Understanding stock market liquidity is essential for anyone looking to invest, trade, or simply make sense of how financial markets work. Liquidity is a key factor that influences how quickly and efficiently you can buy or sell shares, how stable prices remain, and even how much risk you take on as an investor.

In this article, we'll break down what stock market liquidity means, why it matters, and how it affects your investment decisions-all in straightforward, beginner-friendly terms.

What Is Stock Market Liquidity?

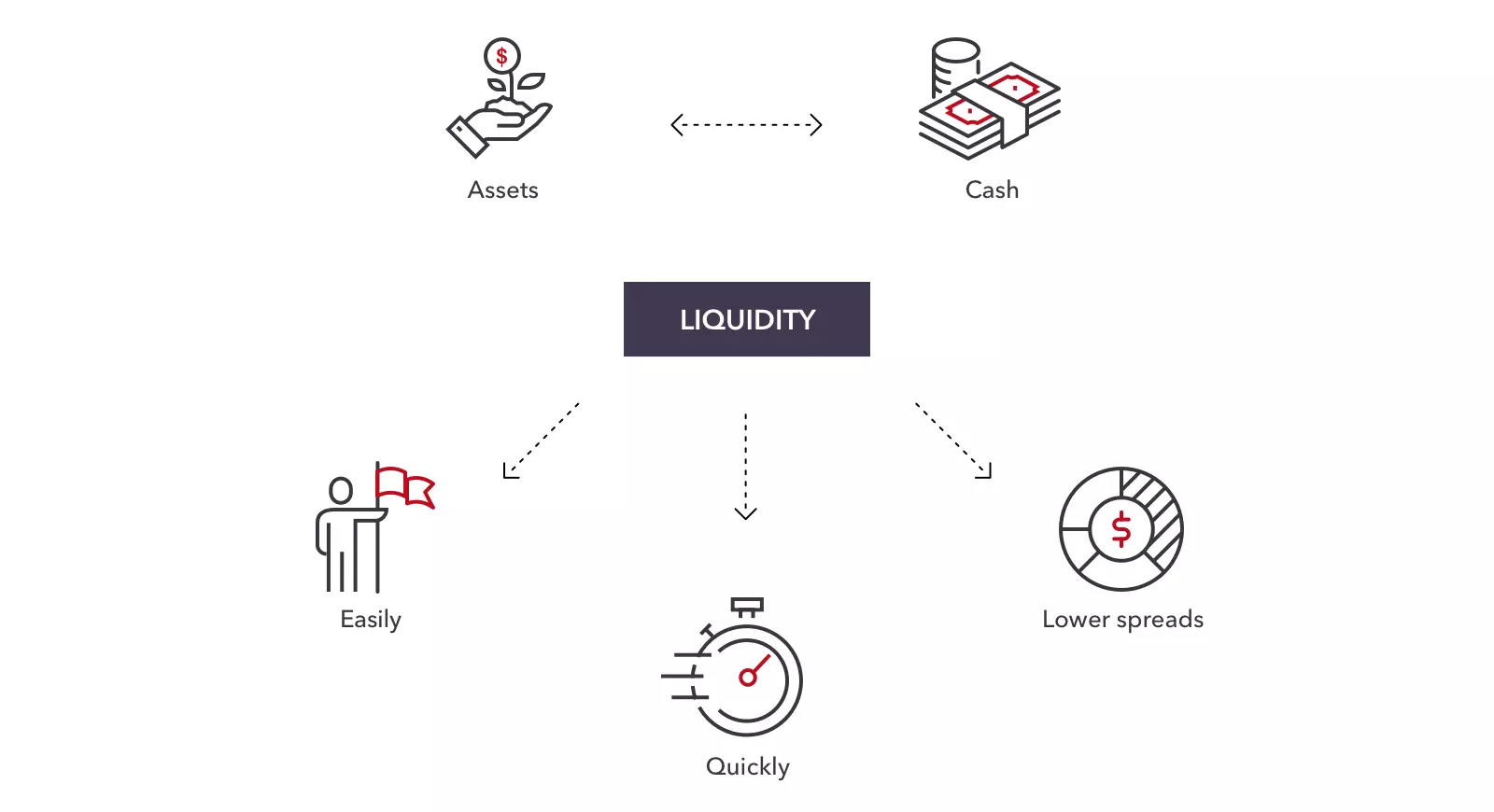

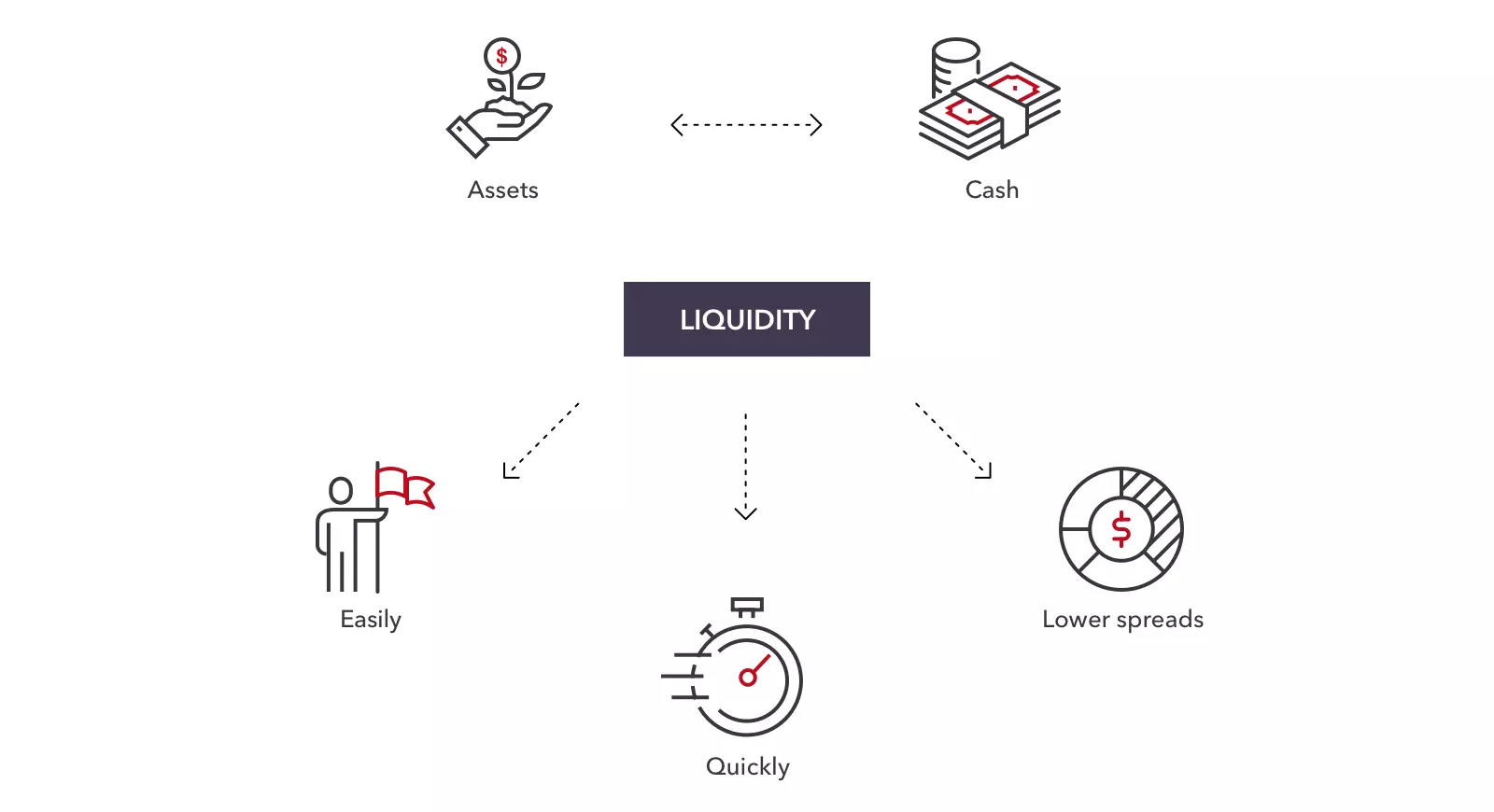

Stock market liquidity refers to how easily and quickly you can buy or sell shares of a company on the stock market without causing a significant change in the share price.

In simple terms, a liquid stock is one that you can trade with minimal effort and at a price close to the current market value. If a stock is highly liquid, there are plenty of buyers and sellers, so transactions happen smoothly and prices remain stable.

Key Features of a Liquid Stock

For example, large-cap stocks like those in the FTSE 100 or S&P 500 are typically very liquid because they are traded in high volumes every day.

How Is Liquidity Measured?

There are a few common ways to assess stock market liquidity:

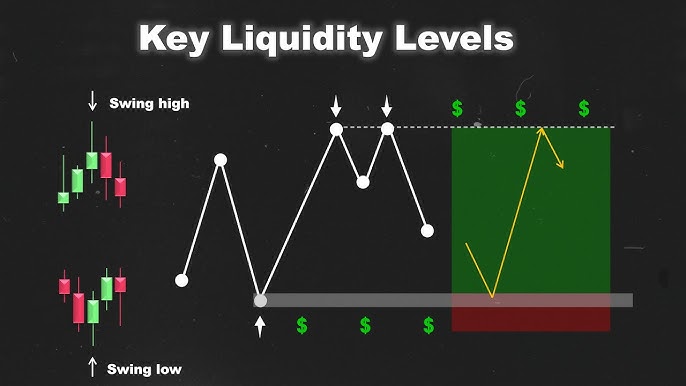

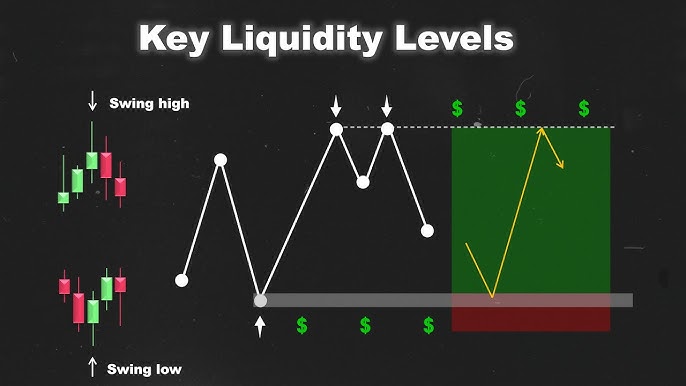

Trading Volume: The number of shares bought and sold over a certain period. Higher volume usually means higher liquidity.

Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller will accept (ask). A narrow spread indicates high liquidity, while a wide spread suggests low liquidity.

Share Turnover: The ratio of shares traded to the total number of shares outstanding. Higher turnover means more liquidity.

Why Is Liquidity Important?

Liquidity makes it easier and faster to enter or exit trades at prices close to the current market value. Here's why it matters:

Quick Transactions: You can buy or sell shares rapidly without waiting for a matching order.

Stable Prices: High liquidity keeps prices stable, even when large trades occur.

Lower Costs: Smaller bid-ask spreads mean you pay less when trading.

Risk Management: In a liquid market, you're less likely to be stuck with shares you can't sell, especially during downturns.

Liquid vs Illiquid Markets

Liquid Market: Many buyers and sellers, high trading volume, tight bid-ask spreads, and stable prices. The stock market is generally considered highly liquid, especially for large, well-known companies.

Illiquid Market: Few buyers and sellers, low trading volume, wide bid-ask spreads, and prices that can change sharply with each trade. Small-cap stocks, foreign shares, or niche markets are often less liquid.

Examples of Liquidity in Action

Highly Liquid Stock: Shares of a major bank or tech company can be bought or sold in seconds, often at the quoted price, because there are always plenty of buyers and sellers.

Illiquid Stock: Shares of a small, little-known company may take longer to sell, and you might have to accept a lower price to find a buyer.

What Affects Stock Market Liquidity?

Several factors can influence how liquid a stock or the overall market is:

Company Size: Larger companies with more shares outstanding and higher trading volumes are typically more liquid.

Market Conditions: Liquidity can dry up during financial crises or extreme volatility, making it harder to trade without moving prices.

Number of Market Participants: More traders and investors mean more liquidity.

Market Makers and Speculators: These participants help provide liquidity by always being ready to buy or sell shares.

Regulations and Trading Hours: Restrictions can limit trading and reduce liquidity.

Risks of Low Liquidity

Price Impact: Selling a large number of shares in an illiquid market can push the price down sharply.

Difficulty Exiting: You may not find a buyer quickly, especially in falling markets.

Higher Costs: Wider bid-ask spreads mean you pay more to trade.

How to Check a Stock's Liquidity

Look at the average daily trading volume.

Check the bid-ask spread-smaller is better.

Review historical price changes for signs of stability.

If you're new to investing, focus on stocks with high liquidity to ensure you can buy and sell easily and at fair prices.

Conclusion

Stock market liquidity is all about how easily you can turn shares into cash without affecting their price. Highly liquid stocks and markets offer quick, cost-effective trading and lower risk, while illiquid assets can be harder to sell and more volatile.

Understanding liquidity helps you make better investment choices and manage your risk, whether you're a beginner or a seasoned investor.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.