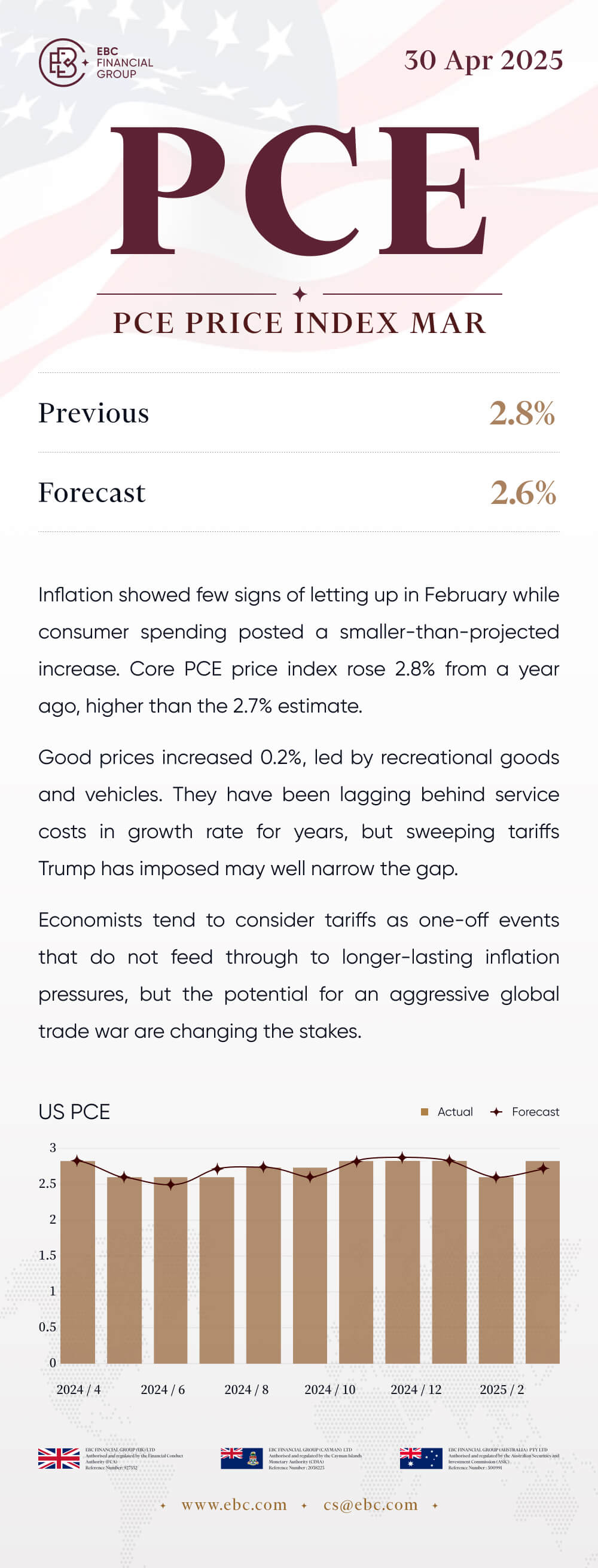

PCE price index Mar

30/4/2025 (Wed)

Previous: 2.8% Forecast: 2.6%

Inflation showed few signs of letting up in February while consumer spending

posted a smaller-than-projected increase. Core PCE price index rose 2.8% from a

year ago, higher than the 2.7% estimate.

Good prices increased 0.2%, led by recreational goods and vehicles. They have

been lagging behind service costs in growth rate for years, but sweeping tariffs

Trump has imposed may well narrow the gap.

Economists tend to consider tariffs as one-off events that do not feed

through to longer-lasting inflation pressures, but the potential for an

aggressive global trade war are changing the stakes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.