As the price of gold has risen, non-ferrous metals have returned to the public eye. And it is sought after because of the excessive increase. But many people do not understand or follow the trend of investment and are very doubtful whether its upward trend can continue. Therefore, this article will give you a detailed introduction, the profile of non-ferrous metals, and an investment analysis.

What are Non-Ferrous Metals?

What are Non-Ferrous Metals?

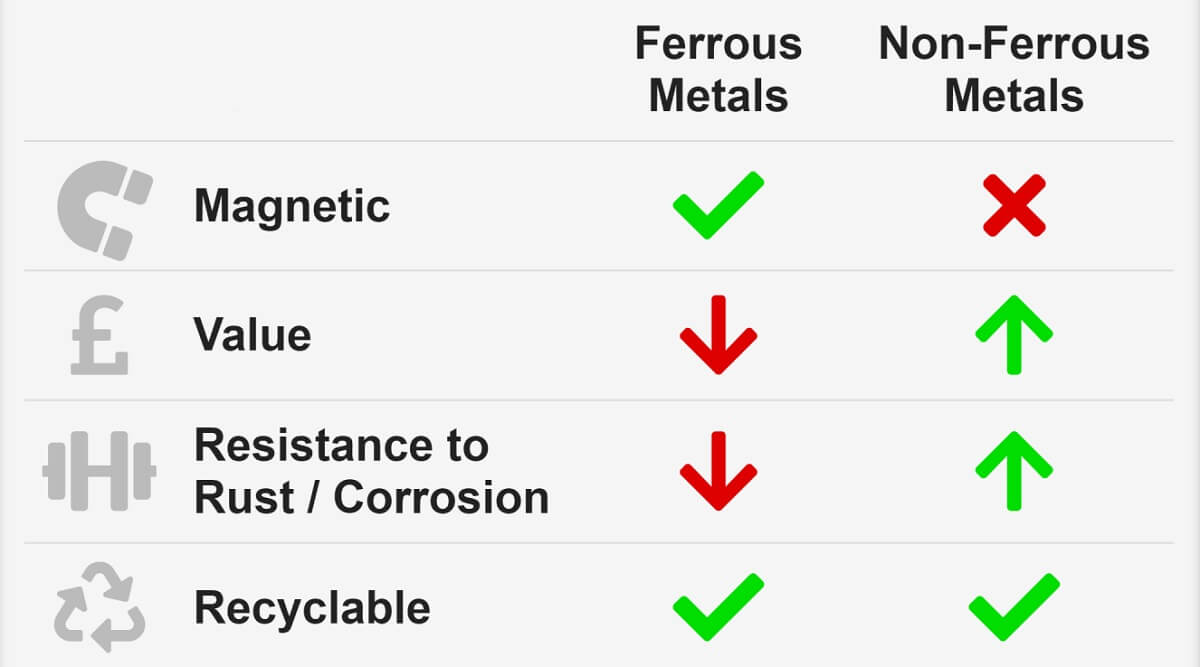

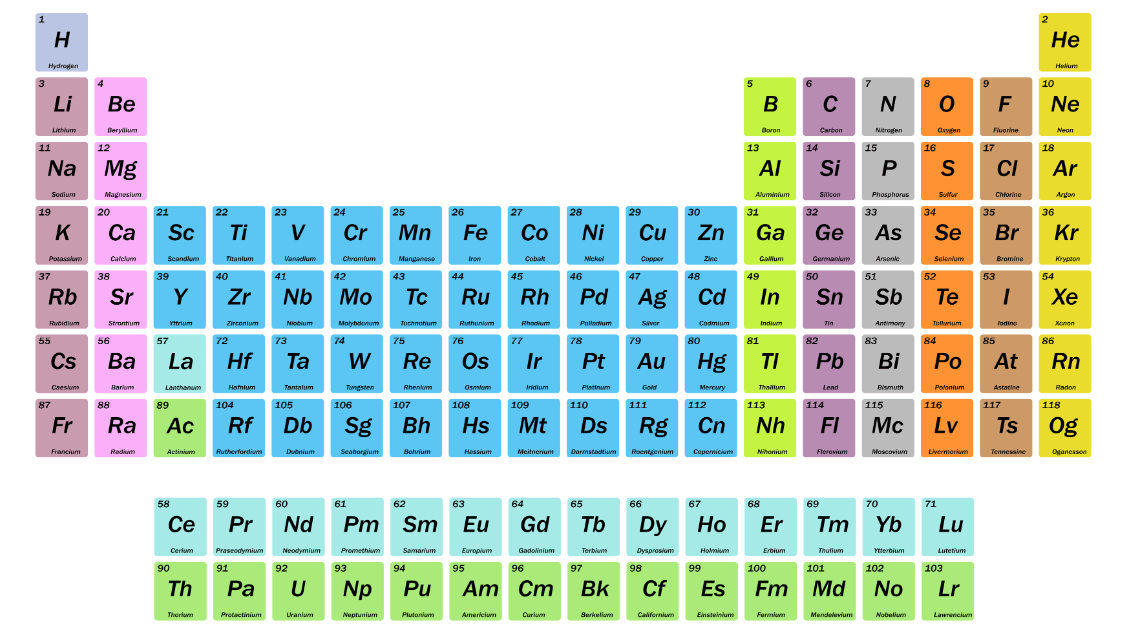

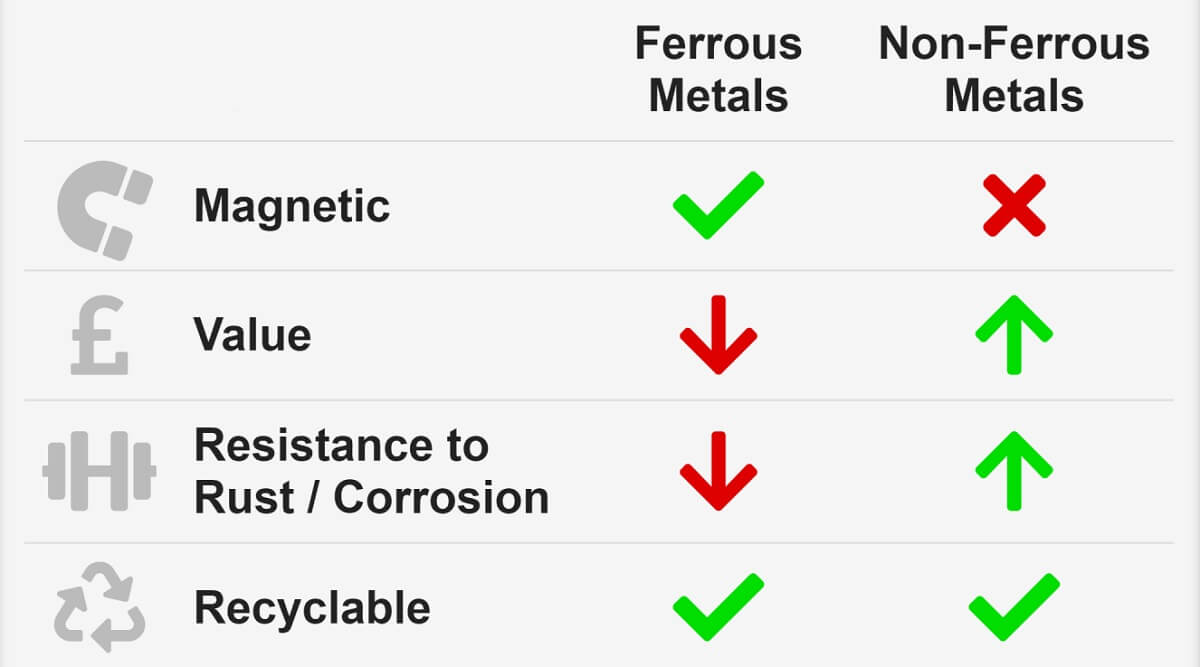

When it comes to metals, people's first reaction is gold and silver. Think again; you can probably think of copper and iron. According to the material classification, metals can be divided into ferrous and non-ferrous. These four metals are the most familiar to mankind, except for iron, which is a ferrous metal, and the others are non-ferrous metals. Ferrous metals are iron and its alloys (such as steel and cast iron), as well as manganese and chromium. All other metals are non-ferrous metals.

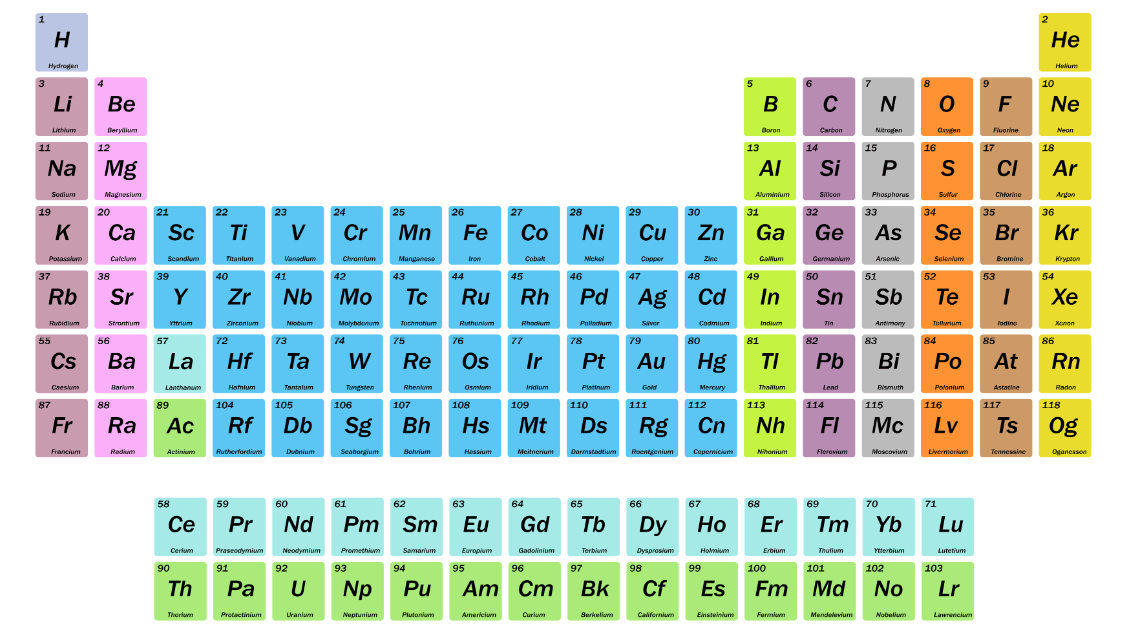

Common non-ferrous metals can be broadly divided into several categories: basic non-ferrous, precious metals, rare metals, and rare earth metals. The basic metals are the most widely used in industry, and their production and consumption are also large. Including aluminum (Aluminium), copper (Copper), lead (Lead), zinc (Zinc), nickel (Nickel), tin (Tin), and so on.

Precious metals are widely used for jewelry, investment, and industrial applications due to their rarity and high economic value. These include gold (Gold), silver (Silver), platinum (Platinum), palladium (Palladium), and so on. Rare metals in natural world reserves are small, but in the field of high-tech, they have important uses. Including titanium (Titanium), tungsten (Tungsten), molybdenum (Molybdenum), lithium (Lithium), zirconium (Zirconium), and so on.

Rare earth metals include 17 chemical elements that play an important role in modern technology, especially in electronics, magnetic materials, and catalysts. These include lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, and other rare earth metals.: holmium (Holmium), erbium (Erbium), thulium (Thulium), ytterbium (Ytterbium), lutetium (Lutetium), scandium (Scandium), yttrium (Yttrium), and others.

In addition to these major groups, there are a number of non-ferrous metals that have important industrial and technological applications. For example, magnesium (magnesium), potassium (potassium), sodium (sodium), calcium (calcium), barium (barium), and so on. These metals play different roles in different industries, such as aerospace, electronics, chemical, construction, transportation, and medical. Their properties and characteristics make them important base materials for modern industrial and technological development.

This category covers metals of various colors, among which are yellow metals such as gold, white metals such as aluminum and silver, and red metals such as copper. These metals are named for their different colors, such as yellow metals for their golden color, white metals including aluminum and silver, and red metals referring to copper for its reddish color when oxidized.

Most non-ferrous metals are usually non-magnetic, in contrast to ferromagnetic materials, which are usually not magnetized. Also, different types of non-ferrous metals have different density and hardness characteristics. For example, some metals, such as aluminum, have a relatively low density, while others, such as tungsten, have a high density.

At the same time, most non-ferrous metals are more resistant to corrosion and do not oxidize and rust easily. For example, the aluminum oxide layer that forms on the surface of aluminum effectively prevents further oxidation and corrosion. These metals can also be alloyed to improve their properties, such as the common aluminum and copper alloys. Through alloying, the hardness, strength, corrosion resistance, and other properties of the metal can be adjusted to make it suitable for different industries and applications.

Metals such as aluminum and titanium are widely used in the aerospace industry because of their light weight and high strength. They are used in the manufacture of aircraft fuselages, engine components, spacecraft structures, etc., and are able to provide sufficient strength while reducing overall weight, thereby improving flight performance and fuel efficiency.

Metals such as stainless steel and copper alloys are often used in the manufacture of various chemical equipment and containers because of their good corrosion resistance. In the chemical industry, containers and equipment need to be in contact with various chemicals for a long time, so corrosion resistance is a very important consideration.

Stainless steel is composed of iron, chromium, nickel, and other elements, has good corrosion resistance and mechanical properties, and is often used in the manufacture of chemical reactors, tanks, piping, and other equipment. Copper alloys also have excellent corrosion resistance and are widely used in the chemical industry for piping, valves, pumps, and other equipment.

Precious metals such as gold, silver, and platinum are often used in the manufacture of jewelry and coins. They have a unique appearance and excellent texture and are therefore widely used in jewelry-making. Gold is a yellow precious metal that is highly resistant to corrosion, has a beautiful appearance, and is often used to make a variety of jewelry, rings, necklaces, and other jewelry items.

Silver is a white precious metal that is also often used to make a variety of jewelry and ornaments. Platinum is a white precious metal with high stability and corrosion resistance and is often used to make high-grade jewelry and coins. These precious metals are considered worthy of collection and investment due to their valuable properties.

Precious metals such as gold, silver, and platinum are more expensive due to their preciousness and wide range of uses and are often used in jewelry, coins, crafts, and other products. Rare metals such as tantalum, lithium, and niobium are also relatively expensive due to their more limited supply as well as their special physical and chemical properties, which have led to an increasing demand in high-tech fields and emerging industries.

These high-value non-ferrous metals are widely traded on the global market and have a significant impact on international economic and industrial development. At the same time, due to their wide range of applications and unique properties, these metals have significant economic value in the high-tech and industrial sectors.

This is because these metals are used in the manufacture of high-tech products such as aviation and spacecraft, electronic equipment, chemical equipment, medical devices, etc., as well as being widely used in traditional industries such as construction, transportation, and energy. Their excellent performance and diversified uses make these metals one of the most indispensable and important materials for modern industry, playing a key role in promoting economic growth and technological progress.

Given the wide range of applications and importance of non-ferrous metals, investors increasingly regard them as investment favorites in the market. In particular, against the backdrop of sustained global economic growth and accelerated industrialization, the demand for such metals continues to be high, which further boosts their attractiveness in the investment arena. In addition to being a physical investment option, investors can also participate in the metals market by purchasing financial instruments such as related metal futures, stocks, or exchange-traded funds (ETFs).

Non-Ferrous Metals Industry Trends

Non-Ferrous Metals Industry Trends

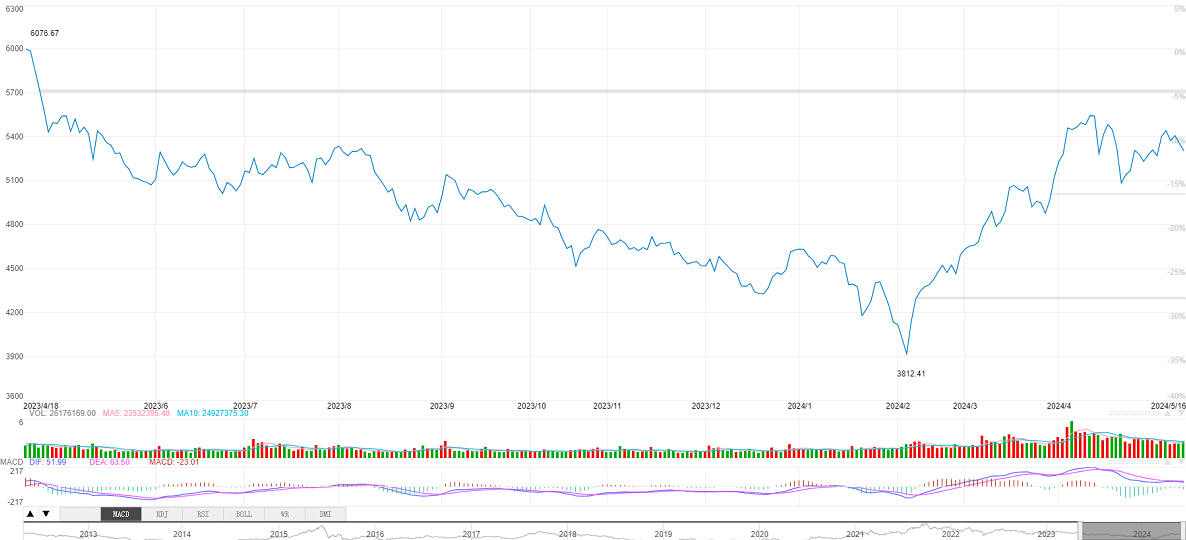

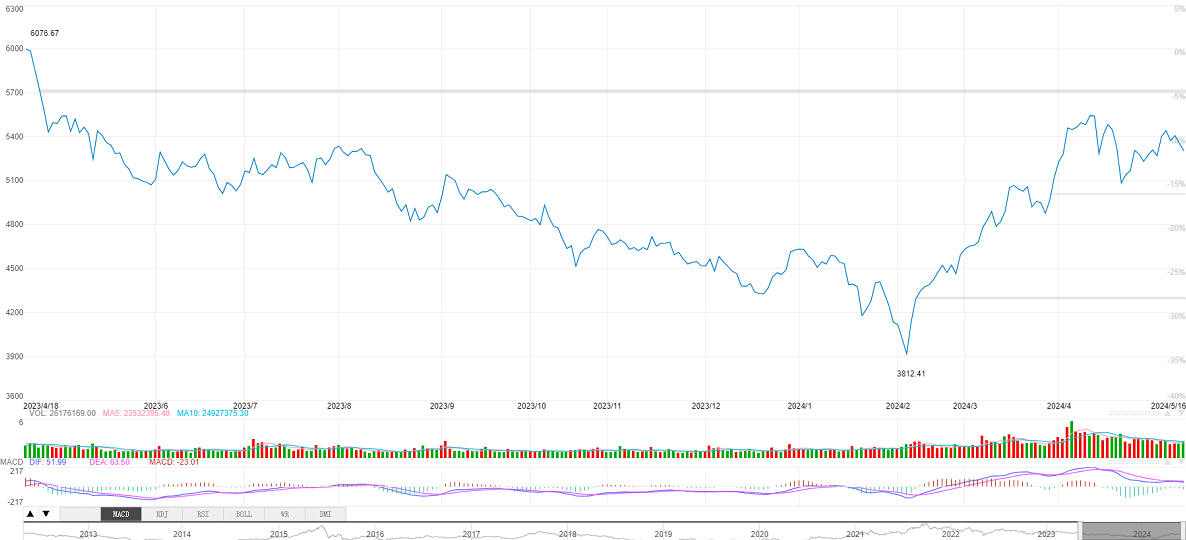

Generally speaking, non-ferrous metals are a pro-cyclical sector. That is, they usually perform better during economic cycles. Throughout the sector's history, they tend to see growth during economic expansions and can face challenges during recessions. Especially during major bull markets, this sector usually outperforms the market as a whole, showing some of the advantages such metals have during economic cycles.

First, there was a major bull market from January 2006 to November 2007. which lasted one year and ten months. During this period, the A-share market as a whole was in a bull market, with the Shanghai Stock Exchange Index hitting record highs, and the pro-cyclical performance of the metals sector outperformed the market as a whole.

The second major bull market took place from November 2008 to November 2010 and lasted for two years. Despite the global financial crisis, China implemented fiscal stimulus driven by global monetary easing, and the metals sector continued to outperform the overall market procyclically.

The third major bull market took place from June 2014 to October 2016 and lasted for two years and four months. During this period, the A-share market once again experienced a major bull market, and the pro-cyclical performance of the metals sector remained strong, rising much more than the overall market. In every round of the major bull market, the metals sector has performed better than the whole market, showing a certain advantage of metals in the economic cycle.

As you can see from this historical data, demand for non-ferrous metals typically increases when economic growth is strong and industrial production is expanding. This is due to increased demand for metals such as copper, aluminum, and nickel from industries such as construction, infrastructure development, and manufacturing. During economic downturns, the demand for such metals usually declines because construction and manufacturing activities slow down and demand for raw materials decreases.

Metals such as copper and aluminum play an important role in infrastructure and are commonly used in building structures, piping systems, and electrical equipment manufacturing. In the real estate industry, materials such as aluminum alloys and steel are commonly used in the manufacture of building components such as windows, doors, curtain walls, and piping, and their corrosion resistance, lightweight properties, and good electrical conductivity make them ideal for modern construction. The use of these metals provides reliable material support for construction projects, contributing to the growth of the infrastructure and real estate sectors.

These metals also play an important role in manufacturing, especially in high-end manufacturing sectors such as automotive, aerospace, and electronics. For example, copper is widely used in electrical and electronics, while aluminum is commonly used in lightweight designs in the automotive and aerospace sectors, and metals such as nickel play a role in the manufacture of batteries and stainless steel. Therefore, as these manufacturing industries expand and develop, the demand for such metals will increase accordingly.

In addition, factors such as the state of the global economy, trade relations, and the geopolitical situation can affect the price and demand for non-ferrous metals. A slowdown in economic growth could lead to a decrease in demand for such metals, while an economic recovery could stimulate an increase in demand. Tensions in trade relations and trade wars may lead to trade restrictions and uncertainty, affecting international trade and price volatility for metals. Geopolitical tensions may lead to disruptions in the supply of resources or regional conflicts, which in turn affect the stability of metals markets and price movements.

Inflation is usually driven by factors such as monetary overissuance and a bull market in commodities, which directly affect non-ferrous metal prices. With the issuance of large amounts of money, the price of metals such as copper tends to rise. In addition, inflation is also reflected in the financial reports of listed companies, bringing about a surge in profits and share prices. The current pace of global economic recovery and the extent of inflation are higher than ever before, so prices of metals such as copper are likely to rise further.

Based on the above logic and historical performance, non-ferrous metals usually perform well during periods of economic expansion. Investors can look at factors such as economic indicators, global trade movements, and infrastructure projects to determine the trend of the metals market. May choose to increase their exposure to such metals, such as by purchasing related stocks, futures, or exchange-traded funds (ETFs). And in a recession, the market for such metals may come under pressure, and investors may reduce their holdings of these assets in favor of safe-haven assets or other better-performing sectors.

Investment Analysis of Non-Ferrous Metals

Investment Analysis of Non-Ferrous Metals

Starting at the beginning of 2024 and continuing through April. Non-ferrous metals were highly sought-after in the capital markets. Prices also rose and rose, at one point rising to 5.591. ahead of the broader market by a wide margin. But since April 15. it has had a downward trend and is still in a substantial shock, so many investors are unable to grasp its trend.

In fact, the key to understanding the ups and downs of the non-ferrous metals market is to understand the unique factors of each metal. For example, for copper, aluminum, and other non-ferrous metals, changes in economic growth, infrastructure, and industrial production activities are among the main influencing factors. Economic expansion and increased infrastructure investment typically raise demand for these metals, which drives up their prices. At the same time, changes in global economic developments, trade relations, and geopolitical situations can also have an impact on the metals market.

Gold is often seen as a safe-haven asset, so investors tend to turn to it in the event of heightened geopolitical tensions or increased market exposure to risks such as currency devaluation and inflation. Changes in central bank monetary policy can also affect the price of gold, especially when central banks adopt loose monetary policy. Investors may buy gold as a hedge against inflation or as part of their asset allocation.

In addition to the impact of global monetary policy, the supply and demand of copper play a crucial role in determining its price. In particular, in recent years, with the acceleration of electrification and the development of a green economy, the demand for copper in areas such as power equipment and electric vehicles has grown significantly, which has provided new support factors for copper prices. Therefore, investors need to pay attention to changes in the global supply chain and the development of emerging industries such as electric vehicles in order to better judge the trend of copper prices.

The price of aluminum is more influenced by demand from the construction industry than by other factors. Although the easing of monetary policy may drive up aluminum prices, the increase in aluminum prices may be limited in the short term due to the decline in demand from China's real estate industry. Therefore, investors need to pay close attention to the movements of the global construction industry, especially the changes in China's real estate market, in order to more accurately assess the future trend of aluminum prices.

Prices of rare earths and energy metals (e.g., nickel, cobalt, lithium, etc.) are dominated by supply and demand. Despite growing demand, oversupply remains a major factor affecting prices. Particularly in the market for energy metals such as lithium, oversupply has been more severe, leading to a constant downward trend in prices. Therefore, investors need to pay attention to the global supply and demand balance, as well as the impact of the policies of various countries on these metal industries, in order to better grasp the market changes.

This rebound in the non-ferrous metals sector is related to the growth of industrial demand, but for such exaggerated gains, sentiment-driven factors may have played a greater role. And usually, these emotion-driven hot spots often rise fast, but the decline is also equally rapid, so in this case, it is recommended to take a cautious attitude and not blindly follow the trend. After all, market sentiment is volatile and can sometimes top out quickly.

The development trend of the non-ferrous metal industry

| Industry Trends |

Key Factors |

Impact |

| Industries are electrifying rapidly. |

Rising demand for electric vehicles |

Demand for metals continues to grow. |

| Rising green economy demand |

Environmental policies are reshaping industry. |

Upbeat rare metal market outlook |

| Supply chain and resource shift |

Geopolitics, trade, and supply chain stability |

Supply-demand shifts raise price uncertainty. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

What are Non-Ferrous Metals?

What are Non-Ferrous Metals? Non-Ferrous Metals Industry Trends

Non-Ferrous Metals Industry Trends Investment Analysis of Non-Ferrous Metals

Investment Analysis of Non-Ferrous Metals