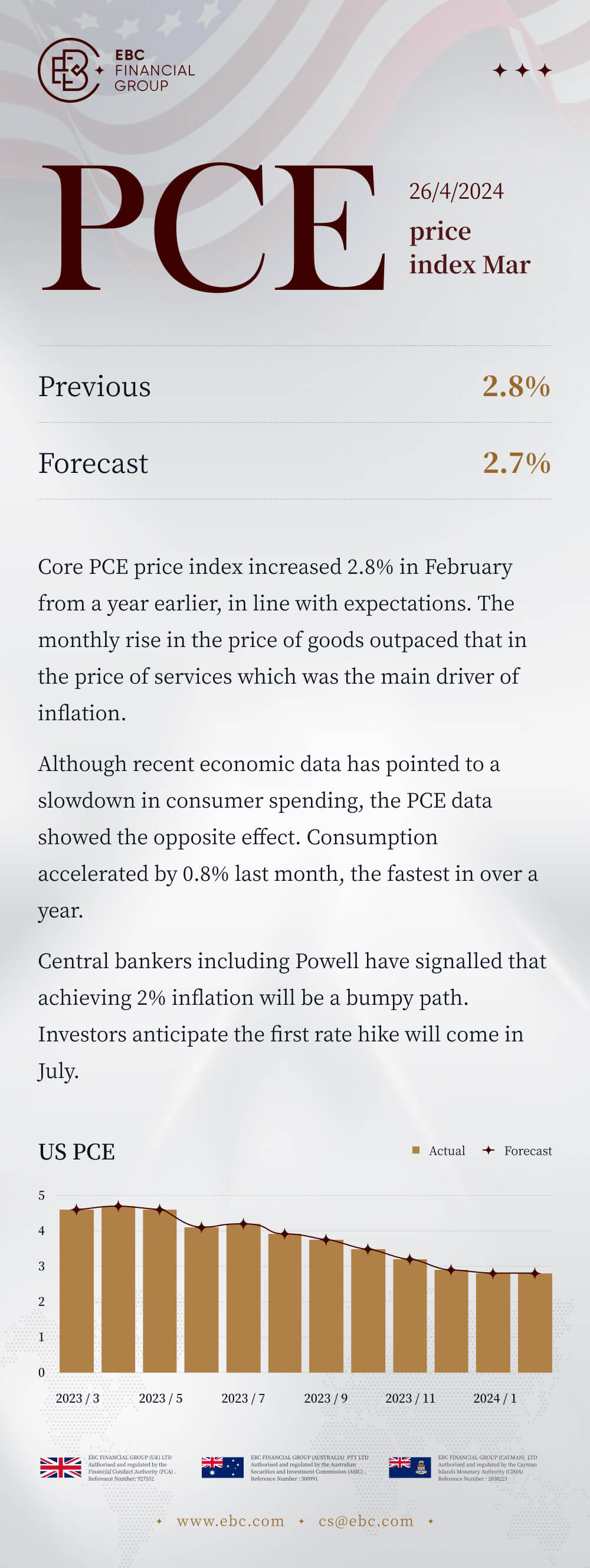

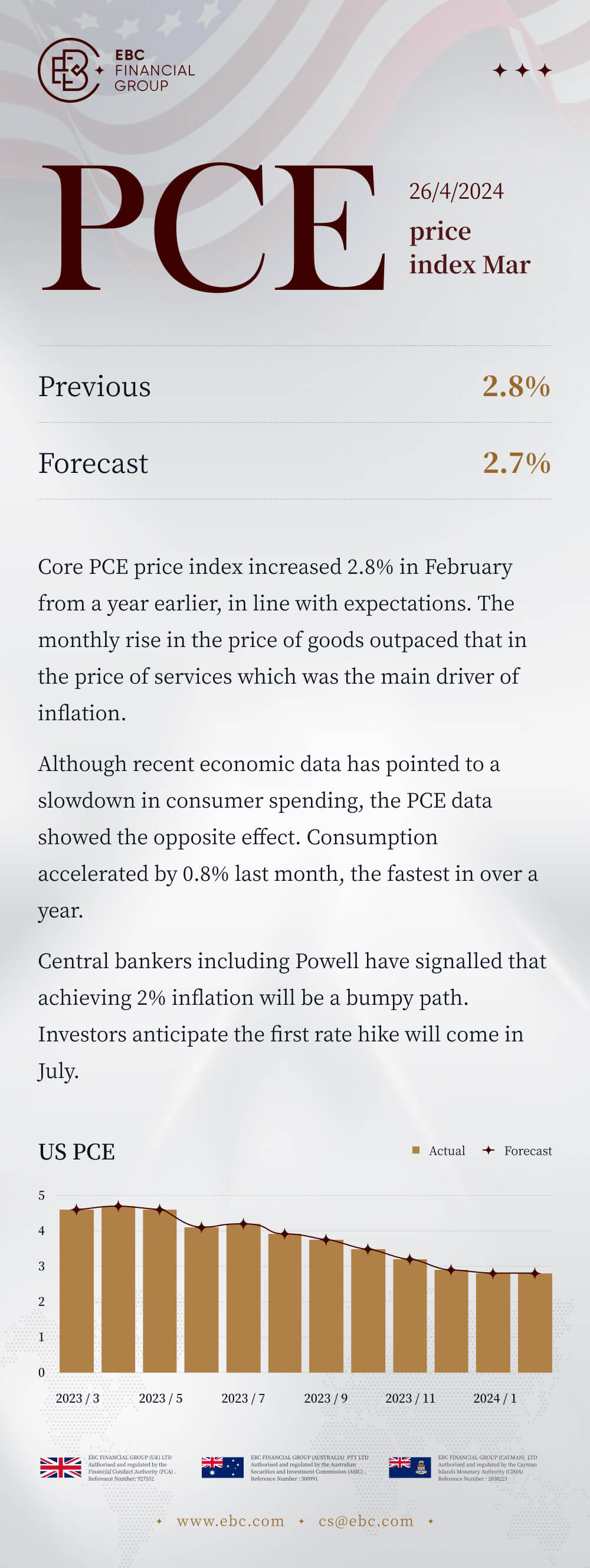

PCE price index Mar

26/4/2024 (Fri)

Previous: 2.8% Forecast: 2.7%

Core PCE price index increased 2.8% in February from a year earlier, in line

with expectations. The monthly rise in the price of goods outpaced that in the

price of services which was the main driver of inflation.

Although recent economic data has pointed to a slowdown in consumer spending,

the PCE data showed the opposite effect. Consumption accelerated by 0.8% last

month, the fastest in over a year.

Central bankers including Powell have signalled that achieving 2% inflation

will be a bumpy path. Investors anticipate the first rate hike will come in

July.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.