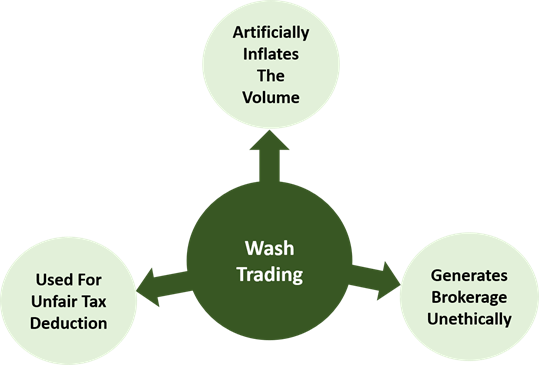

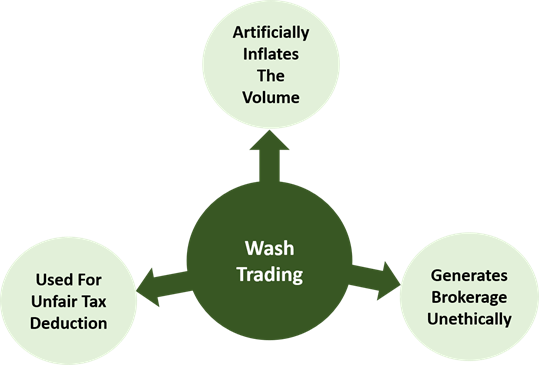

The idea that wash trading is a harmless or technical anomaly could not be further from the truth. Behind its seemingly obscure name lies a tactic that deliberately manipulates market activity, misleads investors and creates false impressions of liquidity.

Although commonly associated with crypto, this practice exists across financial markets and is more widespread than many realise.

As a trading firm committed to transparency and integrity, we believe it is time to challenge some of the most persistent myths surrounding wash trading. Here is what you need to know.

Exposing 9 Myths About Wash Trading

Myth 1: Wash Trading Only Happens in Crypto

While the term gained popularity through the rise of digital assets, wash trading has long been a problem in traditional finance. From equities to commodities, this practice involves buying and selling the same asset simultaneously to create misleading market activity.

The perception that wash trading is limited to crypto ignores its historical roots in conventional trading venues. We recognise its presence across multiple markets, making regulatory vigilance essential regardless of the asset class.

Myth 2: Wash Trading Is a Victimless Act

At first glance, wash trading may seem like an internal manipulation that affects no one else. However, this notion is far from reality. The consequences of wash trading ripple outward, misleading investors, distorting price signals and undermining confidence in the fairness of markets.

In our experience, even minimal wash trading activity can create the illusion of demand, leading others to enter trades based on false data. This results in unjustified gains for the manipulators and real losses for those misled.

Myth 3: Wash Trading Boosts Liquidity

One of the most persistent misconceptions is that wash trading increases market liquidity. The truth is, it merely creates the illusion of liquidity. We have observed that genuine liquidity is characterised by a diversity of buyers and sellers actively participating in the market.

Wash trading, on the other hand, adds no real depth. It clogs order books with artificial transactions, making it harder for genuine traders to execute at fair prices. When this illusion unravels, confidence can collapse swiftly.

Myth 4: It's Hard to Spot Wash Trading

Repeated buy-and-sell patterns

Identical order sizes or timing

No actual change in exposure

Volume spikes with no price movement

With advancements in surveillance tools and trading analytics, wash trading has become easier to identify. Regulators and trading platforms invest heavily in automated systems to track such patterns in real time. The myth that this activity hides in plain sight is no longer true in today's data-driven environment.

Myth 5: Wash Trading Is Legal in Some Markets

A common misunderstanding arises when people assume that the absence of enforcement equals legality. While regulations may differ across jurisdictions, most mature financial systems classify wash trading as illegal or at least prohibited under market abuse rules.

In the UK, for example, it violates the Market Abuse Regulation (MAR). Even in jurisdictions where oversight is still catching up, the ethical breach is clear. We believe compliance should be a baseline, not an afterthought.

Myth 6: Everyone Is Doing It Anyway

This cynical myth fuels further misconduct, but widespread practice does not equal acceptability. Responsible platforms, including ours, implement controls to detect and prevent wash trading.

We work closely with partners and regulators to uphold market integrity. Believing that "everyone does it" only erodes trust and creates an environment where manipulation thrives unchecked.

Myth 7: Wash Trading Doesn't Affect Retail Traders

Retail participants are especially vulnerable to the effects of wash trading. The illusion of market momentum or volume can draw individual traders into unfavourable positions. We have seen how novice traders, relying on volume indicators or trending assets, fall into traps set by wash trading patterns.

This undermines their confidence and leads to losses that could have been avoided in a transparent market. Ensuring clean data benefits retail participants the most.

Myth 8: Platforms Can't Do Much About It

In reality, trading platforms are often the first line of defence. We take this responsibility seriously. Through automated detection systems, detailed audit trails and user education, we strive to maintain fair and transparent trading environments.

While not every instance can be caught immediately, ongoing improvements in our systems and close collaboration with regulators ensure wash trading does not go unchecked for long.

Myth 9: Wash Trading Is a Grey Area

The boundaries of wash trading are clear. When a trader or institution executes trades that nullify each other with no intention of market exposure, that is manipulation.

We believe grey areas are often created by those hoping to avoid accountability. With clearly defined patterns and legal precedent in many markets, this myth fails to hold up under scrutiny.

Final Thoughts

Wash trading is far from a harmless or obscure tactic. It actively distorts markets, misguides traders and erodes trust in financial systems. From our perspective, transparency and integrity must always come first. As markets evolve, so must our tools and vigilance.

At EBC, we continue to develop the systems, policies and expertise needed to detect, deter and ultimately eliminate wash trading wherever it appears.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.