Steve Cohen has always been a mysterious figure on Wall Street.

Every cell in him seemed out of place on Wall Street - a slightly bald, cowboy clad, and hot dog loving mansion. But it's just such a bumpkin like figure who has achieved an average annual return of 30% for 20 consecutive years. To the best fund managers on Wall Street, it's also quite incredible.

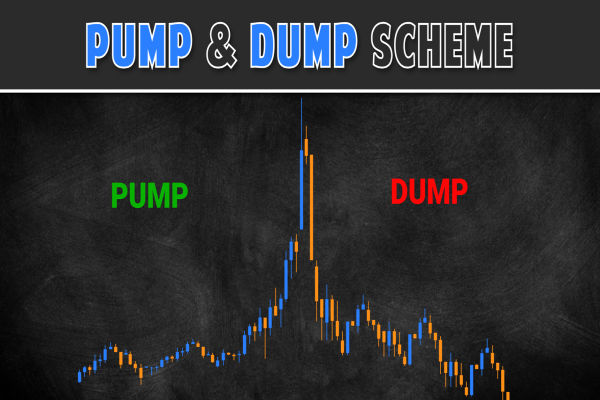

The most confusing aspect is the source of his high returns. He does not have Buffett's traditional investment style of being steady, nor does he have a clear strategy or philosophy like Soros, betting on macro trends or the rise and fall of the real estate market. He is just very talented, as the saying goes, with an excellent sense of trading and a hunting dog like sense of the direction of the stock market. He trades dozens of stocks on a short-term basis every day.

Cohen's trading philosophy is simple: to make money in the market, one must take risks. But the premise is that one must take smart risks. If a trader has a good idea but is unwilling to bet, they cannot earn enough.

The young trader was desperately trying to work for him, while wealthy people lined up to give him the money to manage. By 2002, his SAC became the world's most profitable hedge fund, with a management scale of $15 billion.

Poker was his first teacher

Genius's success was not achieved overnight. Steve was born into an ordinary Jewish family in 1956, and the family had always been very short of money since childhood.

Every day when my father comes off work and brings the New York Post, Cohen rushes to read the stock section. Cohen's favorite activity is playing Texas poker with his classmates because he always wins money. In high school, he participated in poker tournaments and praised this gambling game for teaching him how to "take risks".

Cohen was admitted to Wharton Business School with exceptional talent. During his school years, with the help of a friend, he opened a brokerage account and deposited his $1000 tuition fee, starting his "trading career".

Cohen reads the Wall Street Journal every morning. During a final exam in statistics, he got up and left before finishing his paper, anxiously looking at the closing price of the stock. He started skipping classes and went to the Merrill Lynch office in Philadelphia, where he could watch the stock price screen for a day.

In 1978, after graduating from Wharton University, Cohen worked at Gruntal&The option arbitrage department of Co. found a job as a junior trader and entered Wall Street for the first time. As soon as Cohen sat down in front of the computer screen, he was immediately attracted by the numbers on the screen. Staring at the screen for a moment, he immediately announced that a certain stock would open high tomorrow.

His extreme confidence in his trading ability was evident on his first day of work. I earned $8000 on my first day at work, a figure that shouldn't be underestimated in 1978.

My colleagues in the company were stunned. How can a completely inexperienced person predict stocks so accurately?

Cohen gradually began to engage in event driven Intraday Trading. During the transaction, Cohen was completely engrossed and adrenaline surged. He extremely enjoys the process of betting and making money. He is exceptionally calm and never clears positions due to market fluctuations or nervousness.

Leaving Gruntal& At the time of Co., this genius's ultimate achievement was to manage a $75 million investment portfolio and six traders, earning the company $100000 per day.

The King of Trading: The Terrible Money Printing Machine

In 1992, Cohen established his own business and founded S.A.C. Capital Advisors, using his initials. The initial fund is $23 million.

On Wall Street, there are rumors everywhere that SAC's annual return is 100%. Their trading volume is so large, accounting for 3% of daily trading on the New York Stock Exchange and 1% of daily trading on the Nasdaq. Even large institutions like Goldman Sachs are nervous about losing their business.

Cohen is a talented Day trader. Three years after its establishment, the management scale of SAC has increased by more than four times to $100 million. By 2013, SAC's size had grown to $16 billion, becoming the world's highest return hedge fund.

Everyone wants to entrust the money to Cohen for management. Although he requires 50% of the revenue, which is much higher than his peers' 20%, a large amount of funds are pouring in and cannot be ranked at all.

At its peak, SAC had 1200 employees and managed $17 billion in assets. At this point, SAC is already the largest commission contributor to Goldman Sachs' equity department, handing over millions of commissions to investment banks every month. Become the most influential organization on Wall Street.

Cohen really likes traders who are willing to take risks, and those who participated in sports during college are particularly popular with him. When interviewing a new trader, he will ask the other person: What is the most risky thing you have ever done in your life?

But under Cohen's adventurous spirit, he maintained an extremely rational mind.

He set an iron rule for his subordinates: if a transaction fails, they must clear their positions immediately after reaching the stop loss point, only in this way can they make the next transaction in a completely rational situation.

Cohen draws a lot of information from various corners of the market every day, observing the strength of both buyers and sellers. He even pays attention to the wording of important speeches by policy makers, makes predictions, and buys tens of thousands or even hundreds of thousands of stocks. Once the price rises, sell these tickets. The same strategy is used when shorting.

Cohen's success was not accidental. In addition to his own genius, he is also incredibly diligent. It is said that he has 12 monitors on his trading desk, allowing him to track and trade 80 stocks simultaneously. Every Sunday, Cohen calls the investment manager: each manager is required to spend 5 minutes presenting their investment ideas for the next week, and Cohen makes decisions based on the risk rating of each plan.

Finally, EBC Finance shares with everyone that the success of talented traders is not achieved overnight, but rather relies on accumulated research results to maintain rationality and clear judgment before placing bets. Steve Cohen's trading philosophy is: "To make money in the market, one must take risks. But the prerequisite is to take smart risks. If a trader has a good idea but is unwilling to bet, they cannot earn enough