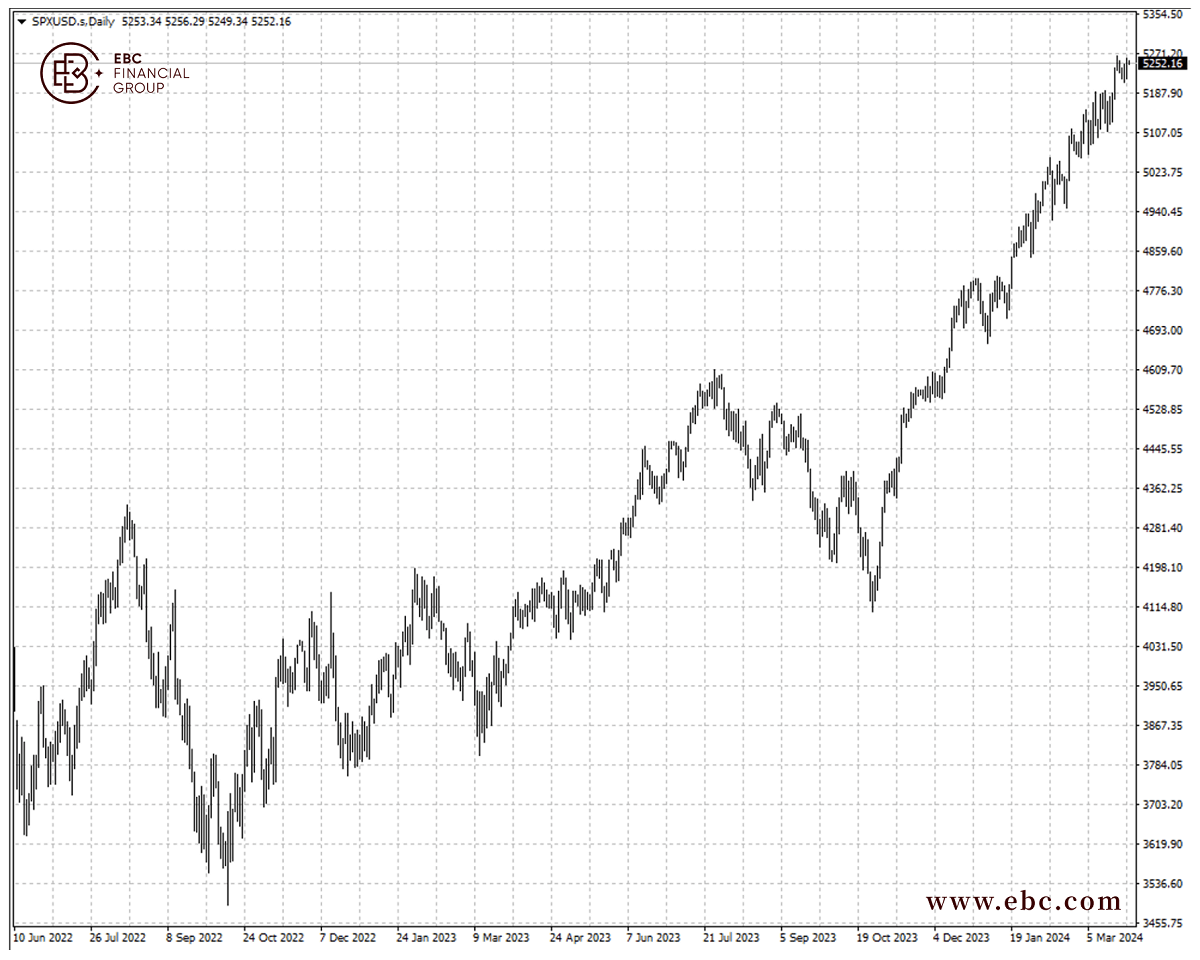

Global equity markets are ending Q1 on a high note, with investors poised for more wild swings ahead. MSCI’s global share index is up 10% since mid-January and smashes through record highs this month.

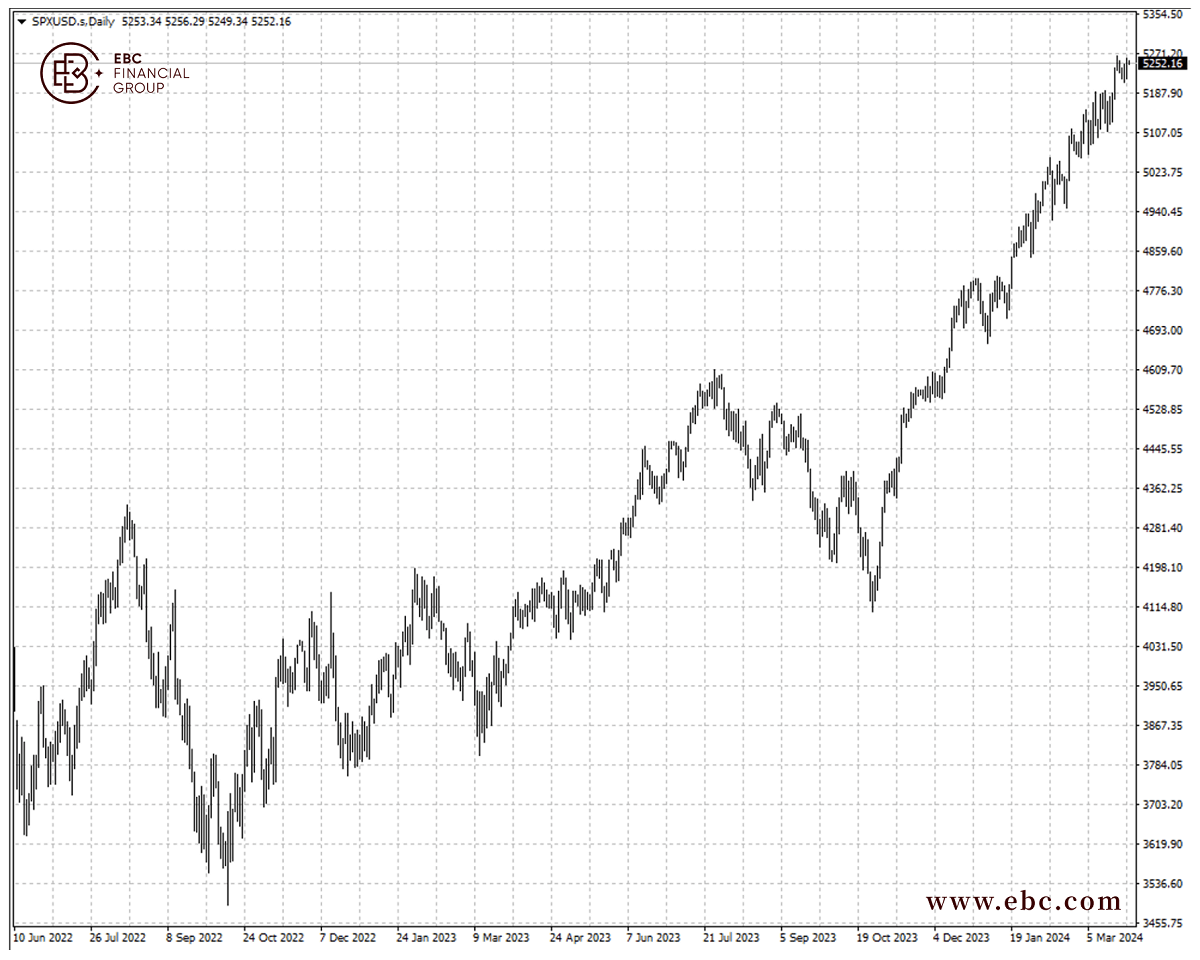

All three US major stock indexes hit their fresh all-time highs within this year. The S&P 500 has notched a gain of 10% so far, largely driven by the unstoppable “Magnificent Seven”.

A Deutsche Bank survey of investors this month found that almost half expected a soft landing and inflation staying above the 2% goal by year-end – the baseline scenario that has pushed Stock Prices higher.

A Deutsche Bank survey of investors this month found that almost half expected a soft landing and inflation staying above the 2% goal by year-end – the baseline scenario that has pushed Stock Prices higher.

But more than half of those surveyed believed the S&P 500. which influences the direction of stocks worldwide, was more likely to fall by 10% than to rise by that amount amid macro uncertainties.

The Bloomberg’s latest survey also showed US stocks will lose momentum and Treasuries have yet to hit bottom. The benchmark index is expected to rise to about 5.424 at the end of 2024.

Narrow breadth

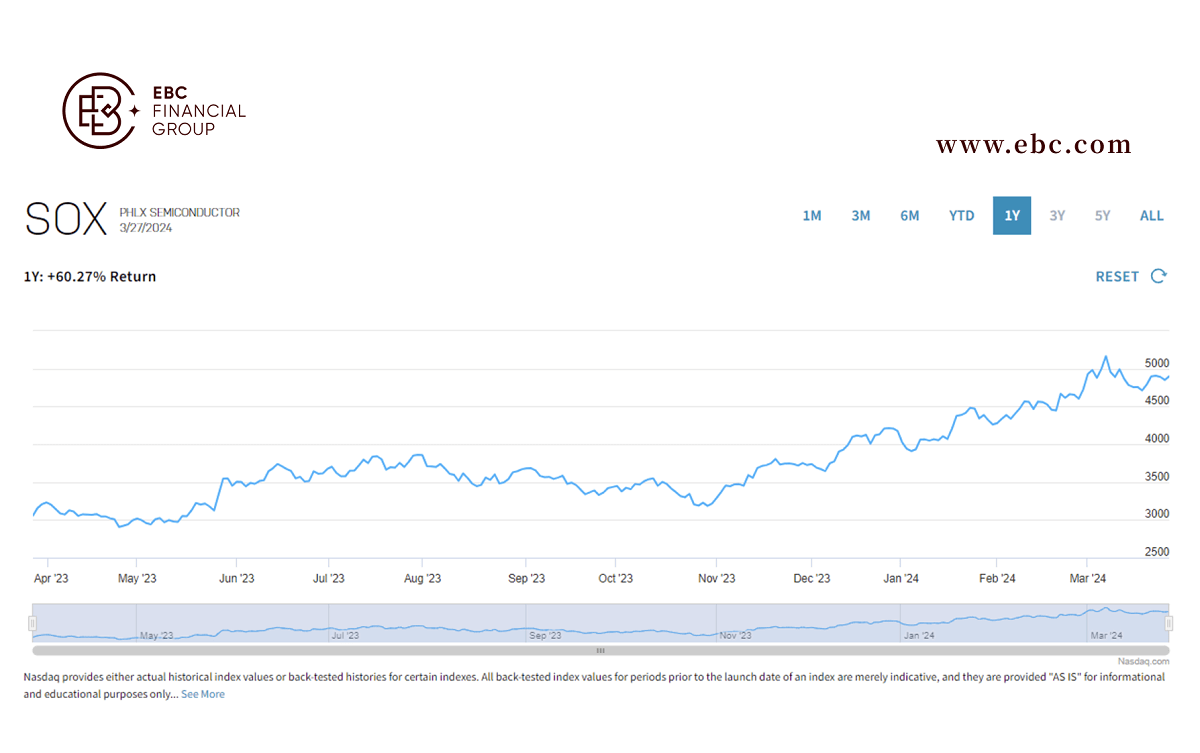

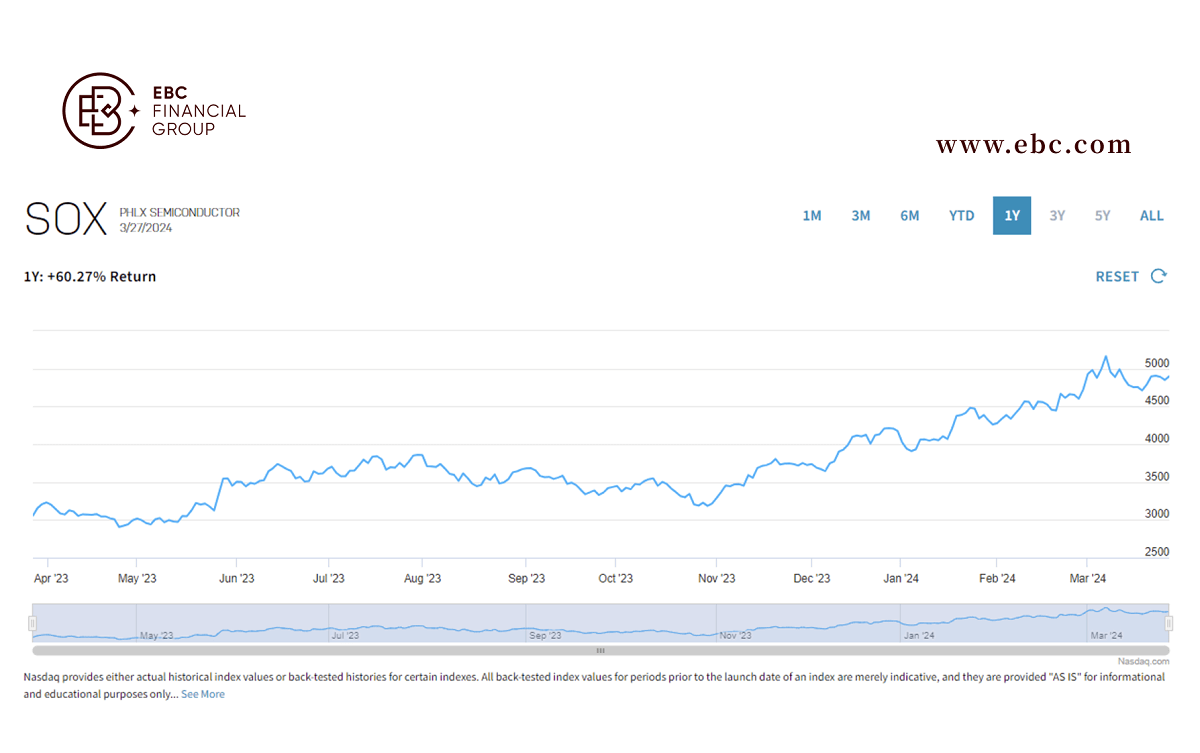

Nvidia, Broadcom, AMD and Micron Technology altogether now make up more than 10% of the S&P 500’s weighting, an unprecedented amount of sway over the index.

Nearly half the stocks on the Philadelphia Semiconductor Index have jumped at least 10% already this year, pushing the gauge’s PS ratio to its highest level in at least two decades.

The concern is the semiconductor industry being notoriously cyclical as players have struggled to cope short-term swings in demand with long-term levels of production capacity.

The concern is the semiconductor industry being notoriously cyclical as players have struggled to cope short-term swings in demand with long-term levels of production capacity.

Nvidia’s revenue is projected to rise 81% in its current fiscal year, but just two years ago its sales were flat. The stock’s multiple of roughly 40 is below the peak around 70 in 2021 but still hefty.

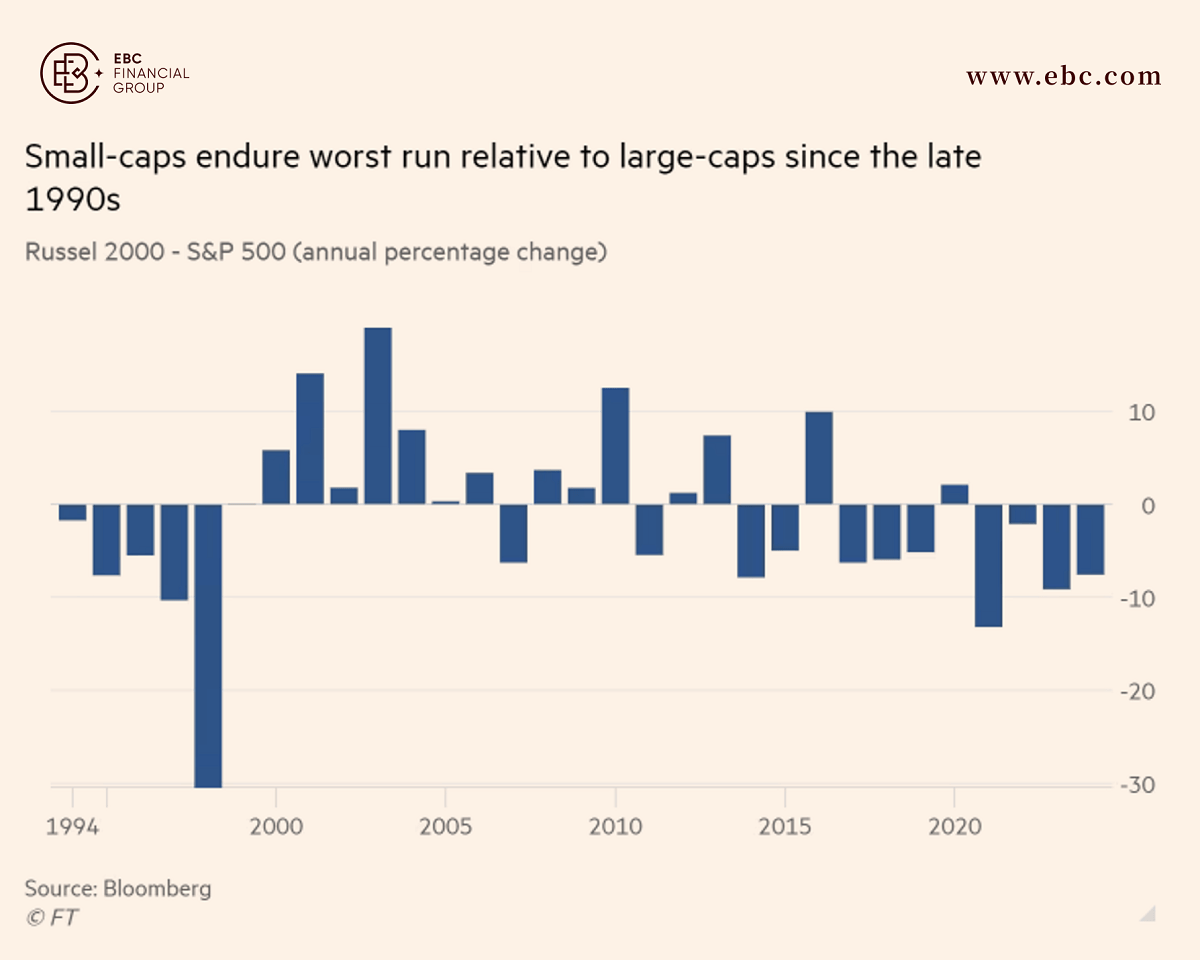

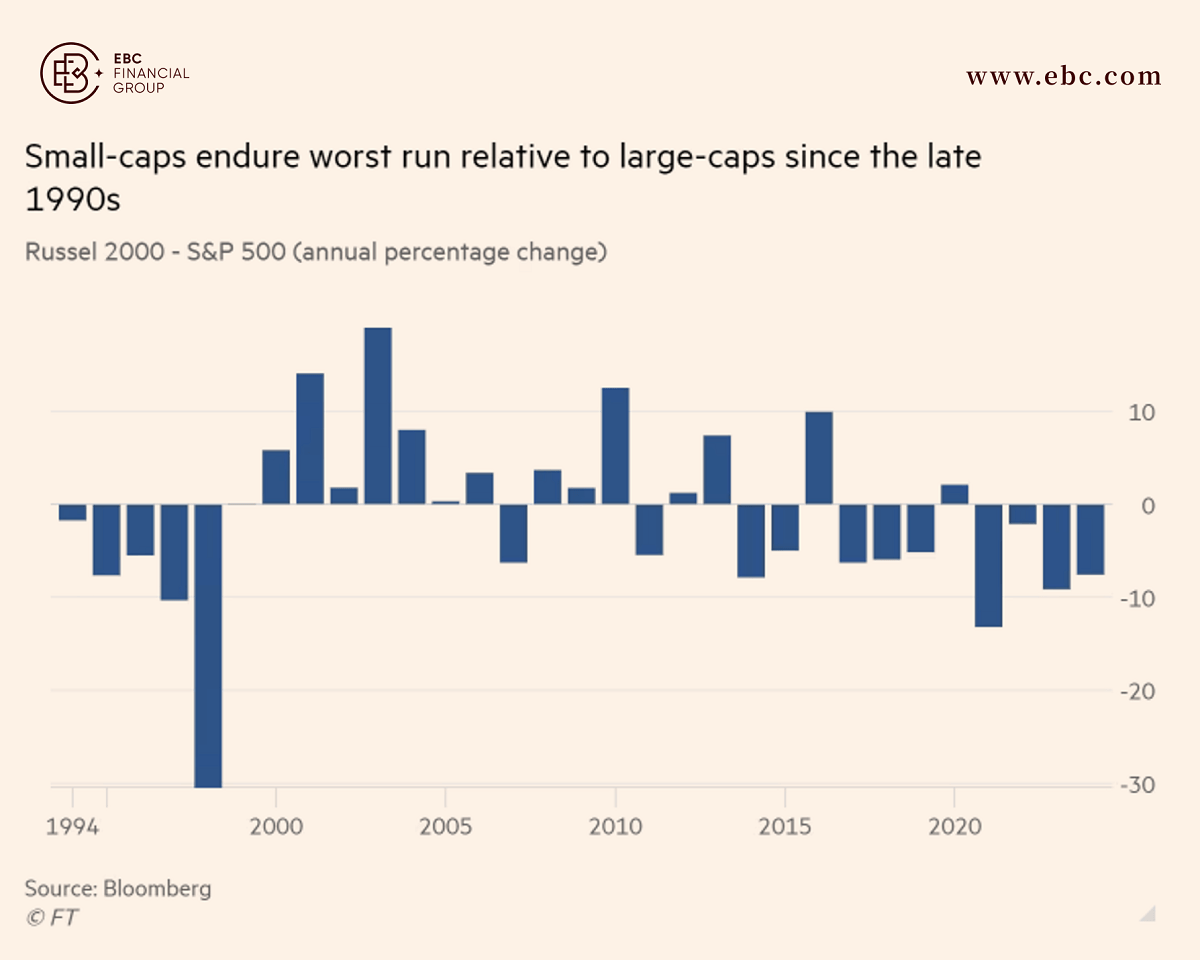

Not only this, US small-cap stocks are suffering their worst run of performance relative to large companies in more than 20 years as the former are weighed down by high interest rates.

Roughly 40% of debt on Russell 2000 balance sheets is short-term or floating rate, compared with about 9% for S&P companies. As a result, their profit margins are particularly hurt by tight financial condition.

Roughly 40% of debt on Russell 2000 balance sheets is short-term or floating rate, compared with about 9% for S&P companies. As a result, their profit margins are particularly hurt by tight financial condition.

Aside from a brief period of outperformance in 2020. small-cap stocks have lagged behind their larger peers since 2016. The gap seems hard to close as the higher-for-longer scenario persists.

Pullback overdue

Morgan Stanley and JPMorgan are some of the most pessimistic strategists at major Wall Street banks. JPMorgan sees the S&P 500 ending the year at 4.200 while Morgan Stanley expects 4.500.

“It’s hard to justify the higher index-level valuations based on fundamentals alone, given that 2024 and 2025 earnings forecasts have barely budged over this time period,” said Morgan Stanley’s Michael Wilson.

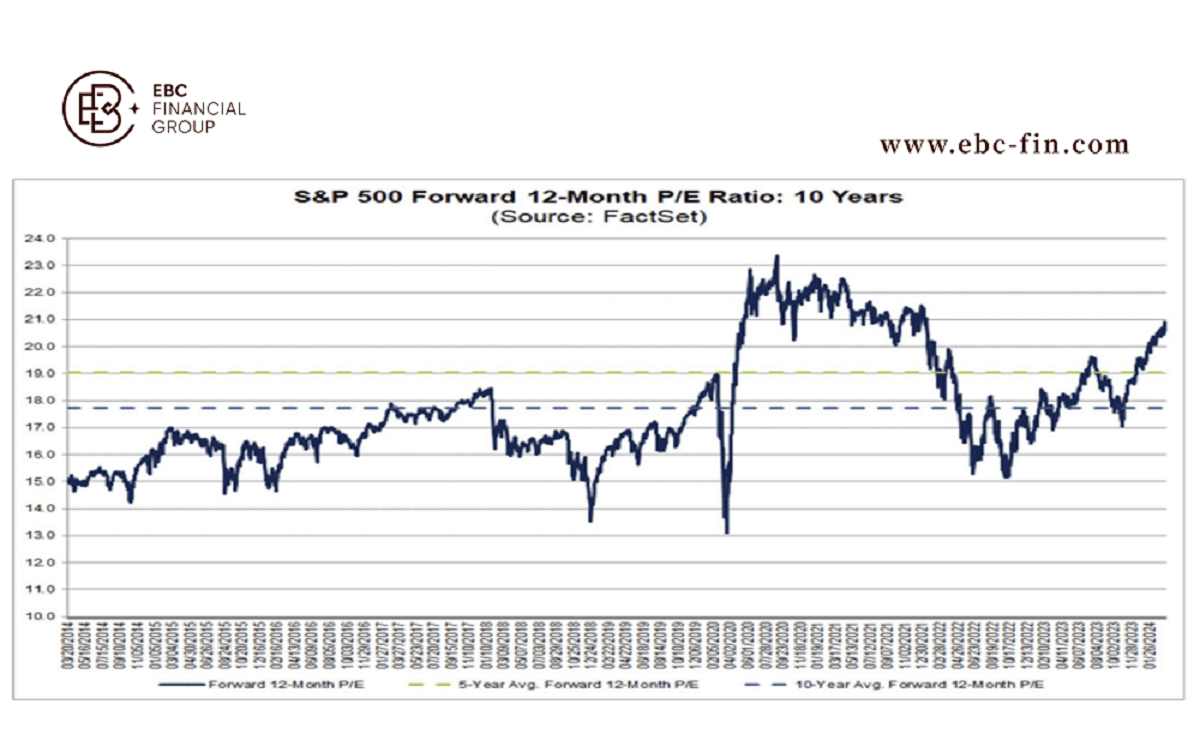

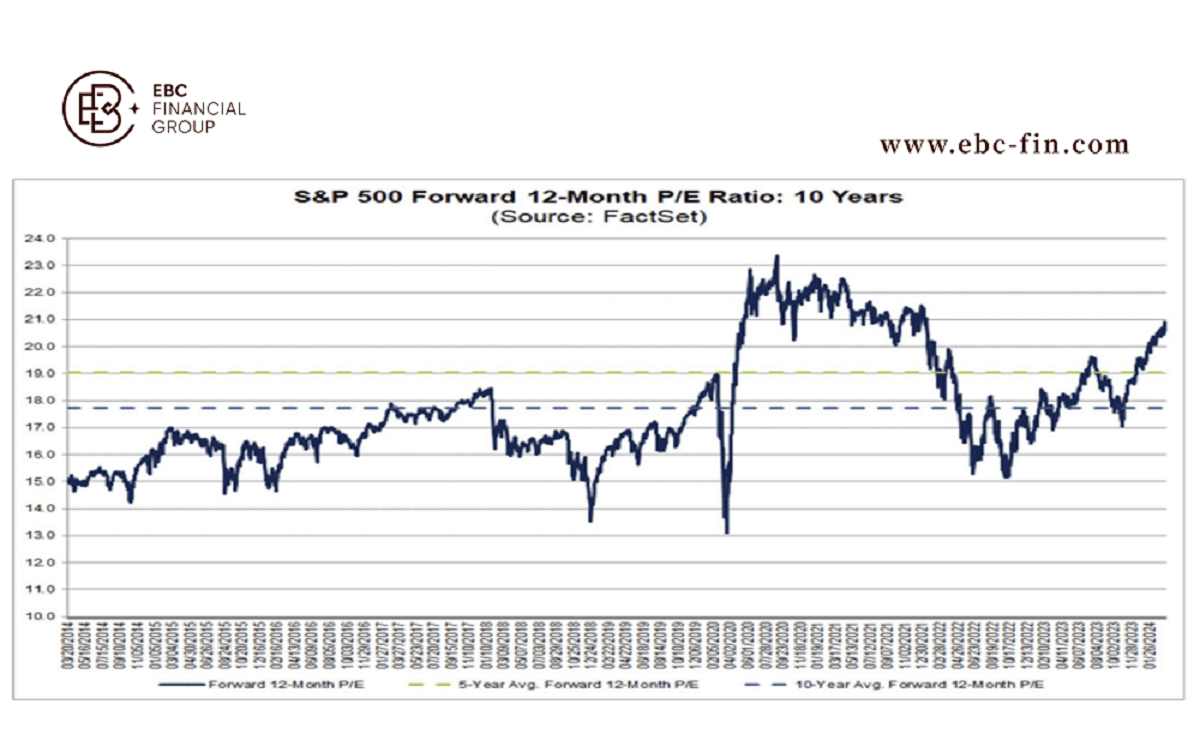

The S&P 500 is trading at around 21 times forward earnings - above the 5-year average of 19.0 and above the 10-year average of 17.7. according to FactSet. That signals complacency around the market.

According to data compiled by Bloomberg, consensus earnings estimates have been revised lower over the past five months. Analysts are expecting EPS to grow about 9% this year versus 11% in November.

According to data compiled by Bloomberg, consensus earnings estimates have been revised lower over the past five months. Analysts are expecting EPS to grow about 9% this year versus 11% in November.

“Our concern is that profit growth could underwhelm, for a number of reasons,” JPMorgan wrote in a note. “If the earnings acceleration fails to materialize, this could act as a constraint.”

The rush into popular momentum stocks typically is followed by a correction, which happened three times since the Global Financial Crisis, according to the bank’s strategist Dubravko Lakos-Bujas.

“We continue to see sentiment as stretched and think a US equity market pullback is overdue,” RBC Capital Markets strategist Lori Calvasina noted, citing signs of top stocks petering out.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

A Deutsche Bank survey of investors this month found that almost half expected a soft landing and

A Deutsche Bank survey of investors this month found that almost half expected a soft landing and  The concern is the semiconductor industry being notoriously cyclical as players have struggled to cope short-term swings in demand with long-term levels of production capacity.

The concern is the semiconductor industry being notoriously cyclical as players have struggled to cope short-term swings in demand with long-term levels of production capacity. Roughly 40% of debt on Russell 2000 balance sheets is short-term or floating rate, compared with about 9% for S&P companies. As a result, their profit margins are particularly hurt by tight financial condition.

Roughly 40% of debt on Russell 2000 balance sheets is short-term or floating rate, compared with about 9% for S&P companies. As a result, their profit margins are particularly hurt by tight financial condition. According to data compiled by Bloomberg, consensus earnings estimates have been revised lower over the past five months. Analysts are expecting

According to data compiled by Bloomberg, consensus earnings estimates have been revised lower over the past five months. Analysts are expecting