Reddit's stock (NYSE: RDDT) is in the spotlight as it prepares to join the Russell 3000 Index at the end of June 2025—a milestone that could reshape its trading dynamics and investor base.

With the stock's performance, valuation, and future prospects under close scrutiny, what are the key drivers influencing Reddit's stock price before this major index inclusion? Here's what traders and investors should know.

Why Reddit's Russell 3000 Inclusion Matters

The Russell 3000 Index tracks the 3,000 largest U.S. companies and serves as a benchmark for over $10 trillion in global assets. Reddit's addition, effective after the close on June 27, 2025, will automatically place its shares into a wide range of passive ETFs and mutual funds. This move is expected to:

Boost liquidity: index funds and institutional investors will be required to buy Reddit shares, increasing daily trading volumes.

Attract new capital: Inclusion can drive a 15–20% valuation premium, as seen with other recent addition

Enhance visibility: Being part of a major index raises Reddit's profile among both institutional and retail investors.

Recent Stock Performance and Volatility

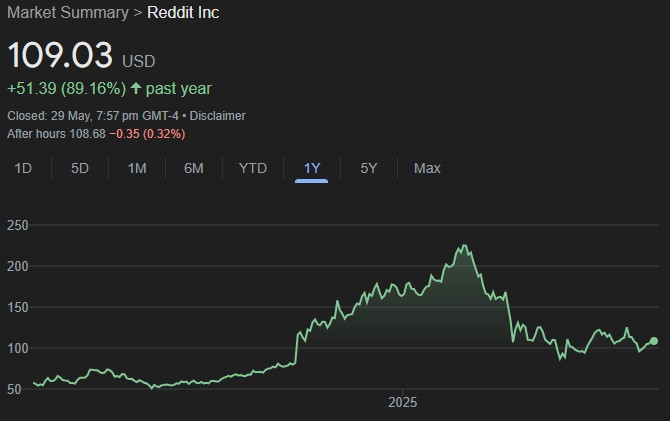

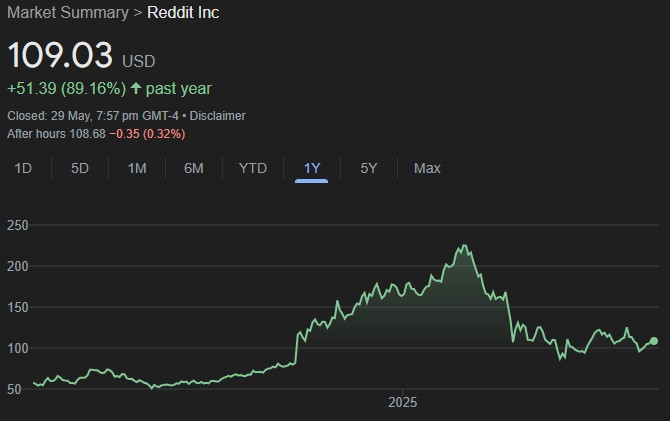

Reddit's stock has been volatile since its ipo, reaching a 52-week high of $230.41 before pulling back to trade near $111–$113 at the end of May 2025. The stock is up 87% over the past year but down 33% year-to-date, reflecting both strong interest and significant corrections as the market digests its growth story.

Key Drivers Behind Reddit's Stock Price

1. Earnings Momentum and Revenue Growth

Reddit delivered robust Q1 2025 results:

Revenue: $392.4 million, up 61% year-over-year.

EPS: $0.13, a dramatic turnaround from an $8.19 per-share loss a year ago.

User Growth: Daily active users rose 31% to 108.1 million, with international markets outperforming the U.S..

Strong revenue growth and improving profitability have fuelled bullish sentiment, though the pace of user growth has slowed compared to previous quarters.

2. Valuation and Market Sentiment

Reddit trades at a high valuation—about 178 times forward earnings and nearly 15 times sales. This reflects high expectations for future growth but also exposes the stock to sharp corrections if results disappoint.

The current sentiment is “neutral,” with a Fear & Greed Index reading of 39 (Fear), and analysts remain divided, with a consensus “Moderate Buy” rating and price targets ranging from $115 to $165.

3. AI and Search Disruption Risks

A major risk for Reddit is the evolving landscape of online search. Analysts warn that Google's AI-powered search could reduce the need for users to click through to Reddit, threatening its ad-driven business model.

More than half of Reddit's traffic comes from users browsing while logged out, often via Google. If AI search answers questions directly, Reddit could see lower engagement and ad revenue.

4. Monetisation and New Features

Reddit is working to diversify revenue through:

Advertising: Ad revenue climbed 61% year-over-year in Q1.

AI tools: New features like Reddit Answers aim to drive engagement and monetisation.

Premium offerings: Expansion of paid features and direct purchase ads may support future growth.

5. Index Inclusion Effects

Historically, stocks joining major indexes experience:

Short-term price bumps: As index funds buy shares to match the benchmark.

Increased trading volume: More liquidity and tighter bid-ask spreads.

Longer-term re-rating: If Reddit can sustain growth, index inclusion may support a higher valuation over time.

However, the effect can be temporary if fundamentals do not keep pace with expectations.

What Traders Should Watch

Q2 and Q3 earnings: Will Reddit maintain its revenue and user growth momentum?

AI and search trends: How will changes in Google and other platforms impact Reddit's visibility and ad revenue?

Index rebalancing: Expect higher volume and potential price volatility around the June 27 inclusion date.

Valuation risks: High multiples mean the stock could swing sharply on any news.

Conclusion

Reddit's upcoming addition to the Russell 3000 Index is a catalyst for increased liquidity, visibility, and institutional interest. However, traders should weigh the company's strong revenue growth and user base against risks from AI-driven search disruption and high valuation.

As the index inclusion approaches, keep an eye on earnings, market sentiment, and trading volumes to navigate the next chapter in Reddit's stock story.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.