative policies in 2025 to stimulate a sluggish property sector, boost domestic demand, and stabilise employment. This creates downward pressure on the yuan as lower Chinese interest rates reduce the attractiveness of yuan-denominated assets.

2) Trade Imbalances and Tariff Tensions

As of mid-2025, trade relations between the U.S. and China remain a point of contention. With the potential return of tariffs or trade restrictions (especially as part of pre-election rhetoric in the U.S.), the yuan has come under pressure. These trade frictions lead to uncertainty, prompting investors to seek the relative safety of the dollar.

However, China is also pushing back by increasing its trade and investment ties with other partners through brics+ and Belt and Road initiatives, partially shielding itself from dollar hegemony.

3) Capital Flows and Investor Sentiment

China continues to experience capital outflows, particularly in the real estate and tech sectors. In contrast, the U.S. attracts foreign capital due to the size and stability of its financial markets. This contrast supports dollar strength relative to the yuan.

Nevertheless, China's central bank is intervening selectively in FX markets to prevent excessive depreciation, which could trigger capital flight or undermine domestic confidence.

4) Digital Yuan and De-dollarisation Trends

In 2025, China's digital yuan (e-CNY) is gaining traction domestically and in some cross-border trade agreements. While it does not yet pose a significant challenge to the global dominance of the U.S. dollar, it reflects Beijing's long-term strategy to decrease reliance on dollar-based settlements.

However, global trade and investment still heavily favour the dollar for the time being, maintaining strong demand for USD despite short-term policy differences.

USD to RMB Forecast 2025: Expert Insights

Forecast models for the remainder of 2025 suggest a wide band of possible outcomes:

If China ramps up its economic stimulus and avoids geopolitical shocks, the yuan could appreciate, driving USD/CNY toward 7.10–7.20

If the U.S. economy re-accelerates or markets anticipate another rate hike, the dollar could regain strength, potentially pushing the pair to 7.50 or higher.

For context, here are some expert's insights into the volatile exchange rate:

1. UBS Forecast

UBS anticipates the USD/CNY rate to reach 7.5 by June 2025, citing factors such as potential U.S. tariff implementations and China's economic policy responses.

2. ING Think

ING maintains a forecast range of 7.00–7.40 for USD/CNY, with a year-end projection of 7.30. They note that risks are tilted towards yuan strength if U.S.-China tensions ease.

3. Gov.Capital

Gov.Capital's model forecasts a gradual decline in the USD/CNY rate, projected to reach 6.74 by May 2026, suggesting potential yuan appreciation.

4. Financial Forecast Center

Their projections suggest the USD/CNY rate will peak at 7.56 in September 2025 before declining to 7.40 by December, reflecting expectations of a weakening dollar towards year-end.

Conclusion

In conclusion, the historical context of the USD/CNY rate reflects a tug-of-war between policy decisions, trade tensions, and macroeconomic performance. In 2025, that struggle continues, with the yuan facing downward pressure due to internal challenges while the dollar maintains strength from capital inflows and safe-haven demand.

While the long-term trajectory may suggest gradual yuan appreciation as China aims for more global influence, short-term dynamics still favour a strong or stable dollar, at least through the remainder of the year.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.