Every profitable gold trader has one secret weapon: timing.

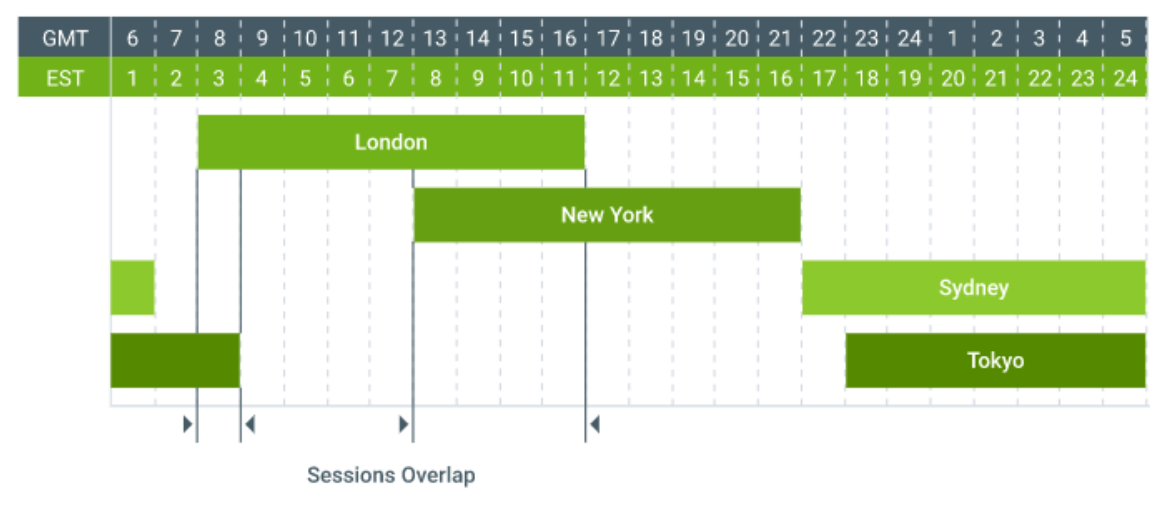

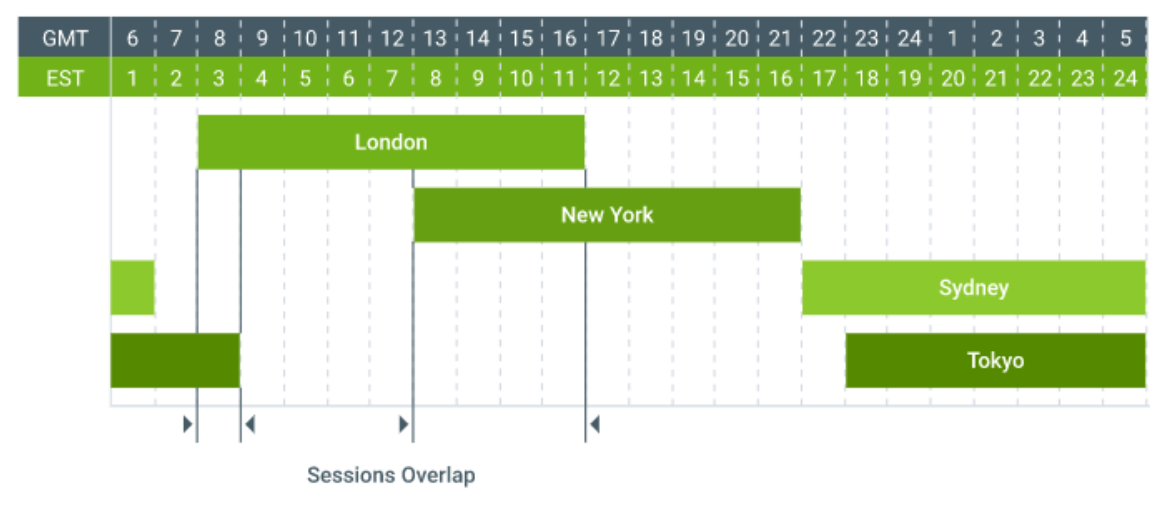

Gold trades almost 24/5, but only a few windows consistently deliver the liquidity, volatility, and follow-through active traders want. The sweet spot? When London and New York overlap (12:00-16:00 GMT), right as institutional flow and top-tier data hit the tape. In this guide, we’ll map the gold session structure, show exactly which hours historically offer the cleanest moves, and convert them into your local time so you can plan entries, exits, and risk like a pro.

Daily Gold Trading Structure

Gold is traded across multiple platforms and exchanges worldwide, primarily via spot, futures, and CFD markets. Thanks to global demand and decentralised trading venues, gold trading hours stretch nearly around the clock from Monday to Friday.

Gold is traded across multiple platforms and exchanges worldwide, primarily via spot, futures, and CFD markets. Thanks to global demand and decentralised trading venues, gold trading hours stretch nearly around the clock from Monday to Friday.

The trading week typically begins on Sunday evening (around 23:00 GMT) with the opening of the Asia-Pacific markets and closes late Friday evening when New York shuts down. The near-continuous nature of gold trading hours provides flexibility for traders worldwide, but navigating this 24/5 market requires an understanding of regional sessions and their characteristics.

Gold's liquidity and volatility vary throughout the day as different markets open and close. For traders, this means that the choice of trading time can influence spread costs, slippage, and the success of technical setups.

Prime Sessions to Watch

Among all the gold trading hours, two market sessions consistently stand out for traders: the London and New York sessions.

Among all the gold trading hours, two market sessions consistently stand out for traders: the London and New York sessions.

| Trading Session |

GMT |

New York (ET) |

London (BST) |

Sydney (AEST) |

Typical Volatility Level |

| Sydney (Asia Open) |

22:00 – 07:00 |

17:00 – 02:00 |

23:00 – 08:00 |

08:00 – 17:00 |

Low to Moderate |

| Tokyo (Asia Core) |

23:00 – 08:00 |

18:00 – 03:00 |

00:00 – 09:00 |

09:00 – 18:00 |

Moderate |

| London (Europe Open) |

07:00 – 16:00 |

02:00 – 11:00 |

08:00 – 17:00 |

17:00 – 02:00 |

High |

| New York (US Session) |

12:00 – 21:00 |

07:00 – 16:00 |

13:00 – 22:00 |

22:00 – 07:00 |

High |

| London-New York Overlap |

12:00 – 16:00 |

07:00 – 11:00 |

13:00 – 17:00 |

22:00 – 02:00 |

Very High |

London Open (circa 07:00 GMT)

The London market is a key global centre for bullion trade. When it opens, there's often a sharp uptick in gold liquidity and price movement. This is particularly true when European economic data is released or when geopolitical risk in the Eurozone surfaces. For traders, this is a valuable window to capture breakouts or manage early intraday positions.

New York Open (around 13:00 GMT / 09:00 EST)

The New York session dominates gold futures trading, especially through the COMEX division of the CME Group. This session often brings the highest daily trading volume. Crucially, this time slot also overlaps with London, amplifying volatility. Many major economic indicators, such as US CPI, employment data, or Fed announcements, are released during these hours, triggering strong directional moves.

While gold does trade during the quieter Asian hours, price action tends to be range-bound and more suited for mean-reversion strategies. For momentum or breakout traders, London and New York remain the most fruitful sessions.

Peak Overlap Zones

The gold trading hours become particularly attractive during overlap periods, when two major trading regions are active simultaneously. These windows represent the most liquid parts of the day, characterised by tighter spreads and rapid order execution, ideal conditions for short-term traders.

London-New York Overlap (12:00-16:00 GMT)

This is the most active and volatile period within the gold trading hours. With two major financial centres operating simultaneously, order flows increase dramatically. Institutional players, central banks, and large speculative traders are often executing positions during this time. For day traders, this overlap offers the best opportunity to ride strong trends or exploit intraday reversals.

Asia-London Overlap (06:00-08:00 GMT)

This window is less volatile but still offers movement, especially when driven by European data or Asian economic sentiment. It can serve as a transition point, with early positioning ahead of the full London session.

Understanding these overlaps can help traders align strategy to session dynamics. Scalpers might target London's open, while trend followers could look to ride movements into the New York close.

Volatility & Liquidity by Day

Beyond the daily rhythm, gold trading hours also fluctuate in quality depending on the day of the week. Traders should be aware of typical patterns that can influence price behaviour:

Monday

Often slower as the market adjusts to weekend news and positions. Liquidity builds gradually, with limited conviction in early moves. Not ideal for aggressive trading.

Tuesday to Thursday

These are the most productive days for traders. Volatility is high, economic data releases are frequent, and technical patterns are more reliable. Most major breakouts and sustained trends develop midweek.

Friday

A mixed day. The US session can be active, but often fades in the afternoon as traders unwind positions before the weekend. Be wary of sharp reversals or profit-taking.

For disciplined traders, adapting risk exposure according to the day's typical behaviour can lead to better risk-reward profiles and more consistent performance.

News & Data Release Timing

One of the most important factors influencing gold trading hours is the timing of key economic news. Gold, being both a safe-haven asset and a hedge against inflation, reacts strongly to macroeconomic indicators—particularly those coming from the United States.

US Non-Farm Payrolls (NFP)

Released on the first Friday of each month at 13:30 GMT, this is one of the most volatile events within the gold trading hours. Price can move hundreds of points in minutes. Ideal for high-risk, high-reward trades.

CPI, PPI, GDP Data

Inflation data is closely watched due to gold's role as an inflation hedge. These events often trigger breakout or reversal opportunities when they deviate from expectations.

FOMC Statements & Fed Rate Decisions

Central bank language can dramatically shift gold's direction. These usually occur during the US session, and traders should monitor the calendar closely.

Being aware of these releases and planning trades around them is essential. Many traders prefer to either position themselves ahead of such events or wait until the dust settles to trade post-release setups.

Global Gold Trading FAQ

When is the most volatile time to trade gold?

Volatility peaks during the London–New York overlap (12:00–16:00 GMT) when global liquidity and institutional order flow converge. These hours often deliver the strongest breakouts, cleanest technical signals, and highest trading volume across gold markets.

Which session offers the tightest spreads?

The London and New York sessions offer the tightest spreads. High-volume participation keeps bid-ask costs minimal, providing smoother execution and reduced slippage, crucial for short-term traders managing multiple entries and exits.

Does gold trade on weekends?

No. Gold markets close late on Friday around 22:00 GMT and reopen Sunday evening. Weekend headlines may cause price gaps at the next open, but no actual trading takes place between Friday night and Sunday.

What is the quietest time to trade gold?

The late U.S. to early Asia window (21:00–00:00 GMT) tends to be the calmest, with thinner liquidity and wider spreads. Most professionals avoid initiating new positions during this period unless news breaks.

How do major news events affect gold prices?

Data releases such as U.S. Nonfarm Payrolls, CPI, and FOMC statements trigger rapid volatility surges. Smart traders either trade breakouts immediately or wait for the first reaction to fade before entering with tighter risk control.

Are some weekdays more active than others?

Yes. Tuesdays through Thursdays generally produce the strongest price swings, while Mondays and Fridays are often more range-bound due to positioning adjustments and lower participation.

Final Thoughts

For active traders, gold trading hours are more than just a schedule, they are a map of opportunity and risk. Trading gold successfully involves aligning strategies with the most liquid and volatile windows of the day, understanding the rhythm of each trading session, and staying alert to economic events that drive price action.

While the market is technically open almost 24/5. it pays to be selective. The London–New York overlap offers unmatched potential, while midweek days tend to produce the cleanest moves. And with major economic releases dictating sentiment, no gold trader can afford to ignore the news calendar.

Master the timing, and the gold market may just reward you for your discipline.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Gold is traded across multiple platforms and exchanges worldwide, primarily via spot, futures, and CFD markets. Thanks to global demand and decentralised trading venues, gold trading hours stretch nearly around the clock from Monday to Friday.

Gold is traded across multiple platforms and exchanges worldwide, primarily via spot, futures, and CFD markets. Thanks to global demand and decentralised trading venues, gold trading hours stretch nearly around the clock from Monday to Friday. Among all the gold trading hours, two market sessions consistently stand out for traders: the London and New York sessions.

Among all the gold trading hours, two market sessions consistently stand out for traders: the London and New York sessions.