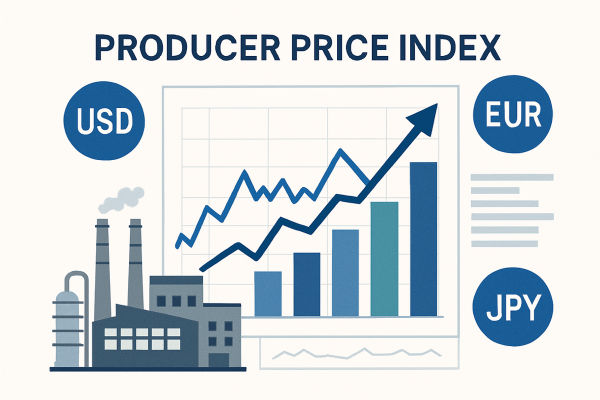

It is said that wool sweaters in China are expensive because we eat too much hot pot! Isn't there a big question? In fact, according to the economic data, there is really a little bit of truth. You see, if you eat hot pot, you have to eat mutton. Does the increase in sheep farming reduce the amount of sheep farming? Followed closely by the wool producer price index (PPI), what is the PPI?

What does the Producer Price Index mean?

The English name for "Producer Price Index", usually abbreviated as PPI, is an economic indicator used to measure the price changes of goods and services in the production and manufacturing industries. PPI usually does not directly reflect the current value of a certain type of product; it mainly focuses on the price changes of products and services produced by enterprises, usually to a base period of prices as a reference to show price changes at different points in time in the form of a percentage.

It usually covers a variety of different industries and sectors, such as dyestuffs, power non-ferrous metals, non-ferrous materials, chemical raw materials, wood and pulp, construction with steel and wood, cement agricultural products, textile raw materials, public goods, etc. PPI reflects the cost of raw materials for the production of the enterprise, which also says that the cost of production of the enterprise A rise in the PPI means that the cost of production for the enterprise has increased. And in order to make a profit, the enterprise will inevitably raise the ex-factory price of goods. In turn, you will find that the price of goods in the store has been rising.

The PPI is published monthly by the National Bureau of Statistics (NBS) and is based on surveys of the three production segments: raw materials, semi-finished goods, and finished goods produced by a wide range of companies. The price changes of the corresponding materials in each segment are recorded, and the final data are formed after complex calculations.

The PPI index will rise if prices in the production chain of enterprises generally increase. Enterprises, due to their own production costs, are not willing to sacrifice their profits. So it will raise the ex-factory price of the product, which will lead to a rise in the final commodity sales price. It is the consumer who suffers in the end. There is still a type of PPI, known as the core PPI, that economists attach importance to in the market. This index excludes food and energy items that are easily affected by seasonal and process-related factors in order to more accurately measure production costs for businesses.

PPI is mainly used by the state to calculate the development speed of industrial production and enterprises to analyze economic benefits, and it is also an important basis for the state to formulate relevant economic policies and national economic accounting.

Related concepts to this index include the Consumer Price Index (CPI), which focuses more on measuring price changes for goods and services purchased by the average consumer. The PPI, in combination with the CPI, can be used to reflect inflation, and together they provide a comprehensive picture of price changes in the economy, which can help in policymaking and economic analysis.

What does the producer Price index mean

| Characteristics |

Description |

| Definition |

Economic indicator that measures the price of final products and services sold by producers. |

| Data |

The National Bureau of Statistics releases a monthly survey of raw materials and other prices. |

Producer Price Index for Agricultural Products

Abbreviated as APPI, it is used to measure price changes in agricultural products. It looks at the price trends of different agricultural products in the agricultural sector and usually covers agricultural products such as grains, livestock products, fruits, vegetables, etc.

Similar to the general PPI, the APPI also takes the price of a base period as 100 and then expresses the change in the price of agricultural products at different points in time in percentage terms. This index is very important for governments, agricultural departments, farmers, and economic analysts as it provides information to understand the market price trends of agricultural products and the cost of agricultural production, which helps in decision-making, market forecasting, and agricultural policy formulation. Different countries and regions may publish their own APPIs to meet the needs of local agricultural markets.

Industrial Producer Price Index

Abbreviated as IPPI, it is specifically designed to measure price changes for products in the industrial sector. It looks at price trends for goods and services in the industrial production sector, which typically includes manufacturing, mining, and energy industries, among others. The purpose of this index is to monitor price changes in industrial products and production in order to understand the cost of production, inflationary trends, and the health of the industrial production market.

It is usually based on prices for a base period of 100 and then expresses price changes at different points in time in percentage terms. This allows governments, economic analysts, and businesses to track the price fluctuations of industrial products and services and make decisions based on this information.

The IPPI is important for economic analysis and policymaking as it provides key information on price movements in the industrial sector and helps to understand the performance and trend of the industrial economy. This index can be used to assess the profitability of producers, formulate price policies, and forecast inflationary or deflationary trends. Different countries and regions may publish their own IPPIs to meet the needs of the local economic environment.

National Producer Price Index (NPPI)

| Index Type |

Description |

| CPI |

Measures changes in the prices of goods and services purchased by the average consumer. |

| PPI |

Monitor production costs and price fluctuations of products and services at the firm level. |

| NPPI |

Combine CPI and PPI to reflect the overall price level and inflation.

|

Rising PPI leads to cpi

A rise in the PPI usually has some impact on the Consumer Price Index (CPI), but it is not the only factor that affects the CPI. Here are some relevant considerations:

Pass-through effect: when the PPI rises, production costs usually increase, and manufacturers may pass these costs on to the price of the final product, leading to higher retail prices. This may have some impact on the CPI, which measures changes in the prices of goods and services purchased by the average consumer.

Pass-through effects: When PPI rises, production costs typically increase, and manufacturers may pass these costs on to the price of the final product, leading to higher retail prices. These factors also have an impact on the CPI, not just depending on what happens to the PPI.

Market competition: In some cases, even if the PPI rises, if the market is highly competitive, firms may not fully pass on cost increases to consumers in order to maintain market share, which may slow down the rate of increase in the CPI.

Market competition: In some cases, even if PPI increases, if the market is highly competitive, companies may not fully pass on the cost increase to consumers in order to maintain market share, which may slow down the rate of CPI increase.

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security, transaction, or investment strategy is suitable for any specific person.