The iShares Russell 1000 Value ETF (IWD) is a popular choice for traders seeking exposure to large-cap US value stocks. With its broad diversification and cost-effective structure, IWD offers significant potential for long-term growth and income.

However, like any investment, trading IWD comes with pitfalls that can erode returns or increase risk if not properly managed. This article highlights six common mistakes traders make with IWD ETF and provides actionable advice to help you avoid them.

How to Trade IWD ETF with Confidence

1. Ignoring Value Cycle Timing

Many traders buy IWD simply because it's a value ETF, without considering where we are in the market cycle. Value stocks tend to outperform during certain periods—typically when interest rates are rising, inflation is elevated, or after growth stocks have led a prolonged rally. Entering IWD at the wrong phase can result in underperformance relative to growth-oriented ETFs.

How to avoid this mistake:

-

Monitor macroeconomic indicators like interest rates, inflation, and GDP growth.

-

Pay attention to sector rotation trends and historical value vs growth cycles.

Consider scaling into positions when value stocks are starting to regain momentum, not after they've already rallied significantly.

2. Overlooking Sector Concentration

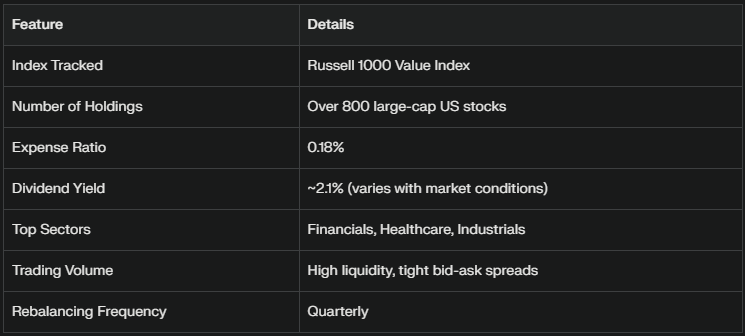

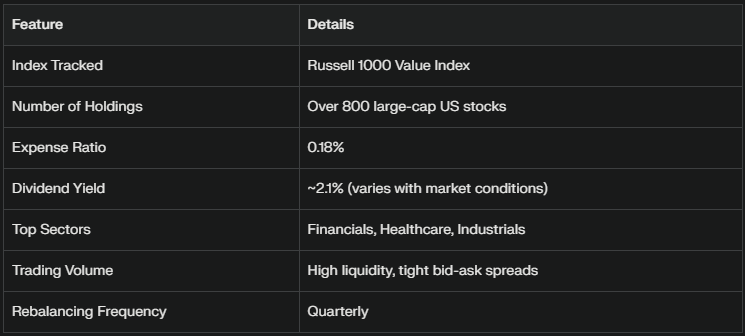

While IWD provides broad exposure, it can be heavily weighted towards certain sectors—such as financials, healthcare, and industrials—depending on the market environment. Traders who ignore these sector skews may inadvertently take on more risk or miss diversification opportunities.

How to avoid this mistake:

-

Regularly review IWD's sector allocations, which are updated quarterly.

-

Complement IWD with other ETFs or assets to fill sector gaps or offset concentration risk.

Use sector analysis to anticipate how macro events (like interest rate changes) might impact the ETF's largest holdings.

3. Neglecting Expense Ratios and Trading Costs

IWD boasts a low expense ratio (currently around 0.18%), but traders who frequently buy and sell can still rack up significant costs through commissions, bid-ask spreads, and taxes. These costs can eat into returns, especially for active traders.

How to avoid this mistake:

-

Factor in all transaction costs before placing trades.

-

Use limit orders to manage bid-ask spread costs, especially during periods of low liquidity.

Consider holding periods and tax implications when planning your trading strategy.

4. Failing to Monitor Dividend Yield and Payouts

One of IWD's attractions is its relatively high dividend yield compared to growth ETFs. However, yields can fluctuate based on market conditions, changes in underlying company payouts, or shifts in sector weights. Traders who ignore these changes may misjudge the income potential or risk missing out on dividend opportunities.

How to avoid this mistake:

-

Track IWD's trailing 12-month yield and upcoming ex-dividend dates.

-

Reinvest dividends through a DRIP (Dividend Reinvestment Plan) if your strategy is long-term growth.

Stay informed about changes to the ETF's distribution policy or underlying holdings' dividend trends.

5. Underestimating Tracking Error

Although IWD is designed to closely follow the Russell 1000 Value Index, small discrepancies—known as tracking error—can occur due to fees, rebalancing lags, and other factors. Traders who assume perfect tracking may be surprised by performance differences, especially over short time frames.

How to avoid this mistake:

-

Compare IWD's returns to its benchmark regularly, especially after rebalancing events.

-

Understand that some tracking error is normal, but large or persistent discrepancies may warrant further investigation.

Use IWD as part of a diversified strategy rather than relying on it as a perfect index proxy.

6. Ignoring Risk Management and Position Sizing

Value stocks, while generally less volatile than growth stocks, are not immune to market downturns or sector-specific risks. Traders who neglect position sizing or fail to use stop-loss orders can suffer outsized losses during sharp corrections or periods of market stress.

How to avoid this mistake:

-

Set clear position size limits based on your overall portfolio and risk tolerance.

-

Use stop-loss or trailing stop orders to protect against large drawdowns.

Regularly rebalance your portfolio to maintain your desired asset allocation and risk profile.

Table: IWD ETF – Key Facts for Traders

Additional Tips for Successful Trading

-

Stay Informed: Follow economic news, earnings reports, and Federal Reserve announcements, as these can impact value stocks and sector performance.

-

Review Holdings: Check IWD's top holdings periodically, as changes in the index can influence risk and return.

-

Diversify: Combine IWD with growth, international, or sector-specific ETFs to balance your portfolio and reduce single-factor risk.

Plan Your Exit: Have a clear Exit Strategy, whether it's based on technical analysis, fundamental changes, or reaching a target return.

Conclusion

Trading the IWD ETF offers a straightforward way to access the performance of large-cap US value stocks, but success requires more than simply buying and holding.

By avoiding these six common mistakes—timing errors, sector concentration, ignoring costs, neglecting dividends, underestimating tracking error, and poor risk management—you can improve your results and build a more resilient investment strategy. Stay disciplined, informed, and proactive to make the most of what IWD has to offer.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.