The Nasdaq Composite Index closed higher and the dollar rebounded on

Wednesday as Federal Reserve Chair Jerome Powell suggested two more interest

rate hikes are probably in the cards.

European stocks closed higher as strong U.S. economic data released allayed

fears of a steep economic downturn, even as Lagarde warned the ECB is still not

seeing enough evidence of an inflation cool-down.

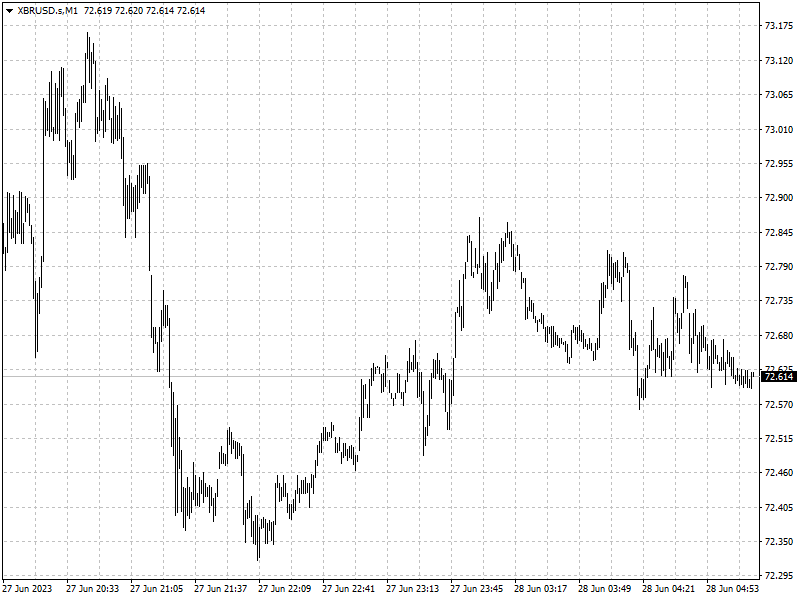

Gold prices fell to their lowest in nearly 4 months on bets for interest

rates remaining higher for longer.

Oil prices climbed about 3% as the second straight weekly draw from U.S.

crude stockpiles was bigger than expected, offsetting demand concerns.

Commodities

Markets were pricing in a 82% chance of a rate hike at the Fed’s next meeting

in July, seeing little odds of any easing in monetary policy by the end of this

year, according to the CME FedWatch tool.

The EIA said crude inventories dropped by 9.6 million barrels in the week

ended June 23, far exceeding the 1.8-million barrel draw analysts forecast in a

Reuters poll.

The 12-month backwardation for Brent and WTI both at their lowest levels

since December 2022. Some analysts expect the market to tighten in the second

half, citing ongoing supply cuts by OPEC+.

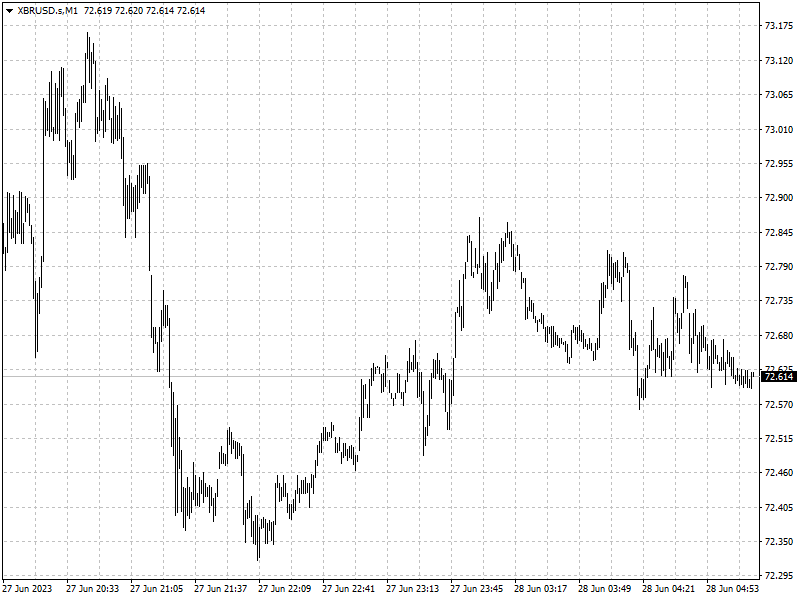

Forex

Earlier economic data showed the U.S. trade deficit in goods narrowed in May

as imports fell, but was likely not enough of an improvement to keep trade from

weighing on second quarter economic growth.

The yen, which has been under pressure as the BOJ has been an outlier among

global central banks by keeping a loose monetary policy, weakened to a fresh

7-month low of 144.61 per dollar.