The foreign exchange (forex) market is the largest financial market in the world, with daily turnover exceeding US$7.5 trillion as of 2025.

Additionally, forex operates 24/5, across borders, with decentralised infrastructure. Because there's no single global regulator, scam brokers can set up offshore and target investors via social media, AI-powered ads, or messaging apps like Telegram and WhatsApp. The combination of high leverage, retail appetite, and easy online marketing makes forex scams an ever-present risk.

From AI-driven deepfake scams to unregulated brokers promising "guaranteed profits," forex fraud is evolving quickly. This article explains how forex scams work, what red flags to watch for, and how you can protect yourself in 2025 and beyond.

Common Types of Forex Scams in 2025

1. Signal-Seller & Influencer Scams

Self-proclaimed "gurus" on TikTok, Instagram, or Discord promise guaranteed returns with paid signals. Some now use AI-generated trading screenshots and deepfake videos to appear more credible.

2. Robot & Auto-Trading Scams

Algorithmic trading exists, yet fraudsters inflate the outcomes. Watch for EAs (Expert Advisors) or bots marketed with "100% win rates" or "risk-free profits", often using manipulated backtests.

3. Unregulated or Fake Brokers

Fraudulent brokers lure clients with high bonuses, only to block withdrawals. Always check registration with bodies such as the CFTC, NFA, FCA, or ASIC.

In 2025, regulators in Asia and Africa issued several warnings regarding clone websites that mimic legitimate brokers.

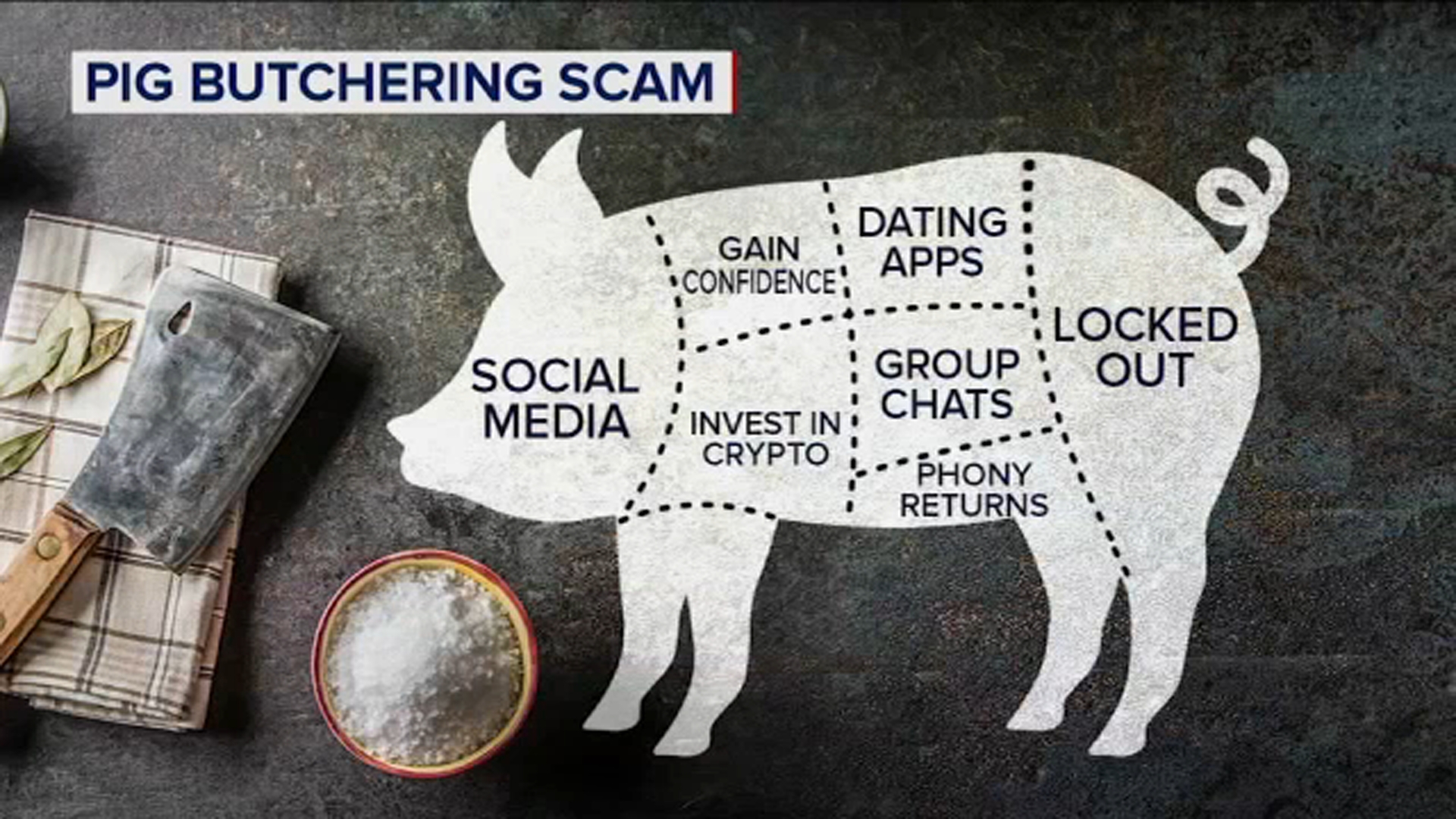

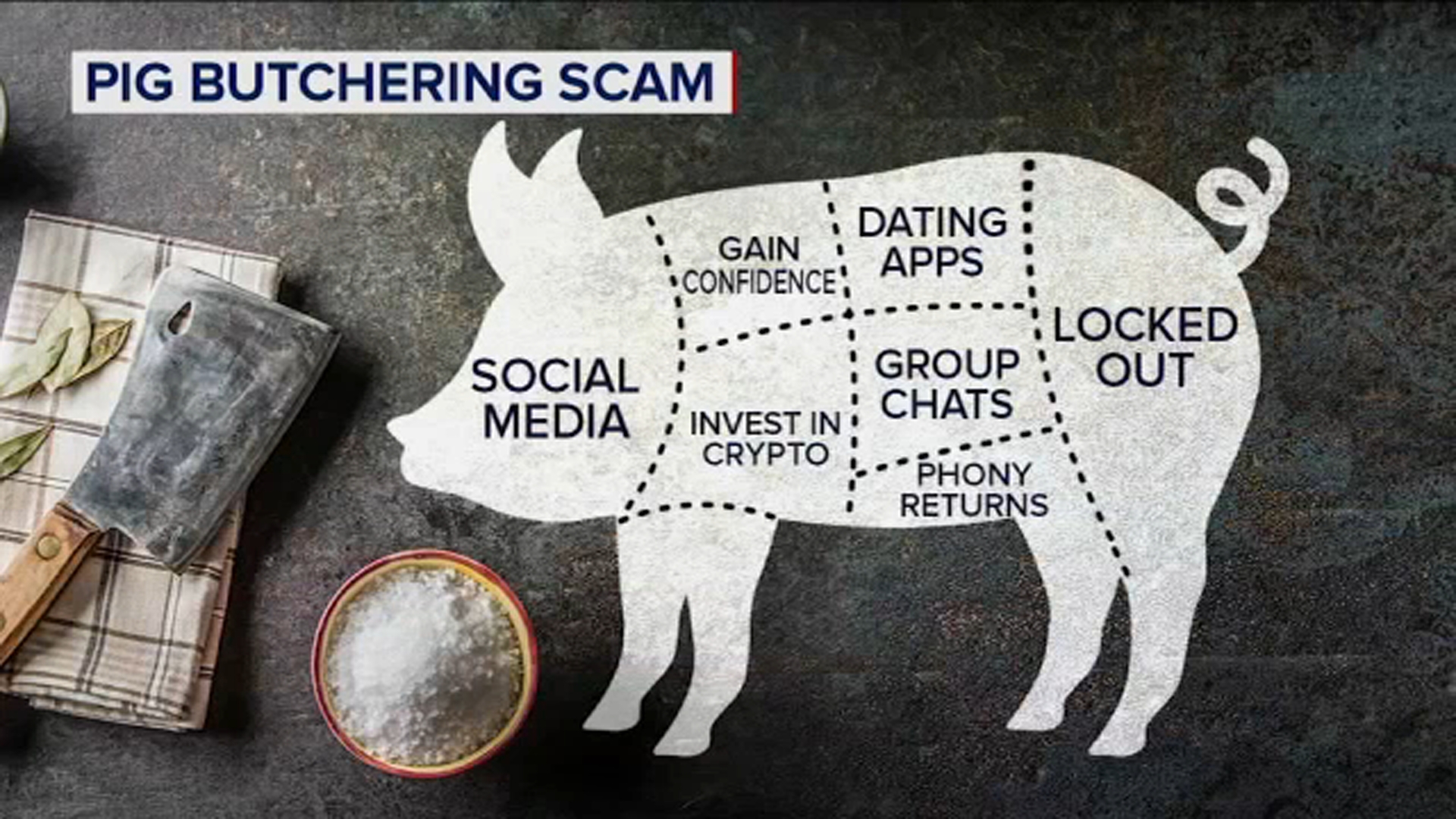

4. Romance & Pig Butchering Scams

Victims are groomed via dating apps or chat platforms, then pushed into "forex investments."

5. AI-Assisted Impersonation

New in 2025: Deepfake voice and video scams. Fraudsters call pretending to be a regulator, broker, or even a friend, urging quick deposits. With AI voice cloning, the deception can be extremely convincing.

2025 Forex Scams Examples

1. Spain (2025):

The CNMV imposed a €10m fine on Deutsche Bank for improperly selling intricate forex derivatives to small enterprises. [1]

2. U.S. (2025):

CFTC filed a lawsuit against two unregistered brokers for operating a $200 million Ponzi-like forex and crypto scam.

3. Asia (2025):

MAS (Singapore) and SFC (Hong Kong) jointly warned against unlicensed Telegram groups offering forex-crypto "arbitrage."

4. Global (2025):

The Europol report verified that losses from pig-butchering surpassed $3 billion, primarily connected to call-centre scams in Southeast Asia. [2]

5. UK (2025):

FCA in the UK cracked down on 12 Instagram/TikTok influencers for promoting fake forex signals without disclosure.

Common Red Flags Every Trader Should Know and Avoid

Guaranteed profits with no risk

Pressure to invest immediately

Difficulty withdrawing funds

Requests to pay via crypto wallets instead of regulated payment rails

Websites with recently registered domains (check WHOIS records)

How to Protect Yourself from Potential Forex Scams

1) Verify regulation: Check official regulator databases (CFTC, FCA, ASIC, MAS, CySEC).

2) Cross-check broker details: Search regulator warning lists (e.g., FCA Warning List, CFTC RED List).

3) Start small: Test withdrawals before committing.

4) Do your research: Use reverse image search for broker logos or "team photos" to detect fakes.

5) Stay sceptical of influencers: Many scams now spread through TikTok/Instagram "luxury trader" accounts.

What to Do If You've Been Scammed?

1) Report immediately to your local regulator and financial ombudsman

2) File a complaint with global authorities (CFTC, FCA, ESMA) if cross-border

3) Alert your bank or payment provider to block further transfers

4) Avoid "recovery scams" from fake firms that promise to get your money back for a fee

Frequently Asked Questions

1. Are Forex Scams Increasing in 2025?

Yes. Worldwide enforcement reports indicate an increase in scam incidents, particularly those related to AI and cryptocurrency.

2. Which Countries Are Most Affected in 2025?

Southeast Asia, the U.S., and parts of Africa have seen the largest reported losses.

3. How Do I Verify a Forex Broker Is Legit?

Check the regulator's official database and confirm the license number.

4. Which Forex Scams Are New in 2025?

AI deepfake impersonations, influencer pump-and-dump Telegram groups, and hybrid forex-crypto apps.

Conclusion

In conclusion, forex scams continue to thrive and are ever-changing. In 2025, scammers increasingly exploit AI, social media, and hybrid forex-crypto offerings to lure victims.

The best defence remains awareness: know the red flags, verify regulations, and stay sceptical of "too good to be true" promises.

For traders, sticking with licensed, regulated brokers like EBC Financial Group ensures access to transparent trading conditions and regulatory protection.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/markets/europe/spain-fines-deutsche-bank-10-million-client-advice-forex-derivatives-2025-02-10/

[2] https://www.europol.europa.eu/media-press/newsroom/news/international-crackdown-dismantles-multimillion-euro-investment-scam