Is It Time to Trust Innovation Over Tradition? For Cathie Wood, the answer is a resounding yes.

As the founder and CIO of ARK Invest, she has built her career on identifying transformative technologies and betting on the companies that will shape the future.

This article explores Wood's journey, her bold investment philosophy, ARK's key strategies, recent market moves, and the lessons investors can take from her vision of innovation-led growth.

From Early Curiosity to Market Visionary

Born Catherine Duddy in 1955 in Los Angeles, Wood developed an early fascination with finance. She graduated with a Bachelor of Science in Finance and Economics from the University of Southern California in 1981.

Her career began at Capital Group as an assistant economist, then progressed to Jennison Associates in New York, where she served as Chief Economist and Portfolio Manager. She made waves predicting interest rate declines in the early 1980s, establishing her reputation as a contrarian thinker.

By 1998. she co-founded Tupelo Capital Management and later managed $5 billion as Chief Investment Officer of Global Thematic Strategies at AllianceBernstein. Her focus on thematic investing and long-term growth laid the foundation for her future endeavours.

Founding ARK Invest: Betting on Disruption

In 2014. Wood launched ARK Investment Management to pursue an unapologetically innovative strategy. "ARK"—Active Research Knowledge—reflects the firm's reliance on deep research to identify transformative technologies.

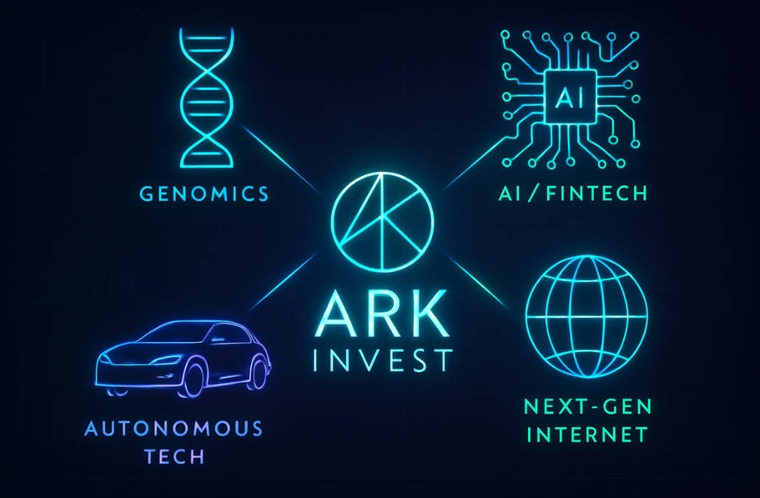

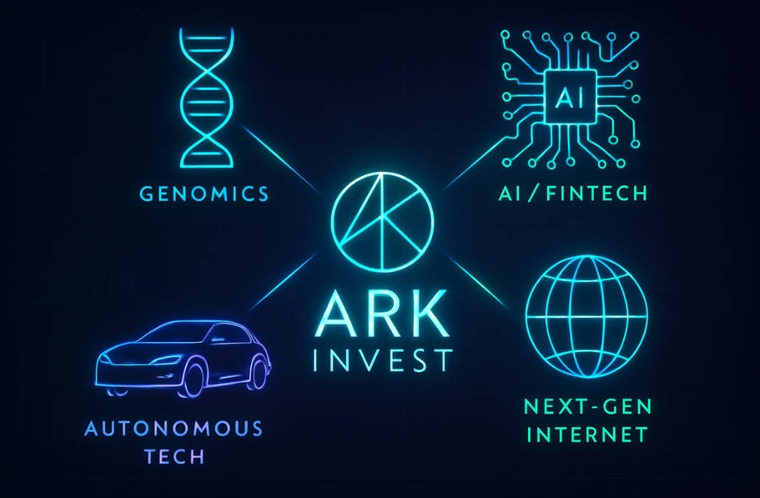

ARK's investment philosophy revolves around spotting companies that are leaders, enablers, or beneficiaries of disruptive innovation.

Its ETFs—ARKK, ARKW, ARKG, ARKF, and ARKQ—offer investors exposure to artificial intelligence, genomics, fintech, autonomous tech, and next-generation internet trends.

Wood's vision extends beyond traditional finance. She positions ARK as a platform for knowledge and transparency, regularly publishing in-depth reports on emerging technologies and market opportunities.

The Philosophy of Bold Investing

ARK Invest thrives on research-driven audacity. Its strategy embraces technologies that have transformative potential, even when market sentiment is sceptical.

Key Sectors: AI, genomics, blockchain, robotics, energy storage.

Approach: Long-term growth focus, high-conviction portfolios, active management.

Methodology: Deep fundamental research combined with scenario analysis to anticipate market shifts.

Wood challenges traditional investment dogma, often taking positions in companies others overlook. This contrarian approach has produced both remarkable gains and high-profile volatility, reflecting her commitment to innovation over consensus.

ARK Invest in Action: Markets, Moves, and Milestones

ARK has consistently sought high-impact opportunities:

1) Tesla and Beyond:

ARK identified Tesla early as a disruptor in automotive and energy.

2) Space and Tech Frontiers:

Projections like a potential $2.5 trillion valuation for SpaceX by 2030 demonstrate ARK's focus on transformative technologies.

3) Defence Tech Adaptation:

Investments in AeroVironment and L3Harris aligned with U.S. regulatory changes on drone exports.

4) Risk Management Innovation:

ARK introduced new ETFs to cap losses in ARKK, showing agility in volatile markets.

Wood's willingness to pivot based on research, regulation, and technological trends illustrates a dynamic, forward-looking investment philosophy.

Leadership Beyond Numbers

Wood's impact extends beyond market returns:

Philanthropy and Advocacy: She established the Duddy Innovation Institute, inspiring young women to pursue disruptive technologies.

Visionary Leadership: Her approach blends conviction with transparency, creating a model for modern investment leadership.

Thought Leadership: Wood frequently engages in public discourse, offering insights on innovation, cryptocurrency, and the future of markets.

Cathie Wood's Approach to Risk and Volatility

ARK Invest embraces high-conviction, concentrated portfolios, which can be volatile. Yet Wood's methodology balances risk through:

This approach challenges traditional passive investing, suggesting that innovation-led portfolios may outperform over the long term despite short-term turbulence.

Frequently Asked Questions

1. How does Cathie Wood identify disruptive opportunities?

Through deep fundamental research, scenario analysis, and a focus on long-term technological trends across sectors like AI, genomics, and blockchain.

2. How does ARK manage risk amid volatility?

ARK balances high-conviction investing with sector diversification, scenario planning, and innovative ETFs designed to mitigate losses.

3. Which investments best reflect ARK's philosophy?

Tesla, SpaceX, Coinbase, and Palantir are examples where ARK combines bold conviction with transformative potential.

4. What is Wood's stance on cryptocurrencies?

She supports digital assets, particularly Bitcoin, seeing them as long-term value stores aligned with innovation.

The Legacy of Cathie Wood

Cathie Wood's work transcends returns. By championing disruptive innovation, she has reshaped the investment landscape, demonstrating that research-led, forward-looking strategies can challenge entrenched financial norms.

ARK Invest continues to serve as a lens through which investors can explore the future: from AI and genomics to space exploration and blockchain. Wood's career offers a compelling lesson: embracing change and innovation is not only profitable but essential for long-term relevance in global markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.