Gold has long been seen as a symbol of wealth and security, but its value is anything but fixed. The price of a single gram can shift daily, influenced by global markets, economic trends, and even geopolitical events. For anyone curious about buying, selling, or simply understanding gold, knowing how much a gram is worth—and why that figure changes—is a practical starting point.

What Determines the Price of Gold Per Gram?

The price of gold per gram is primarily influenced by the global spot price, which represents the current market price for one troy ounce (approximately 31.1 grams) of pure gold. This spot price fluctuates continuously due to various factors:

Supply and Demand: Limited supply and increasing demand, especially from central banks and investors, can drive prices up.

Economic Indicators: Inflation, interest rates, and currency strength, particularly the U.S. dollar, play significant roles.

Geopolitical Stability: Political unrest or economic crises often lead investors to seek the safety of gold, increasing its price.

Market Speculation: Traders' perceptions and speculative activities can cause short-term price movements.

These factors intertwine to create a dynamic pricing environment, making gold both a stable long-term investment and a subject of daily market interest.

Current Gold Price Per Gram: An Overview

As of early May 2025. the price of gold has reached unprecedented levels. The spot price for gold recently surged to approximately $3.500 per troy ounce, marking a significant increase from previous years . This translates to roughly £81.57 per gram in the UK .

However, it's essential to note that the retail price you pay for gold includes additional costs:

Premiums: Dealers add a premium over the spot price to cover manufacturing, distribution, and profit margins.

Purity Levels: The gold's karat rating (e.g., 24K, 22K) affects its price, with higher purity commanding higher prices.

Therefore, while the spot price provides a baseline, the actual cost per gram varies depending on these factors.

Historical Trends in Gold Pricing

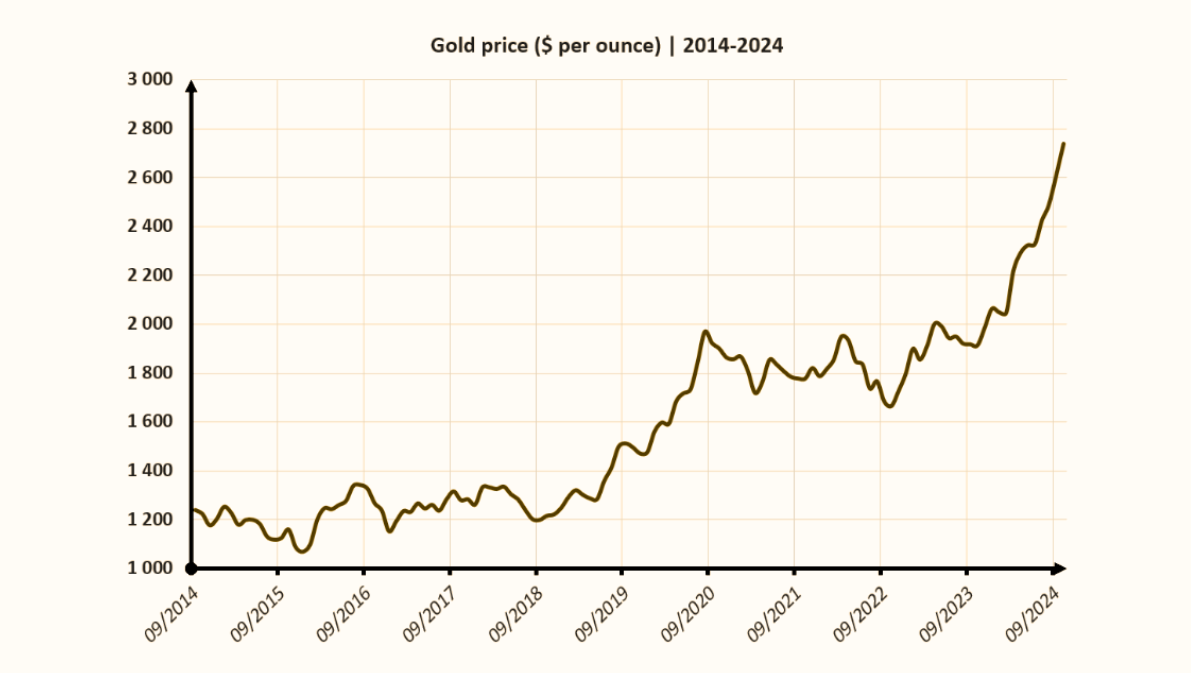

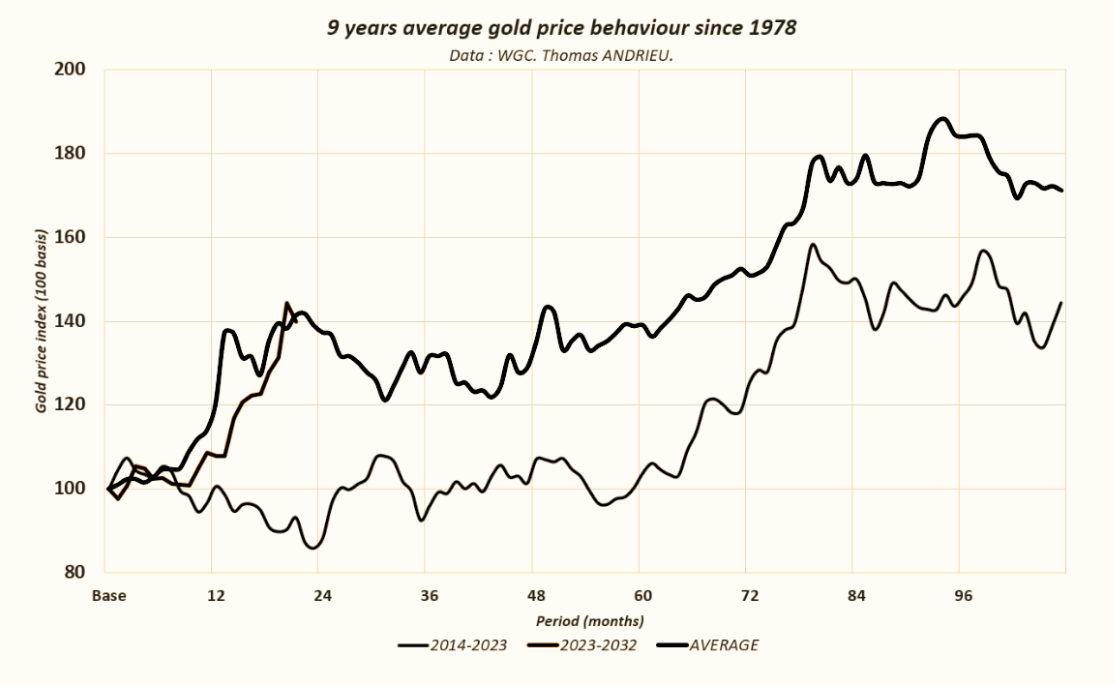

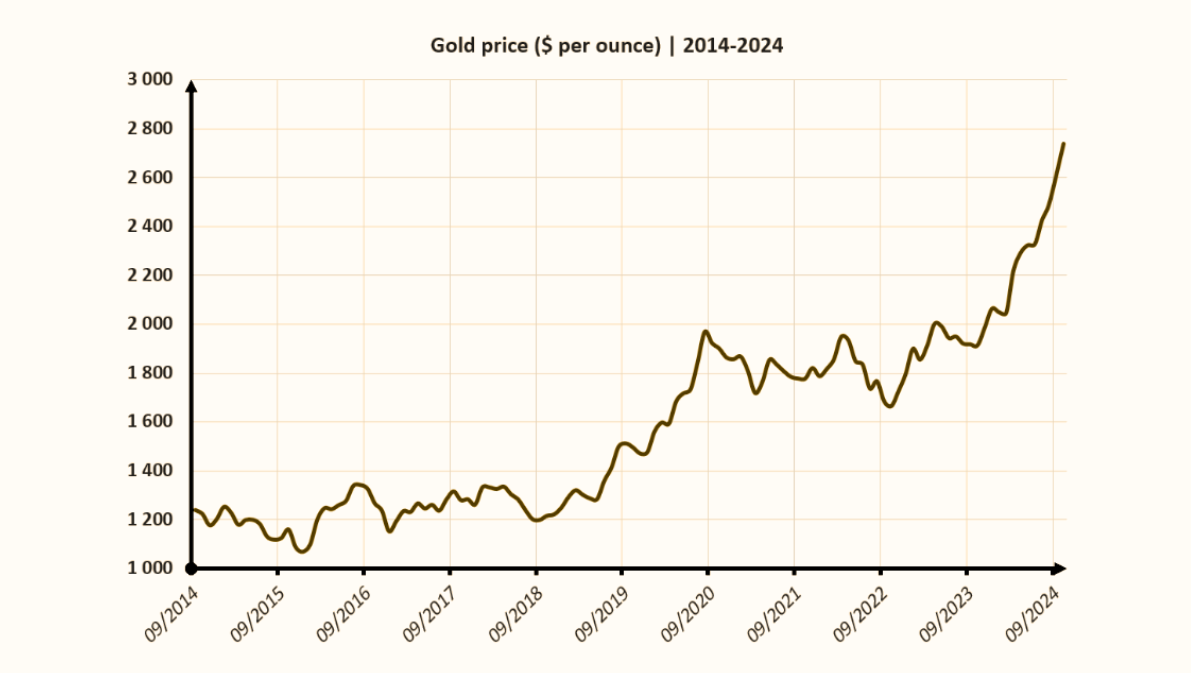

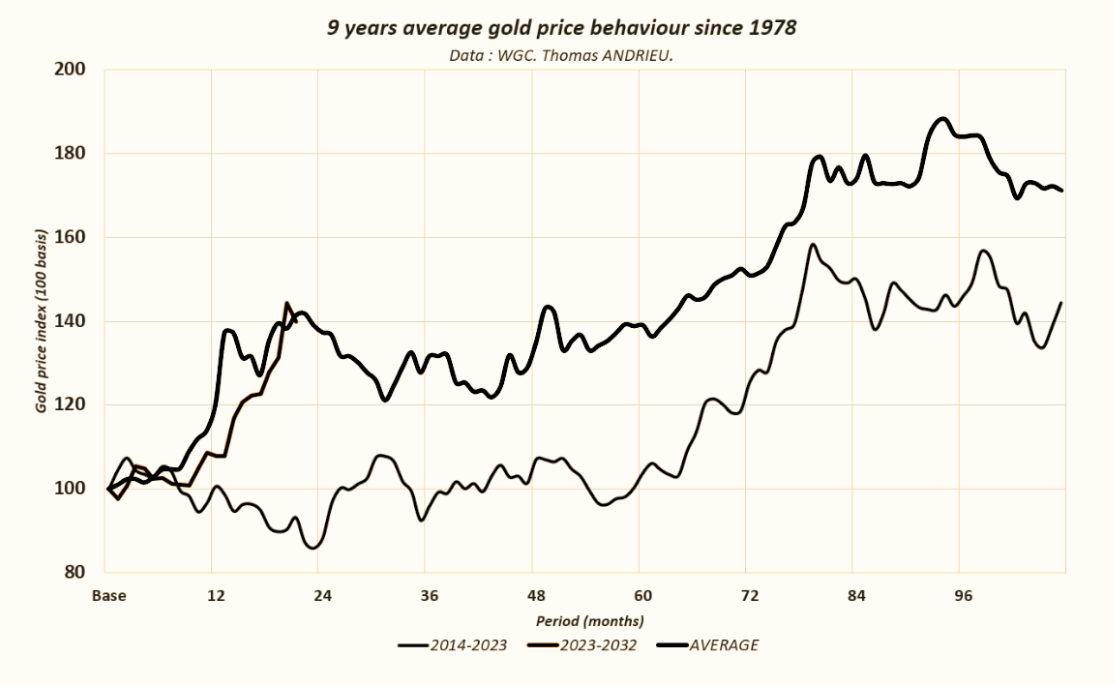

Gold's value has seen significant changes over the decades. In the early 2000s, gold was priced at less than £10 per gram. Fast forward to 2025. and prices have soared to over £80 per gram.

Several events have influenced these trends:

2008 Financial Crisis: Investors flocked to gold as a safe haven, driving prices up.

COVID-19 Pandemic: Economic uncertainty led to increased gold investments, pushing prices higher.

Recent Geopolitical Tensions: Ongoing global conflicts and economic policies have further elevated gold's appeal.

These historical patterns highlight gold's role as a hedge against economic instability and its potential for long-term value appreciation.

Spot Price vs Retail Price: What's the Difference?

To begin with, there's an important distinction to understand: the spot price of gold isn't the same as what you might pay (or receive) at a shop or dealer. The spot price refers to the current market price for one troy ounce of pure gold—roughly 31.1 grams—traded globally in financial markets. This price is constantly changing, influenced by everything from international events to economic data releases.

However, when you go to a jeweller or gold dealer, you'll likely notice that the retail price per gram is higher than the spot price divided by 31.1. That's because sellers add a premium to cover costs like refining, transportation, insurance, and profit margins. So, if the spot price of gold is £81.57 per gram today, the retail price might be £85 or more, depending on the source.

Comparing Gold Prices Across Different Purities

Gold's purity is measured in karats, with 24K representing pure gold. However, gold is often alloyed with other metals to enhance durability, especially in jewellery. Here's how purity affects price:

24K Gold: Pure gold, highest price per gram.

22K Gold: 91.6% pure, slightly lower price.

18K Gold: 75% pure, more affordable.

14K Gold: 58.3% pure, commonly used in jewellery.

For example, as of May 2025. the price per gram for various purities is approximately:

24K: £75.64

22K: £69.28

18K: £56.73

14K: £44.25

9K: £28.36

Understanding these differences is crucial when buying or selling gold, as purity directly impacts value.

Where to Check Real-Time Gold Prices

Staying updated on gold prices is easier than ever, thanks to numerous online resources:

BullionByPost: Offers live gold prices per gram in GBP, along with historical data.

GOLD.co.uk: Provides real-time price charts and market analysis.

The Royal Mint: Features current gold prices and investment options.

London Gold Centre: Offers a live gold price calculator based on purity and weight.

These platforms are invaluable for investors and consumers alike, ensuring informed decisions in buying or selling gold.

Understanding the price of gold per gram involves more than just checking the current rate. It's about comprehending the myriad factors that influence its value, recognising the impact of purity levels, and knowing where to find reliable information. Whether you're a seasoned investor or a curious newcomer, staying informed empowers you to navigate the gold market with confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.