Advanced Micro Devices (AMD) has long been a favourite among tech investors, but is it still a good stock to buy in 2025? As the semiconductor industry evolves rapidly, AMD's position as a leader in CPUs, GPUs, and AI hardware is both an opportunity and a challenge.

Here are five key factors to consider before making your investment decision.

Is AMD a Good Stock to Buy? 5 Factors to Know

1. Strong Financial Performance and Growth Momentum

AMD delivered its highest-ever quarterly revenue in Q1 2025, reporting $7.44 billion—up 36% year-over-year. Net income soared to $709 million (GAAP) and $1.6 billion (non-GAAP), with gross margins at a healthy 50–54%.

The data centre division was a standout, generating $3.7 billion in revenue (a 57% increase), driven by robust demand for EPYC CPUs and Instinct AI accelerators. This financial strength reflects AMD's ability to execute on its product roadmap and capitalise on high-growth markets.

2. AI and Product Innovation

AMD is aggressively targeting the AI market, launching new CPUs, GPUs, and AI PCs at COMPUTEX 2025. The company's partnership with ASUS on next-generation AI PCs and the introduction of the Radeon AI PRO R9700 GPU and Ryzen AI 300 Series CPUs are designed to compete directly with rivals in both cloud and edge AI.

AMD's hybrid AI strategy—spanning data centres, workstations, and consumer PCs—positions it as a formidable force in the AI hardware space, with ambitions to challenge established leaders.

3. Shareholder Value and Buybacks

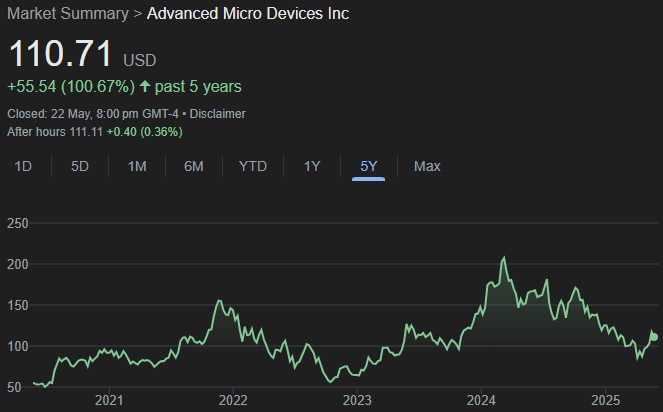

AMD recently expanded its share buyback programme by $6 billion, bringing the total authorisation to $10 billion. This move signals management's confidence in the company's long-term prospects and provides direct value to shareholders.

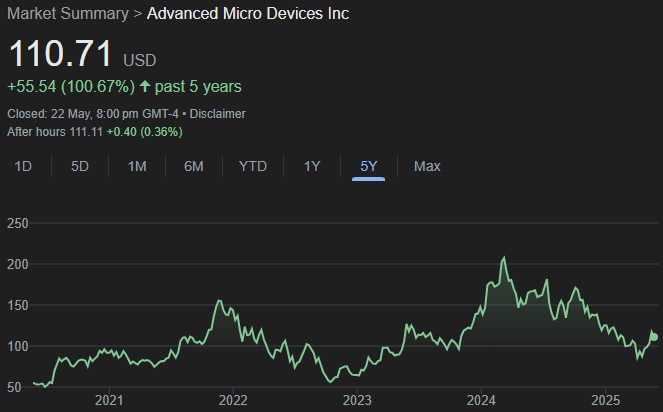

Over the last five years, AMD has delivered a total return of 112.5% for investors, outpacing many peers and reinforcing its reputation as a growth stock.

4. Risks: Export Controls and Competitive Pressure

Despite its strengths, AMD faces notable risks. US export restrictions on advanced AI chips to China are expected to cost the company up to $1.5 billion in lost revenue in 2025 alone.

In addition, AMD remains in fierce competition with industry giants, particularly Nvidia in AI GPUs and Intel in PC CPUs. While AMD's product launches and partnerships are promising, the company must continue to innovate to maintain its momentum and market share.

5. Analyst Ratings and Market Outlook

Analyst sentiment towards AMD is generally positive. Out of 41 analysts, 26 rate AMD a "Strong Buy," and the consensus rating is a "Moderate Buy". The average price target is $141.22, representing a potential 45% upside from current levels, with some targets as high as $225.

However, it's worth noting that AMD's stock underperformed the broader US market and semiconductor sector over the past year, reflecting recent volatility and investor caution. Still, the strong Q1 results and AI-driven growth have led to a 31% surge in AMD's share price in the past month.

Final Thoughts

AMD's robust earnings, aggressive AI expansion, and shareholder-friendly actions make it an appealing option for growth-oriented investors. However, export controls and intense competition remain headwinds that could impact future performance.

As always, consider your risk tolerance and investment horizon before making a decision.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.