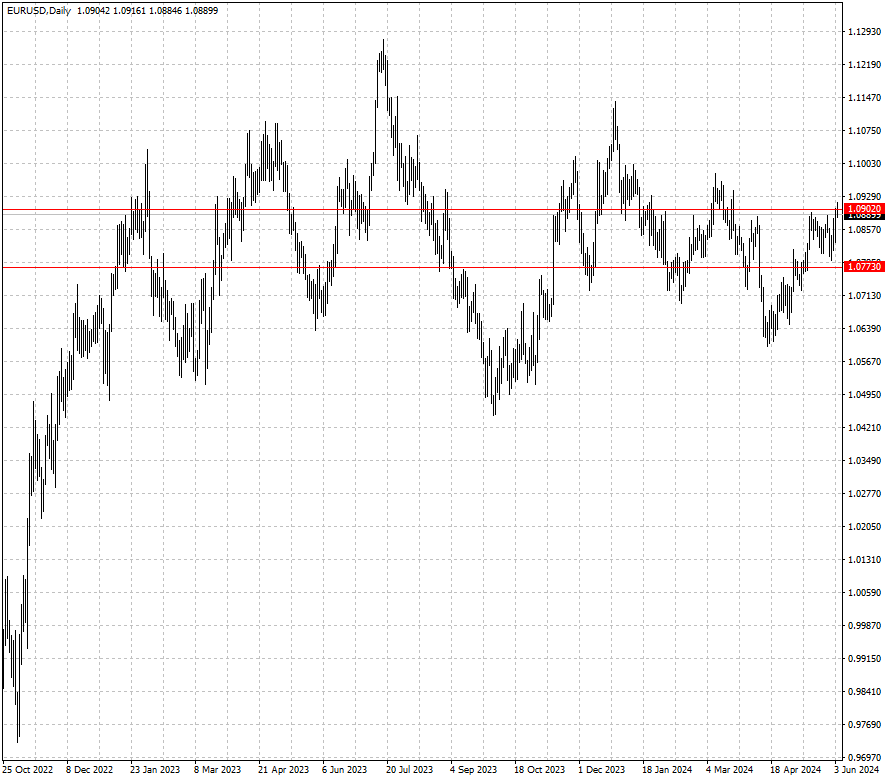

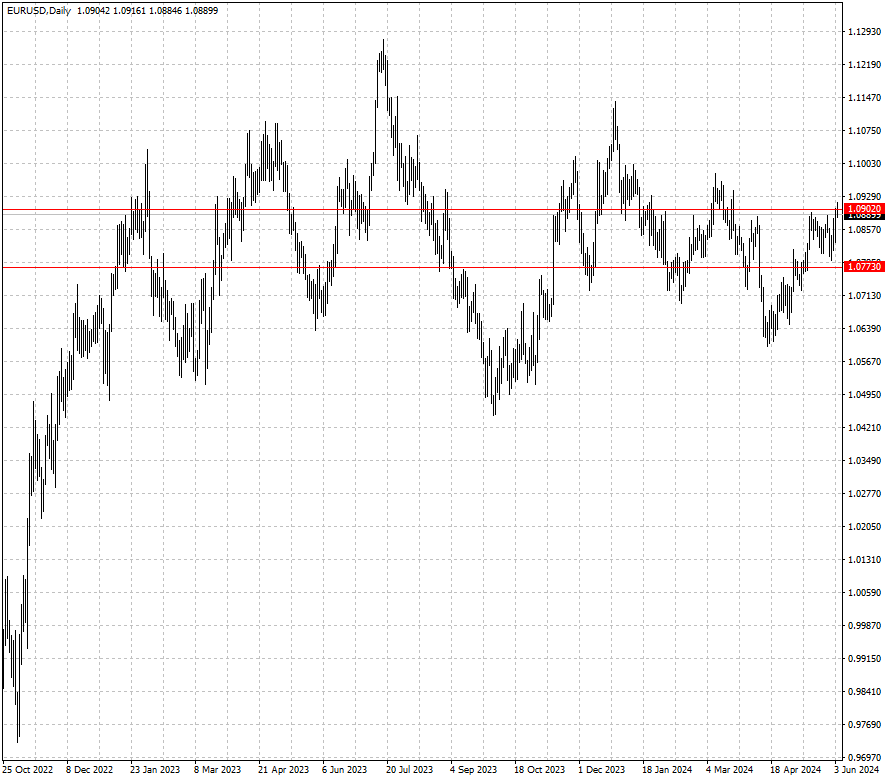

EBC Forex Snapshot, 4 Jun 2024

The dollar languished at its lowest since March against the euro and sterling

on Tuesday as signs of a softening US economy boosted the case for earlier Fed

interest rate cuts.

The ISM purchasing managers index for manufacturing fell to 48.7 in May, from

49.2 in April, while construction spending slid unexpectedly for a second

consecutive month in April.

Following the data, fed funds futures increased the chances of a rate cut in

September to around 59.1%, according to LSEG's data. Markets are pricing in 57

bps of ECB cuts this year.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 27 May) |

HSBC (as of 3 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0773 |

1.0902 |

| GBP/USD |

1.2300 |

1.2803 |

1.2563 |

1.2857 |

| USD/CHF |

0.8988 |

0.9244 |

0.8950 |

0.9123 |

| AUD/USD |

0.6563 |

0.6729 |

0.6582 |

0.6718 |

| USD/CAD |

1.3478 |

1.3846 |

1.3561 |

1.3717 |

| USD/JPY |

152.12 |

157.68 |

154.67 |

158.86 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.