EBC Forex Snapshot, 3 Sep 2024

The dollar fell more than 2% in August, marking its biggest monthly drop this

year and providing some relief to economies that have suffered under the weight

of dollar strength.

Speculative traders turned bearish on the dollar for the first time since

February as the Fed looks set to kick off its easing cycle in September. The US

could face a prolonged slowdown in 2025, abdrn said.

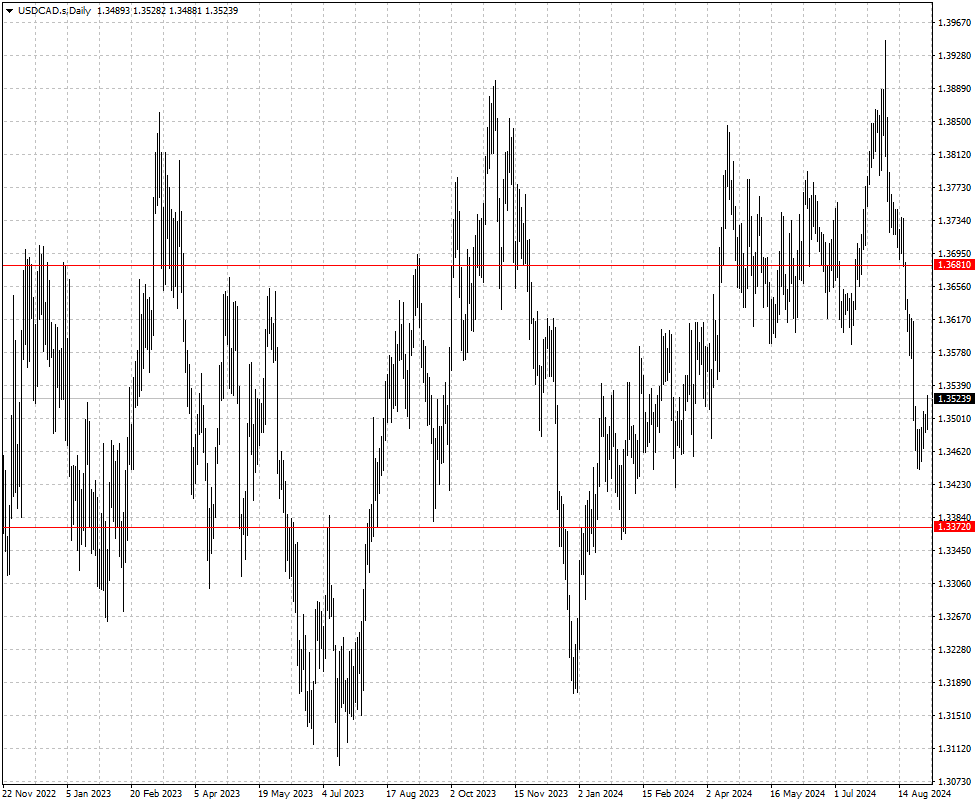

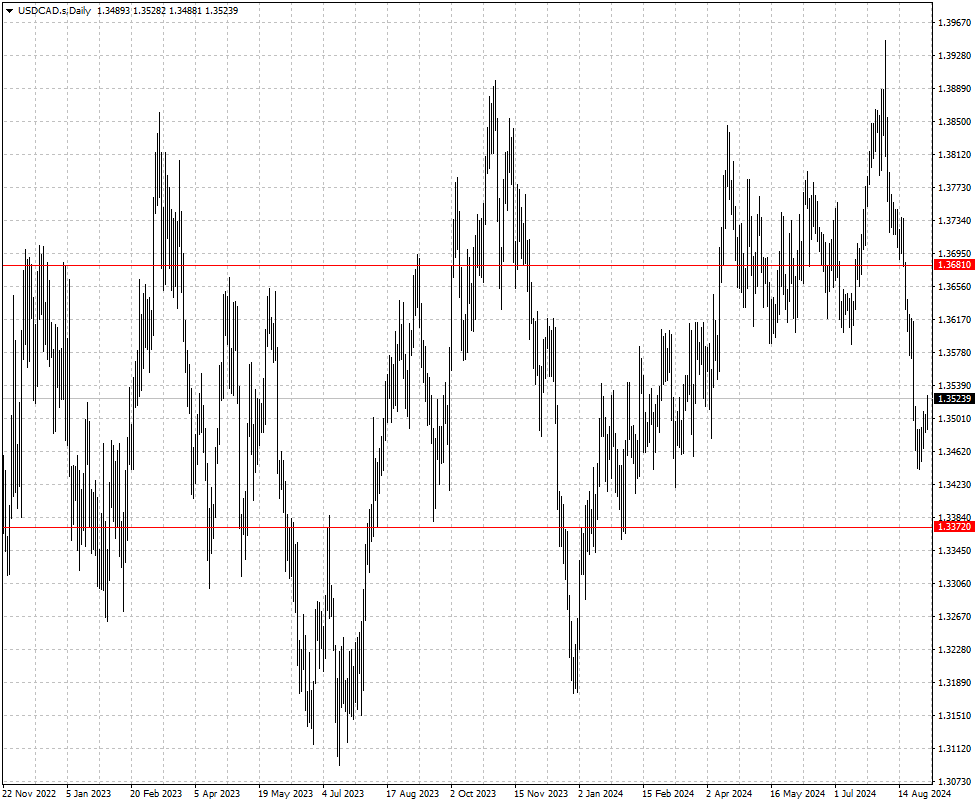

canadian dollar just notched biggest monthly advance this year as risk-on

mood helped push oil prices higher. The economy grew at an annualised rate of

2.1% in Q2, beating estimates for a gain of 1.6%.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 26 Aug) |

HSBC (as of 3 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0819 |

1.1276 |

1.0946 |

1.1199 |

| GBP/USD |

1.2860 |

1.3230 |

1.3373 |

1.3673 |

| USD/CHF |

0.8333 |

0.8827 |

0.8359 |

0.8709 |

| AUD/USD |

0.6615 |

0.6799 |

0.6632 |

0.6886 |

| USD/CAD |

1.3478 |

1.3792 |

1.3372 |

1.3681 |

| USD/JPY |

141.70 |

149.35 |

143.76 |

149.72 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.