Japan’s economy posted its third straight quarterly expansion of an

annualized 6% helped by a robust export growth, handily beating market

expectations of 3.1% gain.

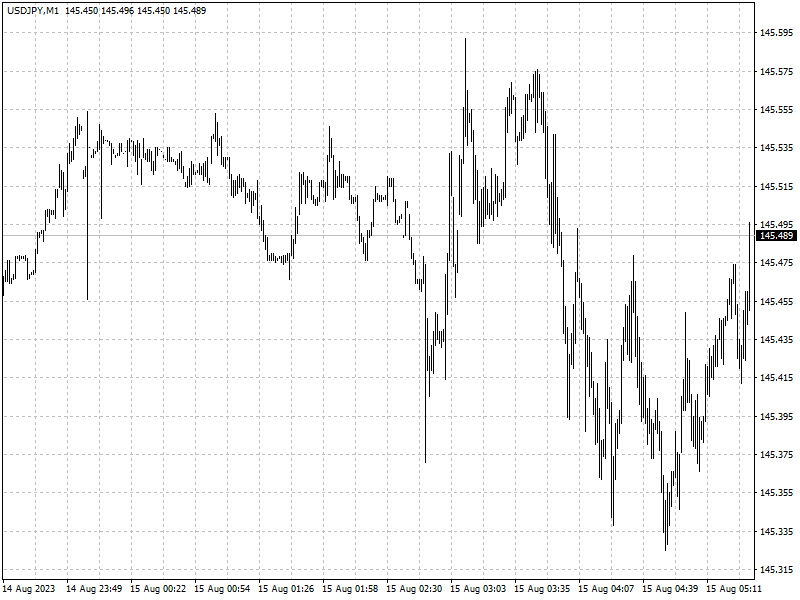

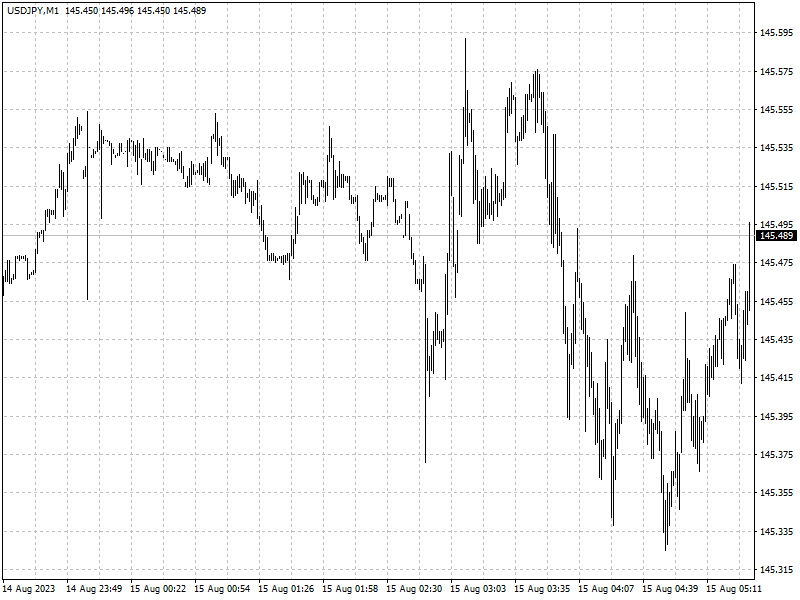

Nikkei 225 index extended gains slightly to trade up nearly 1%, while the

Japanese yen pared losses against the U.S. dollar.

However, the yen is still trading around 145 after breaking the key level

since for the first time since November 2022.

The yen could push back ‘in the 145-148 range’ while short position ‘will

likely rebuild further’ without official intervention, said HSBC on Monday.

On the other side, High longer-end U.S. yields on concerns about the U.S.

budget deficit and Treasury supply adds to the dollar’s resilience, according to

bank.

Japan’s economy will be slowing again across the second half of the year,

said Marcel Thieliant, head of Asia-Pacific at Capital Economics, wrote in a

note.

He added that the jump stemmed from the second-largest contribution from net

trade in the 28-year history of the current GDP series. That offset a surprise

drop in private consumption as well as anemic capital expenditure.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.