There are many investment products on the market, and it is indeed a challenge to choose the right investment programme. Taking funds alone as an example, there are a total of 12.518 funds in the Chinese market. How to choose one is a complicated task. Not to mention the wide array of other financial products, such as stocks and bonds. That's why investors often look for indicators to help them make decisions, and the Sharpe Ratio is one of them. Now let's take an in-depth look at a guide to calculating and applying the Sharpe Ratio.

What is Sharpe Ratio?

It is the Sharpe Ratio, which is a metric used to measure the risk-adjusted return of a portfolio or an asset. It is one of the most important evaluation metrics in the field of investment and is usually used to compare the performance of different investment strategies and fund managers.

It was introduced as an important indicator by William F. Sharpe, a Nobel Prize-winning economist, in the 1960s. The purpose is to provide a more accurate risk-adjusted return on investment so that investors can better assess the performance of different portfolios or assets and make investment decisions accordingly.

Its risk-adjusted performance is assessed by comparing the difference between the average rate of return of a portfolio or asset and the rate of return of a risk-free asset. This difference is known as the excess return, and a higher Sharpe ratio means that the portfolio or asset is earning more excess return per unit of risk and thus performing better.

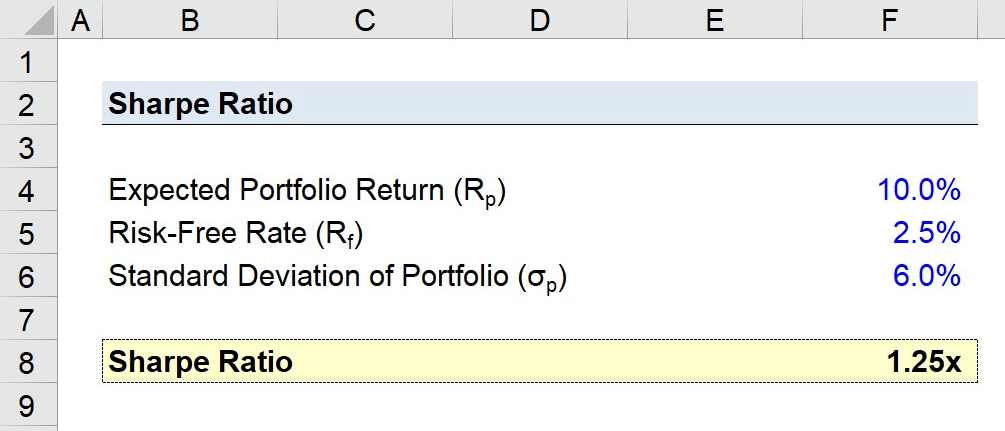

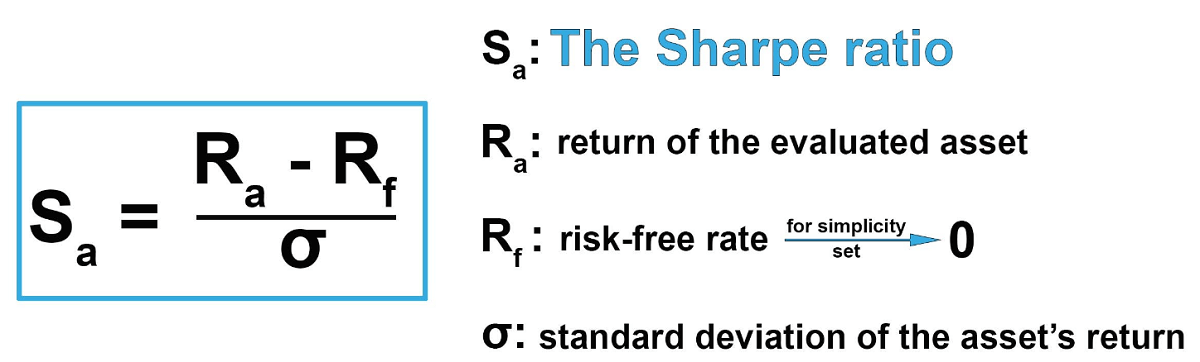

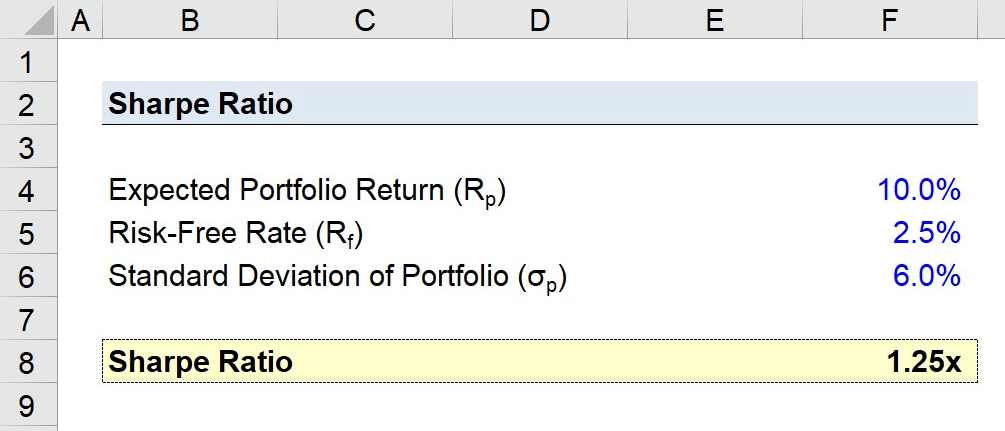

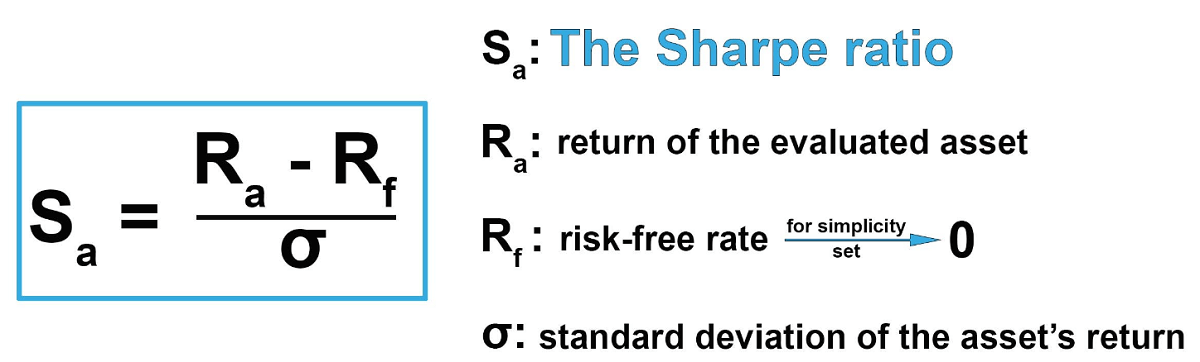

It hinges on calculating the relationship between a portfolio's excess return (i.e., the portfolio return minus the risk-free rate of return, the risk-free investment return available to the investor) and the portfolio's volatility (i.e., the standard deviation of the portfolio's return, which measures the degree of dispersion in the portfolio's return).

In simple terms, this means subtracting the return on the investment strategy from the risk-free rate and dividing by the standard deviation. This makes it possible to quantify the excess return per unit of risk taken. This standardized measure ensures that comparisons between strategies are more accurate and meaningful.

Suppose Iron Egg invests in a publicly traded automobile company, and Tricia invests in a publicly traded electric scooter company. The automobile company in which Iron Egg invested has a Sharpe ratio of 0.9. while the electric scooter company in which Tricia invested has a ratio of 1. This means that Iron Egg took one unit of risk in order to earn 0.9 units of return, while Tricia took one unit of risk in order to earn one unit of return.

Typically, a higher Sharpe ratio is better because it indicates that an investor can earn a higher return for taking the same amount of risk. A high ratio indicates that the investment strategy is more attractive, with relatively high risk-adjusted returns. Conversely, a negative value of the ratio indicates that the investor may be facing a situation where risk exceeds return, a situation in which the investment strategy may not be ideal.

Assume that Fund A has an annualized return of 12% and Fund B has an annualized return of 8%. Also, assume that the risk-free rate is 3%. And the standard deviation of Fund A is 15%, while the standard deviation of Fund B is 10%. The calculation shows that the Sharpe ratio for Fund A is 0.6. while the ratio for Fund B is 0.5.

Although Fund A has a higher return, its higher risk results in a slightly lower ratio than Fund B. In contrast, although Fund B has a slightly lower return, its relatively lower risk results in a slightly higher ratio than Fund A, which implies that Fund B obtains a more stable return at a relatively lower risk.

Moreover, the Sharpe ratio can be a useful tool for traders to make entry and exit decisions. In appropriate market conditions and quotations, traders can use it to evaluate the balance between risk and return of different assets or portfolios to make more informed investment decisions.

When the ratio is high, it indicates that the investment strategy is yielding higher returns at a relatively low risk, which is usually a good time to enter the market. Traders may prefer to invest in assets or portfolios with higher ratios in order to achieve higher returns, and they may increase their positions when the market moves in a positive direction.

Conversely, when the ratio is low, it indicates a lower risk-adjusted return, which may be a signal to leave the market. Traders may consider reducing their positions in poorly performing assets or portfolios to reduce risk and look for more attractive investment opportunities.

The importance of the Sharpe ratio is to remind investors to consider both return and risk when choosing investment targets. Investing is not just about pursuing high returns, but rather about obtaining optimal returns while taking appropriate risks. By using this ratio, investors can make a more comprehensive assessment of the risks and rewards of an investment and thus make more rational and informed investment decisions.

What is Negative Sharpe Ratio?

Generally speaking, a positive Sharpe ratio is often seen as an indicator that an investment strategy is performing well. It indicates that the strategy has achieved relatively high returns while taking a certain amount of risk. This means that an investor can earn more while accepting a certain amount of risk, and such strategies are usually seen as more attractive. This is because they perform better on a risk-adjusted basis.

On the contrary, if the strategy has a negative rate for this ratio, it means that the investor receives a lower return than the risk-free rate while taking on risk and may even lose money. In this case, investors may not find the strategy attractive because they are taking on risk without a corresponding return. Therefore, this strategy may need to be further evaluated and adjusted to improve its risk-adjusted performance.

This is because its being negative indicates that the expected return on the portfolio or asset is lower than the expected return on a risk-free asset (e.g., treasury bonds) and that the volatility (standard deviation) is higher. This usually means that the investor has taken on a greater amount of risk and has failed to earn a return that matches the risk taken.

And its negative value usually indicates that the level of return on the portfolio or asset is lower than the level of return on the risk-free asset, and perhaps even lower than the expected level of return. This implies that the investor has failed to earn the expected return and may even have suffered a loss while taking the corresponding risk.

In other words, the investor may be facing a loss and a negative risk-adjusted return, which is not conducive to long-term financial growth for the investor. Therefore, a negative Sharpe Ratio indicates that the portfolio or asset is underperforming and requires further evaluation and adjustment of the investment strategy.

It can be negative for several reasons, including improper investment strategy, unfavorable market conditions, and misallocation of the portfolio. Investors should carefully review the portfolio or assets to determine the root cause of the negative value and take appropriate steps to improve investment performance. This may include re-evaluating the investment strategy, optimizing the asset allocation, reducing risk exposure, or identifying more promising investment opportunities.

A negative Sharpe Ratio is a signal that investors need to be aware of, indicating that there may be a problem with their investment strategy. In this case, investors should revisit their portfolio or asset allocation strategy to determine the cause of the negative ratio and take appropriate steps to adjust it.

Practical Use of the Sharpe Ratio

As a risk-adjusted return metric, it provides investors with an important tool for evaluating the performance of their investment strategies. By choosing a Sharpe Ratio within a reasonable range, investors can gain a more comprehensive understanding of the level of return achieved by an investment strategy in the context of risk-taking, thereby assessing its performance more accurately and making better investment plans and decisions.

For novice investors, a Sharpe ratio between 0.5 and 0.8 is recommended. Values within this range usually indicate an investment strategy that has a relatively good balance between risk and return and has a relatively robust performance. For novice investors, solid investment performance is easier to understand and accept and helps build confidence in the investment market.

Experienced investors, on the other hand, may choose an appropriate ratio based on their investment objectives, risk appetite, and market conditions. Some investors may seek higher returns and are willing to take greater risks, so they may therefore choose a higher ratio. Other investors may be more conservative and prudent and prefer to choose a lower ratio to reduce investment risk.

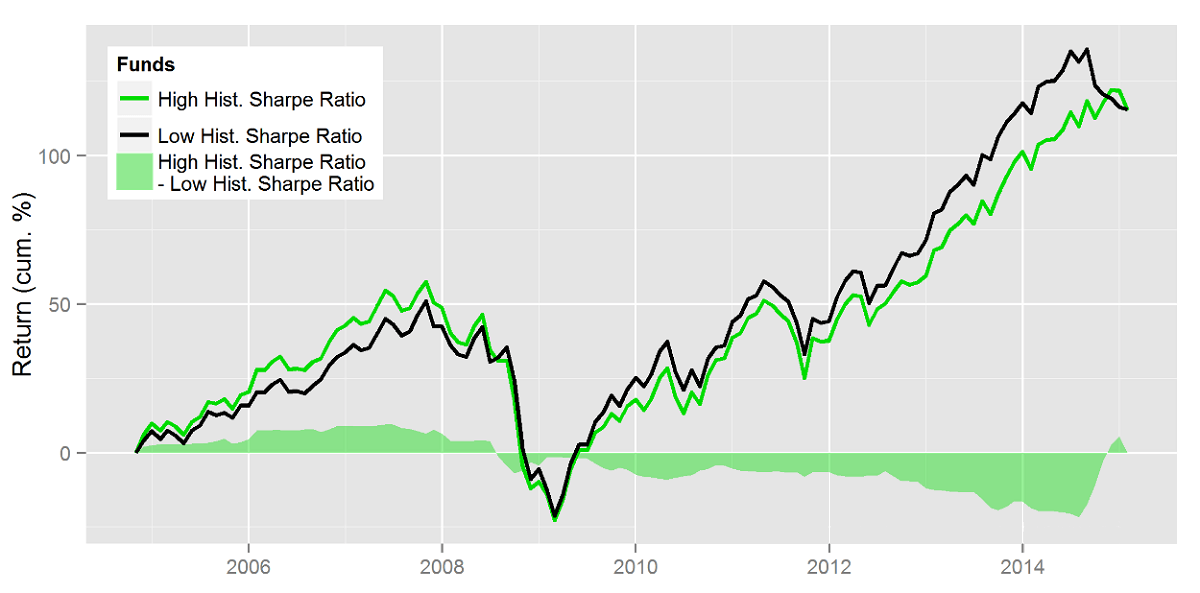

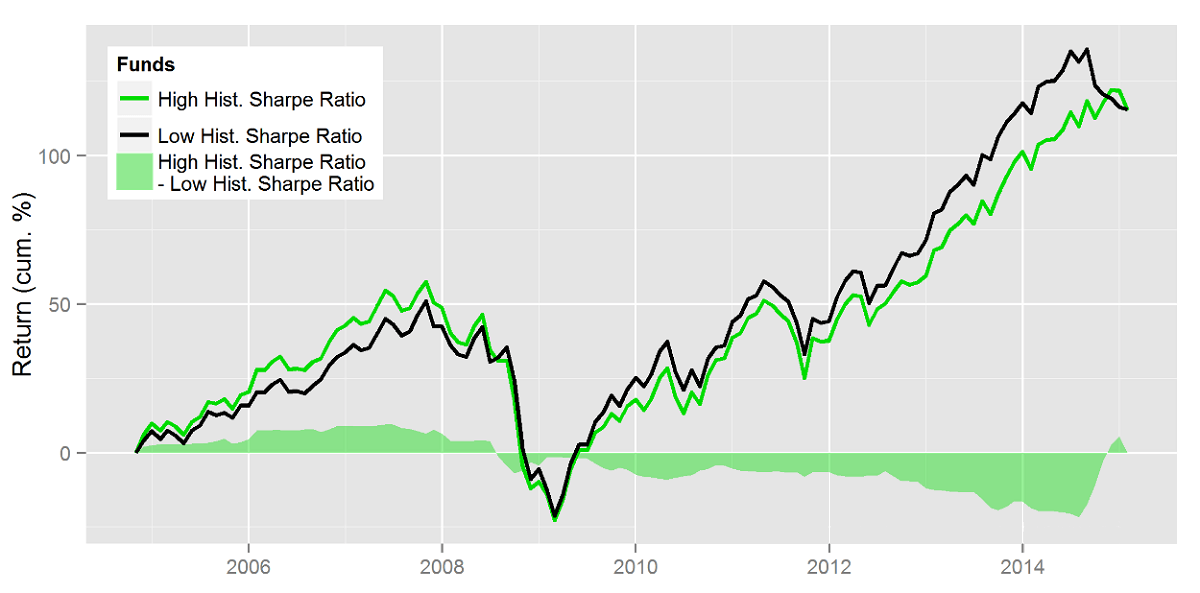

In practice, it is also commonly used to compare the performance of different portfolios, especially when assessing risk-adjusted returns. When this ratio is higher for one portfolio than another, the former is usually considered to have better risk-adjusted return performance and deserves investors' attention.

At the same time, when the ratio is greater than one, it is usually considered a good indicator that the risk-adjusted return of a portfolio or asset is higher than the return of a risk-free asset. That is to say that the investor has earned a relatively high return while taking some risk, thus outperforming the risk-free benchmark.

Conversely, if it is less than one, it means that the risk-adjusted return of the portfolio or asset is lower than the return of the risk-free asset. This means that the return an investor receives for the risk taken is not sufficient to compensate him for the risk taken and hence underperforms the risk-free benchmark.

It is also a very important indicator when assessing the value of a fund. This is because it takes into account the fund's return and risk in a comprehensive manner and can help investors assess the fund's performance in a more holistic manner. The higher the ratio, the higher the excess return obtained by the fund while bearing the same risk, i.e., the better value for money.

However, it is important to note that the funds compared in the selection process must be of the same category, e.g., bond funds are compared with bond funds and equity funds are compared with equity funds. This is very important, as the risk and return profiles to which different types of funds are exposed can be very different.

It can be used to assess not only the performance of a portfolio or fund but also the risk-adjusted return performance of a single stock. By calculating the Sharpe Ratio for a single stock, investors can better understand the level of return the stock is earning given the risk it is taking and compare it to other stocks or portfolios.

A high ratio usually means that the investment strategy or asset realizes a high return with relatively low risk. This suggests that the strategy or asset is worthwhile relative to the risk taken and may be of interest to investors. As a result, stocks or portfolios with higher ratios are often seen as more attractive investment options.

It is important to note, however, that it is not applicable to all types of portfolios. If a portfolio's return distribution does not conform to a normal distribution, i.e., there is a large skewness or kurtosis in the returns, the Sharpe ratio calculation may not be accurate. In such cases, other risk-adjusted return metrics or more sophisticated models may be more appropriate for assessing portfolio performance.

Moreover, it focuses primarily on the risk-adjusted return of the portfolio and does not take into account factors such as liquidity and costs. Liquidity refers to the ease with which an asset can be bought and sold in the market, while costs include fees, taxes, etc. for buying and selling transactions. All these factors may affect the actual return on an investor's investment. Therefore, when using the ratio, investors also need to take into account the liquidity and cost of the portfolio in order to fully assess the performance of the portfolio.

In conclusion, the Sharpe ratio is an important portfolio evaluation indicator that can help investors assess the performance of different investment strategies and fund managers and select portfolios or stocks with better risk-adjusted return performance. However, the Sharpe ratio is not an absolute indicator, and investors need to take other factors into account for comprehensive thinking and decision-making.

What is the typical Sharpe ratio?

| Sharpe ratio range |

Description |

| Less than 0 |

Risk exceeds reward; possible loss. |

| 0 to 0.5 |

Risk and reward are balanced. |

| 0.5 to 1 |

Some excess returns are relatively low-risk. |

| Greater than 1 |

Risk-adjusted returns are higher than the risk-free benchmark. |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.