Just like the first step to renting an apartment when you come to work in a big city,finding a reliable securities company is also a crucial first step for investors who are new to the industry. However,many people harbor the dream of embarking on the peak of life; for the securities companies, this is something they may not understand,let alone a good choice. Accordingly,this article will come to an in-depth analysis of the business of the securities companies and the choice of key points.

What is a Securities Company?

It is in accordance with the provisions of the Company Law and the Securities Law that the State Council Securities Regulatory Commission examines and approves the establishment of units specializing in securities business. In different countries,it has different titles. For example,in the United States,it is called investment banks or securities brokers,and in the United Kingdom,it is called merchant banks.

There are two types of them,which are categorized as securities registration companies and securities operating companies. A securities registration company is a service organization that provides centralized registration of securities transactions and is usually appointed or established by the government or the SEC.Its operation is not for profit but to maintain the fair,transparent,and stable operation of the securities market. Its main duties are to manage and maintain the register of shareholders of a securities issuing company (e.g., a listed company), to record the number and type of securities held by shareholders,and to deal with the registration of transfers, allocations,gifts,etc., between shareholders.

Today,the term securities company usually refers to a securities operating company that has the qualifications of a member of the stock exchange. To put it bluntly,it is an agent company that has a legal business license and is generally called a brokerage firm. These companies have membership in the stock exchange and have legal business licenses to engage in securities business.As brokerage firms,they provide investors with services such as the buying and selling of stocks,bonds,funds,and other securities products,trading,consulting,etc., and collect commissions and fees accordingly.

Becoming a brokerage firm does require a number of things. First of all,the major shareholders need to show that they are good citizens,which means that they need to have a certain social reputation and a good business reputation. Secondly,a brokerage firm needs to have sustained profitability,which is important to ensure the healthy development of the company.

In addition,the net worth of the brokerage firm needs to meet a certain standard,usually not less than RMB 200 million,which ensures that the brokerage firm has sufficient capital to support its business operations. In addition,the firm's practitioners need to hold induction certificates,which indicate that they have the necessary qualifications and abilities to engage in securities business. Finally,a brokerage firm also needs to have a well-established service system to ensure that it is able to provide high-quality services to its clients,enhancing client satisfaction and the firm's competitiveness.

This means that to become a brokerage firm,one needs to have no previous convictions,sufficient capital,and be in compliance with the law. Ordinary investors usually need to trade stocks through brokerage firms,so the main business of brokerage firms includes stock trading,bond trading,securities underwriting,investment counseling,etc. One of the businesses of brokerage firms is to act as agents for buying and selling stocks.

One of the businesses of brokerage firms is to act as agents in the buying and selling of stocks and to provide purchase advice,from which they receive commissions. In addition,they can also buy and sell stocks on their own,or help issuers offer securities in the form of underwriting or distribution,and plan the listing of stocks of restructured enterprises. Similar to housing agents,they also provide counseling and advice to solve all kinds of difficult problems,treating customers as God. However,one needs to be cautious if there is a suggestion of frequent trading,as each transaction will incur a corresponding commission.

Securities companies play a very important role in the financial market and are one of the organizations that investors have to approach for accessing the financial market. Through it,investors can participate in various financial markets,such as the stock market,bond market,and other financial markets,to realize their investment goals.

What does a Securities Company Do?

What does a Securities Company Do?

As financial institutions specializing in securities business,they provide a variety of securities trading services,including the purchase and sale of stocks,bonds,futures,options,etc., as well as the provision of related financial services such as investment consulting,asset management,and securities financing. Its main duty is to provide investors with a platform and services for securities trading and help them realize their investment objectives.

A more graphic explanation is that the financial market is compared to a sports arena; investors are like athletes,and different financial products are like different sports. Securities companies are like stadiums; they provide services and venues for investors. The SFC and the Exchange are like the organizers who manage the sports competitions and are responsible for setting the rules and overseeing the fairness of the competitions.

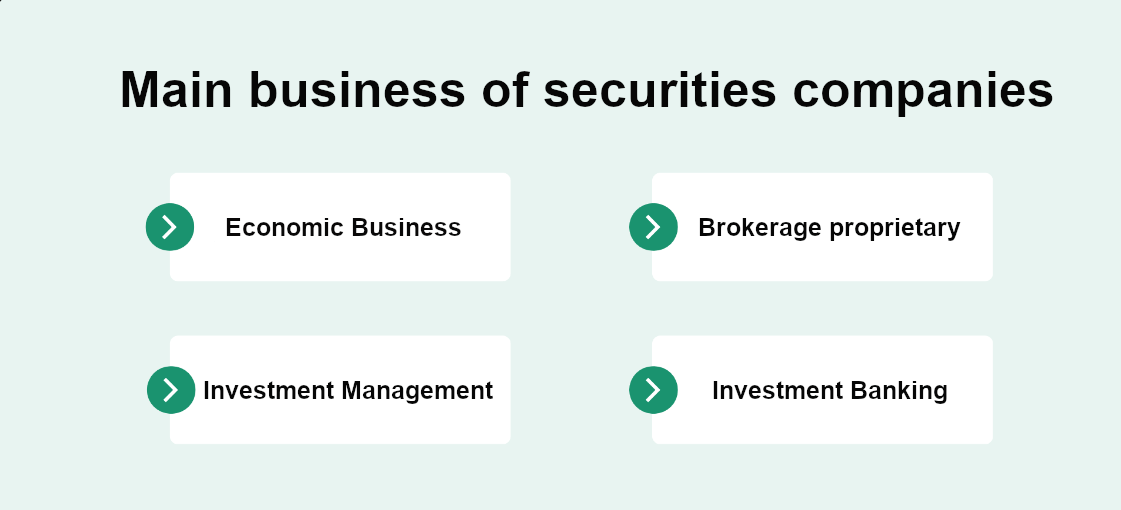

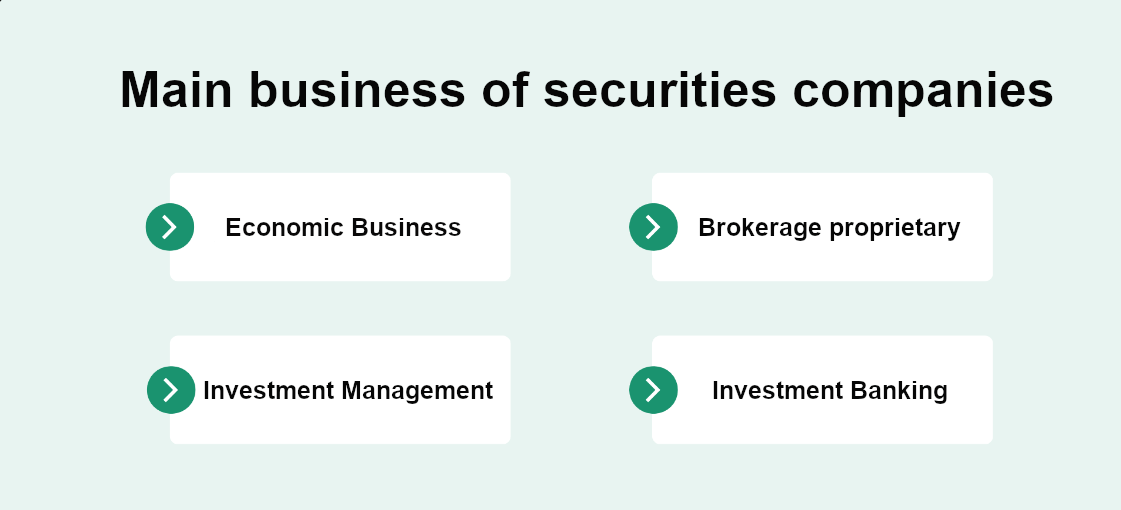

It has four main types of businesses:the first being economic business,the second being proprietary business,the third being investment management business,and the fourth being investment banking. Together,these businesses constitute the core operating model of a securities company,providing market participants with diversified financial services and investment opportunities.

Brokerage business refers to a business in which it acts as an intermediary for the purchase and sale of securities,funds,and other financial products and receives commissions or fees paid by investors from the transactions. It mainly makes profits by providing brokerage businesses because they provide investors with convenient trading platforms and professional services to help them trade securities.By charging commissions,brokerage firms are able to make a profit and usually try their best to increase their business volume in order to increase their commission income.

Proprietary business simply means that brokerage firms utilize their own funds to make investments in the securities market in order to generate income. Analogous to financial institutions such as banks and insurance companies,they make money in a similar way by operating their funds to generate more profits. This approach is a common profit model for financial institutions,which utilize their own funds to make investments and increase the profitability of the business through investment income.

The investment management business is where a brokerage firm or other financial institution manages the assets of its clients and generates income through the issuance of trust products,for example. As an example,it can provide strategies and guidelines for companies that are experiencing difficulties with management or capital and bring in investors and partners to support these companies.

The main way to profit from this type of business is to generate returns by implementing an effective investment strategy or by taking an equity stake in these companies in order to share in their returns. From a securities company's point of view,this is described as competition seeking cooperation in a win-win situation.

As a simple example,suppose an investment project team believes,after market research and risk analysis,that the US dollar will rise against the Chinese yuan over the next two years. It will use its own funds or the funds of its clients to buy US dollars in exchange for RMB in order to bet that the US dollar will appreciate in the future.

Or,for example,if there happens to be some company that needs to go public or raise capital,the investment team will then combine various resources to assess whether the company is worth investing in. Once the investment is successful,the investment team will be able to make a profit; conversely,if the investment fails,it will result in a loss.

One of the main sources of revenue for investment banking is the underwriting and listing business. In this business,investment banks are responsible for organizing and undertaking initial public offerings (IPOs) or other securities offerings to help companies obtain capital. The investment banker will earn underwriting and other related fees from these offerings and thus realize a profit.

In addition,investment banks may participate in the closing of securities in a variety of ways,such as underwriting,distribution,sponsorship,and marketing. These methods can help investment banks earn commissions and other fees for securities transactions,which can be profitable for the investment banks. Although these methods are somewhat similar to underwriting,issuance,and listing businesses,they focus more on the trading and sale of securities than on the financing activities of the business.

In addition to underwriting issuance,listing operations,and brokerage,investment banks can generate revenue by engaging in risk-free arbitrage and risk arbitrage in the secondary market. In these activities,investment banks capitalize on market volatility and price differences between securities to generate profits.

In addition,investment banks are actively involved in corporate mergers and acquisitions and provide merger and acquisition advisory services to their clients. In this way,investment banks can help their clients evaluate M&A targets,raise capital,and structure transactions,thereby earning related advisory fees and transaction commissions.

Investment banks can participate in the M&A activities of enterprises in a variety of ways so as to obtain lucrative profits.First of all,investment banks can help their clients identify potential M&A and acquisition targets and provide advice on purchase and sale prices or non-price terms. By investigating and analyzing the market,investment banks can find the most attractive M&A targets for their clients and help them make informed decisions.

Second,investment banks can also assist hunter companies in developing and implementing M&A programs. This includes assessing the value of the target company,negotiating the terms of the deal,raising capital,and other aspects of the work. The expertise and experience of investment banks can help hunter companies successfully complete M&A transactions and maximize value creation.

In addition,investment banks can help target companies deal with situations such as hostile takeovers and develop anti-takeover plans. By assessing potential risks and challenges,investment banks can provide strategic advice to target companies and assist them in taking appropriate actions to protect their interests.

Securities companies play an important role in the financial market,providing investors with convenient trading channels and professional services and promoting the development and healthy operation of the capital market. Therefore,its compliance and good reputation are crucial,which not only meet the requirements of laws and regulations but are also the basis for the sound development of securities companies.

Choosing a Securities Company

Choosing a Securities Company

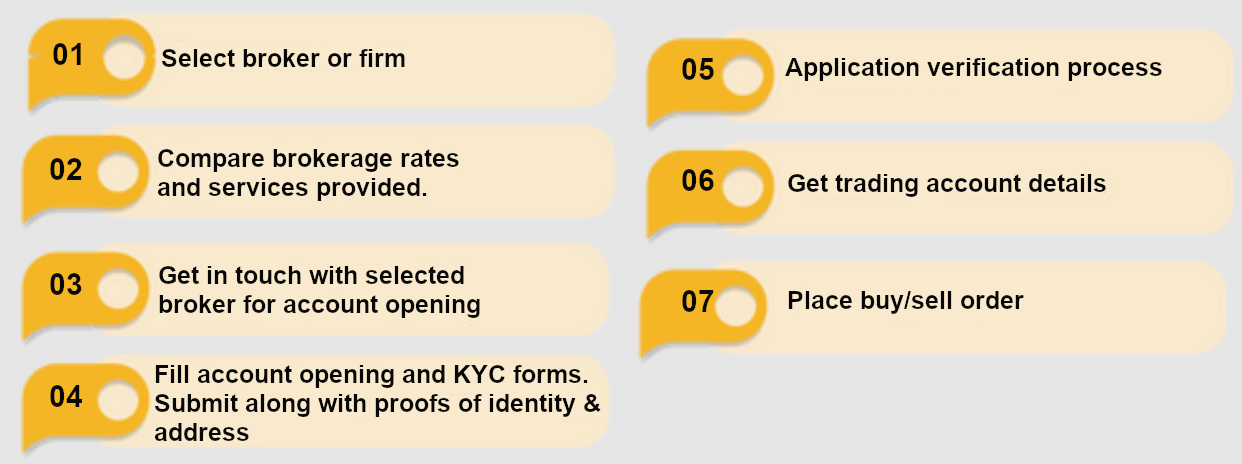

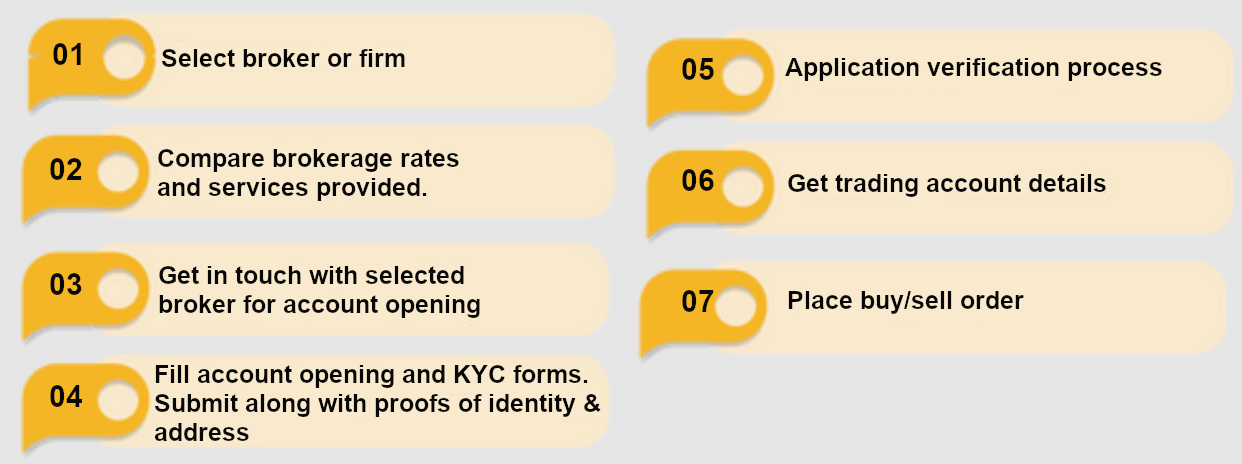

As the saying goes,men are afraid of joining the wrong profession,and women are afraid of marrying the wrong person. One of the things that every investor needs to seriously consider before making an investment transaction is how to choose a reliable securities company. The first key thing to consider is reputation and word of mouth.Only a brokerage firm with a good reputation and word of mouth can reduce the risk of trading.

The second most important thing to understand is the commission fee,knowing that this is part of the cost of trading. Commission fees are the fees that investors need to pay to the brokerage firm during the trading process,and they directly affect the level of profitability of the investor. Therefore,investors need to have a clear understanding of their charges when choosing,including transaction commission,stamp duty,transfer fee,and so on.

It is important to know that in order to earn more commission, securities companies have developed a lot of routines,such as setting the commission for customers to set the price according to the person. The higher the bargaining power,the lower the commission may be; the lower the bargaining power,the higher the commission. Up to 3/1000 down to 3/10000. The difference can be up to 10 times greater.

Another example is that many people,after opening an account,find that the account does not indicate the commission rate at all,so they cannot get a clear picture of what they have to pay for each transaction. This situation confuses them because they do not know if they are being overcharged.Sometimes,they even need to spend a lot of time going to the delivery note to check the fees one by one before they can come up with a concrete result.

And in order to attract new clients,many brokerage firms will offer low commission discounts as a way to attract more clients. However,once a client becomes a regular customer,the brokerage firm may revert to a higher commission level. In this case,it is often not easy for regular clients to notice the change,as they may not be aware of or clear about the commission they are paying.

There is also the fact that the commission paid by clients at the same brokerage firm may be affected by the level of geographical development.Generally speaking,in developed provinces and cities,brokers may set lower commission rates to attract more clients and increase trading volume. In contrast,in less developed provinces and cities,brokers may set relatively higher commission levels to compensate for the pressure on profitability arising from smaller market sizes and lower trading demand.

Under the current commission fluctuation system,there are certain rules governing the commission charged by brokers to their clients. First of all,the commission shall not be higher than 3/1000 of the transaction amount of the securities. This is to protect investors from being pressured by high commissions.At the same time,the commission must not be lower than the collection of regulatory fees for securities transactions and other fees related to securities transactions,such as securities transaction fees.

This shows that brokerage firms have a certain degree of autonomy in setting their own commission rates,so there will be some differentiation in commission fees. However,where there is a difference in fees,there should also be a synchronized difference in services,and this must be made public. So investors should also pay attention to the commission fee,whether there are hidden costs or additional charges,in order to avoid unnecessary expenses in the transaction process.

Then there is the issue of capital security.This is not only to look at the financial strength of the securities companies but also to ensure that the choice of brokerage firm has to be subject to strict regulatory and compliance requirements in line with the provisions of the local financial regulators. This not only effectively protects the safety of investor funds but also protects their rights and interests and reduces risk.

There is also the quality of the trading platform and software,or the quality of the service. For trading platforms and software,investors need to consider factors such as stability,trading tools,and charting and analyzing functions to ensure that trading can be carried out conveniently and efficiently. And pay attention to the quality of services provided by securities companies,including the speed of transaction execution,customer service level, quality of investment advice,and other aspects. The quality of service can be assessed by simulating the opening of an account,consulting customer service,and experiencing the trading platform.

To summarize,choosing a securities company requires comprehensive consideration of a number of factors,such as commission fees,quality of trading platforms and software,quality of service,safety of funds,research reports and investment advice,Trading Products and services,and word-of-mouth evaluations,in order to ensure that you are able to choose the most suitable brokerage firm for your investment transactions.

Ranking of Securities Firms

| Platform |

Assets under management, 2022 (trillions) |

2023 (trillions) |

Change |

| Vanguard |

$8.10 |

$8.20 |

1% |

| Charles Schwab |

$6.60 |

$8.18 |

24% |

| Fidelity |

$3.60 |

$4.40 |

22% |

| J.P. Morgan |

$2.60 |

$3.20 |

23% |

| Bank of America/Merrill Lynch |

$1.30 |

$1.50 |

15% |

| Morgan Stanley |

$1.30 |

$1.40 |

8% |

| Coinbase |

$0.10 |

$0.11 |

13% |

| Robinhood |

$0.06 |

$0.09 |

39% |

| Ally Invest |

$0.01 |

$0.01 |

-2% |

Disclaimer:This material is for general information purposes only and is not intended as (and should not be considered to be) financial,investment,or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment,security,transaction,or investment strategy is suitable for any specific person.

What does a Securities Company Do?

What does a Securities Company Do? Choosing a Securities Company

Choosing a Securities Company