Wall Street strategists growing increasingly bullish on US equities should

have felt the chill as strong inflation readings have bolstered the case that

the Fed has to hold interest rates steady for longer.

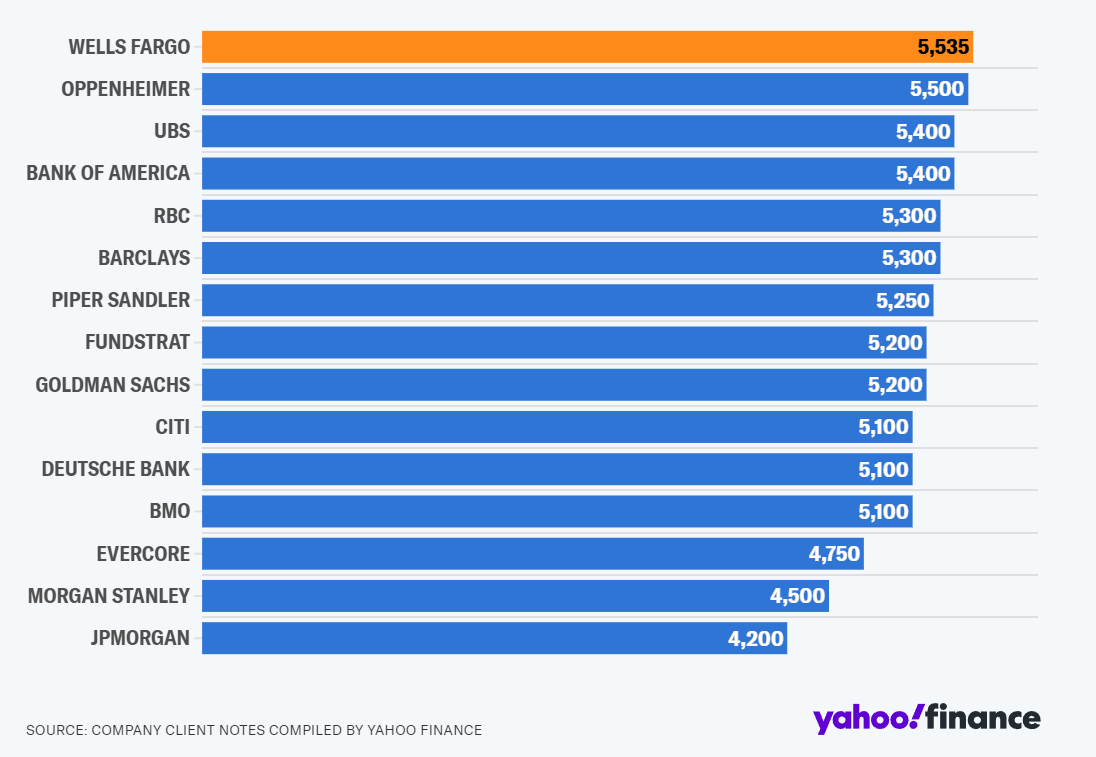

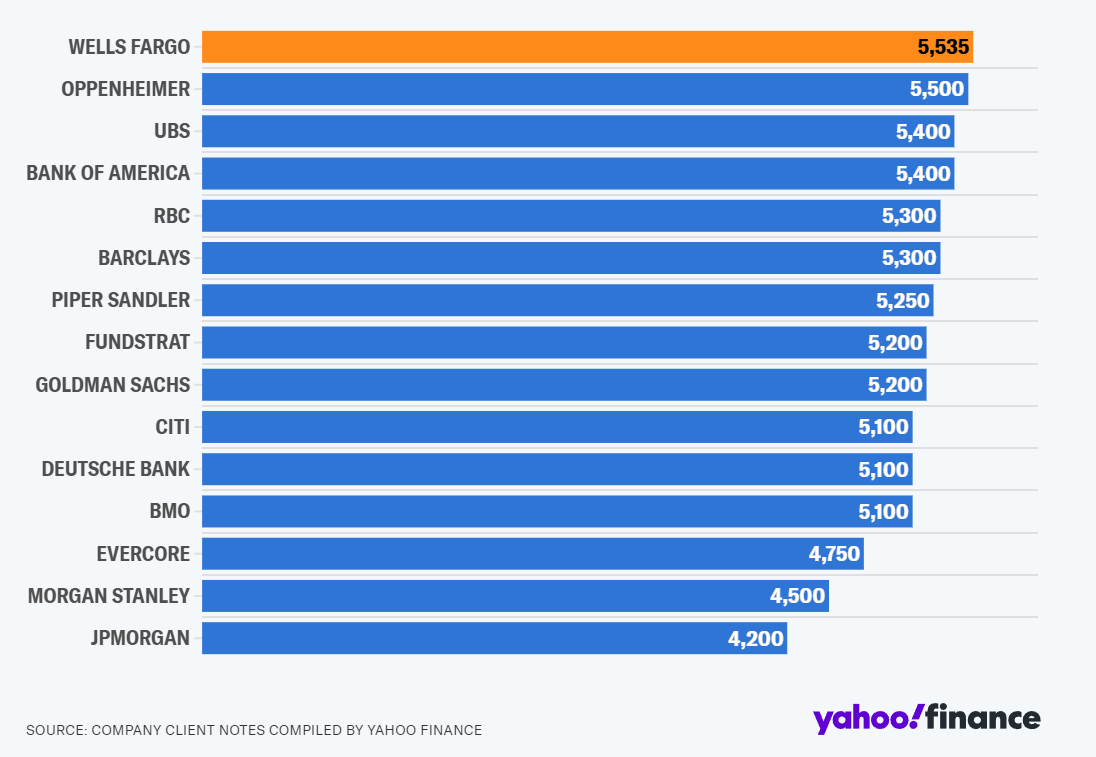

Some of them just raised their targets for the S&P 500 last month. BofA

predicted the index would end the year at 5,400, while Wells Fargo hiked its

target to 5,5,35.

Oppenheimer sees the index ending the year at 5,500, citing positive signs in

earnings over the last several quarters, resilience in US economic growth, and a

"capitulation" among the bearish community.

But the gauge of the US equities took a sharp turn earlier this month,

raising concerns that peak euphoria on the horizon could eventually threaten to

deliver a reckoning on Wall Street.

A survey from BofA found that investor allocation to equities is the highest

in over two years, while data from Goldman Sachs Group and Citigroup showed that

funds have little room to keep buying stocks.

Data from Goldman Sachs showed that CTAs have about $170 billion worth of

bullish bets on global equities. Those funds would need to dump $229 billion of

futures over the next month if the stocks keep declining.

Citigroup strategist Chris Montagu warned that there are $52 billion of long

positions on the S&P 500 and 88% of them are in a loss. “Should the market

turn negative, the move could be faster and larger.”

Tech bust

Recent sell off saw the Nasdaq 100 registering the fourth consecutive weekly

loss – the longest since Dec 2022. Traders have even built up bets the Fed could

tighten further.

Options markets suggest a roughly 20% chance of a rate hike within the next

12 months. If the PCE figures disappoint again later this week, richly valued AI

stocks may face immediate downward pressures.

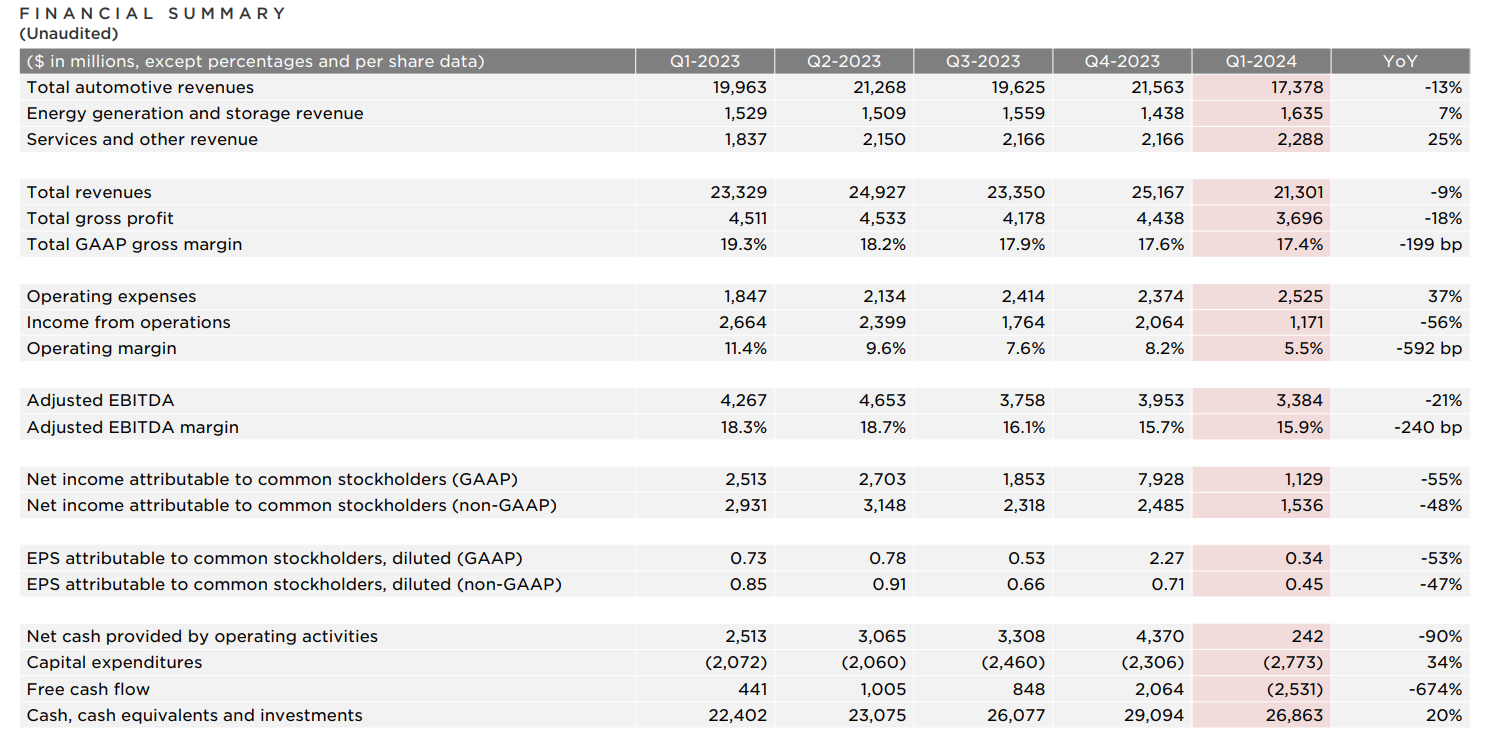

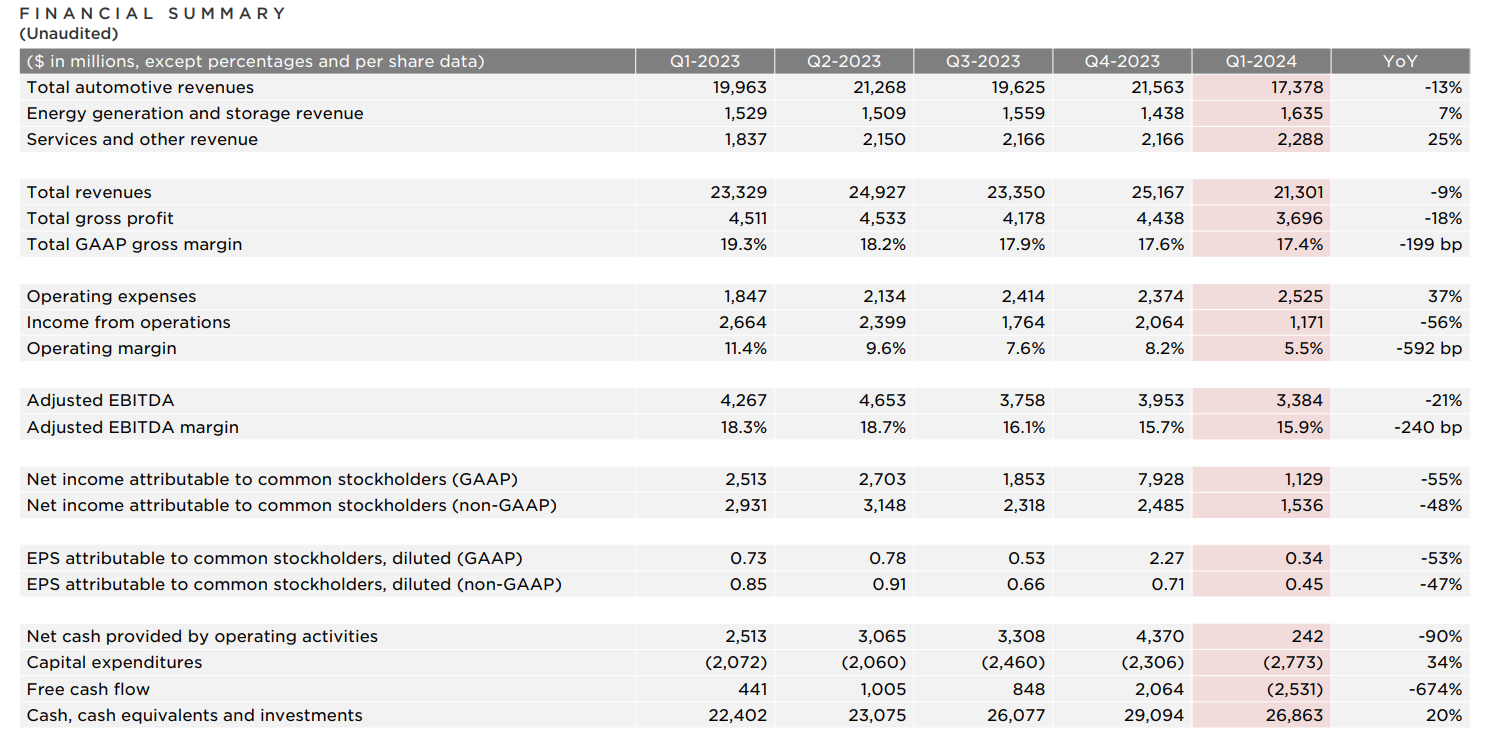

tesla became the first flop among the Magnificent 7 after missing revenue and

EPS estimates over the past quarters. Its plan to lay off more than 10% of its

global workforce also complicates the prospect.

Ahead of this week’s earnings, UBS cut their sector recommendation on the

rest of the hyped-up group to neutral from overweight due to the difficult comps

and cyclical forces.

The investment bank said the surging earnings momentum was driven by

“asynchronous earnings cycles” spurred by the pandemic and EPS growth for the

six stocks will slow to 42% in Q1 from 68%.

The irrelevant tech stocks didn’t participate in the pandemic-driven boom,

but now consensus forecasts predict a reacceleration in earnings for those

stocks, it added.

Investors remain leery across the tech spectrum, pulling back on mega cap

growth and tech stocks, according to Deutsche Bank. They will be watching

closely when Meta, Microsoft and Alphabet report this week.

Steeper correction

JPMorgan’s equity strategist t Marko Kolanovic said, while earnings results

from Corporate America this week may temporarily stabilize the market, it

doesn’t mean stocks are out of the woods.

From his perspective, recent trading patterns and the current market

narrative parallel those of last summer, when upside inflation surprises and

hawkish Fed revisions spurred a drop in risk assets.

Even an upbeat corporate earnings season could hardly drive equities higher

as much of the optimism is already priced in, according to Mislav Matejka,

another strategist at the bank.

“We need to see clear earnings acceleration in order to justify current

equity valuations, which we fear might not come through.” He added S&P 500

earnings should decline when excluding the tech sector.

Meanwhile, Morgan Stanley warned about the impact of higher rates on stock

valuations. It expects equities to show greater sensitivity to rates with the US

10-year bond yield spiking above 4.4%.

Citigroup analysts expect that profit outlooks for US semiconductor companies

will be more muted this time around in that AMD, bellwether of the industry,

will unlikely raise AI forecast until the summer.

Societe Generale strategist Manish Kabra is not that pessimistic, saying a

strong earnings season to continue to drive the bigger US stocks as peak rates

should keep a lid on Treasury yields.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.