As more traders look for ways to build wealth steadily while preserving capital, dividend-focused strategies have gained significant appeal. Among the top contenders in this space is the Vanguard Dividend Appreciation ETF (VIG)—a fund known for its disciplined approach to selecting high-quality companies that consistently raise their dividends.

VIG isn't just another dividend ETF chasing high yields. Instead, it targets businesses with a proven ability to grow payouts year after year, even through economic uncertainty. This focus on dividend growth rather than yield positions VIG as a reliable choice for traders seeking a blend of long-term income and capital appreciation—without taking on excessive risk.

What Is the VIG ETF?

The Vanguard Dividend Appreciation ETF, commonly referred to as VIG, is a passively managed exchange-traded fund that tracks the performance of the S&P U.S. Dividend Growers Index. This index is designed to include high-quality companies that have increased their dividends for at least 10 consecutive years.

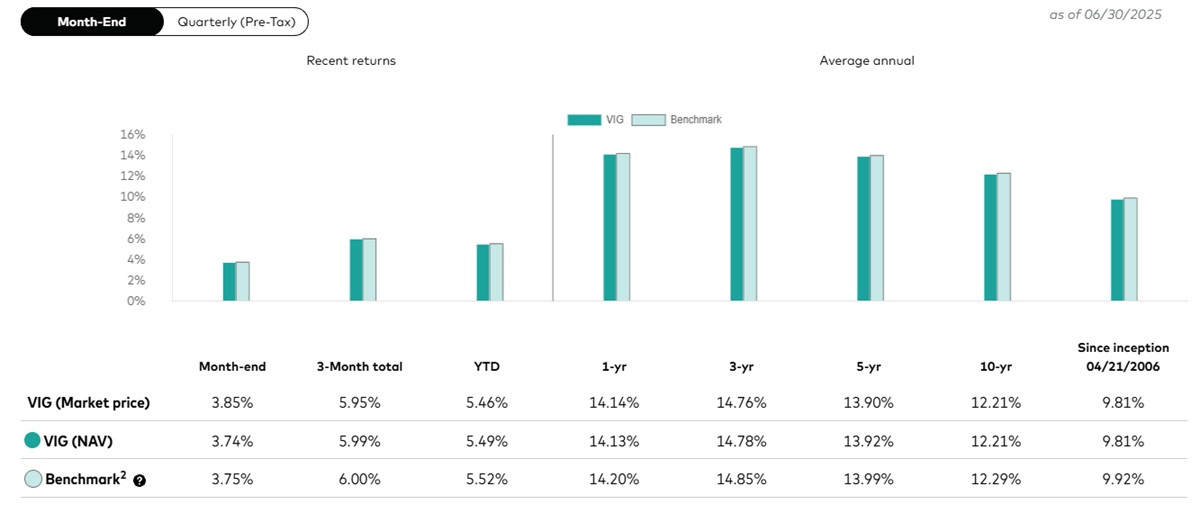

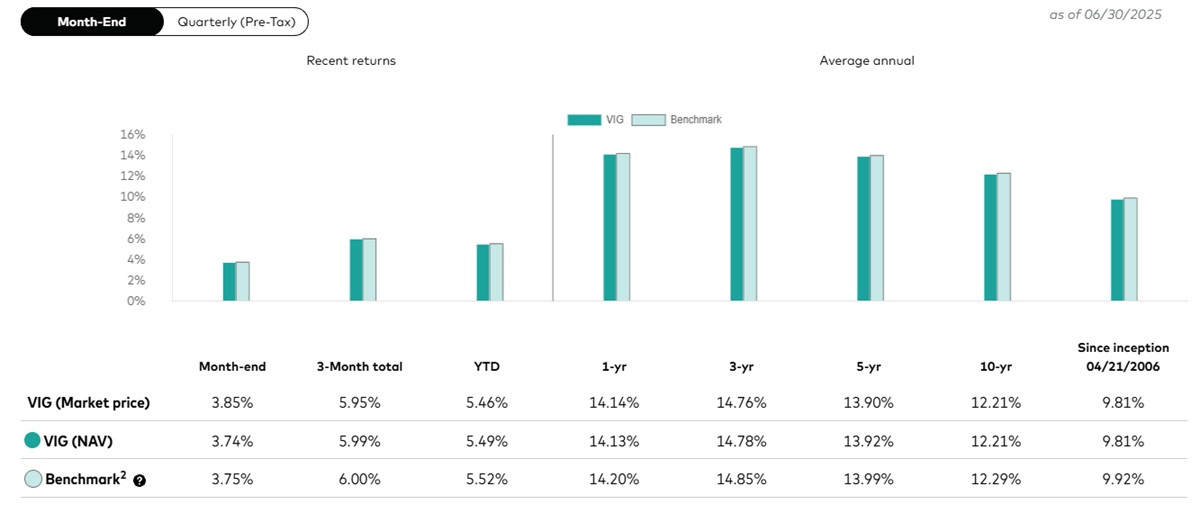

Launched in April 2006 by Vanguard—one of the largest asset managers in the world—VIG quickly became a favourite among traders seeking a reliable source of dividend income without compromising on long-term capital growth. Rather than targeting the highest-yielding stocks, VIG's methodology focuses on dividend sustainability and growth, which helps to reduce exposure to companies that might cut payouts in economic downturns.

In practice, this means VIG's portfolio is tilted toward mature, financially sound businesses that prioritise returning value to shareholders in a measured and consistent manner.

Fund Structure & Launch Details

VIG is structured as an ETF, providing traders with intraday liquidity, tax efficiency, and broad diversification through a single investment vehicle. It is listed on the New York Stock Exchange Arca (NYSE Arca) and trades like a common stock.

VIG is structured as an ETF, providing traders with intraday liquidity, tax efficiency, and broad diversification through a single investment vehicle. It is listed on the New York Stock Exchange Arca (NYSE Arca) and trades like a common stock.

The fund has seen immense growth in assets under management (AUM) since inception, now exceeding $90 billion, placing it among the top dividend-focused ETFs globally. It boasts a low expense ratio of just 0.05%, in keeping with Vanguard's reputation for cost-effective investing. This minimal fee allows traders to retain more of their returns compared to other dividend-oriented funds, some of which charge significantly higher fees.

As a passive fund, VIG does not attempt to outperform the market but rather to closely replicate the performance of its benchmark index. The fund is rebalanced quarterly, ensuring that only those companies meeting the dividend growth criteria remain included.

Dividend Policy & Yield Strategy

What sets VIG apart from many other dividend ETFs is its commitment to dividend growth rather than high yield. The fund's underlying index mandates that all constituents have a minimum 10-year history of increasing dividends—a stringent requirement that ensures only companies with enduring financial strength make the cut.

What sets VIG apart from many other dividend ETFs is its commitment to dividend growth rather than high yield. The fund's underlying index mandates that all constituents have a minimum 10-year history of increasing dividends—a stringent requirement that ensures only companies with enduring financial strength make the cut.

This strategy results in a modest yield, typically in the range of 1.7% to 1.9%, which is lower than that of high-yield ETFs but more stable over the long term. Importantly, the focus on quality over quantity reduces the risk of owning companies with unsustainable dividend policies—often the Achilles' heel of many high-yield portfolios.

VIG's dividends are distributed quarterly, and the fund's emphasis on steady, predictable income makes it especially appealing during uncertain economic times, when dividend cuts are more prevalent in lower-quality stocks.

Fees & Cost Efficiency

One of the most attractive aspects of VIG is its ultra-low cost structure. With an expense ratio of just 0.05%, it is among the most cost-effective ETFs in the dividend space. This low fee is crucial for long-term traders, as even small cost differences can significantly erode investment returns over time.

To put this into perspective, for every £10.000 invested, the annual management fee is just £5. compared to £37 or more for actively managed dividend funds or similar ETFs with higher fees. Vanguard's scale and operational efficiency enable it to offer such low costs, making VIG a logical choice for fee-conscious traders.

Additionally, due to its ETF structure, VIG is inherently tax-efficient, with low portfolio turnover helping to minimise capital gains distributions—a notable advantage over traditional mutual funds.

Ideal Investor Profile

While VIG offers benefits for a wide range of investors, it is especially well-suited for:

Long-term investors seeking sustainable income growth

Younger investors building a diversified portfolio focused on quality

Those nearing retirement who prefer dividend stability over maximum yield

Investors averse to high volatility and riskier sectors

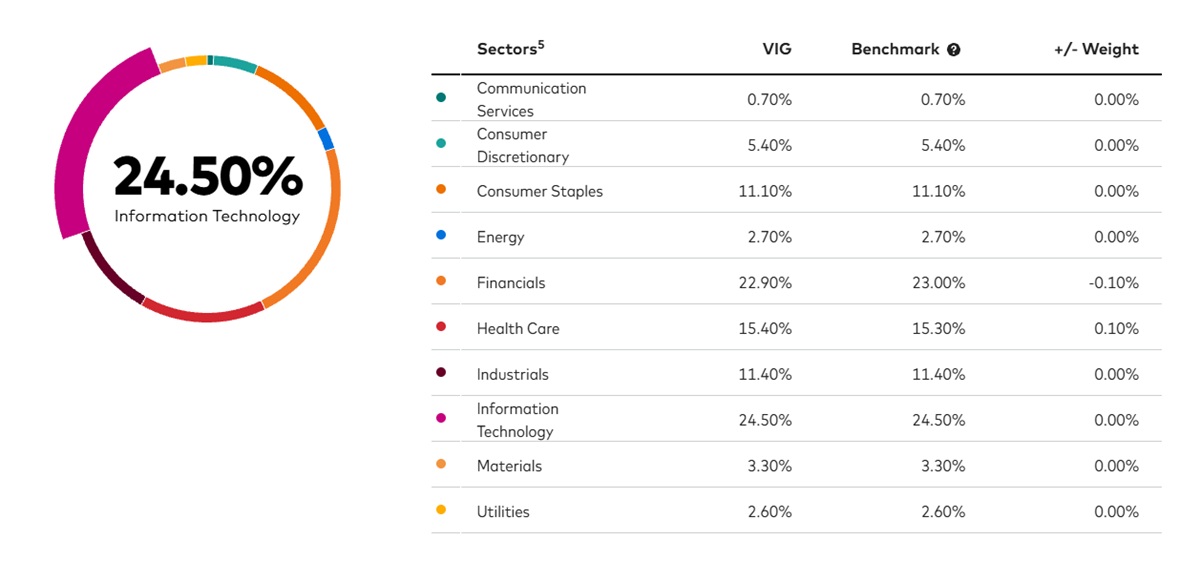

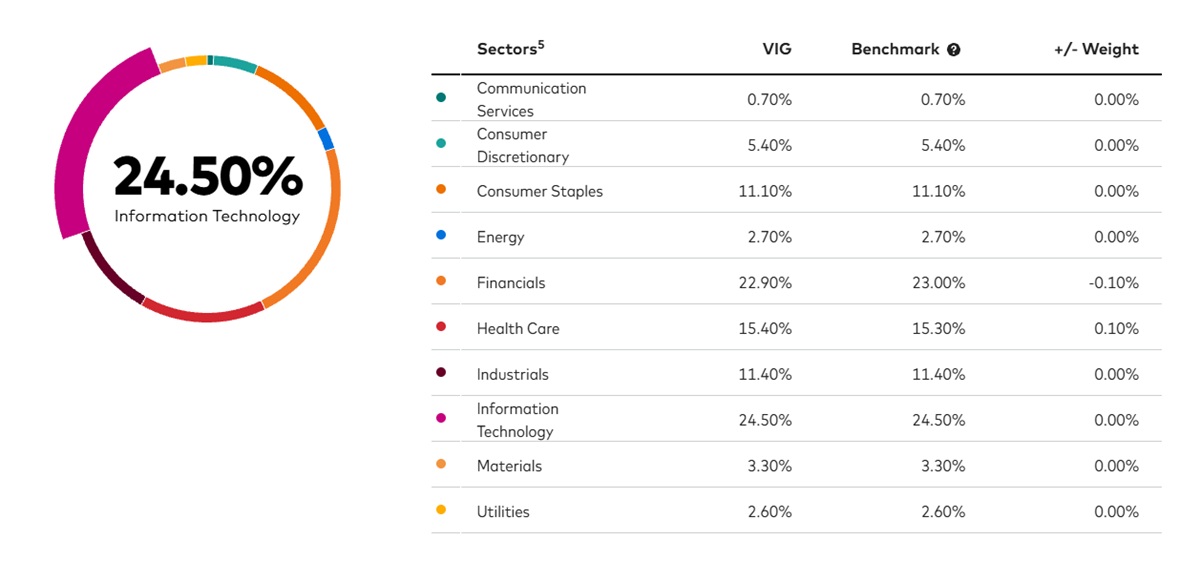

Unlike some high-yield funds that overweight energy or REITs, VIG's focus on dividend growers naturally tilts it toward sectors like industrials, consumer staples, healthcare, and technology—all of which tend to demonstrate strong balance sheets and consistent cash flows.

However, investors who require immediate high income, such as retirees relying heavily on distributions, may find that other options like Vanguard High Dividend Yield ETF (VYM) or Schwab U.S. Dividend Equity ETF (SCHD) offer more attractive yields.

In short, VIG is best viewed as a core equity holding for those seeking capital appreciation coupled with rising income over time, rather than as a short-term yield play.

Conclusion

The Vanguard Dividend Appreciation ETF (VIG) is a thoughtfully constructed fund that offers a disciplined approach to dividend investing. By focusing on companies with a consistent history of dividend growth, it aims to deliver reliable, rising income alongside long-term capital gains. Its low fees, strong diversification, and emphasis on financial quality make it an ideal candidate for a broad range of investors and traders, particularly those focused on wealth-building over decades rather than yield-chasing in the short term.

For anyone looking to combine the benefits of dividend investing with the stability of top-tier corporations, VIG represents one of the most prudent choices in the current ETF landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

VIG is structured as an ETF, providing traders with intraday liquidity, tax efficiency, and broad diversification through a single investment vehicle. It is listed on the New York Stock Exchange Arca (NYSE Arca) and trades like a common stock.

VIG is structured as an ETF, providing traders with intraday liquidity, tax efficiency, and broad diversification through a single investment vehicle. It is listed on the New York Stock Exchange Arca (NYSE Arca) and trades like a common stock. What sets VIG apart from many other dividend ETFs is its commitment to dividend growth rather than high yield. The fund's underlying index mandates that all constituents have a minimum 10-year history of increasing dividends—a stringent requirement that ensures only companies with enduring financial strength make the cut.

What sets VIG apart from many other dividend ETFs is its commitment to dividend growth rather than high yield. The fund's underlying index mandates that all constituents have a minimum 10-year history of increasing dividends—a stringent requirement that ensures only companies with enduring financial strength make the cut.