In the world of investing and trading, you'll often hear the phrase “risk off” used to describe market conditions. But what does “risk off” really mean, and why does it matter for beginners?

This guide breaks down the concept in straightforward language, helping you understand how shifts in risk appetite can affect your investments and the broader financial markets.

What Does “Risk Off” Mean?

“Risk off” is a term used to describe a market environment where investors become cautious and move their money away from risky assets, such as stocks and high-yield bonds, into safer investments like government bonds, cash, or gold. This shift usually happens when there is uncertainty, bad economic news, or fear about the future.

In simple terms, when people in the market are worried, they play it safe.

Why Does “Risk Off” Happen?

A risk off mood is triggered by events or news that make investors nervous about the future. This could include:

Economic downturns or recession fears

Negative earnings reports from major companies

Geopolitical tensions or wars

Uncertain central bank policies

Sudden market shocks or crises

When these events occur, investors want to protect their capital rather than chase higher returns, so they move their money into assets that are considered more stable.

What Are Safe-Haven Assets?

During risk off periods, investors typically seek out “safe-haven” assets. These are investments that are expected to hold their value or even rise when markets are turbulent. Common safe-haven assets include:

Government bonds (like US Treasuries or German Bunds)

Gold

Cash or money market funds

Safe-haven currencies (such as the US dollar, Japanese yen, or Swiss franc)

How Can You Spot a Risk Off Environment?

There are several signs that markets have entered a risk off phase:

Stock markets start to fall or become more volatile

Prices of government bonds and gold rise

Safe-haven currencies strengthen against others

Investors and traders talk about “flight to safety” or “market uncertainty”

Financial news will often mention “risk off sentiment” when these patterns appear.

Risk Off vs. Risk On: What's the Difference?

Risk On: Investors feel confident, so they buy riskier assets like stocks, emerging market currencies, or commodities. Markets tend to rise.

Risk Off: Investors feel nervous, so they move money into safer assets. Markets tend to fall or become more volatile.

These two moods can alternate quickly, depending on news and global events.

Why Does Risk Off Matter for Beginners?

Understanding risk off is important because it helps you:

Recognise when markets are becoming more cautious

Adjust your investment strategy to protect your capital

Avoid panic selling by understanding that market moods can change

If you're investing for the long term, knowing about risk off can help you stay calm during downturns and make more informed decisions.

How Should Beginners Respond to Risk Off Markets?

Don't panic: Market downturns are normal and often temporary.

Diversify: Holding a mix of assets (stocks, bonds, gold, cash) can help reduce risk.

Review your goals: Make sure your investments match your risk tolerance and time horizon.

Stay informed: Keep an eye on economic news and market sentiment, but avoid making impulsive decisions based on fear.

Real-World Examples

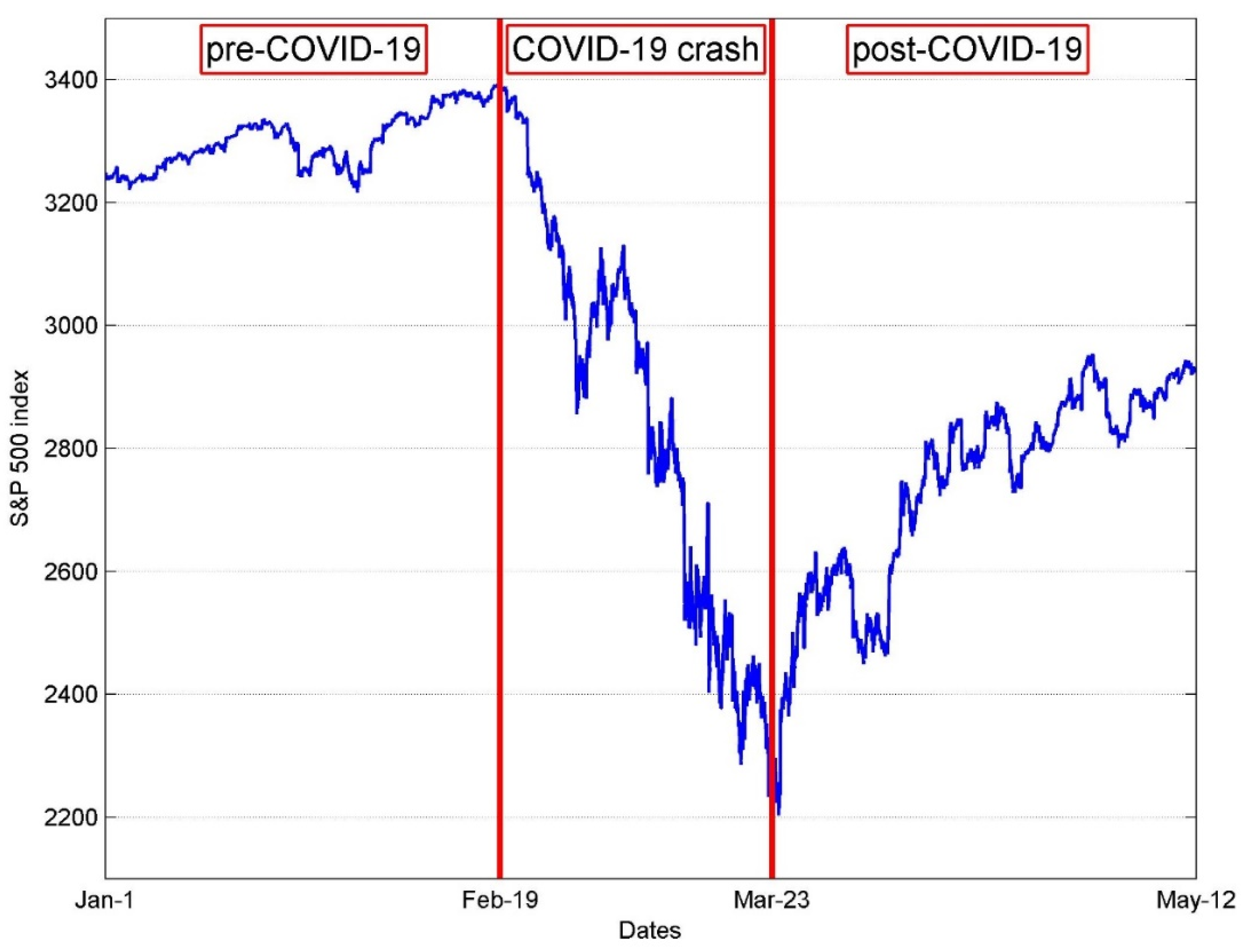

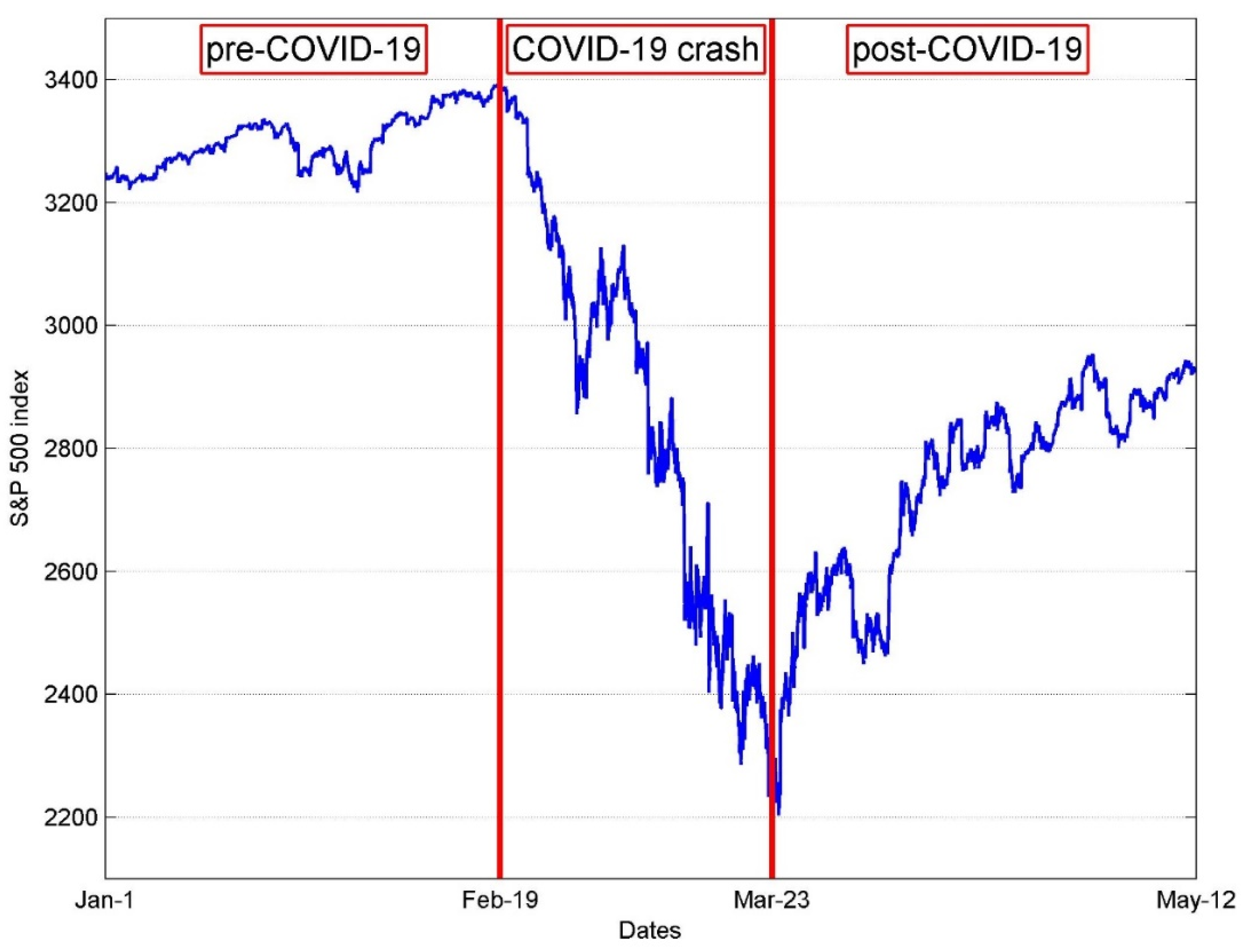

During the 2008 financial crisis, markets experienced a strong risk off environment. Investors sold stocks and moved money into US Treasuries and gold, causing Stock Prices to fall and safe-haven assets to rise. A similar pattern occurred during the COVID-19 pandemic's early months in 2020.

Final Thoughts

“Risk off” simply means investors are playing it safe, moving away from risky assets and into safer ones when they sense trouble ahead. By understanding this basic concept, beginners can better navigate market ups and downs, make smarter investment choices, and avoid emotional reactions during turbulent times.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.