EBC Forex Snapshot, 20 Mar 2024

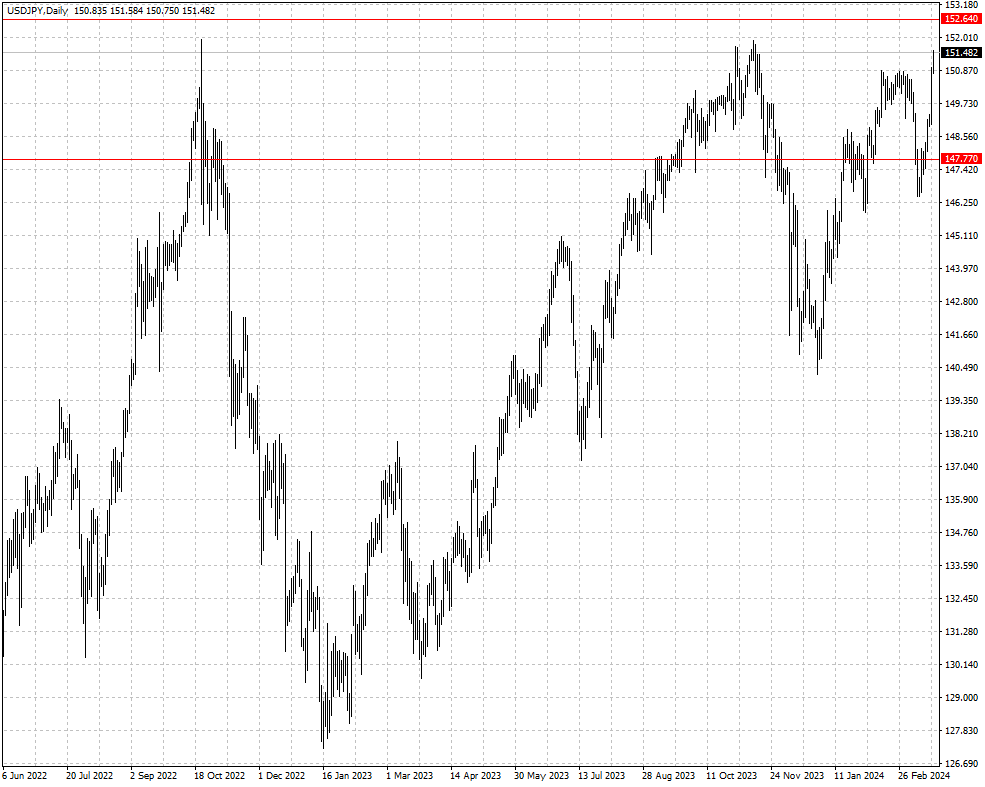

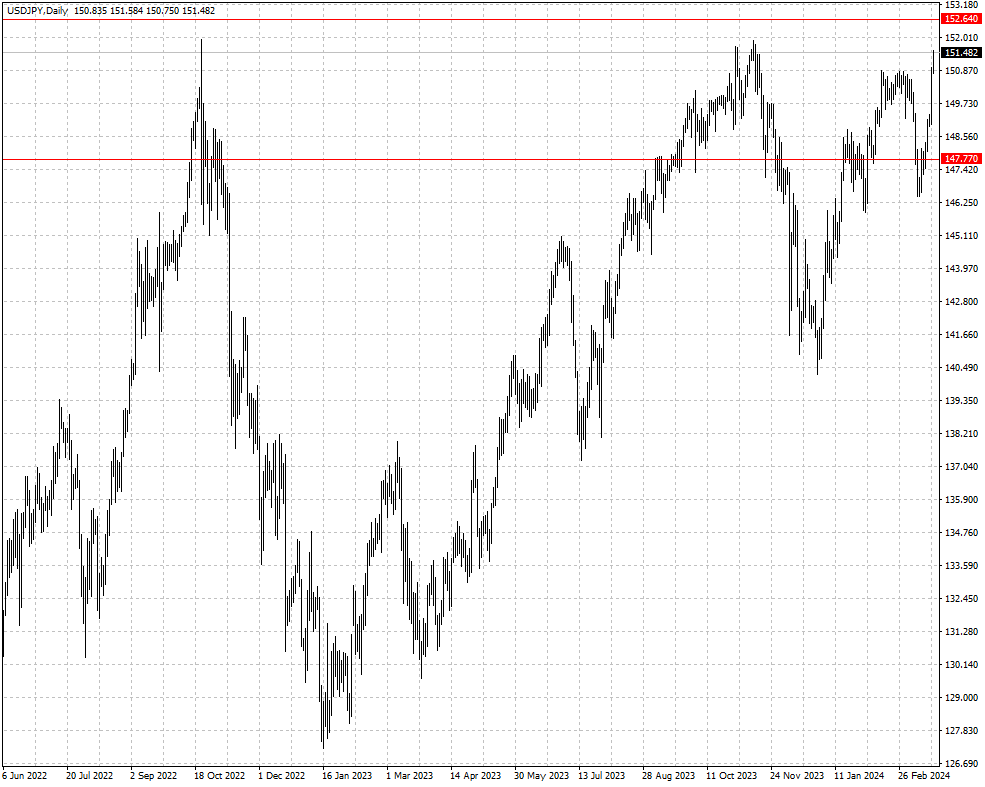

The yen languished near a four-month low against the dollar and a 16-year

trough against the euro on Wednesday as traders wagered Japan's monetary

settings will remain accommodative after a rate hike.

In the previous session, the currency weakened to 151.58 per dollar, with the

multi-decade low of 151.94 in sight and the threat of intervention by Japanese

authorities resurfacing.

The main spotlight for the day remains on the Fed that is expected to stand

pat. Traders are pricing in a 59% chance of the Fed starting its easing cycle in

June, the CME FedWatch tool showed.

|

Citi (as of 18 Mar) |

HSBC (as of 20 Mar) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0779 |

1.0965 |

| GBP/USD |

1.2503 |

1.2896 |

1.2580 |

1.2876 |

| USD/CHF |

0.8741 |

0.9000 |

0.8772 |

0.8942 |

| AUD/USD |

0.6443 |

0.6691 |

0.6448 |

0.6639 |

| USD/CAD |

1.3359 |

1.3607 |

1.3449 |

1.3645 |

| USD/JPY |

146.26 |

149.21 |

147.77 |

152.64 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.