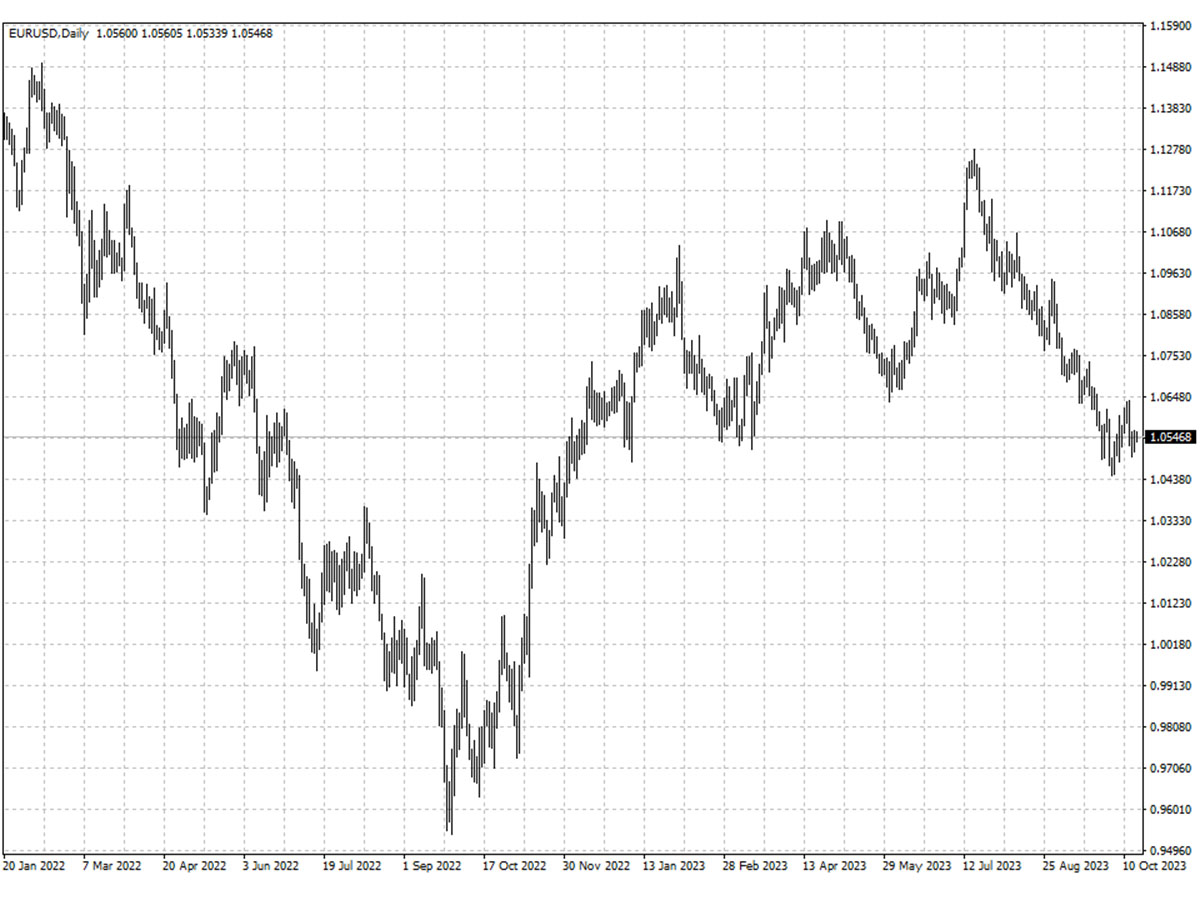

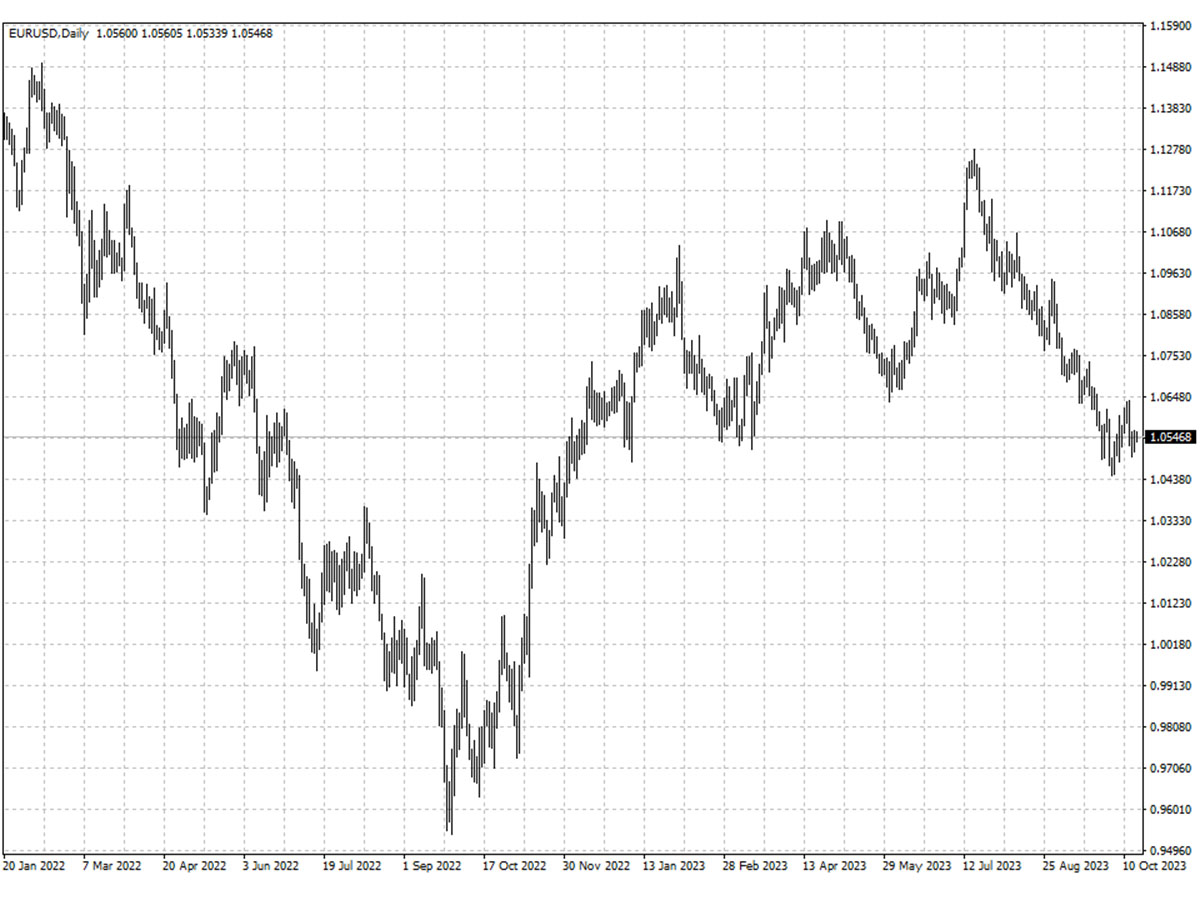

It has been nearly a year since the dollar was as valuable as the euro. Back

then the single currency hit its lowest in more than two decades on the heels of

Russia’s intrusion.

Having dropped around 6% from its peak in mid-July, the euro may be on track

to fall back to that level in face of multiple headwinds.

Over the past few weeks alone, analysts at firms including Nomura, Rabobank,

JPMorgan and Citi have slashed their forecasts to just shy of $1.

speculators are still bullish though they cut bets on euro moving upward in

recent weeks. Their net long positions were about 75,000 contracts for the week

to 10 Oct, down from over 170,000 in Aug.

The odds of the euro hitting that level by early next year have more than

doubled, according to a Bloomberg options model. The median forecast sees a

rally towards $1.08 by year-end.

Germany economic dilemma

Germany's economy is seen as shrinking slightly in the third quarter as the

global economic slowdown, money tightening and energy prices slow its expected

recovery, the economy ministry said last week.

It would mark a contraction for two consecutive quarters. The German GDP

declined 0.6% in the second quarter on a monthly basis due to subdued external

demand.

German businesses are increasingly curbing investments and eyeing production

abroad as their business model reliant on cheap energy has been torpedoed by

Russia-Ukraine war.

https://www.theguardian.com/world/live/2023/oct/17/russia-ukraine-war-live-avdiivka-assault-weakening-putin-arrives-beijing-china-meeting-president-xi.

The conflict between Israel and Hamas propelled European gas prices to their

highest since March last week. The prospect of another gas bull market could

further detail German’s effort to revive growth.

Moreover, clean energy projects are slowed by extensive bureaucracy and

not-in-my-backyard resistance while Africa’s gas development will take years as

alternative to Russian supply.

Despite a sluggish economy, many German companies find themselves confronted

by labour shortage. According to the latest survey by the Ifo Institute, a

record 49.7% of companies are currently short of workers.

Meanwhile, the US surprisingly resilient economy in recent months has fed

into the dollar strength. The odds are now against the eurozone to play catch-up

with China’s slowdown as well as heightening geopolitical risks.

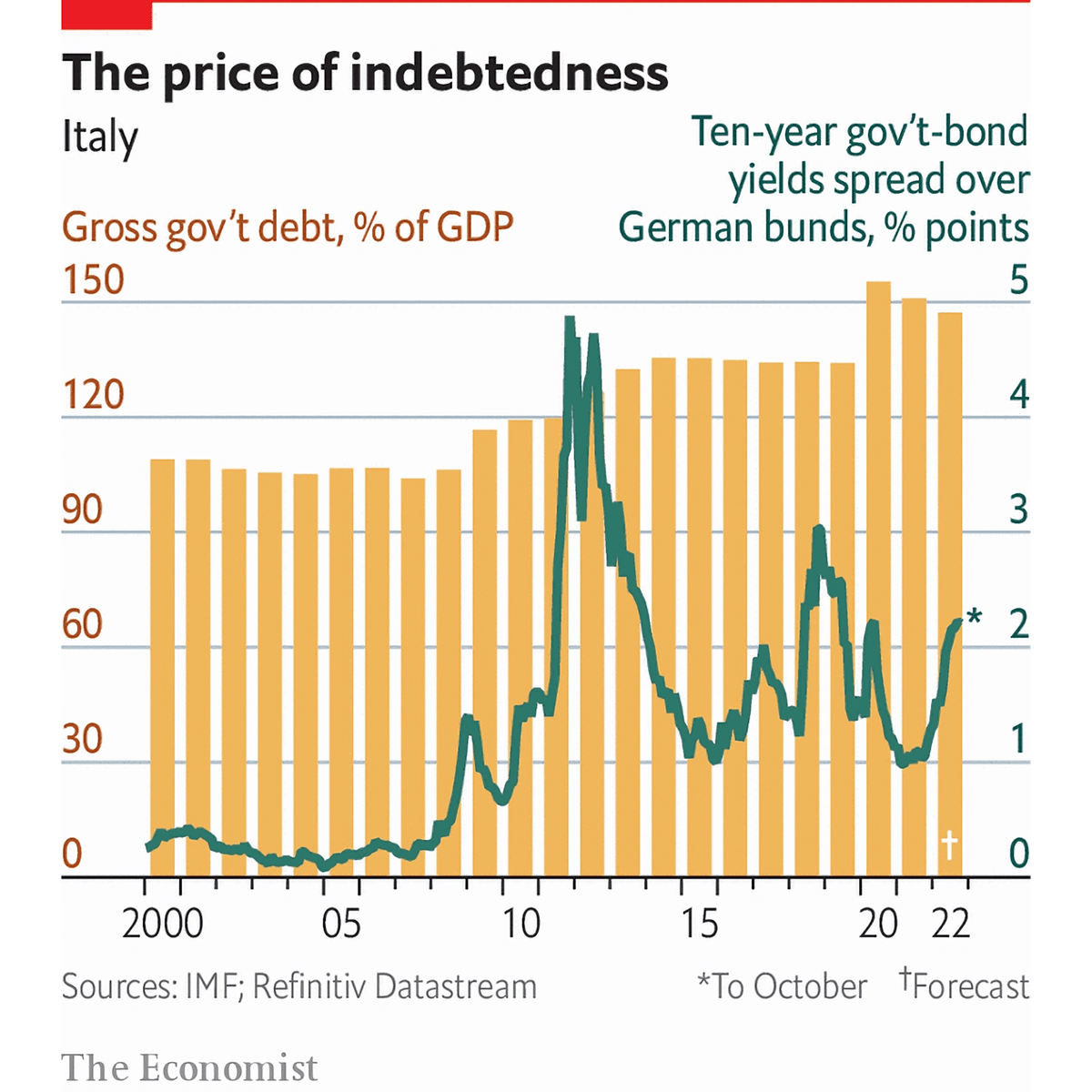

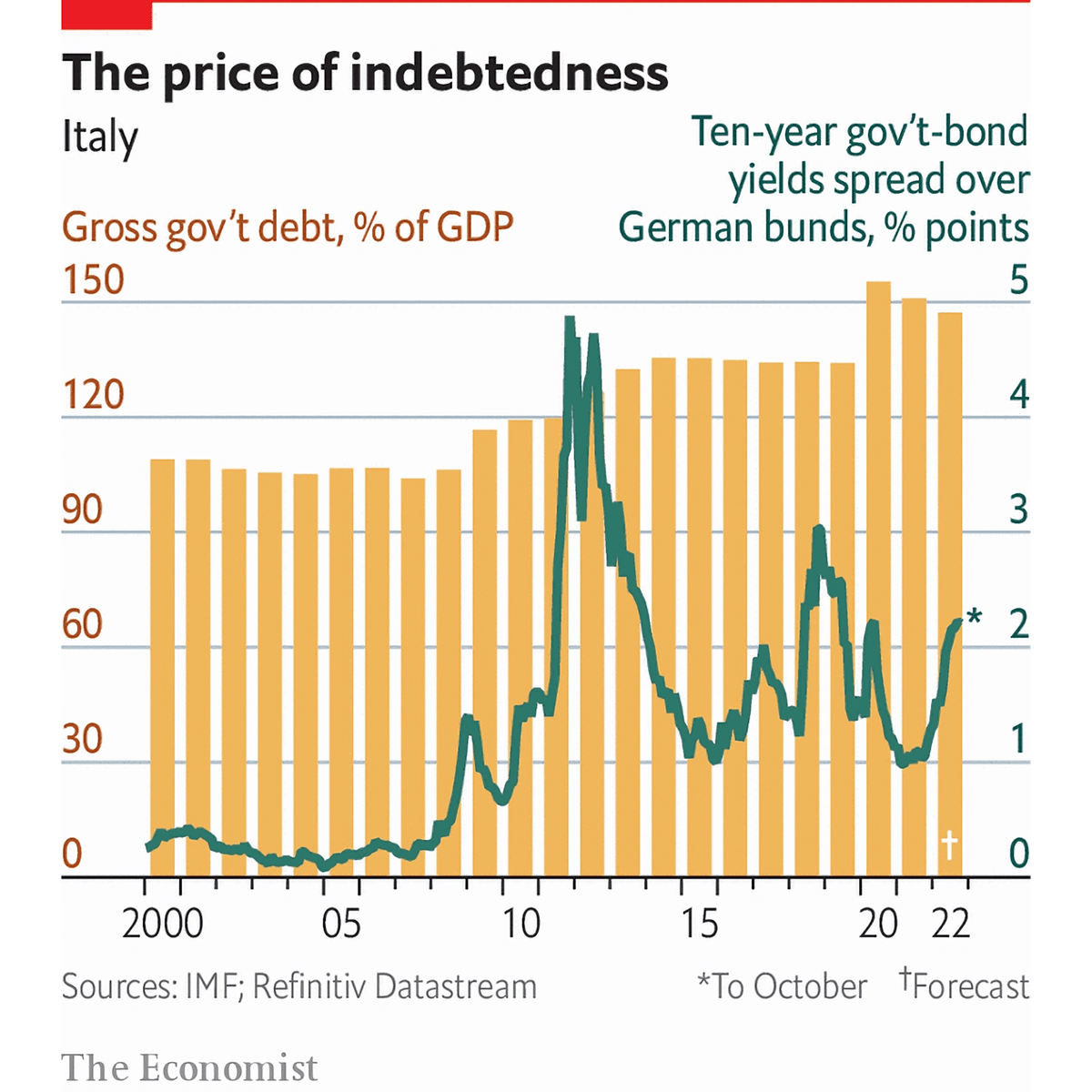

Italy debt problem

Italy’s government announced its budget for 2024 on Monday, setting out a new

raft of fiscal measures worth around €24 billion in tax cuts and increased

spending.

The extra borrowing of €15.7 billion added to concerns about Italy’s

financial stress. The country’s 10-year government bond yields are perching

close to 5%.

Also the gap between yields on Italian 10-year bonds and the German

equivalent was stable after the budget;s approval, hovering slightly above 2

pps.

The ECB is under mounting pressures to end it tightening cycle, but a shift

in its policy to quantitate tightening will hinder gobbling up the Italian

government bond in case of another debt crisis in the bloc.

Faced with these added cost burdens, Italy’s debt is predicted to fall only

marginally over the next few years. A reduction is expected from 140.2% of GDP

in 2023 to 139.6% in 2026.

The prospect that Italy could grow its way out from under its debt burden

appear to be dim though high interest rates will unlikely tip the Eurozone’s

third largest economy into recession.

Ageing population is a major challenge that seems insurmountable. Births last

year saw a 14th consecutive annual drop and were the lowest since the country;s

unification in 1861.

What makes it worse, the incumbent government has barely instilled confidence

to markets with ill-considered windfall profit tax on the banks and other

market-unfriendly reforms.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.