EBC Forex Snapshot, 3 Jul 2024

The dollar remained on the back foot on Wednesday after dovish comments from

Fed Chair Jerome Powell following a strong domestic jobs reports sent Treasury

yields lower.

US job openings rose in May after posting outsized declines in the prior two

months, but data or April was revised lower. The trend remained consistent with

an easing in labour market conditions.

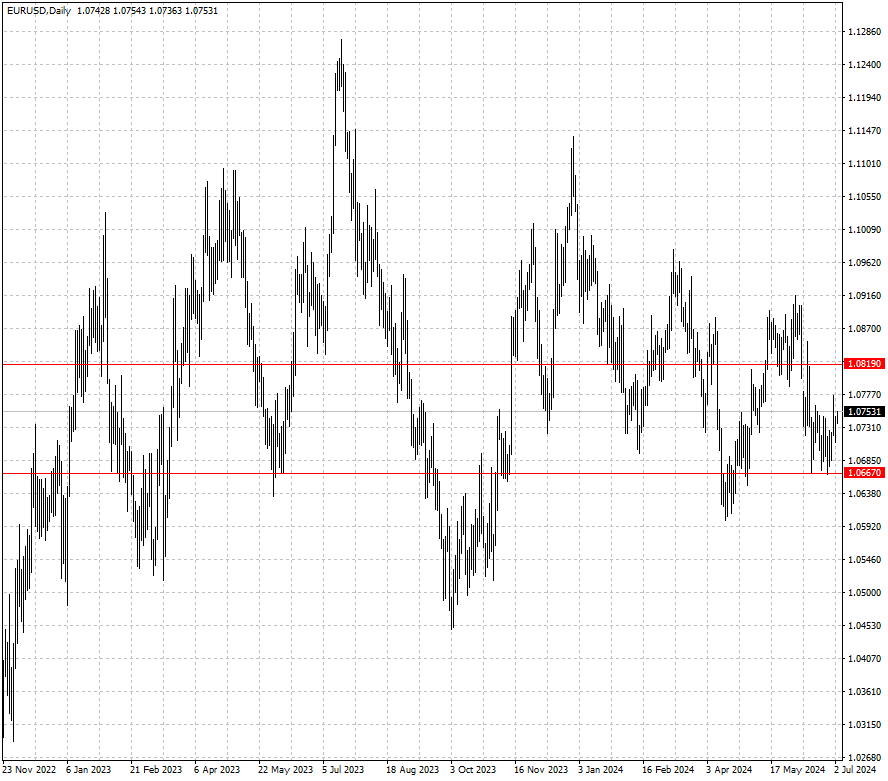

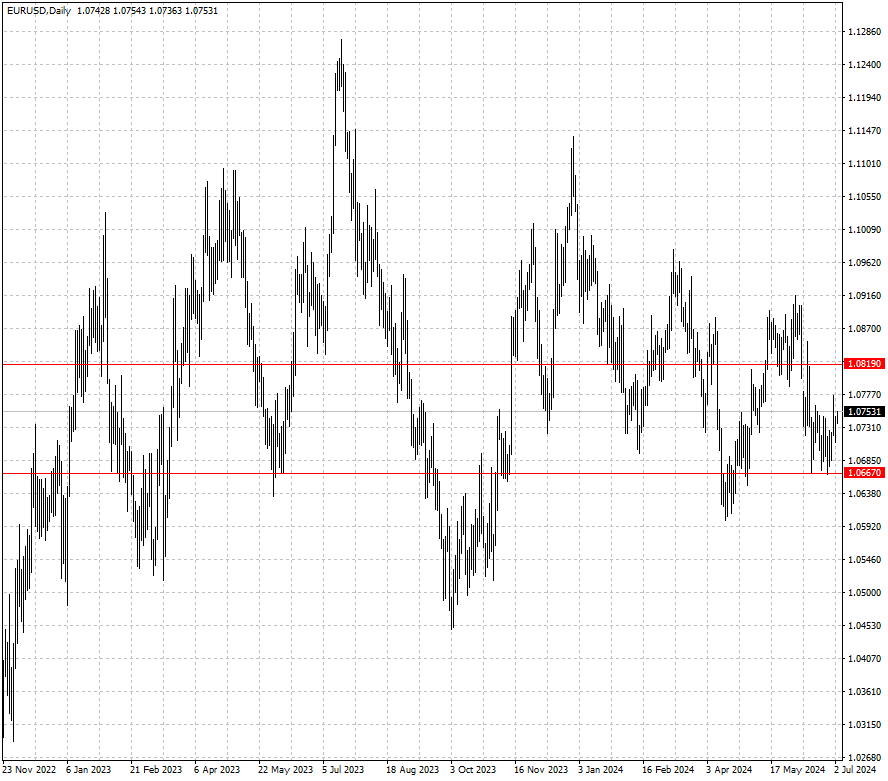

The euro was flat. Euro zone inflation eased last month but a crucial

services component remained stubbornly high, fuelling concern that domestic

price pressures could stay at elevated levels.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 24 Jun) |

HSBC (as of 3 Jul) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0668 |

1.0916 |

1.0667 |

1.0819 |

| GBP/USD |

1.2619 |

1.2860 |

1.2594 |

1.2791 |

| USD/CHF |

0.8827 |

0.9158 |

0.8891 |

0.9116 |

| AUD/USD |

0.6564 |

0.6729 |

0.6603 |

0.6708 |

| USD/CAD |

1.3577 |

1.3846 |

1.3608 |

1.3761 |

| USD/JPY |

153.60 |

160.00 |

158.09 |

163.27 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.