A report that Trump wanted a minimum of 15%-20% tariffs – higher than the

anticipated universal 10% rate - on the EU only dealt a minimal blow to markets.

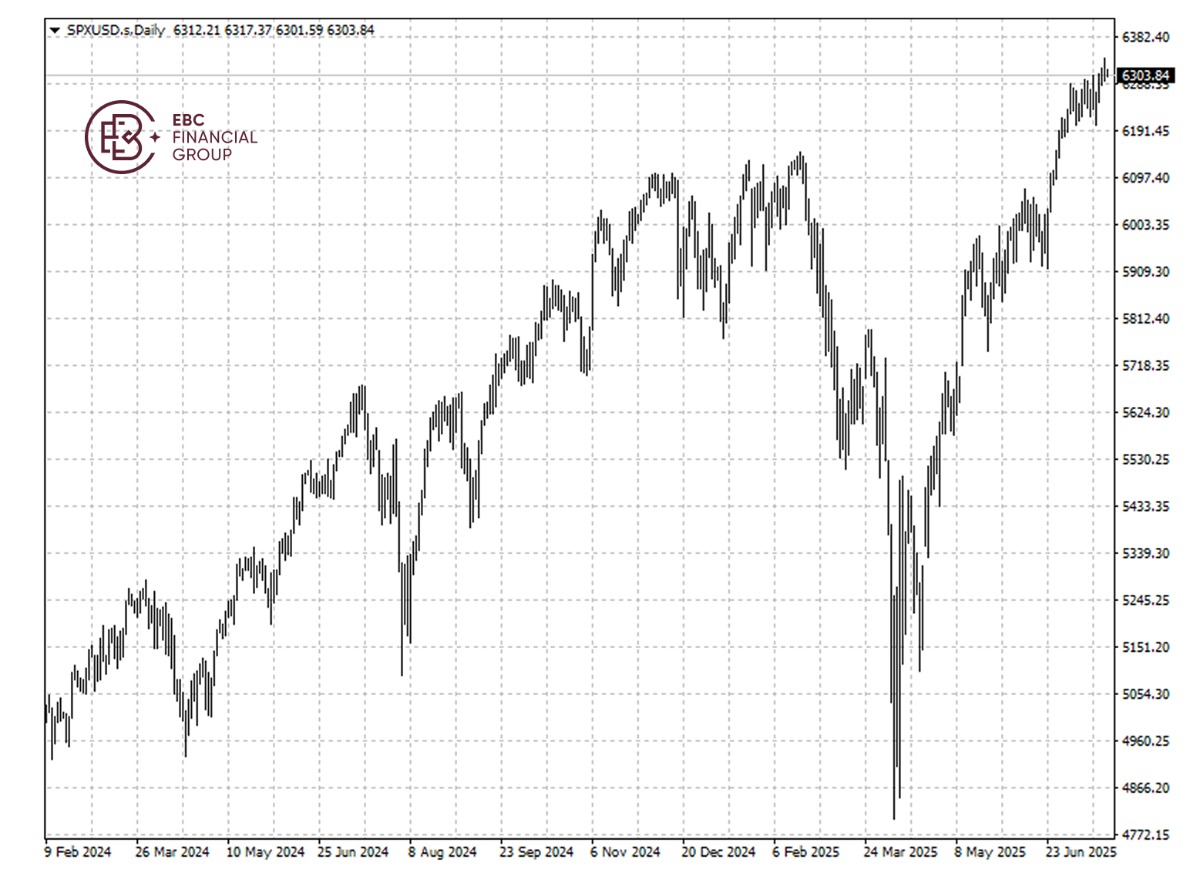

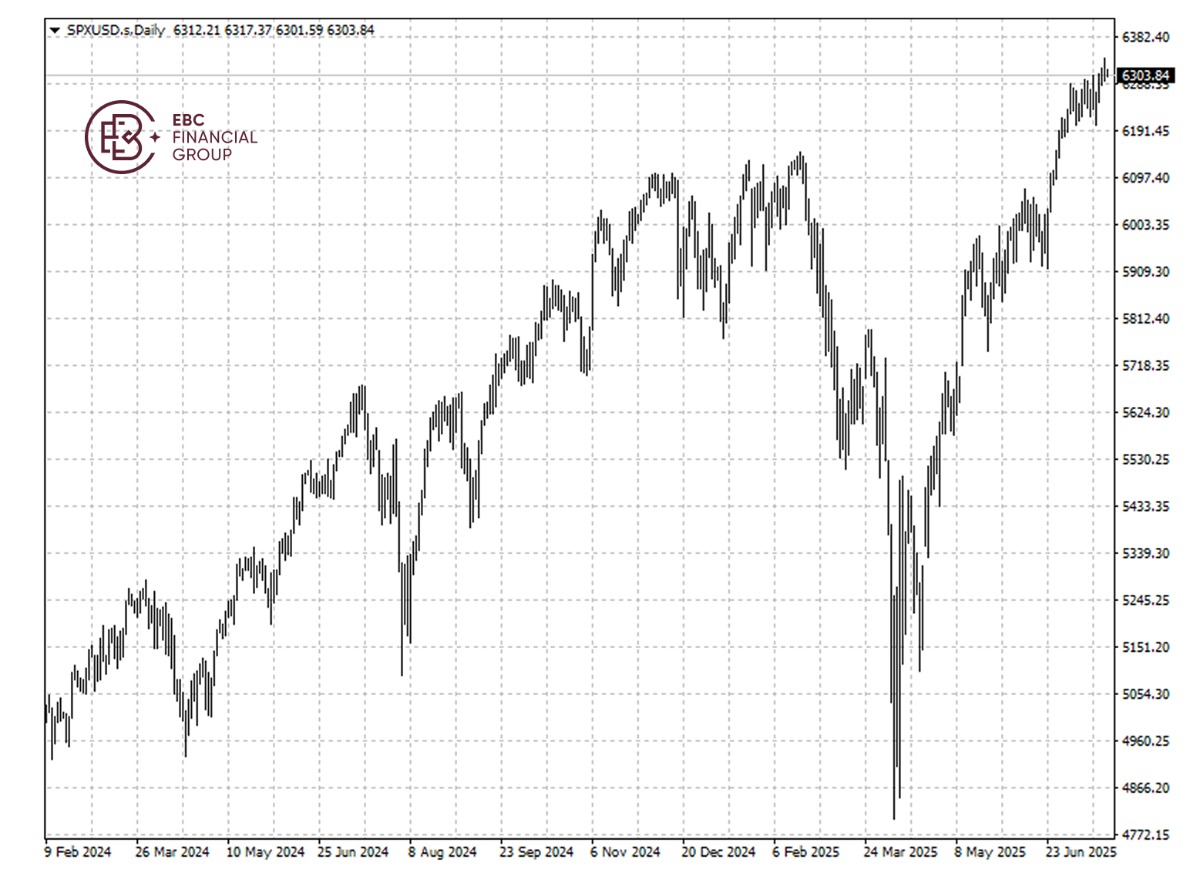

The S&P 500 is sitting around its record peak.

An upbeat start to earnings season has also helped to quell tariff fears for

now. Around 83% of the S&P 500 companies that have reported earnings have

exceeded expectations, according to FactSet data.

Big banks such as JPMorgan Chase and Goldman Sachs, which serve as barometers

for economic activity, had solid beats. Meanwhile, Big Tech still benefit from

AI narrative, particularly Nvidia.

The University of Michigan's July report shows that consumer sentiment index

rebounded to its highest level in five months in early July after Trump signed a

budget bill which includes tax cuts.

Investor sentiment surged in July to its most bullish since February, driven

by the biggest jump in profit optimism in five years and a record surge in risk

appetite, BofA's latest global fund manager survey showed.

Volatility measures for stocks remained muted, suggesting there is little

sense of panic to hedge or shift positions. Respondents believed the short

dollar trade was the most crowded right now.

Sentiment was getting somewhat exuberant, but fund managers' overweight

positioning in stocks was not yet at extreme levels.

Buoyant mood

RBC Capital Markets on Sunday raised its year-end target to 6,250 from 5,730,

its second hike this year, citing stronger investor sentiment and growing focus

on 2026 economic prospects.

RBC strategists anticipate another year like this in 2026, adding that they

now factor in how stocks perform leading up to periods of moderate GDP growth,

specifically between 1.1% and 2%.

Likewise, Morgan Stanley maintained its bullish stance on the market, citing

strong earnings momentum, and said it was expecting a modest pullback in Q3 that

could create an opportunity to buy the dip.

The Wall Street brokerage leaned more towards its bull case of hitting 7,200

by the middle of the year with "valuations supported around current levels,"

though high Treasury yields could hurt rate sensitive stocks.

Jefferies has raised its S&P 500 year-end target to 5,600 from its

previous forecast of 5,300. JPMorgan Asset says medium-sized US tech stocks

still have room to gain due to optimism over AI.

HSBC Holdings has recommended higher US stock allocations in portfolios due

to overestimation of the negative impact of tariffs on margins as well as

underestimation of the positive tailwind from the weaker dollar.

People have really bought into this belief that there is a Trump put, that if

markets correct or if US interest rates go up, Trump will back off as he did in

April, according to Invesco.

The invincible

Trump's proposed tariffs on basic metals have already caused a spike in costs

for American factories, with New York commodity futures trading higher than

other global benchmarks.

Manufacturers have already sounded the alarm about the long-term threat that

the levies pose, arguing that they risk undermining ambitions to challenge

China's industrial might.

Wall Street is already lowering expectations for some of the biggest

carmakers which have a sprawling global supply chain. Potential EU and Japan

retaliations would also take a toll on US brands.

That means the most well-capitalized and growth-oriented names could still

ellipse their counterparts. The Russell 2000 has seen a meagre gain of less than

1% so far.

Those who favour small-cap stocks might point to earlier periods of trading

to show the merits of their strategy. But a broadening rally has not unfolded in

the way they hoped despite improving economic data.

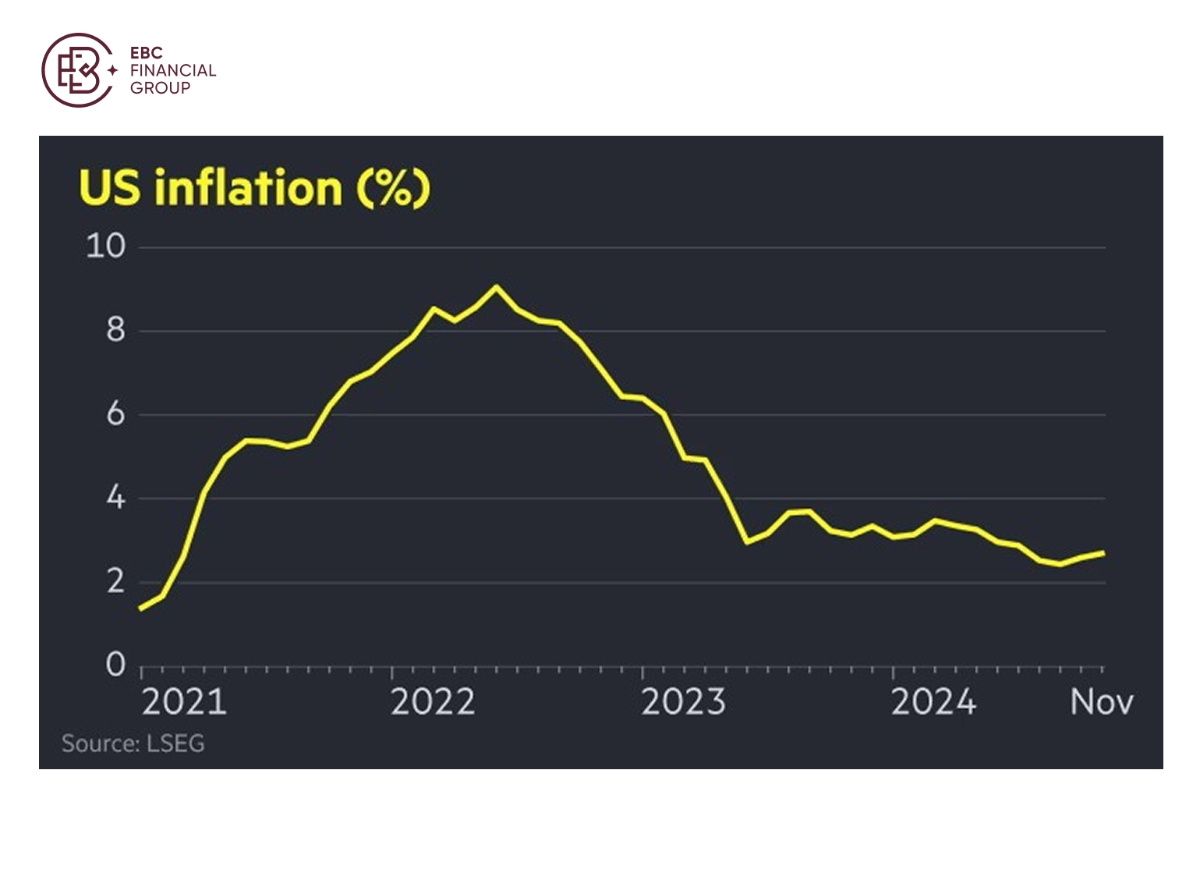

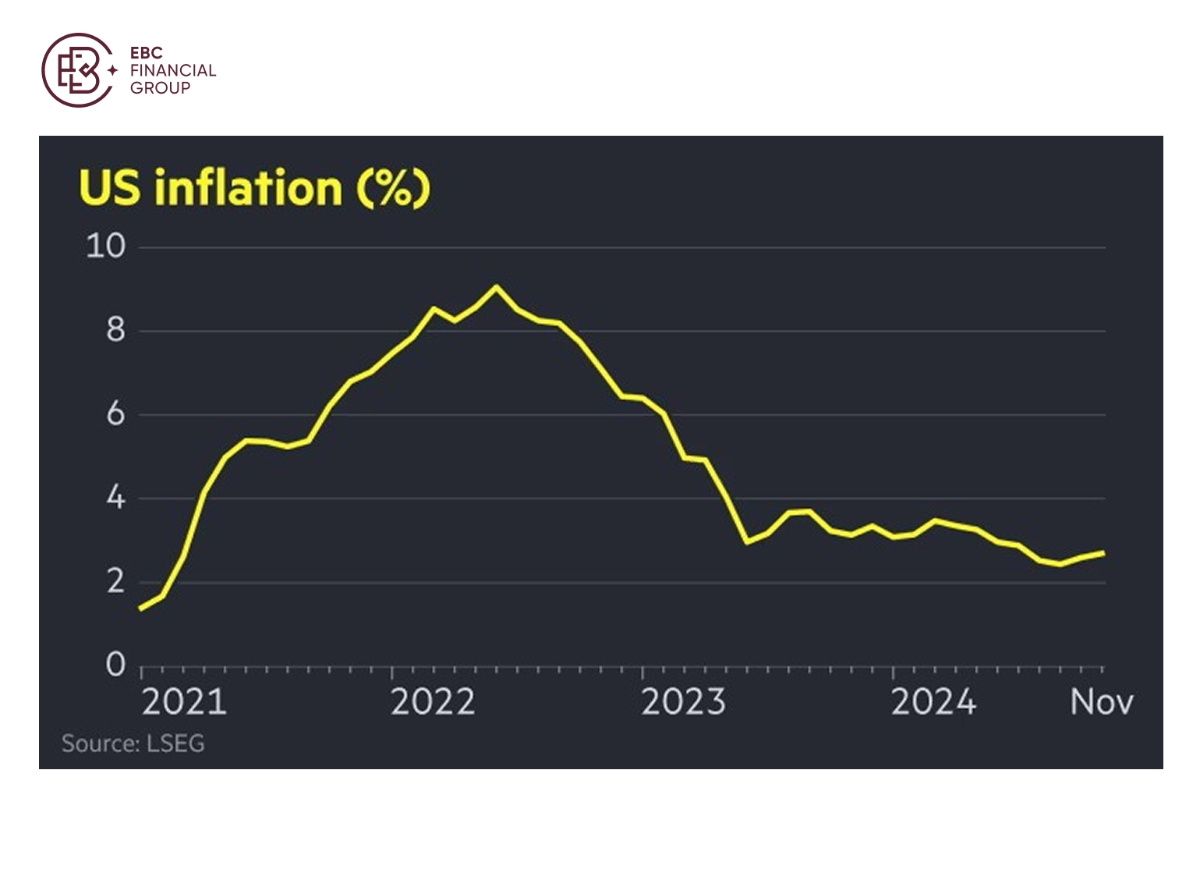

Meanwhile, cooling inflation bodes well for growth stocks because capital can

be obtained more cheaply. Consumer spending and income showed further signs of

weakening in May, according to official data.

Unless US growth keeps surprising to the upside the rest of the year, it will

be hard for the laggards to play catch-up. Thus the S&P 500 and the Nasdaq

100 could remain the most rewarding bets.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.