The Tao of Charlie Munger condenses a lifetime of pragmatic wisdom: think across disciplines, avoid stupid mistakes, concentrate on high-conviction opportunities, and practise continuous learning. Apply these habits consistently and you will improve decisions in investing and in life.

Charlie Munger's thinking is compact and uncompromising. He favours clear incentives, simple mental models, and rigorous inversion — working backwards from failure to success — more than grand pronouncements or elaborate forecasts.

This article lays out Munger's core ideas, explains how they apply to investing and business, and shows how to embed them in everyday life. The language is plain, the structure systematic, and practical steps are emphasised so you can act on the ideas rather than merely admire them.

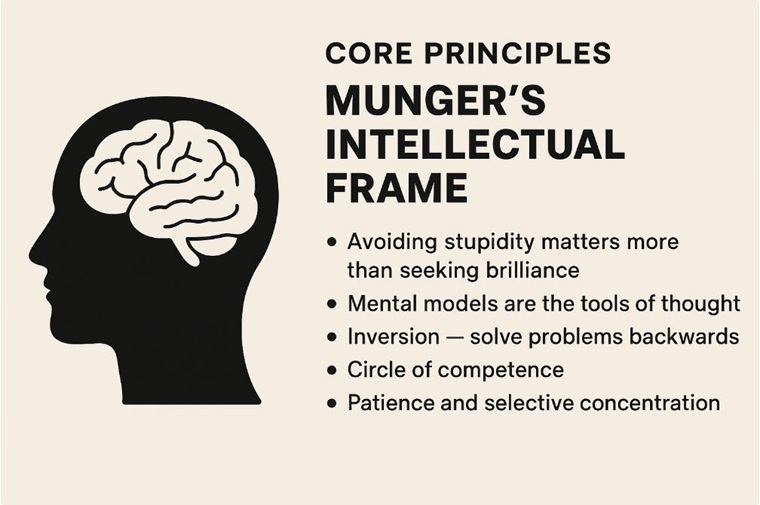

Core Principles: Munger's Intellectual Frame

1. Avoiding stupidity matters more than seeking brilliance.

Munger famously suggests that the single greatest edge is not being dumb. Reducing big, avoidable errors compounds into superior long-term performance.

2. Mental models are the tools of thought.

Rather than specialised tricks, Munger recommends a latticework of basic models drawn from psychology, economics, mathematics, engineering and history. The broader and deeper your set of models, the fewer mistakes you'll make.

3. Inversion — solve problems backwards.

Ask "What would cause failure?" and eliminate those causes. Inverting a problem often exposes hidden risks and simpler solutions.

4. Circle of competence.

Know what you understand well and what you do not. Operate where probabilistic advantages exist; outside that circle, act cautiously.

5. Patience and selective concentration.

Wait for opportunities with asymmetric payoff and act decisively when the odds are favourable. Munger praises focused bets on high-conviction ideas rather than excessive diversification.

6. Continuous learning and intellectual humility.

Read widely, update beliefs with new evidence, and be willing to change your mind when the facts require it.

Investing Principles — Practical Rules

Below are Munger's principal investing rules, expressed as actionable guidance.

1. Prioritise quality businesses with enduring competitive advantages.

Seek companies with durable pricing power, strong brands or unique network effects.

Prefer businesses that convert earnings into high returns on capital over time.

2. Use intrinsic value and margin of safety, but focus on business quality.

Valuation matters, but so does the quality of the underlying franchise. A conservative purchase price for a great business is superior to a cheap price for a mediocre business.

3. Bet big when you've found an exceptional opportunity.

When probability and reward are clearly in your favour, concentration amplifies returns. However, ensure the downside is tolerable.

4. Avoid over-trading and short-term noise.

Allow businesses to compound. Frequent trading increases errors and costs.

5. Study incentives and management character.

Alignments of interest, honesty and competence in management are critical. Incentive structures distort behaviour — pay attention to them.

6. Recognise and correct mistakes quickly.

Admit errors and act to limit their consequences rather than rationalising loss-making positions.

Quick reference: Munger's investing checklist

| Question to ask |

Why it matters |

| Does the business have durable competitive advantages? |

Protects future cash flows and pricing power |

| Is the management honest and aligned with shareholders? |

Reduces agency costs and self-dealing risk |

| Can I estimate the intrinsic value? |

Helps avoid overpaying |

| Do I understand the business (circle of competence)? |

Reduces forecasting errors |

| Is downside acceptable if wrong? |

Ensures survivability and compounding |

Mental Models — The Latticework

Munger's advice centres on accumulating a broad toolkit of simple, transferable ideas. Below are categories and examples.

1. Psychological models (common cognitive biases):

Incentive-caused bias, confirmation bias, envy, social proof, loss aversion.

Use: recognise predictable human errors in markets, management and your own thinking.

2. Economic and financial models:

Supply and demand, opportunity cost, comparative advantage, return on invested capital.

Use: evaluate business economics and industry structure.

3. Mathematical models:

Compounding, Bayesian updating, expected value, regression to the mean.

Use: quantify probabilities, avoid naïve extrapolations.

4. Engineering and systems thinking:

Feedback loops, redundancies, failure modes.

Use: design resilient portfolios and scrutinise business processes.

5. Historical and biological analogies:

Study past business successes and human nature. Biology supplies useful analogues for adaptation and selection.

Selected mental models and how to apply them

| Model |

Practical application |

| Inversion |

Ask "How can this fail?" then guard against those causes |

| Opportunity cost |

Compare alternatives explicitly when committing capital or time |

| Misaligned incentives |

Examine management contracts and compensation schemes |

| Compounding |

Prioritise decisions that preserve the ability to compound returns |

| Regression to the mean |

Avoid assuming current outperformance will continue without cause |

Business and Management — What Works

1. Simplicity and economics beat complexity.

Simple business models that reliably generate cash and are hard to replicate often outperform complex but unscalable ideas.

2. Brand and pricing power are underpriced strengths.

A brand that allows a business to maintain margins through competition is often an enduring moat.

3. Corporate culture and incentives shape outcomes.

4. Capital allocation is the defining job of management.

Effective reinvestment, sensible dividends and disciplined buybacks compound shareholder value.

Life Lessons — Character, Career and Conduct

Munger's insights extend far beyond markets. They form a code for daily living.

1. Be rational and honest with yourself.

Self-deception is a chief enemy. Regularly test beliefs against reality.

2. Choose your associates carefully.

Surround yourself with intelligent, ethical people. Character transmits through networks.

3. Cultivate lifelong learning.

Read widely; focus on foundational books rather than ephemeral material.

The goal is "a little bit wiser each day." Small, continuous gains compound similarly to capital.

4. Work on projects that fit your nature.

Avoid roles or businesses that require actions you find morally repugnant or emotionally draining.

5. Frugality and the proper scale of wants.

Munger highlights that a temperate life — preventing the "failure of the will" to overconsume — preserves freedom and focus.

Decision Processes — How to Think, Step by Step

1. Frame the problem.

State the decision, the desired outcome and the time horizon.

2. List failure modes (invert).

Identify what would make the decision disastrous.

3. Invoke relevant mental models.

Pull 3–6 models from different domains and test the scenario through them.

4. Estimate probabilities and payoffs.

Use expected value thinking; be explicit about assumptions.

5. Decide and size the bet.

Apply concentration when the odds are clearly positive and your circle of competence covers the topic; diversify otherwise.

6. Monitor and update.

Track outcomes, learn from mistakes and revise priors with evidence.

Common Mistakes and How to Avoid Them

Fix: favour probabilistic thinking and stress-test key assumptions.

Fix: insist on unit economics and customer value before following trends.

Fix: analyse incentives for management, partners and yourself.

Fix: hold a core of high-conviction positions and smaller, hedging positions elsewhere.

Putting Munger's Wisdom into Practice — A Monthly Routine

Reading plan (weekly): allocate time to read history, biographies, economics, science and clear analyses.

Monthly review: pick one investment or idea and apply the inversion checklist. Document what could go wrong.

Learning log: write short notes on new models discovered and practical examples where they applied.

Quarterly portfolio review: check alignment with circle of competence and reassess conviction sizing.

Limitations and Cautions

1. Not a formula for instant success.

Munger's ideas require discipline, intellectual effort and time. They are habits, not shortcuts.

2. Context matters.

What works for Berkshire Hathaway-style investors may not fit every timeframe or mandate; adapt principles to your constraints.

3.Behavioural inertia is hard to overcome.

Even when one knows the right mental model, human psychology often obstructs its application. Build structures to enforce good behaviour.

Conclusion — A Compact Manual for Better Decisions

Charlie Munger's teachings are deceptively simple because they insist on fundamentals: wide reading, a latticework of reliable mental models, inversion, modesty about what you do not know, and a relentless focus on avoiding fatal mistakes.

If you adopt even a modest portion of these habits — expand your mental models, invert before deciding, concentrate when you truly understand the opportunity, and admit mistakes quickly — your decisions in investing, business and life will improve materially.

Frequently Asked Questions (FAQ)

1. What is The Tao of Charlie Munger about?

It's a collection of quotes and insights compiled by David Clark, reflecting Charlie Munger's philosophy on investing, decision-making, and living wisely.

2. Who is Charlie Munger?

Charlie Munger (1924–2023) was the long-time vice chairman of Berkshire Hathaway and Warren Buffett's business partner. He was renowned for his multidisciplinary thinking and rational approach to investing.

3. What does "Tao" mean in this context?

"Tao" refers to the path or way — in this case, Munger's way of thinking and behaving rationally in finance, business, and everyday life.

4. What are the main lessons from Munger's philosophy?

Key lessons include:

Focus on avoiding mistakes rather than seeking brilliance.

Stay within your circle of competence.

Read widely and learn from multiple disciplines.

Be patient and let compounding work over time.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.