EBC Forex Snapshot

15 Jan 2024

The dollar eased on Monday as investors revived their bets of early rate cuts

by the Fed. Producer prices unexpectedly fell last month, suggesting inflation

would continue to subside.

Market pricing now points to a 78% chance that the central bank will begin

easing rates in March, as compared to a 68% chance a week ago, according to the

CME FedWatch tool.

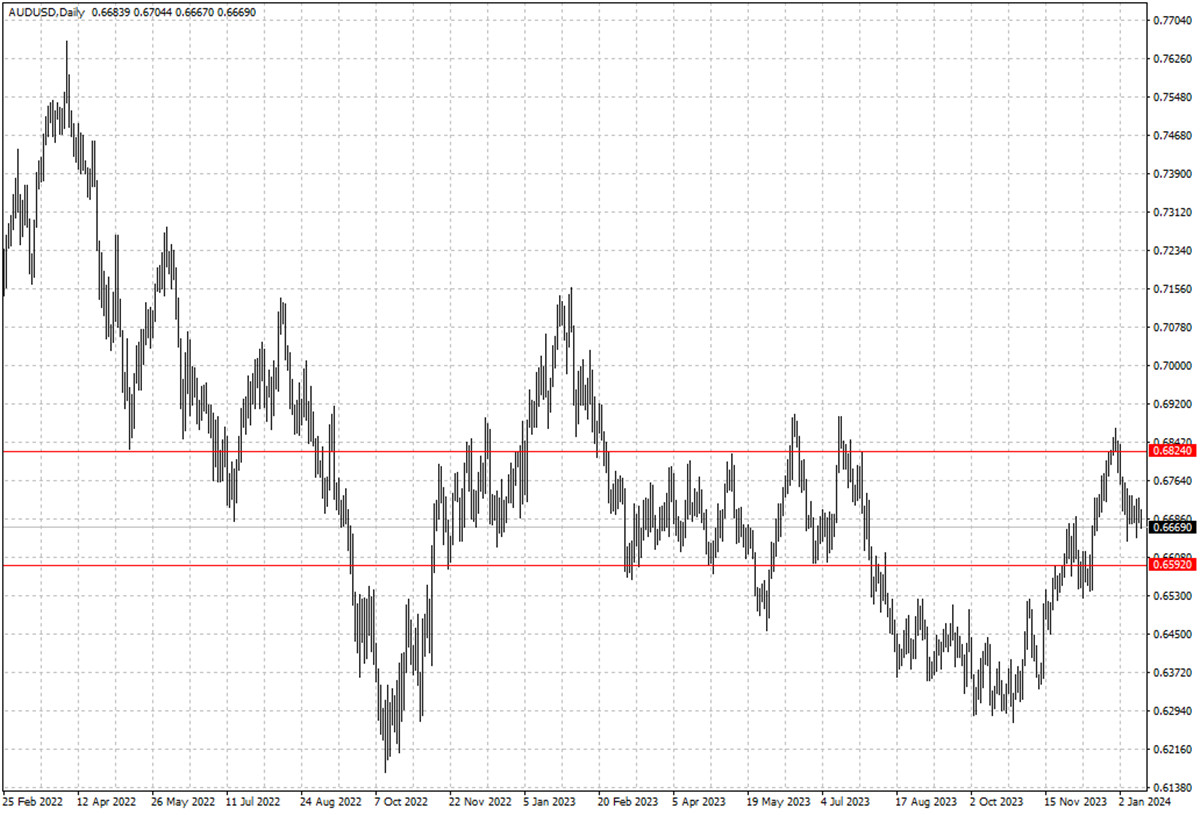

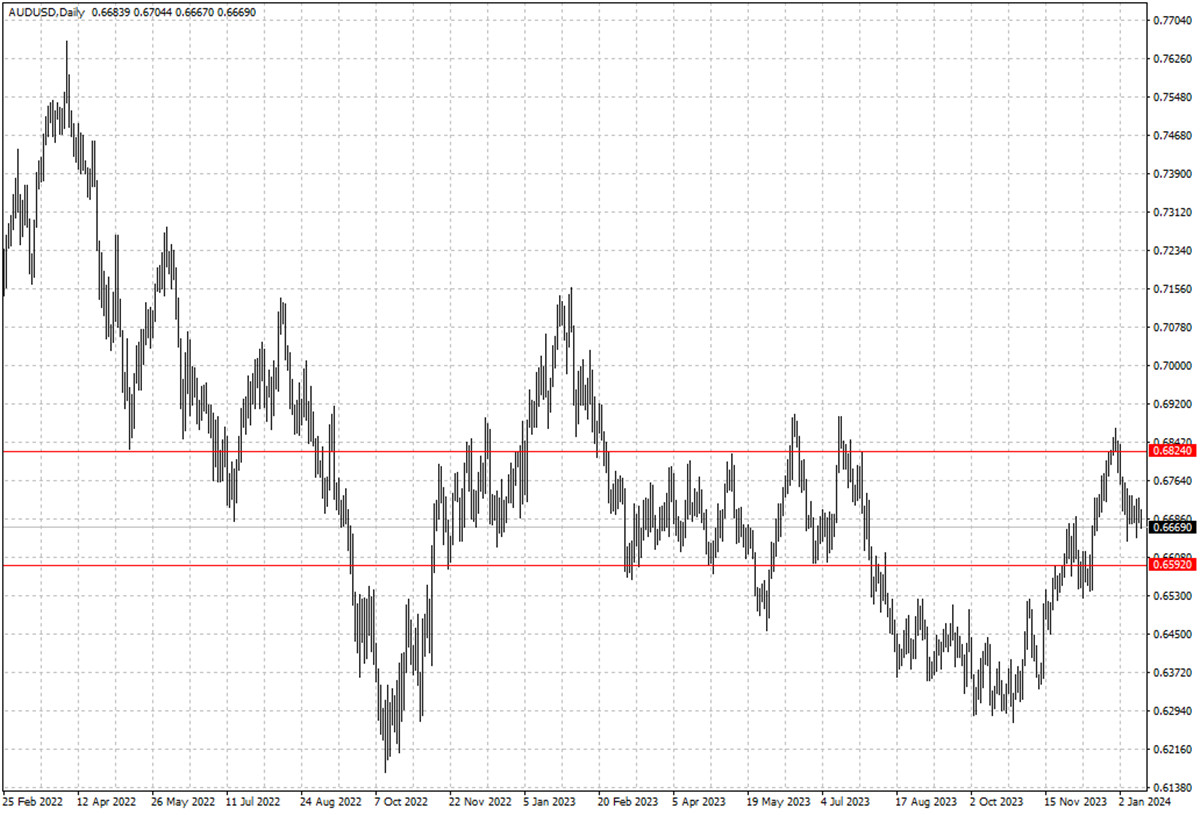

The australian dollar remained weak due to softer inflation and iron ore dip.

The commodity tumbled last week by the most in at least five months on concerns

about a weakening economy of top consumer China.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 8 Jan) |

HSBC (as of 15 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0833 |

1.1150 |

1.0836 |

1.1100 |

| GBP/USD |

1.2536 |

1.2848 |

1.2630 |

1.2850 |

| USD/CHF |

0.8333 |

0.8667 |

0.8377 |

0.8622 |

| AUD/USD |

0.6641 |

0.6900 |

0.6592 |

0.6824 |

| USD/CAD |

1.3177 |

1.3483 |

1.3241 |

1.3509 |

| USD/JPY |

139.48 |

144.96 |

141.29 |

147.76 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.