U.S. stocks advanced in a broad rally on Tuesday, and the dollar softened as

robust economic data eased recession fears and stoked investors' risk

appetite.

Gold prices softened as upbeat economic reports dulled the safe-haven metal's

luster. Oil slumped over 2% on signals of more rate hikes and lower summer

consumption.

Commodities

Benchmark 10-year Treasury yields climbed, making zero-interest-bearing gold

less attractive. Gold has shed about 2.6% this month, set for a second

consecutive monthly fall if losses hold.

‘the key question is the extent to which the internal tensions within Russia

or any potential toppling of the government might affect global monetary

policy,’ Commerzbank analysts wrote in a note.

U.S. inventory data from the API showed that U.S. crude stocks fell by about

2.4 million barrels in the week ended June 23, according to market sources

citing the data.

Brent's six-month backwardation reached its lowest since December and was

barely positive, indicating shrinking concern about supply crunches.

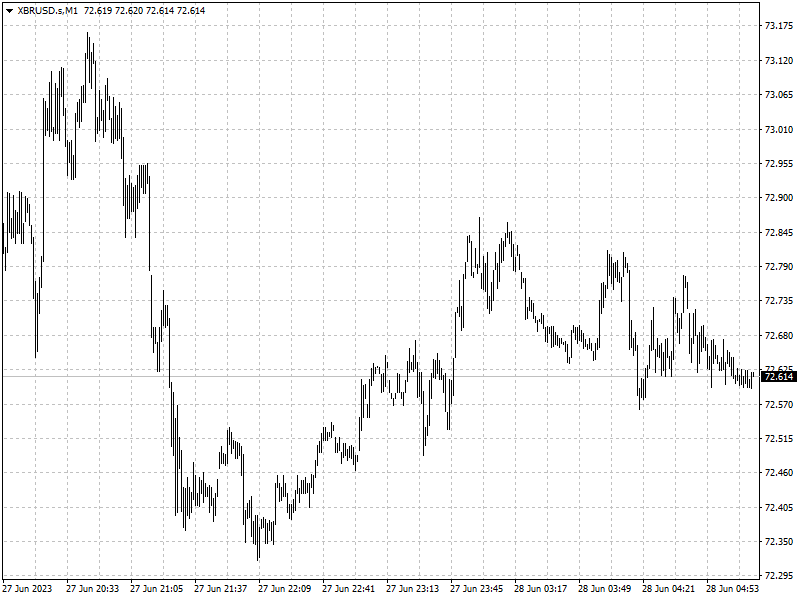

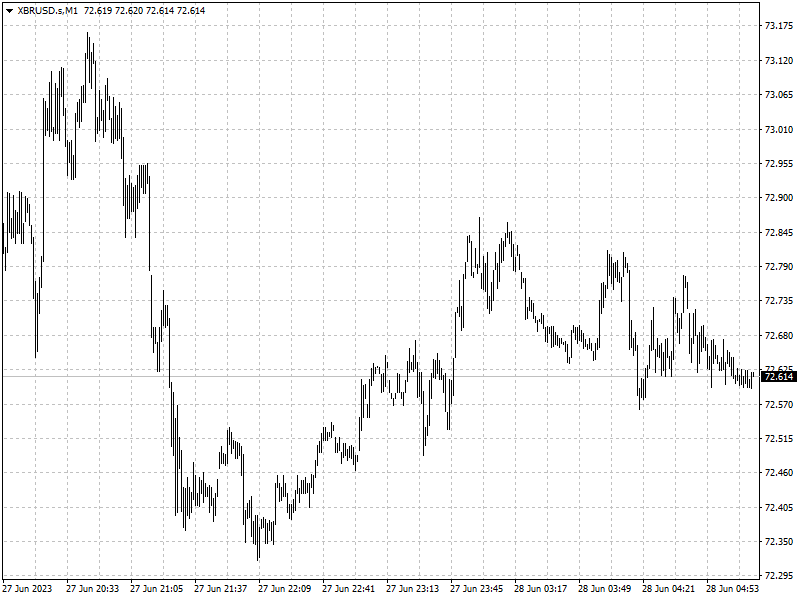

Forex

The greenback retreated further after data showed new orders for

U.S.-manufactured capital goods unexpectedly rose in May, indicating some

caution remained among businesses for new capital investment.

Additional data on single-family new home sales in May and home prices in

April also indicated the housing market has been able to weather rising interest

rates from the Fed.

Morgan Stanley said on Tuesday it was now expecting the Fed to hike its key

interest rate by 25 basis points in July, from an earlier estimate of a pause,

raising its terminal rate forecast to 5.375%.