The question of whether forex trading is halal (permissible) or haram (forbidden) under Islamic law is one of the most debated topics among Muslim traders.

The short answer is that forex trading can be halal if conducted under Sharia-compliant conditions. However, it may be haram if it involves prohibited elements such as excessive speculation, interest (riba), or gambling (maysir).

This article examines the significance of halal and haram regarding trading, the various Islamic rulings, and ways Muslim traders can engage in forex trading responsibly while adhering to their beliefs.

What Is Halal and Haram in Islamic Finance?

Before evaluating forex, it's crucial to understand the Islamic principles of finance:

Halal (Permissible): Activities allowed under Sharia law, such as trade with fair contracts, transparency, and no interest (riba).

Haram (Forbidden): Activities that involve usury (riba), gambling (maysir), uncertainty (gharar), or unethical industries (e.g., alcohol, gambling).

In Islam, money itself has no intrinsic value; it's only a medium of exchange. Therefore, making a profit must come from fair trade or investment, not from exploiting money directly through interest.

Is Forex Trading Halal? Shariah Principles Explained

Many scholars argue that forex trading can be halal under the following conditions:

1. Real Currency Exchange (Sarf)

Islam permits exchanging one currency for another (sarf) as long as the trade is:

In spot forex trading, traders generally meet this condition, since they execute trades instantly.

2. No Interest (Riba)

Riba, or usury, is strictly forbidden in Islam. In standard forex accounts, overnight swaps (interest charged when holding a position overnight) can make trading haram.

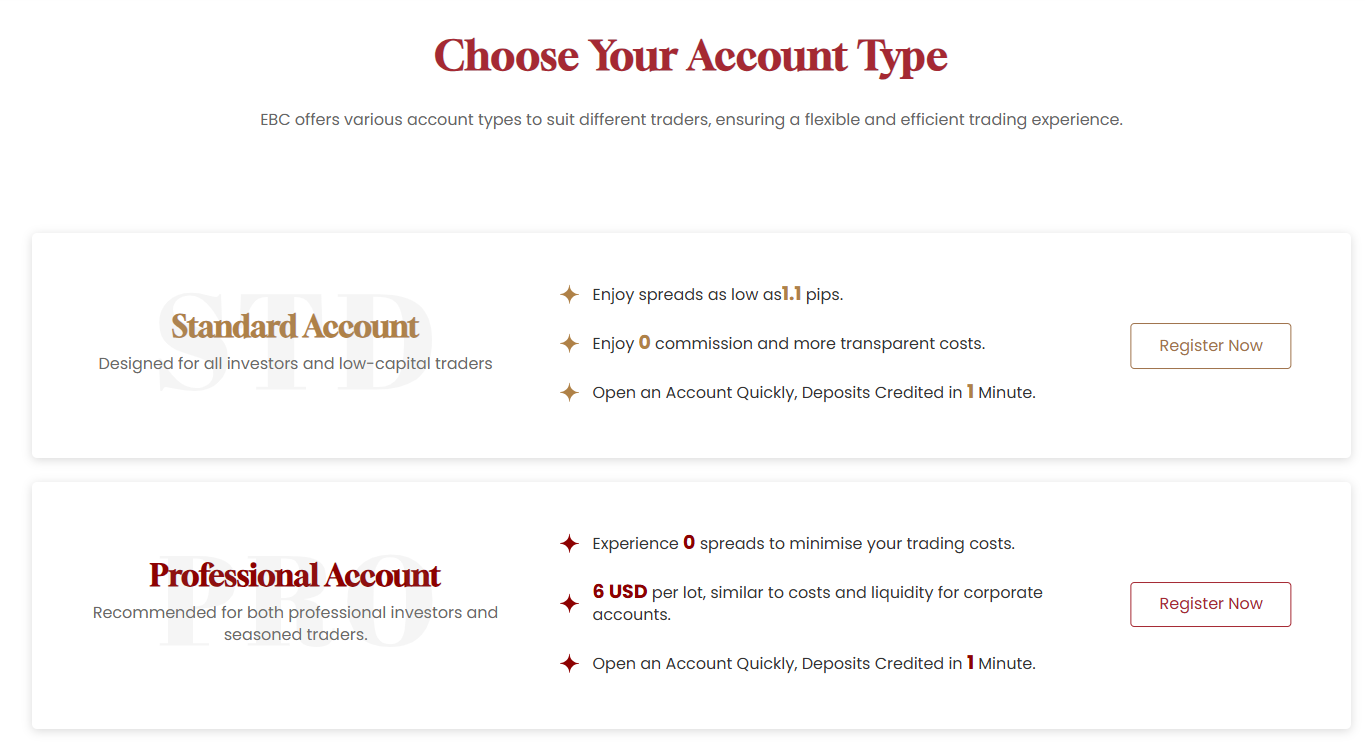

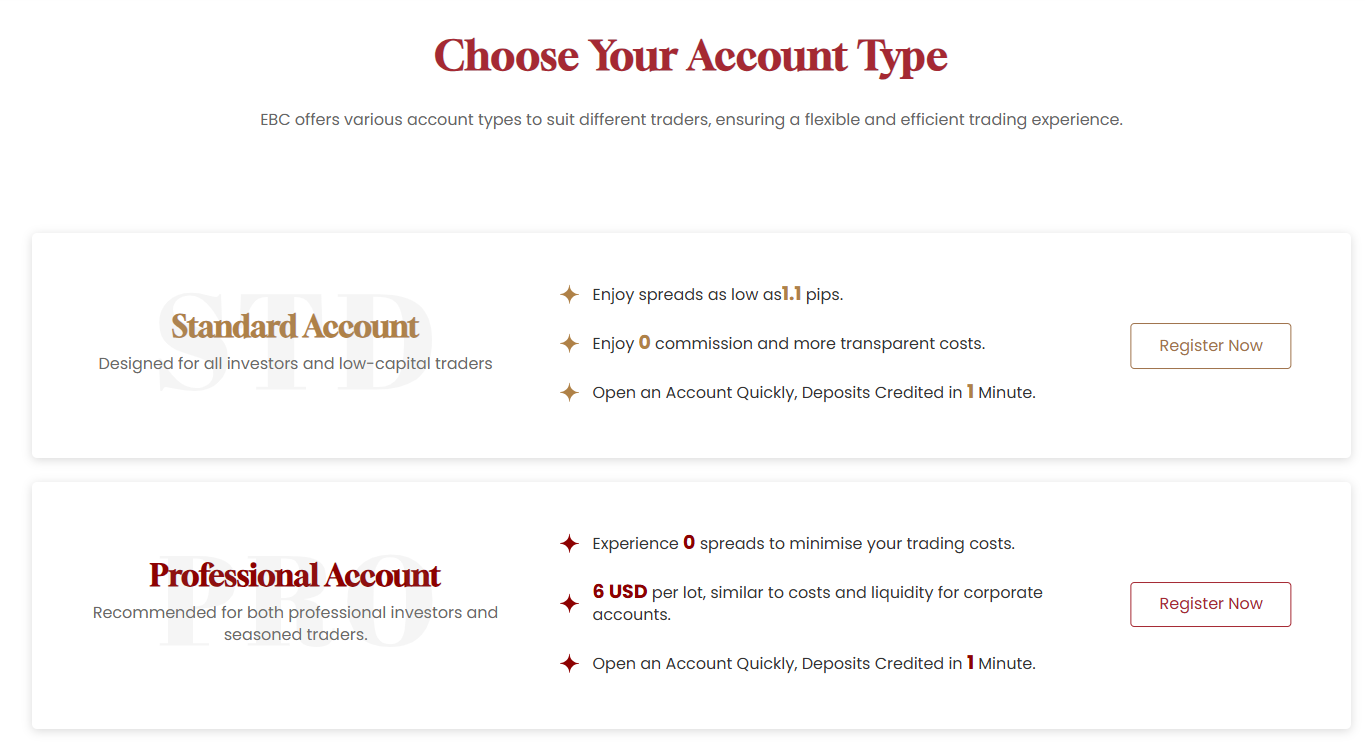

However, many brokers, such as EBC, offer swap-free accounts to Muslim traders, making trading halal.

3. Trading as a Form of Business

Islam encourages fair business and trade. If forex is treated as a business where risk and reward are balanced, and not as gambling, it can be considered halal.

Why Forex Trading May Be Considered Haram?

On the other hand, some Islamic scholars and institutions argue that forex trading may be haram because of these factors:

1. Interest (Riba) in Swap Accounts

If a trader uses a regular forex account, they may pay or receive interest on overnight positions. This riba makes the trade haram.

2. Speculation (Maysir)

Viewing forex trading as a kind of gambling, where traders depend solely on luck and quick speculation, breaches Islamic principles.

3. Excessive Uncertainty (Gharar)

Islam prohibits contracts that involve excessive uncertainty. Leveraged forex trading can sometimes involve high levels of risk and unpredictability, which some scholars classify as gharar.

4. Derivative Contracts

Trading forex through derivatives (such as futures or options) can be haram because settlement may not be immediate, violating the rules of currency exchange (sarf).

What Is The Role of Islamic Forex Accounts?

To make forex trading halal, brokers provide Islamic trading accounts. These accounts are designed specifically for Muslim traders by:

Removing interest charges (swap-free).

Allowing traders to hold positions overnight without riba.

Offering transparent fee structures (often a fixed commission instead of swaps).

For instance, EBC offers swap-free forex accounts for Muslim traders who engage in the forex market without conflicting with their beliefs.

However, some Islamic scholars warn that not all swap-free accounts are automatically halal. For example, if brokers charge hidden fees or structure swaps differently, it may still resemble riba. Traders should always verify the broker's compliance policies.

Recent Views from Islamic Finance Bodies (2024–2025)

The OIC Fiqh Academy and AAOIFI (Accounting and Auditing Organisation for Islamic Financial Institutions) maintain that spot currency exchange is halal. However, deferred settlement contracts and interest-based accounts are haram.

Additionally, recent debates (2023–2025) emphasise that high leverage and speculative trading can lead to gharar and maysir. Many scholars recommend moderation in leverage and avoiding purely speculative trades.

It highlights that forex is not inherently haram, but the practice determines its permissibility.

How Muslim Traders Can Ensure Halal Forex Trading

1) Use an Islamic Account (Swap-Free):

Always trade with a broker such as EBC that offers Sharia-compliant accounts.

2) Avoid Over-Leveraging:

Stick to moderate leverage to avoid excessive risk (gharar).

3) Focus on Analysis, Not Gambling:

Make informed trades based on strategy, not luck.

4) Avoid Long-Term Interest Exposure:

Do not hold positions in non-Islamic accounts overnight.

5)Trade Spot Forex Only:

Refrain from futures and options that involve delayed settlement.

Examples of Halal and Haram Forex Trading

Spot Trade Example:

A trader buys USD/JPY today.

The trade is executed instantly at the market price.

Brokers do not charge any interest if you hold it overnight.

Business-Like Approach:

A trader uses analysis (technical + fundamental).

They manage risk carefully with stop-loss orders.

Their profits come from market movement, not chance.

Both instances conform to Islamic trading principles.

Haram Trade Example:

A trader buys EUR/USD using a regular account.

The position is held overnight, and the broker charges swap interest.

Profit/loss is affected by riba, making it haram.

Frequently Asked Questions

1. Is Forex Trading Halal in Islam?

Forex trading is halal in Islam if it involves spot currency exchange, no interest (riba), and is done through an Islamic (swap-free) account.

2. Why Do Some Scholars Consider Forex Trading Haram?

Some scholars consider forex haram because many accounts involve riba (interest on overnight swaps), high speculation (maysir), and uncertainty (gharar), which are prohibited in Islamic finance.

3. Which Type of Forex Trading Is Haram?

Many scholars consider Forex trading through futures, options, or interest-based accounts haram because settlement is not immediate, or interest is involved, violating Islamic financial rules.

4. Is Day Trading Forex Halal?

Day trading forex can be halal if trades are based on real currency exchange, executed immediately, and carried out in a swap-free account. The key is avoiding speculation that resembles gambling.

5. Are Islamic Forex Accounts Truly Halal?

They can be halal, but only if properly structured. Traders should confirm whether fees or spreads replace swaps in a Sharia-compliant manner.

Conclusion

In conclusion, forex trading is halal if it involves spot currency exchange, no interest (swap-free), and responsible risk management. The safest way for Muslim traders is to use Islamic forex accounts, ensuring compliance with Sharia law.

For Muslim traders, the key is to choose halal trading methods and Sharia-compliant accounts. Forex is not inherently haram as it depends on how it is practised.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.