The acronym DYOR—“do your own research”—has become a guiding principle for both new and experienced investors. While the phrase is often associated with digital assets, its core message is universal: never rely solely on someone else's opinion or hype when making financial decisions.

Instead, take responsibility for your own due diligence to make informed, confident choices. In this article, we explain the meaning of DYOR, why it matters, and how to apply it to your investment strategy.

DYOR Meaning in Finance Explained

DYOR stands for “do your own research.” It is a call to action, encouraging individuals to thoroughly investigate any investment opportunity before committing their money. This means looking beyond headlines, social media tips, or recommendations from friends and influencers. Instead, investors are urged to examine the facts, understand the risks, and form their own conclusions based on evidence and analysis.

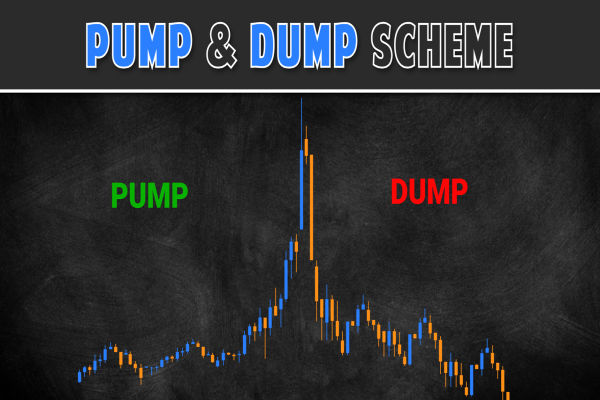

The rise of DYOR as an investing mantra reflects the reality that financial markets are full of noise, misinformation, and sometimes outright scams. By doing your own research, you protect yourself from making decisions based on hype, emotion, or misleading advice.

Why Is DYOR Important?

1. Avoiding Costly Mistakes

Markets can be unpredictable, and investments that sound promising at first glance may hide significant risks. Relying on others' opinions or blindly following trends can lead to poor decisions and financial losses. DYOR helps you spot red flags, such as unsustainable business models, lack of transparency, or questionable management.

2. Building Confidence and Independence

When you conduct your own research, you gain a deeper understanding of the assets you invest in. This builds confidence and reduces anxiety during periods of volatility. Independent research also empowers you to make decisions that align with your financial goals and risk tolerance, rather than being swayed by the crowd.

3. Managing Risk

Every investment carries risk, but thorough research helps you assess whether the potential reward justifies the risk. By examining fundamentals, market conditions, and historical performance, you can make more balanced decisions and avoid overexposing yourself to any single asset or sector.

4. Navigating Misinformation

The internet is awash with opinions, predictions, and “hot tips.” Not all of this information is reliable. DYOR acts as your shield against misinformation, hype, and even fraud. It encourages you to verify claims, question assumptions, and seek out credible sources before acting.

How to Do Your Own Research

1. Understand the Basics

Start by learning the fundamentals of the asset or company you are considering. For shares, this might include understanding the business model, industry trends, and competitive landscape. For funds or ETFs, look at their holdings, fees, and performance history.

2. Analyse Financials

Review financial statements, such as balance sheets, income statements, and cash flow reports. Look for consistent revenue growth, manageable debt levels, and healthy profit margins. Financial ratios like price-to-earnings (P/E), return on equity (ROE), and dividend yield can provide further insight.

3. Assess Management and Governance

Strong leadership and transparent governance are crucial for long-term success. Research the backgrounds of company executives and board members, and check for any history of misconduct or poor decision-making.

4. Evaluate Market Conditions

Consider broader market trends and economic factors that could impact your investment. For example, interest rate changes, inflation, or regulatory developments can all affect asset values.

5. Compare Alternatives

Don't just focus on a single opportunity. Compare it with similar investments to see how it stacks up in terms of risk, reward, and growth potential. This helps you avoid putting all your eggs in one basket.

6. Read Multiple Sources

Gather information from a variety of reputable sources, such as financial news outlets, company reports, regulatory filings, and independent analysis. Be wary of relying solely on social media or unverified online forums.

7. Question the Hype

If an investment is being heavily promoted or seems “too good to be true,” proceed with caution. High-pressure sales tactics and promises of guaranteed returns are classic warning signs.

Common Pitfalls to Avoid

Confirmation Bias: Avoid only seeking information that supports your existing beliefs. Challenge your assumptions and consider opposing viewpoints.

Overconfidence: Even after thorough research, remember that no investment is risk-free. Stay humble and be prepared for unexpected outcomes.

Neglecting Updates: Markets and companies change over time. Continue to monitor your investments and update your research regularly.

The Role of DYOR in Modern Investing

DYOR is more than just a slogan—it's a mindset. In an era where information is abundant but not always reliable, the ability to critically assess opportunities is a valuable skill.

Whether you're investing in shares, funds, property, or any other asset, doing your own research is key to building long-term wealth and avoiding costly mistakes.

Conclusion

DYOR—do your own research—is a simple yet powerful principle for anyone looking to invest wisely. By taking the time to investigate, question, and understand your investments, you put yourself in a stronger position to achieve your financial goals.

Remember, the best investment decisions are those made with knowledge, care, and independence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.