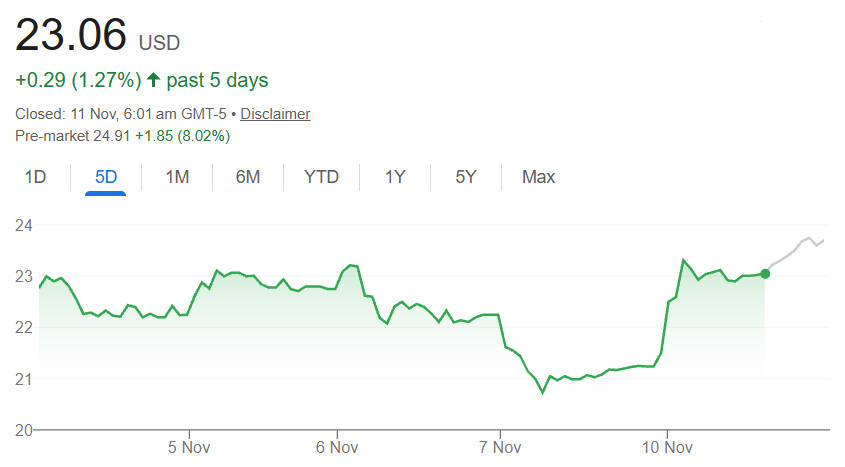

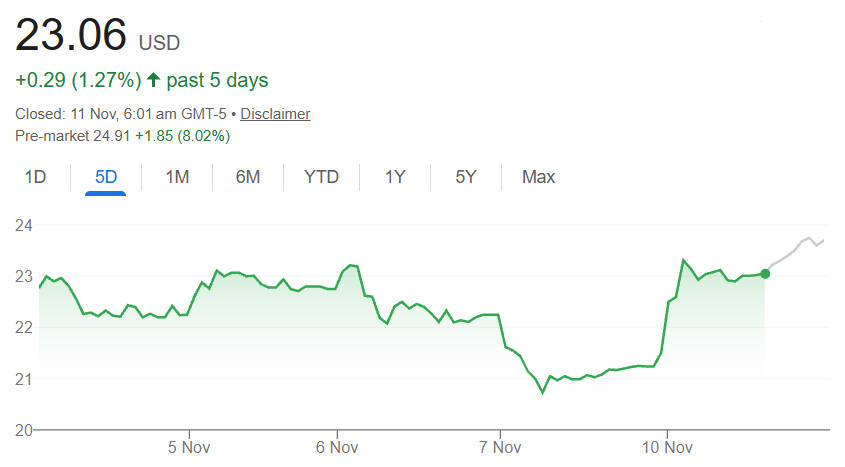

Hesai Group reported third quarter net revenue of RMB 795 million, a year-on-year increase of 47.5 per cent, and its U.S.-listed shares rose by more than 6 per cent in pre-market trading as investors reacted to the figures and management commentary.

The current trading price of HSAI shares is about US $23.06.

Hesai Q3 Results: Key Facts and Market Reaction

This section summarises the essential facts investors need at a glance. The company released its Q3 results before U.S. market open on 11 November 2025. and trading in HSAI showed a marked pre-market uplift. The headline figures were the strong revenue print and the pronounced share price reaction.[1]

Key facts

Quarter: Q3 2025 (results announced 11 November 2025).

Net revenue: RMB 795 million for Q3 2025. up 47.5 per cent year on year.

Market reaction: Shares rose more than 6 per cent in U.S. pre-market trading following the announcement.[2]

Hesai Q3 Results: Business Context And Market Position

Hesai is a leading developer and manufacturer of LiDAR sensors and perception solutions for autonomous vehicles and advanced driver assistance systems. The company has pursued aggressive manufacturing scale and price reductions to broaden adoption of LiDAR across automotive and robotics markets.

Recent corporate plans to expand capacity and to reduce unit prices have shaped investor expectations about revenue growth and addressable market size.[3]

Hesai Q3 Results: Financial Breakdown

The table below summarises the key line items from the third quarter as disclosed or reported. Where the company provided a multi-line breakdown, this table uses those items. If you plan to publish this article, replace any provisional figures with the official earnings release and slide deck from the investor relations site.

| Item |

Q3 2025 (Reported) |

Year-on-Year change |

| Net revenue |

RMB 795 million |

+47.5% |

| Core drivers (summary) |

Volume growth; stronger ASPs; new contracts |

— |

Hesai Q3 Results: Drivers Behind Revenue Growth

Company commentary and market observers identified several contributors to the quarter's revenue expansion. These included higher shipment volumes of LiDAR units, growth in automotive and industrial product sales, and progress on commercial partnerships.

Price adjustments and operational scale gains also supported margin and revenue improvements in the period. Readers should note that revenue drivers may vary quarter to quarter and are sensitive to end-market demand and supply chain conditions.

Hesai Q3 Results: Profitability, Cash Flow And Balance-Sheet Notes

Hesai's reported revenue improvement was accompanied by commentary on profitability trends. The company previously emphasised efforts to cut per-unit costs and expand production, which can improve gross margins over time. Investors should review the accompanying earnings schedule for precise gross profit, operating profit and cash flow numbers, which the company publishes on its investor relations site.

Hesai Q3 Results: Analyst Reaction And Market Sentiment

The stronger than expected revenue print triggered immediate buying in pre-market trading and prompted analysts to revisit near-term forecasts. Broker notes and market commentary published around the announcement reflected renewed optimism about scale economics and addressable volumes for LiDAR sensors, while some analysts cautioned about competitive pressures and execution risk.

Hesai Q3 Results: What This Means For Different Investors

Below are concise takeaways for several investor types.

Long-term investors:

The revenue acceleration supports the thesis that LiDAR adoption is broadening. Continued cost reduction and contract wins would strengthen the long-term case.

Short-term traders:

The pre-market jump shows that sentiment can be volatile around earnings. Traders should monitor intraday liquidity and post-release guidance.

Risk-focused investors:

Key risks include execution at scale, competition on price and technology, and potential demand cyclicality in the auto sector.

Hesai Q3 Results: Financial Table For Publication

If publishing a full write-up, include a second table that compares consensus estimates with reported figures. Replace the placeholders below with official consensus numbers where available.

| Measure |

Consensus estimate |

Reported (Q3 2025) |

Surprise |

| Revenue |

(consensus placeholder) |

RMB 795 million |

(calc) |

| EPS |

(consensus placeholder) |

(reported EPS) |

(calc) |

Hesai Q3 Results: Management Commentary And Forward Guidance

Management emphasised the company's drive for scale, broader OEM engagement and cost reductions when discussing the quarter. The firm has previously told investors that lowering LiDAR unit costs is a priority for accelerating adoption in mainstream vehicle models. For precise quotes and any formal guidance updates, consult the company's earnings release and the transcript of the conference call.

Hesai Q3 Results: Next Catalysts To Watch

Investors should monitor several near-term items that could affect the share price and sentiment: the full quarterly earnings presentation and call transcripts; any updates to shipment volumes and average selling prices; analyst estimate revisions; and broader automotive and ADAS demand indicators.

Frequently Asked Questions

Q1: What were the headline numbers in Hesai's Q3 results?

A1: The company reported net revenue of RMB 795 million for Q3 2025. up 47.5 per cent year on year.

Q2: Why did HSAI move in U.S. pre-market trading?

A2: The share move reflected the stronger-than-expected revenue print and upbeat management commentary that suggested accelerating demand and improving unit economics. This prompted more than a 6 per cent pre-market gain.

Q3: Where can readers find the full report and the earnings presentation?

A3: The full Q3 release, slides and webcast details are available on Hesai's investor relations website. The company also hosts an earnings conference call when it issues results.

Q4: What are the key risks investors should remember?

A4: Execution risk when scaling production, pricing competition in LiDAR, dependency on automotive demand cycles and potential supply-chain constraints are the chief near-term risks.

Conclusion

Hesai Q3 results delivered a substantial year-on-year revenue increase and a pronounced market response, with shares rising more than 6 per cent in U.S. pre-market trading. The quarter underlines the momentum in LiDAR adoption and the importance of scale and cost reductions for the company's next phase of growth.

Investors should consult the full release and conference call transcript for the detailed line items and management guidance that will determine near-term outlook.

Sources:

[1]https://investor.hesaitech.com/news-releases/news-release-details/hesai-group-report-third-quarter-2025-financial-results-tuesday

[2]https://www.itiger.com/hant/news/1126857532

[3]https://www.reuters.com/technology/chinas-hesai-halve-lidar-prices-next-year-sees-wide-adoption-electric-cars-2024-11-27/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.