Two of the most commonly followed methods, depending on an individual's goals, risk tolerance, and time commitment, are delivery trading and Intraday Trading. While both involve buying and selling stocks, they operate on different principles and timelines.

Understanding the key differences between these trading styles is essential for beginners and seasoned investors who want to align their strategies with their financial objectives.

In this guide, we will break down the core distinctions between delivery trading and intraday trading, including how each works, the advantages and risks, strategies to follow and which style might suit you best, depending on your trading profile.

What Is Delivery Trading?

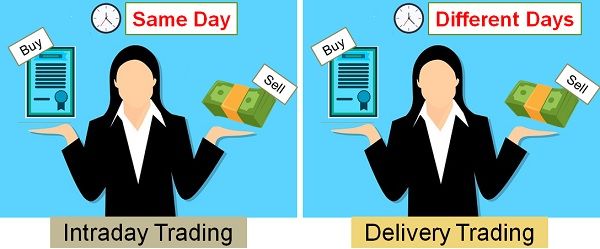

Delivery trading, also known as positional trading or cash market trading, refers to buying stocks and holding them in your demat account for more than one trading day. The primary goal of delivery trading is to invest in shares that can grow in value over time.

Unlike short-term methods, delivery trading is typically based on fundamental analysis, including evaluating company performance, market conditions, and long-term industry trends. Traders who follow this method often aim to benefit from capital appreciation, dividends, or even bonus issues companies offer over time.

When you buy a stock through delivery trading, you take actual asset ownership. That means you can hold it for days, weeks, months, or even years until you decide to sell.

Pros and Cons

Advantages

Delivery trading provides the benefit of long-term capital appreciation. If you choose fundamentally strong stocks, they may offer steady growth, dividends, and portfolio stability. You also get the flexibility to hold your position during market downturns without the pressure of daily price movements.

Additionally, the absence of leverage in delivery trading reduces the risk of margin calls or forced exits, making it a safer option for beginners.

Disadvantages

The primary drawback is capital requirement. You need to pay the full price of the shares, which may limit your ability to diversify. Also, delivery traders may miss out on short-term price swings that intraday traders capitalise on. Gains may also take months or years to realise.

What Is Intraday Trading?

Intraday or day trading involves buying and selling financial instruments within the same trading session. The goal is to capitalise on small price movements by entering and exiting positions quickly. Positions are squared off before the market closes, which means no shares are carried over to the next day.

Intraday traders rely heavily on technical analysis, price action, momentum indicators, and market volatility. The trades are fast-paced, involving higher volumes and leveraged positions to maximise profits.

This method demands constant attention to the screen, quick decision-making, and a clear understanding of short-term price behaviour. It's not uncommon for intraday traders to execute multiple trades a day, sometimes within minutes.

Pros and Cons

Advantages

Intraday trading allows traders to make quick profits based on market volatility. With access to margin, you can control larger positions with a smaller capital base. Traders can also avoid overnight risks such as gap-ups or gap-downs caused by after-hours news or global events.

Frequent trades mean more opportunities to profit, and losses can be limited quickly by using stop-loss orders.

Disadvantages

Intraday trading is stressful and demands constant monitoring, technical expertise, and fast execution. Losses can accumulate rapidly, especially with leveraged trades. Emotional trading, overtrading, and inadequate risk management can quickly deplete your capital.

The learning curve is also steep, and traders must have a strict risk-to-reward strategy to survive.

Delivery Trading vs Intraday Trading: Key Differences

1) Time Horizon

Delivery Trading: Long-term to medium-term. Investors can hold shares for days, months, or years.

Intraday Trading: Very short-term. Positions are closed on the same day.

2) Ownership of Shares

3) Capital Requirements

Delivery Trading: Requires full payment of the stock's value. Brokers do not offer margin or leverage in most cases.

Intraday Trading: Requires less capital due to margin trading and leverage but also increases risk.

4) Risk Level

5) Trading Strategy

6) Charges and Brokerage

Delivery Trading: Brokerage fees are generally higher, as the trade involves ownership and taxes like STT (Securities Transaction Tax) on the full transaction.

Intraday Trading: Lower brokerage, but frequent trading can add significant costs.

Real-World Example

Stock: Infosys Ltd (INFY)

Scenario A – Delivery Trading:

A delivery trader purchases INFY shares at ₹1,400 each after evaluating the company's Q1 results, expecting growth in the IT sector. After 6 months, the share rises to ₹1,650. The trader sells and earns a ₹250 profit per share, receiving dividends during the holding period.

Scenario B – Intraday Trading:

An intraday trader sees a technical breakout in INFY on the 5-minute chart. They buy 100 shares at ₹1,420 and place a target at ₹1,435. The price hits the target within an hour. The trader exits and books ₹1,500 profit minus brokerage.

However, if the price had dropped instead, they would have incurred a similar loss if the stop-loss wasn't executed properly.

Which One Is Right for You?

Choosing between delivery and intraday trading depends on several factors, including:

Your risk appetite: Delivery trading may be more suitable if you're conservative and want steady growth.

Time availability: Intraday trading demands full-time attention, while delivery trading allows passive monitoring.

Knowledge level: Intraday trading requires a deeper understanding of technical tools and quick decision-making.

Capital availability: Intraday allows trading with lower capital due to margin but increases risk. Delivery needs higher upfront capital but offers safer, long-term returns.

Beginners are often advised to start with delivery trading to understand the market dynamics before diving into intraday strategies.

Conclusion

In conclusion, intraday and delivery trading each offer distinct benefits and risks. Delivery trading is better if you prefer a more relaxed, long-term investment approach emphasising wealth accumulation.

Conversely, intraday trading may be more suitable for you if you enjoy a fast-paced trading environment, possess strong analytical skills, and can actively monitor the market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.