The yen rallied from its lowest level since early April on Thursday after the

Fed hold interest rates as expected. But two policymakers appointed by Trump

favoured a rate cut of 25 bps.

Trump on Wednesday announced that Washington had reached a "Full and

Complete" trade deal with Seoul, setting blanket tariffs on the country's

exports at 15%, the same as that is imposed on Japan and the EU.

He also said that India will pay a tariff of 25% beginning 1 Aug, in addition

to a "penalty" for what he views as unfair trade policies and for India's

purchase of military equipment and energy from Russia.

The US GDP grew at a much stronger-than-expected pace in Q2, powered by a

turnaround in the trade balance and renewed consumer strength, the Commerce

Department reported.

While the BOJ is set to keep rates steady next week, markets are pricing in

the chance of a near-term hike. The board may also revise up this year's

inflation forecast and offer a more sanguine view on economy.

While praising the trade deal as reducing uncertainty, deputy governor Uchida

warned it was still not clear how new tariffs could affect the business mood and

spending plans.

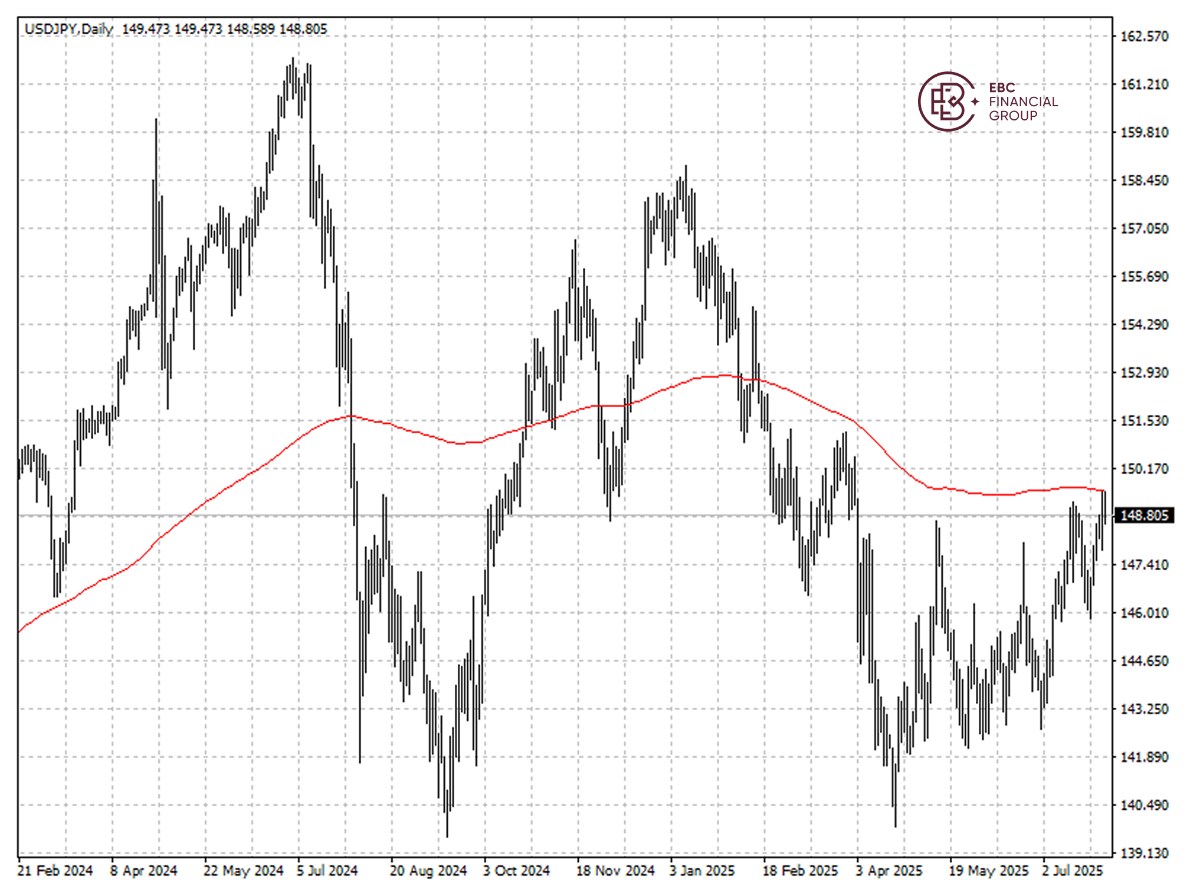

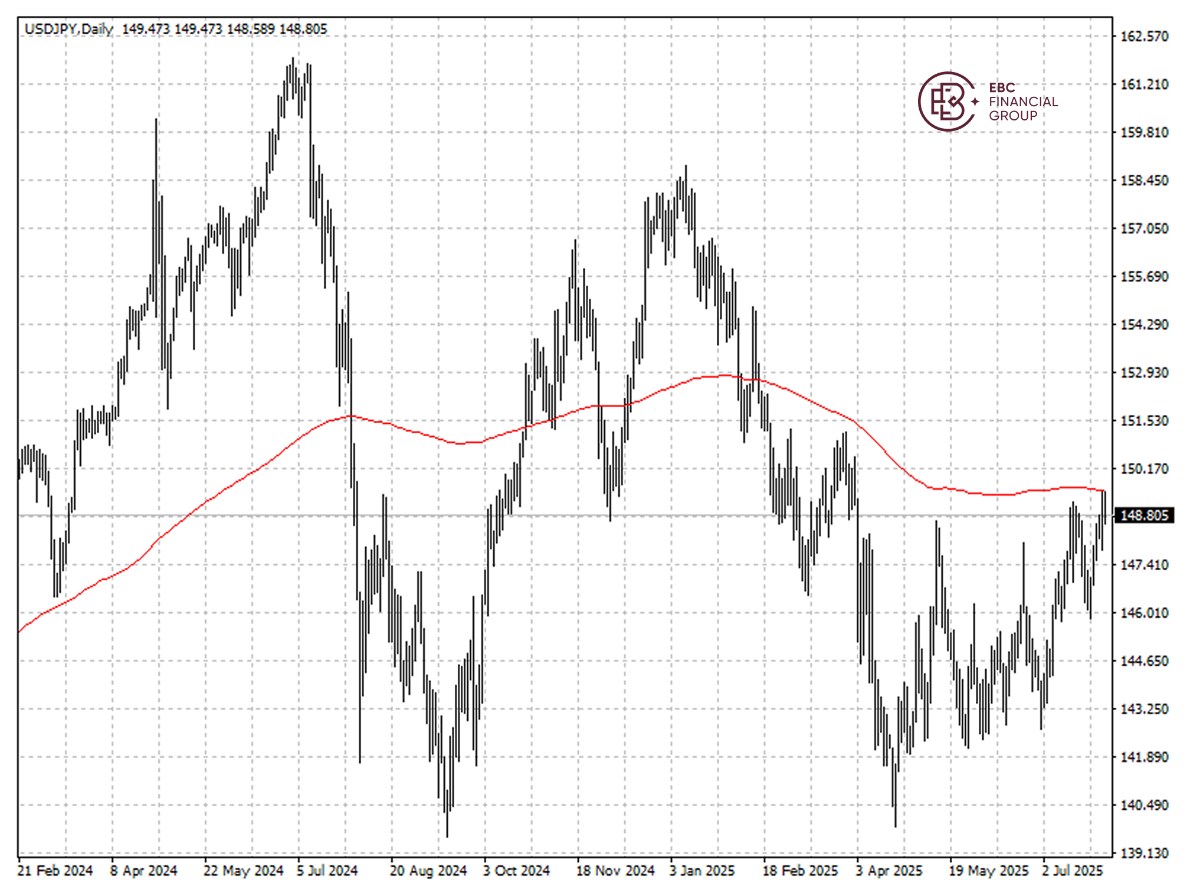

The yen found support at 200 SMA, but it has not negated the bearish bias. We

expect the rally to stall around 148.5 per dollar before resuming its

downtrend.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.