The S&P 500 Bond Index is a powerful tool for investors seeking exposure to the corporate debt of America's largest and most recognisable companies.

As the corporate-bond counterpart to the renowned S&P 500 equity index, it offers a transparent, measurable, and diversified benchmark for tracking the performance of U.S. investment-grade corporate bonds.

Here's what you need to know about its key facts and the benefits it brings to modern portfolios.

What Is the S&P 500 Bond Index?

Launched in 2015, the S&P 500 Bond Index is designed to measure the performance of U.S. dollar-denominated corporate bonds issued by companies in the S&P 500 and their subsidiaries. This index serves as a barometer for the credit market health of blue-chip U.S. firms, mirroring the equity S&P 500 in the bond market.

Key Characteristics

Number of Constituents: Nearly 7,000 bonds

Market Value Outstanding: Over $5.9 trillion USD

Total Par Value: Over $6.4 trillion USD

Eligibility: Bonds must be USD-denominated, issued by S&P 500 companies or subsidiaries, and rated by at least one major agency (S&P, Moody's, or Fitch).

Minimum Size: $250 million for investment-grade, $100 million for high-yield bonds

Coupon Types: Fixed, zero, step-up, and fixed-to-float (if at least one month before float date)

Exclusions: Bills, floating-rate issues, STRIPS

Rebalancing: Monthly

Why Was the Index Created?

The S&P 500 Bond Index was developed to address the need for a transparent, investable, and measurable benchmark in the often opaque corporate bond market.

By focusing on bonds issued by familiar S&P 500 companies, the index provides clarity and confidence for investors looking to track or invest in high-quality U.S. corporate debt.

Key Benefits for Investors

1. Transparency and Familiarity

Because the index includes bonds from well-known S&P 500 companies, investors benefit from a higher degree of transparency and measurability. The issuers are household names, making it easier to understand the underlying credit risk and performance.

2. Diversification

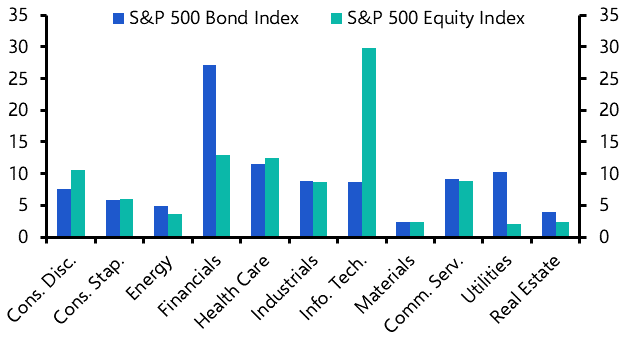

The index covers nearly 7,000 bonds across multiple sectors and credit qualities, offering broad exposure to the U.S. investment-grade corporate bond market. This diversification helps reduce the impact of any single issuer or sector on overall performance.

3. Risk/Return Efficiency

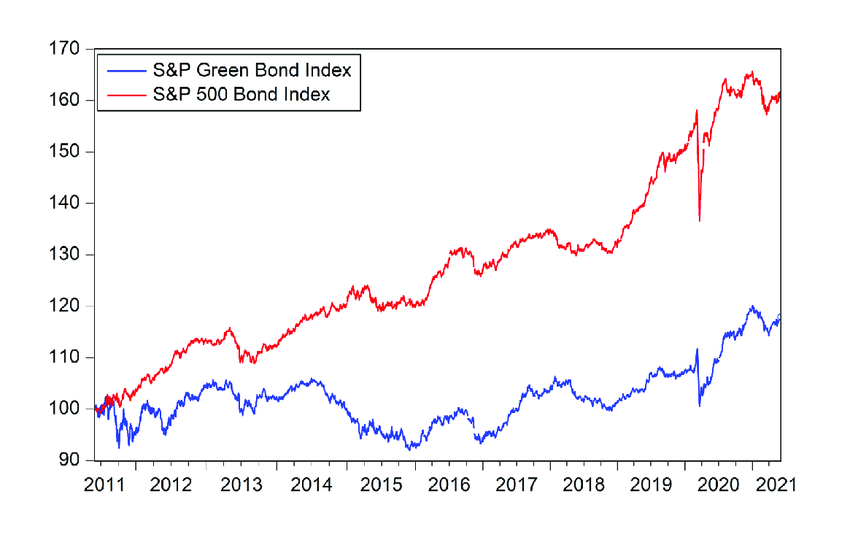

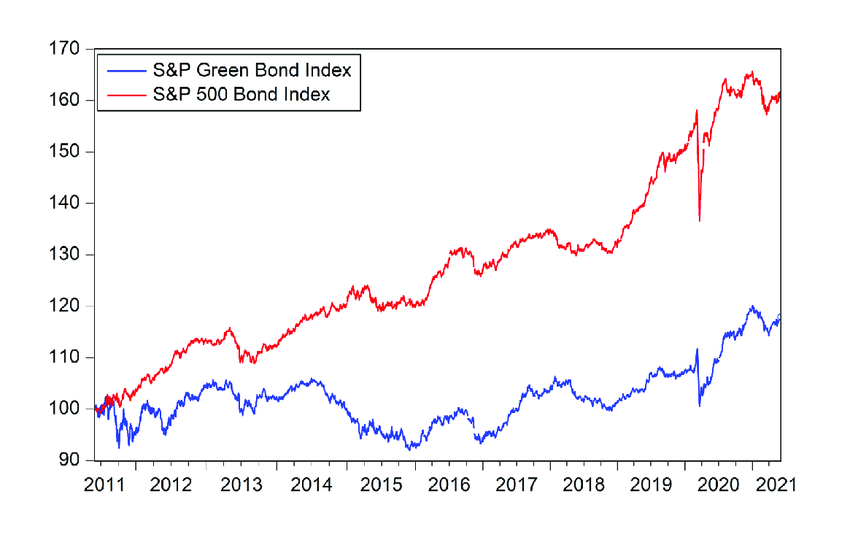

Historical analysis shows that the S&P 500 Bond Index has consistently delivered a higher risk/reward ratio than many peer indices, regardless of the investment horizon. It has shown lower volatility and higher returns compared to other broad-based, investment-grade bond benchmarks.

4. Portfolio Diversification Benefits

Bonds and equities tend to move in opposite directions, especially during periods of market stress. The S&P 500 Bond Index acts as a “shock absorber” in a diversified portfolio, helping to counterbalance equity downturns and reduce overall risk.

5. Benchmarking and Investment Products

The index serves as a benchmark for investment products such as bond ETFs and mutual funds, enabling investors to track or replicate the performance of the U.S. corporate bond market with confidence.

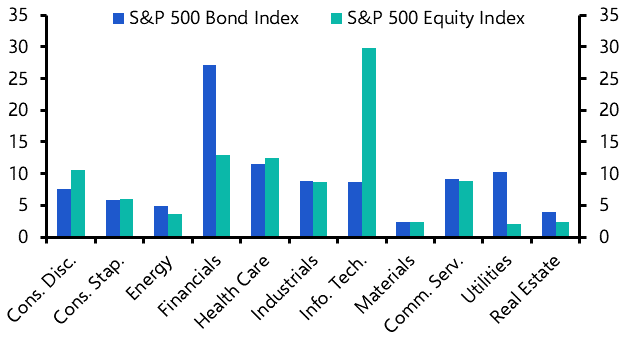

6. Sector and Credit Segmentation

Sub-indices are available for sector-specific or credit-quality-specific exposure, including investment-grade and high-yield segments, allowing investors to tailor their strategies to their risk appetite and market outlook.

How Is the Index Constructed?

The S&P 500 Bond Index is market-value weighted, meaning larger bond issues have a greater impact on index performance. Bonds must have a minimum maturity of one month and be rated by at least one major credit agency. The index is rebalanced monthly to reflect new issues, maturities, and credit rating changes.

Comparing to Other Bond Indices

The S&P 500 Bond Index represents about 52% of the total U.S. corporate bond market by market capitalisation and 83% of the investment-grade segment.

Its risk and return characteristics are similar to other broad-based indices, but its focus on S&P 500 issuers provides a unique blend of quality, transparency, and familiarity.

Conclusion

The S&P 500 Bond Index offers investors a transparent, diversified, and risk-efficient way to track the U.S. corporate bond market.

By focusing on the debt of blue-chip S&P 500 companies, it delivers clarity, broad exposure, and valuable diversification benefits-making it an essential benchmark for modern fixed-income portfolios.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.